* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Who Wants to be a Millionaire?

Survey

Document related concepts

Pensions crisis wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Fear of floating wikipedia , lookup

Early 1980s recession wikipedia , lookup

Exchange rate wikipedia , lookup

Real bills doctrine wikipedia , lookup

Quantitative easing wikipedia , lookup

Monetary policy wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Helicopter money wikipedia , lookup

Transcript

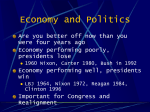

Who Wants to be a Millionaire!? Monetary Policy Fastest Finger Question #1: List the following groups in order based on salary: (starting with the least) A. Teacher B. Airline pilot C. Carpenter …And the Winner Is… C. Carpenter A. Teacher B. Pilot Road to Riches… 1 Ex 2 Extr 3 Extra 4 Extra Cre 5 Extra Credit 50/50 ASK A FRIEND! Money that has an alternative use: (1 Point) A. Fiat money C. Convertible money B. Commodity money D. Monopoly money Something accepted by all parties as payment for goods and services (2 Points) A. Currency C. Fiat Money B. Medium of exchange D. Gold The interest rate the Fed. Charges its member banks? (4 Points) A. Prime rate C. Excessive rate B. Discount rate D. Reserve rate Rule stating that a percentage of every deposit be set aside as legal reserves: (6 Points) A. Discount rate C. Reserve requirement B. Gold standard D. Excess reserves Excessive increases in the monetary supply lead to: (8 Points!) A. Deflation C. Inflation B. Low interest rates D. High interest rates List the following commodities by price – lowest to highest: A. Silver B. Platinum C. Gold …And the Winner Is… Silver C. Gold B. Platinum A. The Fed. Must constantly choose between two evils. They are: (1 Point) A. Consumers C. Inflation B. Banks D. Recession The Fed. does all of the following services EXCEPT: (2 Points) A. Oversees the activities of the Treasury Dept. B. Maintains currency / coins C. Enforces consumer legislation D. Clears checks Which scenario indicates ‘easy/loose money policy’: (4 Points) A. Selling gov. securities C. Raising the discount rate B. Decreasing the reserve requirement D. Raising the price of milk How does the gov. measure inflation from year to year? (6 Points) A. Current GDP C. Producer price index B. GDP price deflator D. Consumer price index Which is a good explanation of the wage-price spiral? (8 Points) A. Fed. Produces more money, so wages go up B. Wages go up when prices rise C. Prices drop, then wages drop D. A funnel cloud produces by high wages List the following from lowest to highest percentage: A. Rate for students B. Prime rate C. Discount rate …And the Winner Is… discount rate B. prime rate A. rate for students C. Our current money is ? (1 Point) A. Specie money C. Backed by silver B. Inconvertible fiat money D. worthless Properties, possessions…stuff you have? (2 Points) A. assets C. liquidity B. liabilities D. balances Our current money has value because? (4 Points) A. It is backed by the gold std. C. It is portable, durable, and divisible B. Government D. Public said you must use confidence in it it If a person robs a bank and your money is stolen, the gov. will insure it: (6 Points) A. True C. Only up to $1,000 B. False D. Only if the robber gets away How does the Fed. influence your purchasing power? (8 Points) A. They incentivize borrowing B. They set prices of consumer goods C. They control the CPI D. They decide whether your check is good or not List the following items in order based on percentage charged by banks: (starting with the lowest) A. Credit card B. Car loan C. Mortgage (home loan) …And the Winner Is… C. Mortgage (home loan) B. Car loan A. Credit card Who might get hurt by inflation? (1 Point) A. Consumers who C. People with don’t get a raise credit card debt B. Investors in the D. Gold stock market speculators If the FED loaned BofA $10,000 at 5% interest, how much money will they make over one year? (2 Points) A. $5 C. $500 B. $50 D. $0 – the Fed doesn’t make a profit b/c they are part of the government If the Treasury Dept. and FED wanted to encourage loose money policy, they might? (3 Points) A. Raise the C. Raise the reserve requirement Discount Rate B. Lower the D. Not wear a belt reserve requirement Which would be an example of commodity money? (4 Points) A. C. B. D. Dolphin Teeth If the FED used open market operations to get money out of circulation / fight inflation, it would? (5 Points) A. Sell t-bills C. Print money B. Buy t-bills D. Lower interest rates