* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download +0,25 - Amazon Web Services

Nouriel Roubini wikipedia , lookup

Transition economy wikipedia , lookup

Non-monetary economy wikipedia , lookup

Nominal rigidity wikipedia , lookup

Business cycle wikipedia , lookup

Economic growth wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

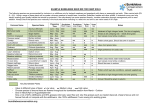

Chinese economic reform wikipedia , lookup

PORTFOLIO AND SELECT COMMITTEES ON FINANCE October 2004 RECENT ECONOMIC DEVELOPMENTS International Economy International oil price World economic outlook: Real GDP Annual percentage change in real GDP Actual Projections 2003 2004 2005 3,9 2,1 3,0 2,5 0,5 2,2 5,0 3,6 4,3 4,4 2,2 3,4 4,3 2,9 3,5 2,3 2,2 2,5 3,0 5,5 4,0 6,1 4,3 4,5 7,7 1,8 6,6 4,5 5,5 7,6 4,6 5,9 5,4 4,8 6,9 3,6 World Advanced economies USA Japan Euro area United Kingdom Newly industrialised Asian economies 1) Emerging market and developing countries Africa Central and eastern Europe Developing Asia Western hemisphere 1) Includes Hong Kong SAR, Korea, Singapore and Taiwan Province of China. Source: IMF World Economic Outlook, September 2004 World economic outlook: Consumer prices Annual percentage change in consumer prices Actual Projections 2003 2004 2005 3,8 2,1 3,0 -0,2 2,1 1,6 3,6 2,1 3,0 -0,1 1,9 1,9 2,4 2,6 6,0 8,6 6,9 4,0 6,5 5,5 8,1 5,9 4,1 6,1 World 3,7 Advanced economies 1,8 USA 2,3 Japan -0,2 Euro area 2,1 United Kingdom 1,4 Newly industrialised Asian economies 1) 1,4 Emerging market and Developing countries 6,1 Africa 10,3 Central and eastern Europe 9,2 Developing Asia 2,6 Western hemisphere 10,6 1) Includes Hong Kong SAR, Korea, Singapore and Taiwan Province of China. Source: IMF World Economic Outlook, September 2004 Key central bank interest rates Countries 1 January 2004 USA 1,00 Japan 0,00 Euro area 2,00 United Kingdom 3,75 Canada 2,75 Denmark 2,00 Sweden 2,75 Switzerland 0 – 0,75 Australia 5,25 New Zealand 5,00 Israel 4,80 Hong Kong 2,50 Malaysia 4,50 South Korea 3,75 Taiwan 1,38 Thailand 1,25 30 September 2004 1,75 0,00 2,00 4,75 2,25 2,00 2,00 0,25 – 1,25 5,25 6,25 4,10 3,25 4,50 3,50 1,38 1,50 Latest Change (Percentage points) 21 Sep 2004 (+0,25) 19 Mar 2001 (-0,15) 6 Jun 2003 (-0,50) 5 Aug 2004 (+0,25) 8 Sep 2004 (+0,25) 6 Jun 2003 (-0,50) 1 Apr 2004 (-0,50) 16 Sep 2004 (+0,25) 3 Dec 2003 (+0,25) 9 Sep 2004 (+0,25) 1 Apr 2004 (-0,20) 22 Sep 2004 (+0,25) 21 May 2003 (-0,50) 12 Aug 2004 (-0,25) 26 Jun 2003 (-0,25) 25 Aug 2004 (+0,25) Key central bank interest rates (continued) Countries 1 January 2004 30 September 2004 India Brazil Chile Mexico1 Czech Republic Hungary Poland Russia South Africa 1 The Bank of Mexico uses the money market shortage to influence liquidity conditions, while the interest rate is market determined. Source: National central banks 6,00 16,50 2,25 6,17 2,00 12,50 5,25 16,00 Latest Change (Percentage points) 8,00 6,00 29 Apr 2003 (-0,25) 16,25 15 Sep 2004 (+0,25) 2,00 7 Sep 2004 (+0,25) 7,95 24 Sep 2004 (+6 mil pesos) 2,50 26 Aug 2004 (+0,25) 11,00 16 Aug 2004 (-0,50) 6,00 25 Aug 2004 (+0,50) 13,00 15 Jun 2004 (-1,00) 7,50 12 Aug 2004 (-0,50) RECENT ECONOMIC DEVELOPMENTS National Economy Real gross domestic product Real gross domestic expenditure Real final consumption expenditure by households Real household disposable income Household debt as percentage of household disposable income Real gross fixed capital formation Real domestic final demand Change in inventories Gross saving as percentage of gross domestic product Non-agricultural employment Non-agricultural nominal remuneration per worker Non-agricultural labour productivity Non-agricultural nominal unit labour cost Nominal unit labour cost in manufacturing All-goods production prices Headline inflation and CPIX Exchange rates of the rand Growth in M3 Total loans and advances extended to private sector Money-market interest rates Yield on long-term government bonds Share prices - all classes Summary Strong world demand of petroleum and petroleum products has led to crude oil prices reaching unprecedentedly high levels in this quarter. The sharp increases in oil prices, steady decline in output gaps across the world among other factors have caused the IMF to lower its global growth forecast for 2005. If growth in advanced economies most of which are our major trading partners is projected to decline in the next 12 months, as it is, that may not auger well for South Africa’s economic prospect from the external accounts perspective. Summary (Continued) Domestic demand remains the key driver of South Africa’s output growth, in this growth phase of the business cycle. Favourable manufacturing output and agricultural and mining production signal a continuation of the consolidation phase of the South African economy. Lower interest rates, moderately wider budget deficit and an improvement in the country’s international terms of trade have contributed to the country’s current growth performance. Summary (Continued) When CEO’s of major firms; say that higher consumer spending is the result of a structural rather than just a cyclical improvement in the economy, the record level of consumer and business confidence is probably not misplaced. Growth performance in the first half of 2004 have seen employment in the second quarter of 2004 picking up by about 5 per cent - an expansion in employment occurred in both the private and public sector. Summary (Continued) On the prices side, the targeted CPI variant, CPIX, has remained within the target range for about 12 months to date. Our short-term forecasts, consistent with the consensus, show that inflation will remain within the target range in the near term. Higher oil prices, increases in domestic demand growth over income and some base effects in August of next year may inject undesirable pressures on the inflation front and output. Summary (Continued) Huge as the deficit on the current account of the Balance of Payments was in the second quarter of 2004, it was however adequately financed by capital inflows from the rest of the world - allowing the South African Reserve Bank to continue “creaming off” part of these flows to add to the country’s accumulated foreign exchange reserves. We expect continued deceleration in growth across the spectrum of the monetary aggregates currently well aligned with robust economic activity - though not consistent with inflation targeting range. Thank you