* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download GFC: Cause and consequences

Economic bubble wikipedia , lookup

Business cycle wikipedia , lookup

Monetary policy wikipedia , lookup

Balance of payments wikipedia , lookup

Long Depression wikipedia , lookup

Global financial system wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Globalization and Its Discontents wikipedia , lookup

Systemic risk wikipedia , lookup

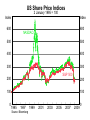

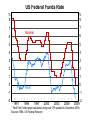

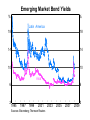

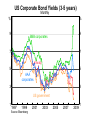

The Global Financial Crisis: Causes and Consequences Warwick J McKibbin CAMA, Australian National University & The Lowy Institute for International Policy, Sydney & The Brookings Institution, Washington DC Presentation to Wednesday Lowy Lunch,8 April 2009 Overview • Some Context: – Understanding the World since 1997 • The Global Finance Crisis unfolding – Key characteristics • Understanding the nature of the crisis – The main shocks • Possible Scenarios looking Ahead – Pessimism or optimism? • The Global Macroeconomic Policy Response • Summary and Conclusion The Context • From a project on understanding the global financial crisis with Dr Andy Stoeckel using a global economic model to understand the key shocks Philosophical Debate • Populist view is that we need a new economic framework and we need to throw away our empirical knowledge of how economies work • Alternative view is that our current frameworks work well but we need to better understand the nature of the shocks impacting on the world 3 observations • Modern economies thrive on liquidity and confidence • The world is a complex place and it is unlikely that there is a single cause of anything we observe • It is unhelpful to create simplified straw men and cut them down one by one until there is nothing left. Major Shocks Since 1997 • • • • • • • • • • Asia crisis (1997/98) Rising bond spreads 1999-2001 Dotcom bubble 98-2000 burst 2001 US monetary relaxation from 2001 to mid 2004 US monetary tightening mid 2004 to june 2006 then cuts from late 2007 Productivity surge in China manufacturing (relative price shock) Rise in commodity prices, oil, food, 2004-late 2007 Bond spreads rise from mid 07 Stock markets peak in Oct 2007 Collapse of Lehman Bros - Collapse of stock markets; economic growth and global trade Asian Currencies against USD December 1989 = 100, monthly Index Index Singapore 125 125 Malaysia 100 South Korea 100 Hong Kong Taiwan 75 75 China Thailand 50 50 Philippines 25 0 25 Indonesia l l l l l l l l l l l l l l l l l l l 93 97 01 05 09 Sources: Bloomberg; Thomson Reuters l l l l l l l l l l l l l l l l l l l 93 97 01 05 09 0 Real GDP Year-ended percentage change % % Australia 6 6 4 4 2 2 Euro area % US % Asia* 5 5 0 0 Japan New Zealand -5 -10 -5 1996 1999 2002 2005 2008 * Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand Sources: ABS; CEIC; Thomson Reuters -10 US Share Price Indices 2 January 1995 = 100 Index Index 600 600 NASDAQ 500 500 400 400 300 300 S&P 500 200 200 100 100 0 l 1995 l l 1997 Source: Bloomberg l l 1999 l l 2001 l l 2003 l l 2005 l l 2007 l 2009 0 US Federal Funds Rate % 8 % 8 7 7 Nominal 6 6 5 5 4 4 3 3 2 2 1 1 0 0 Real* -1 -1 -2 l l 1991 l l l 1994 l l l 1997 l l l 2000 l l l 2003 l l l 2006 l -2 2009 l * Real Fed Funds target calculated using core CPI updated to December 2008. Sources: RBA; US Federal Reserve Major Countries' Share Price Indices Log scale, December 1994 =100 Index 350 300 Euro area Index 350 300 Canada US 250 250 200 200 150 150 Australia UK 100 100 Japan 40 l 1995 l l 1997 Source: Bloomberg l l 1999 l l 2001 l l 2003 l l 2005 l l 2007 l 2009 40 Rising Global Imbalances • Global Savings in excess of global investment – low long term real interest rates • National savings and investment imbalances – Countries with national savings greater than national investment run current account surpluses – Countries with national investment greater than national savings run current account deficits Current Accounts 1995-2008 (%GDP) 25 20 15 NIEs Europe ASEAN5 Middle East China USA $bil 10 5 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 -5 -10 Source IMF World Economic Outlook October 2008 Current Accounts 1995-2008 ($US) 600 400 200 0 $bil 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 -200 -400 -600 -800 -1000 Source IMF World Economic Outlook October 2008 NIEs Europe ASEAN5 Middle East China USA Investment 50 45 40 35 %GDP 30 25 20 15 10 5 0 1995 1996 1997 Malaysia 1998 1999 Indonesia 2000 Thailand 2001 Korea 2002 2003 1 Main drivers behind the decline in current account balance in the United States Boom collapses US dot com inv estment boom 0 -100 US fiscal deficit and -200 public dissav ing, low US$ billion ... -300 personal sav ing rates -400 -500 -600 Asian financial crisis and -700 -800 loss of inv estor confidence Japanese inv estment slump -900 1991 1993 1995 1997 1999 Source: OECD Economic Outlook No. 76, December 2004 2001 2003 2005 Sources of current account imbalances • • • • • Fall in Asia investment Fall in US (public and private saving) Fluctuations in US investment Rising oil prices High Chinese savings relative to investment Role of excess savings • Search for yield • Low real interest rates encouraging risk taking led to apparent mispricing of risk Emerging Market Bond Yields % % Latin America 18 18 14 14 10 10 Asia 6 2 6 l 1995 l l 1997 l l 1999 l l 2001 Sources: Bloomberg; Thomson Reuters l l 2003 l l 2005 l l 2007 l 2009 2 Relative Price shocks • Fall in relative price of manufacturing relative to commodities • Rise in relative price of future consumption relative to current consumption (a rise in risk) • Rise in inflation globally from loose global monetary policy but lags in relative price adjustment Commodity Prices in $US (Index = 100 in 2003M1) 500 450 400 350 300 250 200 150 100 50 20 03 20 M1 03 20 M4 0 20 3M7 03 M 20 10 04 20 M1 04 20 M4 04 20 M7 04 M 20 10 05 20 M1 05 20 M4 0 20 5M7 05 M 20 10 06 20 M1 06 M 20 4 06 20 M7 06 M 20 10 07 20 M1 07 20 M4 0 20 7M7 07 M 20 10 08 20 M1 08 M 20 4 08 M 7 0 Source: IMF World Economic Outlook Database October 2008 Energy Food Agricultural Raw Materials Metals Beverages Preliminary model results • Energy/commodity price hikes from 2004 • 1/3 due to the emergence of rapidly growing developing economies • 1/3 due to the lagged effects of loose US monetary policy through fixed exchange rates on global liquidity • 1/3 due to speculation The Global Financial Crisis • Contraction of the US Housing market (excess capacity) • Massive de-leveraging by financial institutions with MBS exposure – Transparency problems in securitized assets (regulatory breakdown) • Lehman Bros collapse Sept 2008 • Credit markets freeze due to unknown counter party risk • US and UK Governments slow to react to loss of confidence – Paulson plan • Stock market slump and housing price decline reduces consumption and investment • Recession in the industrial world • Recession globally US Corporate Bond Yields (3-5 years) Monthly % % 9 9 BBB corporates 7 7 Swap 5 5 AAA corporates 3 3 US government 1 1997 1999 Source: Bloomberg 2001 2003 2005 2007 2009 1 US Corporate Bond Spreads (3-5 years) Spread over government yields, monthly Bps Bps 800 800 600 600 AAA corporates 400 400 BBB corporates A corporates 200 200 Swap 0 1997 1999 Source: Bloomberg 2001 2003 2005 2007 2009 0 What is the core of the latest crisis? • Collapse in US housing market – reducing household wealth and consumption • Rise in risk • Existing capital requires a higher return • Need to scale back capital • Fall in equity markets also reduces wealth • Rise in household risk premia reduces future income streams A example from the G-Cubed model See www.gcubed.com Equity Risk Shock • Suppose equity risk premia rise by 8% forever • Versus equity risk premia rising 8,6,4,2,0 Change in US Real GDP from 8% equity risk premium 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 -1 %deviation -2 -3 -4 -5 -6 Temp Permanent Change in US Capital Stock from 8% equity risk premium 2 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 -2 -4 -6 -8 -10 -12 -14 -16 -18 Temp Permanent Household Risk Shock • Suppose household discount them future at 4% per year forever • Household discount rate rises 4,2,0….. Change in US Consumption from 4% household risk premium 8 6 4 2 -4 -6 -8 -10 -12 -14 72 68 64 60 56 52 48 44 40 36 32 28 24 20 16 12 8 -2 4 0 %deviation 0 Permanent Temporary Change in US Real GDP from 4% household risk premium 2 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 %deviation -2 -4 -6 -8 -10 Permanent Temporary Core Shocks • In the US and UK it is a financial crisis • In other countries it is a fall in exports and a loss of domestic confidence • This is both a supply side shock and a demand side shock not just insufficient demand On the global policy responses • In a single economy – Monetary policy effective – Fiscal policy less effective • In a global economy – Coordinated monetary policy less effective – Coordinate fiscal policy more effective • Temporary fiscal policy more effective than permanent fiscal policy – Composition matters for supply versus demand response Role of Policy • Monetary policy shifts demand from the future to the present • Fiscal policy largely shifts demand from the future to the present plus it can change incentives to invest and save with permanent effects on the level of income 3 Scenarios • Risk premia remain high – Long process of capital destruction – Demand stimulus can’t change this but can soften the blow Early signs of recovery? • Optimism – Commodity prices slightly rising – Chinese foreign investment rising • Pessimism (and key risks) – European economies fiscal liabilities putting strain on the Euro – Eastern Europe looking more like East Asia in 1997 2 scenarios • 1) Risk returns to pre 2007 levels – Strong recovery with demand stimulus overlaying – Governments have borrowed heavily and now need to finance large deficits – Rising global interest rates as public and private compete 3 scenarios • 2) Risk premia fall to back to 1990s levels • US and UK in long asset adjustment period • Developing countries return to growth momentum quickly Summary and conclusion • A series of shocks over the past decade but the big shock is a loss of confidence (risk shock) • Large financial and real implications of this type of shock • Trade is not the major channel of transmission but the problem is a synchronized loss of confidence • Monetary and fiscal policies can’t do much to stabilize the supply side but can help smooth demand in the short run • Macro policy’s main role is to raise confidence rather than as an end in itself • Regulatory reform and institutional reform is critical for handling future shocks www.sensiblepolicy.com