* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Survey

Document related concepts

Foreign-exchange reserves wikipedia , lookup

Economic democracy wikipedia , lookup

Miracle of Chile wikipedia , lookup

Balance of payments wikipedia , lookup

Global financial system wikipedia , lookup

International monetary systems wikipedia , lookup

Transcript

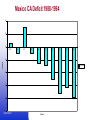

New International Capital Flows Lino Covarrubias Heather Edelstein Matthew Peabody Kristina Spacone 5/23/2017 1 Topics of Discussion 5/23/2017 Behavior of Capital Flows Long Term Investment Asian Economic Crisis Mexican Peso Crisis Chilean Regulation of Capital Flows Lessons for Capital Mobility 2 Capital Flows to Latin America Supply of Capital Technology Pension and Insurance Funds Baby Boomers Low Interest Rates in US Structural Investment Codes Macroeconomic Policy (exchange rates) Privatization Political reform 5/23/2017 3 Types of Capital 5/23/2017 Foreign Direct Investment Bond Purchases Portfolio Equity Flows Lending Directly to support trade 4 Risk of new Capital Flows 5/23/2017 Lack of efficiency Short-term money External vulnerability Exchange rates Interest Rates 5 Long Term Investment 5/23/2017 Focus on local manufacturing Preferable to short term investment Concentrated in Mexico & Brazil 6 Pros and Cons of FDI Pros Technology Efficiency Source of capital Job creation Management skills Cons 5/23/2017 Culture Human rights abuse Environment Job loss in parent country Linkage w/locals Technology 7 Maple Gas – Positive Example 5/23/2017 Drill gas in Peruvian jungle Provide electricity to Peru New ideas Environmental challenges Community Success – effect on Peru 8 Asia Crisis – Effect on Latin America 5/23/2017 Global loss in investor confidence Increasing interest rates Brazil’s downfall 9 MEXICAN PESO CRISIS OF 9495----> History Prior to the Event: 5/23/2017 Healthy recovery from 1982 debt crisis1987 PACTO -bus, labor, and govt price controlFiscal Stabilization (low and stable inflation- 8% in 94 compared to 20% in late 80’s) Opening of internal markets NAFTA talks beginning in 91 and signed in 94 Hi returns in Mexico--outlook lured Int’l Capital10 WHAT WENT WRONG? 5/23/2017 Demand by Investors to Invest in Mexico created an ASSET Overvaluation. To ensure not missing out on the opportunity, Investors willingly infused capital without knowing the full extent of the value (sound familiar?) Capital Inflows artificially overvalued the PESO (up to 30%).11 What went wrong? Mexican Gov’t did nothing- sugar coated the problem 5/23/2017 This overvaluation increased the prices of Mexican exports, making them less competitive in World Markets. This caused a decrease in exports= increase in CA (current Account)-GRI Peso not overvalued- reflects growth potential. 12 CA and Peso strength MEX CADEF AND E-RATE CAD RER 70000 100 80 50000 40000 60 30000 40 20000 Real buy pwr CAD $ MILL 60000 20 10000 0 83-90 91 92 93 94 95 96 97 YEARS 5/23/2017 13 What went wrong? Presidential election-PRI under attackcould not afford domestic econ problem (I.e. devaluation) Economic problems: 5/23/2017 By 1994: CA is 8% of GDP- deficit must be funded by capital inflows. Although Investors were concerned, this did not cause the capital flight Mexico feared. If there was a problem Intl Capital flow would not come in. 14 Mexico CA Deficit 1988-1994 4 2 0 85 86 87 88 89 90 91 92 93 94 % GDP -2 % GPD -4 -6 -8 -10 5/23/2017 Years 15 What went wrong? 1994 political uncertainty did- Jan: Chiapas uprising; MAR- Pres candidate Colosio assassinated; INT Capital flew!!! This caused dwindling dollar reserves at Central Bank to pay for public debt Situation screamed for devaluation- Mexico said no and spent $10Bill from MAR-MAY in reserves to keep from devaluing peso. 16 5/23/2017 What went wrong? To prevent further Capital flight-Int Investors were protected by “TESOBONOS”- dollar dominated treasury bonds.--> MEX internalized currency devalue risk. After AUG 99 elections- still no devaluation 5/23/2017 17 THE BIG BLOW DEC 94-Reserve decreased to dangerous levels- $9bill MEX has no choice but to devalue peso Bad 5/23/2017 timing- Did it Tuesday before XMAS, with a Finance minister not yet connected Investors felt deceived and didn’t believe MEX would make good on TESOBONOS Major Capital flight 18 MEXICO’S RESCUE 5/23/2017 MEXICO did following: increase in privatization of railroads, ports wages held down, cut govt spending, Interest rates increased to 55% to hold investors domestically, caused a recessionary environment- further decreasing investor confidence. JAN95: US, IMF, and Bank Intl Settlements- $28 BILL loan - help Mexico stabilize 19 LESSONS LEARNED CA deficit below what is sustainable by the economy (normally 3% GDP) is a recipe for disaster, especially if it is being funded by short-term int’l capital. 5/23/2017 Short-term int’l capital is very susceptible to political volatility. 20 Chilean case: Regulation An anecdote…but a cure? 100 80 60 GDP 40 Capital Inflows 20 0 1979 1981 5/23/2017 Composition had shifted from loans to FDI, “hot money” as well as portfolio investments and Chilean investment abroad. Laws attracted FDI into Chile. Most money entered the export sector particularly mining. Similar recipe for disaster confronts Chile with large inflows of international capital. 21 Chile opens doors to investment abroad 1991-Chile liberalizes laws regulating the outflow of capital. $ Pours money into other LA countries. Primarily: 5/23/2017 Argentina-electricity business, ceramics, industrial oils. Bolivia-Railways Peru-Pension industry, copper wire 22 Impact of Capital Flows: Vicious Circles Chilean model driven by exports. Moving on up Exports Capital Inflows •Copper •Agricultural Products 5/23/2017 Inflated Appreciated CHP ex-rate chokes exports that had originally made the success 23 Downside Risk-Is the Chilean model bullet proof? 5/23/2017 Capital Controls are difficult to enforce. Because Chile is largely dependent on commodities, a drop in global commodity prices could have devastating effects on the balance of payments on current account. 24 Chilean Remedy Balance external sector growth and internal stability How? Reserve requirements Quotas, Fees Foreign exchange market intervention, and sterilization. Capital enters Chile on “Chilean” terms. 5/23/2017 25 Conclusion 5/23/2017 Changes in the LA economic environment are perceived to be more permanent. Improvements, regulatory action, and changes are restoring investor confidence. Stability, confidence, and predictability are being restored prompting financial investments. Investors see LA as a “good investment risk” Inflow of capital has it’s benefits and drawbacks. 26