* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Corporate Governance

Survey

Document related concepts

Transcript

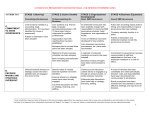

1 ‘Bubble Act’ 1720 Recognised the ‘moral hazard (Risk)’ of the relationship in the principle-agent relationship A key theme that was established and continues to today is that directors are accountable to shareholders Companies Act (CA) 1844 Required audited balance sheet (a ‘value statement’ at year-end) to be presented to shareholders ▪ Problem: Anyone could be the auditor. Companies Act 1856 The CA 1844 audit provision was removed 2 Companies Act 1900 Reintroduction of balance sheet audit Auditor to be appointed by shareholders CA 1929 P&L a/c required ▪ Shows how the company has fared over the year. CA 1948; CA 1967 Required auditor to be qualified Auditor to express ‘an opinion’ A lot of disclosures to shareholders required 3 CA 1981 Aspects of GAAP introduced into law Directors’ report to be audited Directors’ report to contain comment on the companies future development Small and medium sized companies exemptions CA 1985; CA 1989; CA 2006 (Mainly consolidation) Director’s ‘duty of competence’ (Common Law) codified ▪ Negligence where a failure of a reasonable standard of competence IFRS for listed companies 4 The government’s role in a capitalist economy To protect the public interest Most of the statutes have resulted from a public scandal Usually involving fraudulent activity Thus legislation has attempted to make directors increasingly more accountable to shareholders over time 5 Cadbury 1992 Greenbury 1995 Hampel 1998 Turnbull 1999 Higgs 2003 Tyson 2003 Smith 2003 6 Corporate governance (CG) - not a ‘new’ thing Based on existing, implicit CG behaviour It may thus be considered a ‘codification’ exercise of good CG practice in the UK in 1992 Public concern over several corporate failures Particularly the Pollypeck and Maxwell Communications Corporation cases in 1991 The rapid growth in executive remuneration and conflicts of interest between directors and shareholders The Stock Exchange initiated the Cadbury enquiry 7 ‘The committee on the financial aspects of corporate governance’ The Code of Best Practice’ (1992) Voluntary code ▪ But for listed companies a compliance statement was required ▪ ‘Comply or explain’ – Principles rather than rules The ‘principles v rules’ argument (UK v USA) The following example is a true case, but in a non-financial setting (from China Daily, December 2007) 8 Hospital Doctor – What will he or she do here? Underlying principles of medical profession Rules of the hospital 9 In financial accounting – Should there be strict and detailed rules trying to cover all situations (US approach) or Limited rules with ‘overriding’ principles (true and fair / fair presentation) (UK/International approach) In practice there is a concerted effort to bring US and UK/International accounting standards together. Back to UK CG… 10 ‘This, more than any other initiative in corporate governance reform, has led to the shift of directors’ dialogue towards greater accountability and engagement with shareholders…’ and ‘…has generated the more significant change of corporate responsibility toward a range of stakeholders, encouraging greater corporate social responsibility in general’ Solomon, 2007 11 The report covered three areas Directors ▪ It defined the composition of the board, its responsibilities, and the responsibilities of the chairman, and the audit and remuneration committees. Auditing Shareholders ‘Fat cats’ 12 The Greenbury Report released in 1995 was the product of a committee established by the United Kingdom Confederation of Business and Industry on corporate governance. It followed in the tradition of the Cadbury Report and addressed a growing concern about the level of director remuneration. 13 ‘Fat cats’ Continued public concern over several incidences of very high directors’ remuneration Objective to set up a Code of Practice for directors’ remuneration 14 The Committee on Corporate Governance (the Hampel Committee) was established in November 1995 to review the Cadbury Committee's recommendations on corporate governance. The Hampel Committee released a preliminary report in August 1997, followed by a final report in January 1998. 15 Continued public concern over corporate failures The Hampel Committee Notably that of Barings Bank, 1995 The intention was to ‘combine, harmonise and clarify’ the Cadbury and Greenbury recommendations and create an overall code of corporate governance Issue of a revised and extended ‘Combined Code’, 1998 16 More extensive, covering… Board performance Disclosure of information Remuneration Role of the audit committee Training Role of the nomination committee Conduct of AGM’s Role of the remuneration committee Roles of chairman and chief executive Directors’ contracts Key elements incorporated in the Stock Exchange Rules (1998) 17 It also underlined the voluntary, ‘principlesbased’ approach as a key element Refocused the emphasis on accountability primarily to the shareholders, then to other stakeholders 18 The report covered two areas 1. Principles ▪ ▪ ▪ ▪ Directors Directors’ remuneration Relations with shareholders Accountability and audit 2. Institutional shareholder provisions The ‘Codes’ issued after Hampel’s are mainly modifications of the basic CadburyGreebury-Hampel model 19 The Turnbull Report was first published in 1999 and set out best practice on internal control for UK listed companies. In October 2005 the Financial Reporting Council (FRC) issued an updated version of the guidance with the title 'Internal Control: Guidance for Directors on the Combined Code'. 20 Public concern over risk management and control Barings Bank, 1995 At this point we need to re-consider what risk management, systems and internal control are… 21 It initiated the Higgs Report on “The Role and Effectiveness of Non-Executive Directors” (Nonworking director of a firm) does not participate in the day-to-day management of the firm) which was published in January 2003. Recommendations from Higgs included a definition of ‘independence’ and the proportion of independent non-executive directors on the board and its committees; added emphasis on the process of nominations to the board through a transparent and rigorous process. 22 Around the same time, the Financial Reporting Council published the Smith Report, “Guidance on Audit Committees”. Both the Higgs and Smith Reports were published in January 2003. 23