* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download MGF5181 International Business Strategy

International monetary systems wikipedia , lookup

Group of Eight wikipedia , lookup

Balance of trade wikipedia , lookup

Brander–Spencer model wikipedia , lookup

Heckscher–Ohlin model wikipedia , lookup

Development economics wikipedia , lookup

Economic globalization wikipedia , lookup

Development theory wikipedia , lookup

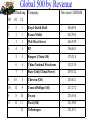

MGX5181 International Business Strategy Week Two The Multinational Corporation MNC International trade theories and their impact on the internationalising organisation Week 2 objectives • Assess the role of the MNC in international strategy • Brief review of the impact of international trade theories on the internationalising organisation. 2 2 The World’s Multinational’s • Many have sales larger than their host nations GDP. • According to one estimate, the 500 largest industrial corporations account for 80% of the world’s direct investment and ownership of foreign affiliates. • Corporate Headquarters for the 500 largest industrial corporations are in 32 different nations. • One third of world exports consist of goods flowing between different parts of same companies. • Often created by mergers and acquisitions Ownership • Mostly owned by pension funds, banks or insurance companies. Often run by powerful people. • Ownership becoming global as foreign capital transfers to shares in local markets. (e.g. foreign institutions own more of Aust sharemarket than locals. Australian institutions invest approx 20% of their funds overseas). Global 500 by Revenue Global Ranking Company 08 10 12 Revenue USD$Mil 3 2 1 Royal Dutch Shell 484,489 2 3 2 Exxon Mobil 452,926 1 1 3 Wal-Mart Stores 446,950 4 4 4 BP 386,463 5 5 Sinopec (China Oil) 375,214 6 6 China National Petroleum 352,338 7 7 State Grid (China Power) 259,142 6 10 8 Chevron (Oil) 245,621 10 12 9 ConocoPhillips (Oil) 237,272 5 8 10 Toyota 235,364 8 11 11 Total (Oil) 231,580 12 Volkswagen 221,551 Australian Companies in Global 500 (2012) Aust Rank Company 08 10 12 Global Rank 10 12 Revenue USD Mil Head Office 1 4 1 1 BHP Billiton 159 108 71,739 2 2 Wesfarmers (Coles) 183 171 54,147 Melb Perth 3 3 3 Woolworths 184 175 53,559 Sydney 5 4 4 CBA (Bank) 249 227 44,306 Sydney 7 5 5 Westpac (Bank) 254 229 44,112 Sydney 2 6 6 National Aust Bank 266 254 40,521 Melb 6 7 7 ANZ (Bank) 338 291 36,731 Melb 8 8 8 Telstra 441 438 24,968 Melb 9 Caltex Australia 486 22,810 Sydney Global 500 Most Profit Global Ranking 2008 10 12 Company 5 2 1 Gazprom (Russia , Energy) 44,459 1 3 2 Exxon Mobil 41,060 4 3 ICBC – Industrial & Commercial 32,214 Bank of China 2 5 4 Royal Dutch Shell 30,918 7 9 5 Chevron 26,895 6 6 China Construction Bank 26,180 7 Apple 25,922 8 BP 25,700 9 BHP Billiton 23,648 10 Microsoft 23,150 11 Vale (Brazil, Mining) 22,885 12 Petronas 21915 10 8 11 Profit 2012 USD$Mil National Composition of the Largest MNCs Country Of top 260 (1973) Of top 500 (2008) Of top 500 (2010) Of Top 500 (2012) USA 126 (48.5%) 153 (30.6%) 133 132 Japan 9 (3.5%) 64 (12.8%) 68 68 Britain 49 (18.8%) 34 (6.8%) 30 27 France 19 (7.3%) 39 (7.8%) 35 32 Germany 21 (8.1%) 37 (7.4%) 34 32 China 11 (2003) 29 (5.8%) 61 73 Canada 4 (1.5%) 14 (2.8%) 11 11 15 15 Switzerland South Korea 15 (3%) 14 13 Netherlands 13 (2.6%) 13 13 Australia 8 (1.6%) 8 9 1 1 Malaysia Features of MNC’s • Annual Revenue Typically sales in hundreds of millions of dollars. Around 2000 MNC’s have annual sales over US$1 billion. Many MNC’s have higher annual revenue than the GNP of various countries. About half the world’s 100 largest economies are companies. • Character MNCs are predominantly oligopolistic (operate in markets where there are few sellers) Features of MNC’s • Affiliates Most MNCs have a sizeable number of affiliates. Top 500 own over 50% of worlds productive assets. • Areas of operation MNC’s are the product of developed countries. Almost 3/4 of the operations are in developed market economies. Features of MNC’s • Structure & Control By and large control is via complete or majority ownership. Usually there is a common global strategy. Parent can control foreign affiliates via resources eg: capital, technology, trademarks, patents and manpower, plus long and short term budgets. Are there any really Global Companies? • Research by Alan Rugman & Alain Verbeke (2004): Assessed world’s 500 largest companies. They found they represent over 90% of all foreign direct investment and about half of all world trade. 380 gave data on a regional basis. Found that 320 had an average of 80.3% of sales in their home region. Therefore concluded that most were really only regionally based. Found most only global at “back end” of value chain – some connection in functional areas such as financial capital, HR capital, R&D, knowledge or components to serve home region clients. Are there any really Global Cos? • Rugman and Verbeck found there was really only nine global companies in their study: 1. IBM 2. Sony 3. Royal Philips Electronics 4. Nokia 5. Intel 6. Canon 7. Coca-Cola 8. Flextronics Intl 9. LVMH (Moet Hennessy Louis Vuitton) • Common themes The application of scientific technical knowledge in the marketplace (7) Masters of using branding in consumer markets (2) All offer products that appeal across cultural and national boundaries ie products people wanted, sheer availability or status allure Multinational’s and Foreign Direct Investment • Multinationals achieve managerial control over their assets abroad through foreign direct investment (FDI). • FDI is direct investment in business operations in a foreign country, including establishment of new operations as well as purchases of more than 10% of existing companies. Foreign direct investment • Basic types of affiliates: A controlled affiliate is an enterprise in which the investor has control of more than 50% of the voting power. A non-controlled affiliate is an enterprise in which the investor has control of at least 10% of the voting power and no more than 50%. • Source: OECD 2012 FDI by type • M&As • Non-resident purchase of existing equity (10% to 100% of the voting power) – Sub-category (above 50% of the voting power) • Other types of FDI • Issuance of new equity – Greenfield (New) investment – Extension of capital • Financial Restructuring • Source OECD 2012 FDI Inflows 2003-2012 OECD 2013 Multinational’s and Foreign Direct Investment • Motivation for FDI is diverse: Marketing factors Barriers to trade Cost factors Investment climate Major Determinants of Direct F.D.I. Marketing Factors: • Size of market • • • • • Market growth Desire to maintain share of market Desire to advance exports of parent company Need to maintain close customer contact Dissatisfaction with existing market arrangements • Export base • Desire to follow customers • Desire to follow competition Barriers to Trade: • Government erected barriers to trade • Preference of local customers for local products General: • Expected higher profits • Other Major Cost Factors: • • • • • • • • • Determinants of Direct F.D.I. Desire to be near source of supply Availability of labour Availability of raw materials Availability of capital/technology Lower labour costs Lower other production costs Lower transport costs Financial (and other) inducements by government More favourable cost levels Investment Climate: • General attitude toward foreign investment • • • • • • Political stability Limitation on ownership Currency exchange regulations Stability of foreign exchange Tax structure Familiarity with country MNCs and the Host Country • Positive Impact: Capital Formation Technology Transfer Regional & Sectoral Development Internal Competition & Entrepreneurship Favourable Effect on Balance of Payments Increased Employment MNCs and the Host Country • Negative Impact Industrial dominance Exploitation of raw materials and cheap labour Bribery and corruption Interference in political matters Technological dependence Disturbance of economic plans Cultural change Interference by home government through MNC Degree of government control may be less than intended MNCs The Home Country Perspective • Improves Gross Domestic Product via repatriation of profits, royalties & fees. • Increases export opportunities. • Political advantages. • Job losses. • Net effect on imports & exports. • Creating competitors. Allegations Against MNC’s • In transferring technology to less developed countries, prices are set too stringently. • If a country attempts regulation, MNC’s merely divest and move where regulations are less stringent. • The centralisation and control of key functions of MNC’s in their home countries perpetuate a neocolonial dependence of less-developed countries. Allegations Against MNC’s • Sensitive country information is disseminated internationally by MNC’s global intelligence networks. • MNC’s introduce superfluous products that do not contribute to social needs and perpetuate class distinctions. • National labour interests are undermined because of global activities of MNCs. Allegations Against MNC’s • MNC’s avoid paying taxes. Through artificial transfer pricing, MNC’s undermine attempts by Governments to manage their economic affairs. • The best jobs are given to citizens of the nation in which the MNC’s have their headquarters. Allegations Against MNC’s • Inappropriate technology is introduced by MNC’s to less developed countries. • National labour interests are underminded because of the global activity of MNEs. MNC “Code of Conduct” • In the 1990s the United Nations set up a Code of Conduct on Transnational Corporations in respect of their international dealings. • Intended to create a stable business environment conducive to foreign direct investment and other company activities that stimulate economic development. • UN Centre on Transnational Corporations closed down by USA pressure in 1998 as US MNCs complained about scrutiny. • Replaced in 1999 by UN “Global Compact” which has no teeth as no penalties. Global Compact This is a voluntary initiative to promote good corporate citizenship (according to UN) UN request to world business. Has 10 Principles: Human Rights • Principle 1: Support and respect the protection of international human rights within their sphere of influence • Principle 2: Make sure their own corporations are not complicit in human rights abuses Labour Global Compact • Principle 3: Freedom of association and the effective recognition of the right to collective bargaining; • Principle 4: The elimination of all forms of forced and compulsory labour.; • Principle 5: The effective abolition of child labour; and • Principle 6: The elimination of discrimination in respect of employment and occupation. Environment • Principle 7: Support a precautionary approach to environmental challenges; • Principle 8: Undertake initiatives to promote greater environmental responsibility; and • Principle 9: Encourage the development and diffusion of environmentally friendly technologies. Global Compact Anti-Corruption • Principle 10: Businesses should work against all forms of corruption, including extortion and bribery. Economic Theories For International Trade Traditional Trade Theories and Modern Trade Theories Traditional Trade Theories • Review your knowledge on the following economic theories for international trade: Mercantilism Absolute Advantage – Adam Smith Comparative Advantage – David Ricardo Factor Proportions Theory – Heckscher & Ohlin Modern Trade Theories • Country Similarity Theory In 1961 Steffan Linder suggested that most trade in manufactured goods is between countries of similar per capita income. ie consumers have a similarity of preference when at the same stage of economic development. Global Horizons Theory • • • • As part of a firm’s growth, their geographical horizons change. Change is caused by: INTERNAL Executives, Technology, Product, Raw Material Supply • EXTERNAL Customer, Government Product Life Cycle (Vernon, 1966) • Concept is related to product life cycle and concerns the role of innovation in trade patterns. • Phase 1: New Product., Domestic Market • Phase 2: Export Mature Product., Other Industrialised Countries • Phase 3: Foreign Production Export to Developing Countries • Phase 4: Move Production to Developing Countries • Phase 5: Export of Product Back to Home Country New Trade Theory • Emerged in 1970’s (see Helpman and Krugman) • Proposed key driver for internationalisation was to obtain economies of scale Increase in range of goods available to consumers Decrease average cost of goods • Certain products may be dominated by countries whose firms were first movers in their production Ownership Advantage Theory S.Hymer, 1976 • Company must have a compensating advantage that offsets innate advantages of local firm • Advantages are either firm specific or ownership specific E.g.: Technology, Product Differentiation, Economies of Scale, Access to Capital Markets, Entry Restrictions. Internationalisation Approach Buckley and Casson,1976 • Seeks to explain why foreign direct investment is a more effective way of exploiting resources and markets than indirect methods like exporting or licensing. • Emphasis is on extending direct operations. Company needs a competitive advantage or a unique asset to expand. Incentive depends on the relationship of: Industry specific factors • E.g.: Product, Industry Structure Regional Specific • Geographical, Social Nation Specific • Political & Fiscal Firm Specific • Management Ability Global Strategic Rivalry theory • In the 1980s economists such as Paul Krugman and Kelvin Lancaster developed a new way of looking at the growth of MNCs. According to these theories firms struggle for a sustainable competitive advantage to exploit to dominate the global marketplace. Global Strategic Rivalry theory cont. • Focus is on strategic decisions adopted as firms compete globally. Sustainable competitive advantage is achieved by: owning intellectual property rights investing in research and development achieving economies of scale or scope exploiting the experience curve Porter’s National Competitive Advantage theory (Porter’s diamond) • In 1990 Michael Porter stated that success in international trade came from the interaction of four country and firm specific factors: factor conditions • land, labour, capital, education, infrastructure etc. • International rivals will differ in the mix and cost of available factors and the rate of factor creation. demand conditions • Competitors from other nations face differing segment structures to home demand, differing buyer needs and differing levels of buyer sophistication. • Large sophisticated domestic consumer base often stimulates innovative products. • Understanding competitors home demand conditions helps you predict their foreign strategies and product development. Porter’s National Competitive Advantage theory (Porter’s diamond) Cont Related and supporting industries • Competitors based in other nations will differ in availability of domestic suppliers, quality of interaction with suppliers, and presence of related industries. • being close to local suppliers leads to improved communication, costsavings, innovations transferable overseas. Firm strategy, structure and rivalry • the domestic environment shapes firms ability to compete internationally. According to Porter you need vigorous competition, and strong local investment in areas that provide sustainable advantages e.g. R&D, quality control, brand imaging, employee training). Other diamond components • Chance • Government Porter’s Country Diamond Context for firm strategy and rivalry Factors (input) conditions • Factors inputs quality and cost: - Natural resources - Human resources - capital - Physical infrastructure - Administrative infrastructure - Information infrastructure - Scientific and technological infrastructure 44 • A local context that encourages appropriate forms of investments and sustained upgrading • Vigorous competition Related and supporting industries • A critical mass of capable local suppliers • Presence of clusters Demand conditions • Sophisticated and demanding customers • Customers needs that anticipate those elsewhere • Unusual demand in specialized segments that can be served globally Lasserre Fig 6.11, p.176 Porter’s National Competitive Advantage theory (Porter’s diamond) Cont • Porter’s rules for innovation: Sell to the most sophisticated and demanding buyers and channels • Stimulates fast improvement • Sets valuable benchmarks • Challenges ability to compete Seek out the buyers with the most difficult needs • Enhances ability to deal with pressure • Encourages research and development Porter’s National Competitive Advantage theory (Porter’s diamond) Cont Establish norms of exceeding the toughest regulatory hurdles or product standards • Encourages early upgrading Source from the most advanced and international home-based suppliers • Deal with those with a competitive advantage and insights that may assist you Treat employees as permanent • Requires focus to improve productivity via training and rewards Establish outstanding competitors as motivators • Provide benchmarks to compare and exceed Porter’s National Competitive Advantage theory (Porter’s diamond) Cont • Developing clusters Use home nation clusters of buyers, suppliers and related industries to gain competitive advantages. Use home based suppliers and buyers as international allies • Regular senior management contact • R&D interchanges • Reciprocity in serving as test sites for new products and services • Cooperation in penetrating international markets Internalisation Theory • Relies heavily on the concept of transaction costs. Transaction costs are the costs of entering into a transaction such as negotiating, monitoring and enforcing a contract. The firm must decide whether it is better to own its own factory overseas or contract others to undertake the work e.g. license, franchise, supply agreement. When transaction costs are high it is better to internalise production i.e. direct foreign investment Eclectic Theory • John Dunning (1988) combined location advantage, ownership advantage and internalisation advantage to form a unified theory of FDI. • According to Dunning FDI will occur when 3 conditions are satisfied: Location advantage • Must be more profitable to operate in foreign market than domestic Ownership advantage • Firm must have unique competitive advantage over local firms e.g. technology, marketing or management capabilities) Internalisation advantage • Benefit of establishing own production facilities (control) must outweigh using a local independent firm (licensing) to provide the service