* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download lecture notes

Survey

Document related concepts

Transcript

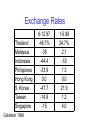

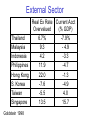

Financial Crises East Asia 1997, Russia 1998, Brazil ? Background to 1997 East Asian crisis • Fundamentalist view • Contagion view Three factors: • Macro policy in OECD • Domestic mismanagement • Investor panic Exchange Rates Thailand Malaysia Indonesia Philippines Hong Kong S. Korea Taiwan Singapore Goldstein 1998 6-12.97 -48.7% -35 -44.4 -33.9 0.0 -47.7 -14.8 -15 1-5.98 24.7% 2.1 -53 1.3 0.0 21.9 1.2 4.0 Stock Markets Thailand Malaysia Indonesia Philippines Hong Kong S. Korea Taiwan Singapore Goldstein 1998 6-12.97 -29.3% -44.8 -44.4 -33.5 -29.4 -49.5 -9.3 -23.0 1-5.98 3.7% -2.4 8.2 18.2 -6.2 -.9 .3 -7.1 IMF Growth Forecasts for 1998 May ’97 April ’98 Change Indonesia 7.4 -5.0 -12.4 Thailand 7.0 -3.1 -10.1 S. Korea 6.3 -0.8 -7.1 Malaysia 7.9 2.5 -5.4 Philippines 6.4 2.5 -3.9 Singapore 6.1 3.5 -2.6 Hong Kong 5.0 3.0 -2.0 China 8.8 7.0 -1.8 Taiwan 6.3 5.0 -1.3 Goldstein 1998 External Causes • Credit boom in the 1990s – Low interest rates in the U.S. and Japan – Expansion of portfolio funds – $420 billion net flows to Asian emerging markets • Deteriorating current account – Overvalued real exchange rates – Slowing exports and increasing competition External Sector Real Ex Rate Current Acct Overvalued (% GDP) Thailand 6.7% -7.9% Malaysia 9.3 - 4.9 Indonesia 4.2 -3.3 Philippines 11.9 -4.7 Hong Kong 22.0 -1.3 S. Korea -7.6 -4.9 Taiwan -5.5 4.0 Singapore 13.5 15.7 Goldstein 1998 Financial Market Vulnerabilities Capital inflows concentrated: – Real estate (30-40% of bank lending) – Equities – Borrowing in foreign currencies w/ short maturities Why? Financial Market Supervision • Weak banking sectors—high ratios of nonperforming loans • Lack of transparency, sound accounting procedures • Inadequate loan-loss reserves • Corrupt lending • Banks as quasi-fiscal agents Precipitating event • Thailand—CB reserves depleted, rolling over government debt • S. Korea—rolling over foreign-currency denominated bank liabilities • Indonesia—corporations attempt to hedge their currency positions Contagion • Trade linkages? – Hard to explain contagion from small countries to large ones • Competitive devaluation? – Same objection • Goldstein’s “wake-up call” hypothesis – Do capital markets sleep? – Rational buffalo Russia 1998 • Fixed exchange rate, overvalued in real terms • Incentive to run a fiscal deficit – Election of 1996 – Collapse of tax revenues • • • • Nominal debt High interest rates Central Banking dilemmas Bail-out of 1998 Why not Brazil in 2002? • • • • • • Public debt to GDP: 60% Of which, linked to the dollar: 40% Spread over U.S. treasuries: 18% Devaluation: >40% in 2002 $30 billion IMF program in August Luiz Inacio Lula da Silva (Lula) elected in October First Steps • Reaffirm primary surplus goal of 3.75% of GDP, an IMF condition • Propose legislation to strengthen Central Bank’s independence • Conservative appointments • Postponing populist agenda Discussion Do IMF rescue packages help countries that face financial crises?