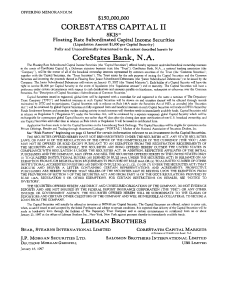

Corestates Capital II

... Act") will be evidenced by global Capital Securities in fully registered form and beneficial interests in such Capital Securities will trade in DTC's Same-Day Funds Settlement System and secondary market trading activity in such interests will therefore settle in immediately available funds. Capital ...

... Act") will be evidenced by global Capital Securities in fully registered form and beneficial interests in such Capital Securities will trade in DTC's Same-Day Funds Settlement System and secondary market trading activity in such interests will therefore settle in immediately available funds. Capital ...

ppt_montreal_crise

... “Recent events highlight the importance of sustainable public finances and the need for our countries to put in place credible, properly phased and growth-friendly plans to deliver fiscal sustainability […]. Those countries with serious fiscal challenges need to accelerate the pace of consolidation. ...

... “Recent events highlight the importance of sustainable public finances and the need for our countries to put in place credible, properly phased and growth-friendly plans to deliver fiscal sustainability […]. Those countries with serious fiscal challenges need to accelerate the pace of consolidation. ...

The International Monetary Fund: 70 Years of Reinvention

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

PDF Download

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

... As recently as 2008, the International Monetary Fund (IMF) seemed to be winding down its business. After the Argentine and Uruguayan crises of 2001-2003, the world had been comparatively free of financial crises. IMF lending, whether expressed as a share of world GDP or imports, fell to its lowest l ...

Skill Composition, Technological Change and Firm Performance

... industries. For these purposes, I construct a measure of ICT capital and apply different quantitative approaches to the estimation of the firm–level production function using Norwegian unbalanced employer-employee panel data for the period 2002–2006. The ideal measure capturing the economic contribu ...

... industries. For these purposes, I construct a measure of ICT capital and apply different quantitative approaches to the estimation of the firm–level production function using Norwegian unbalanced employer-employee panel data for the period 2002–2006. The ideal measure capturing the economic contribu ...

Victory Capital Management Inc ADV Part 2A

... Additionally, Victory Capital may allow certain restrictions for SMA clients or the SMA program in ways that it may not for the UMA program. For example, Victory Capital allows SMA clients to place some restrictions on the securities that can be held in their account. Currently, Victory Capital perm ...

... Additionally, Victory Capital may allow certain restrictions for SMA clients or the SMA program in ways that it may not for the UMA program. For example, Victory Capital allows SMA clients to place some restrictions on the securities that can be held in their account. Currently, Victory Capital perm ...

Intel Capital Presentation

... • Displace PPC in Storage systems with Intel BBs (GAP) – System-on-chip technology for IA, IPF, Xscale, IOP, IXP ...

... • Displace PPC in Storage systems with Intel BBs (GAP) – System-on-chip technology for IA, IPF, Xscale, IOP, IXP ...

2015 Year-End Dermatology Update

... investments within the sector. With macroeconomic trends indicating strong future demand for services amidst a shortage of dermatology providers, private equity groups have sought to provide capital resources and industry relationships to an existing practice platform in order to rapidly capture mar ...

... investments within the sector. With macroeconomic trends indicating strong future demand for services amidst a shortage of dermatology providers, private equity groups have sought to provide capital resources and industry relationships to an existing practice platform in order to rapidly capture mar ...

Download Full Report

... the other capital flight estimates for overlapping periods of study. For the period 2000-2005, our CED+GER estimates are again closer to the IMF’s estimates than any other. However, for the next six-year period 2006-2011, the difference between the IMF and GFI estimates widen considerably due mainl ...

... the other capital flight estimates for overlapping periods of study. For the period 2000-2005, our CED+GER estimates are again closer to the IMF’s estimates than any other. However, for the next six-year period 2006-2011, the difference between the IMF and GFI estimates widen considerably due mainl ...

Patterns of International Capital Raisings

... conducted in international markets, but only a small fraction of firms actually uses international markets, and of this small fraction, a very small sub-sample accounts for the bulk of international capital raisings. In 2005, firms from developing and developed countries raised, respectively, 51 and ...

... conducted in international markets, but only a small fraction of firms actually uses international markets, and of this small fraction, a very small sub-sample accounts for the bulk of international capital raisings. In 2005, firms from developing and developed countries raised, respectively, 51 and ...

c Copyright by Amrita Dhar May 2016

... The focus among economists so far has mostly been on analyzing either the causes or the consequences of extreme episodes. Clearly, identification of “extreme’’ episodes is crucial for doing such analysis. The existing literature sets ad hoc threshold criteria for identifying these episodes.3 My obje ...

... The focus among economists so far has mostly been on analyzing either the causes or the consequences of extreme episodes. Clearly, identification of “extreme’’ episodes is crucial for doing such analysis. The existing literature sets ad hoc threshold criteria for identifying these episodes.3 My obje ...

S33898F437_en.pdf

... three non-LAC emerging economies: Korea, Malaysia and South Africa. One paper com pares the outstanding differences as well as similarities in the approaches adopted, by Korea and Malaysia, after the explosion of the East Asian crisis; both countries, after a period of orthodox reces sive adjustm e ...

... three non-LAC emerging economies: Korea, Malaysia and South Africa. One paper com pares the outstanding differences as well as similarities in the approaches adopted, by Korea and Malaysia, after the explosion of the East Asian crisis; both countries, after a period of orthodox reces sive adjustm e ...

19.1 Financing Your Business

... Most start-up funds come from an entrepreneur’s personal resources; however, there are other common sources of funding. ...

... Most start-up funds come from an entrepreneur’s personal resources; however, there are other common sources of funding. ...

Is the Crisis Problem Growing More Severe?

... Finally, we ask whether the patterns we observe in the frequency, severity and longevity of crises are best explicable in terms of international economic policies (the flexibility of the exchange rate and the openness of the capital account) or the management of the domestic financial system. It wil ...

... Finally, we ask whether the patterns we observe in the frequency, severity and longevity of crises are best explicable in terms of international economic policies (the flexibility of the exchange rate and the openness of the capital account) or the management of the domestic financial system. It wil ...

venture capital pre-investment decision making process

... making model for transition economies diverges from past research in two areas. First, it was seen that privatization of state-owned enterprises are considered important in deal origination and most of the VCs were active to solicit deals from targeted industries. Second, the study revealed that fir ...

... making model for transition economies diverges from past research in two areas. First, it was seen that privatization of state-owned enterprises are considered important in deal origination and most of the VCs were active to solicit deals from targeted industries. Second, the study revealed that fir ...

Antero Midstream Partners LP

... growth rate for net production for the years 2018 through 2020. For 2017, Antero Resources plans to operate an average of four drilling rigs in the Marcellus Shale and three drilling rigs in the Ohio Utica Shale. Antero Resources plans to complete 135 wells in the Marcellus Shale and 35 wells in the ...

... growth rate for net production for the years 2018 through 2020. For 2017, Antero Resources plans to operate an average of four drilling rigs in the Marcellus Shale and three drilling rigs in the Ohio Utica Shale. Antero Resources plans to complete 135 wells in the Marcellus Shale and 35 wells in the ...

Yip, Paul SL, (2005). The Exchange Rate Systems in Hong

... properly managed, it could provoke destabilizing capital flows and lead to volatile exchange rates. This highlights the need for regional coordination of policy measures during the liberalization process, even though it is the domestic authorities and institutions that are ultimately responsibility ...

... properly managed, it could provoke destabilizing capital flows and lead to volatile exchange rates. This highlights the need for regional coordination of policy measures during the liberalization process, even though it is the domestic authorities and institutions that are ultimately responsibility ...

Ten Years After: Revisiting the Asian Financial Crisis

... The various participants in the Asian crisis ranged from Wall Street to Jakarta. Asian and Western governments, the private sector, and the International Monetary Fund (IMF, or the Fund), established to provide temporary financial assistance to help countries ease balance of payments adjustments, al ...

... The various participants in the Asian crisis ranged from Wall Street to Jakarta. Asian and Western governments, the private sector, and the International Monetary Fund (IMF, or the Fund), established to provide temporary financial assistance to help countries ease balance of payments adjustments, al ...

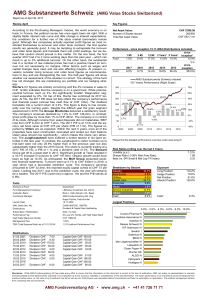

AMG Substanzwerte Schweiz (AMG Value Stocks

... According to the Purchasing Managers’ Indices, the world economy is on track. In France, the political course has once again been set right. With a slightly flatter interest rate curve and little change in interest expectations, the conditions for a further rise of the stock market barometers remain ...

... According to the Purchasing Managers’ Indices, the world economy is on track. In France, the political course has once again been set right. With a slightly flatter interest rate curve and little change in interest expectations, the conditions for a further rise of the stock market barometers remain ...

NBER WORKING PAPER SERIES INTERNATIONAL CAPITAL FLOWS UNDER DISPERSED INFORMATION: Cédric Tille

... DSGE literature in macroeconomics. We adopt the two key features of noisy rational expectations (NRE) models from the market microstructure literature. First, agents have private information about future fundamentals. Second, there is “noise” in the form of unobserved portfolio shifts, which preven ...

... DSGE literature in macroeconomics. We adopt the two key features of noisy rational expectations (NRE) models from the market microstructure literature. First, agents have private information about future fundamentals. Second, there is “noise” in the form of unobserved portfolio shifts, which preven ...

Slide 1

... The last 19 years have been full of turmoil from the economic and financial point of view. Considering the number of financial crises that have taken place and the unfolding of the current financial crisis that began in 2007, I considered the phenomenon of Sudden Stop an important issue, especially ...

... The last 19 years have been full of turmoil from the economic and financial point of view. Considering the number of financial crises that have taken place and the unfolding of the current financial crisis that began in 2007, I considered the phenomenon of Sudden Stop an important issue, especially ...

Financial Collateral and Macroeconomic Amplification∗

... the latter featuring a higher marginal product of capital. On one hand, this allows borrowers to expand their borrowing capacity. On the other hand, the decline of bankers’real assets is typically counteracted by the expansion of their …nancial assets. However, as these are perceived to be increasi ...

... the latter featuring a higher marginal product of capital. On one hand, this allows borrowers to expand their borrowing capacity. On the other hand, the decline of bankers’real assets is typically counteracted by the expansion of their …nancial assets. However, as these are perceived to be increasi ...

Community Investment

... Between them they have over 10 million members. They range in size from The Co-operative Group, the world’s largest consumer co-operative society, with a turnover in 2007 of £9.4bn, to tiny allotment societies dating back to the nineteenth century. Only a comparatively small number of societies have ...

... Between them they have over 10 million members. They range in size from The Co-operative Group, the world’s largest consumer co-operative society, with a turnover in 2007 of £9.4bn, to tiny allotment societies dating back to the nineteenth century. Only a comparatively small number of societies have ...

Capital Flows and Destabilizing Policy in Latin America

... substantial volatility in both private and public consumption. In the empirical literature, Gavin et al. (1996) find that Latin American economies are about two to three times more volatile than industrial countries. They suggest that this volatility is in part a consequence of pro-cyclical fiscal p ...

... substantial volatility in both private and public consumption. In the empirical literature, Gavin et al. (1996) find that Latin American economies are about two to three times more volatile than industrial countries. They suggest that this volatility is in part a consequence of pro-cyclical fiscal p ...