Download attachment

... – Accounting require that the financial statements in the first year of adoption of a new financial reporting framework contain an opening statement of financial position.1 Existing auditing standards apply for audits of financial statements for periods ending before December 14, 2010. The CASs appl ...

... – Accounting require that the financial statements in the first year of adoption of a new financial reporting framework contain an opening statement of financial position.1 Existing auditing standards apply for audits of financial statements for periods ending before December 14, 2010. The CASs appl ...

Corporate Governance of Listed Companies in China

... the discussion highlighted the importance of providing information to investors about the board and senior management selection process. China – like all other countries around the world – faces the continuous challenge of ensuring that its corporate governance laws and regulations are translated in ...

... the discussion highlighted the importance of providing information to investors about the board and senior management selection process. China – like all other countries around the world – faces the continuous challenge of ensuring that its corporate governance laws and regulations are translated in ...

Sartorius Stedim Biotech Group Reference Document

... This Reference Document contains statements concerning the future performance of Sartorius Stedim Biotech S.A. These statements are based on assumptions and estimates. Although we are convinced that these forward-looking statements are realistic, we cannot guarantee that they will actually apply. Th ...

... This Reference Document contains statements concerning the future performance of Sartorius Stedim Biotech S.A. These statements are based on assumptions and estimates. Although we are convinced that these forward-looking statements are realistic, we cannot guarantee that they will actually apply. Th ...

CPA PassMaster Questions–Auditing 4 Export Date: 10/30/08

... the audit client and thus may be unaware of all the financial relationships the bank has with the client. Choice "a" is incorrect. Standard bank confirmations contain a signature from an authorized client employee and are a very commonly used audit procedure. It is unlikely that a bank would refuse ...

... the audit client and thus may be unaware of all the financial relationships the bank has with the client. Choice "a" is incorrect. Standard bank confirmations contain a signature from an authorized client employee and are a very commonly used audit procedure. It is unlikely that a bank would refuse ...

Annual Report 2011-2012 - Financial Intelligence Centre

... measures that countries should have in place to combat money laundering, the financing of terrorism and the proliferation of weapons of mass destruction. The latest revision of the Recommendations – the first since 2003 – introduces three major changes: ·· Emphasis on a risk-based approach, in which ...

... measures that countries should have in place to combat money laundering, the financing of terrorism and the proliferation of weapons of mass destruction. The latest revision of the Recommendations – the first since 2003 – introduces three major changes: ·· Emphasis on a risk-based approach, in which ...

ASRE 2410 Review of a Financial Report Performed by the Independent Auditor of the Entity. The choice of ASRE 2400

... Financial Report for a Half-Year Example of an Unmodified Auditor’s Review Report on a Half-Year Financial Report – Single Disclosing Entity Appendix 4: Example of an Unmodified Auditor’s Review Report on a Financial Report Financial Report Prepared in Accordance with a Financial Reporting Framework ...

... Financial Report for a Half-Year Example of an Unmodified Auditor’s Review Report on a Half-Year Financial Report – Single Disclosing Entity Appendix 4: Example of an Unmodified Auditor’s Review Report on a Financial Report Financial Report Prepared in Accordance with a Financial Reporting Framework ...

Data mining journal entries for fraud detection: A Pilot Study

... should respond to this heightened risk environment in the 2000 report of their “Panel on Audit Effectiveness” (POB 2000). The Panel conducted reviews of working papers, which the Panel termed “Quasi Peer Reviews,” for a significant number of audits. In additio ...

... should respond to this heightened risk environment in the 2000 report of their “Panel on Audit Effectiveness” (POB 2000). The Panel conducted reviews of working papers, which the Panel termed “Quasi Peer Reviews,” for a significant number of audits. In additio ...

Aue2602 Summary

... fewer people involved and if no real distinction between these phases then must place more reliance on : access controls and programmed controls rather then manual controls preventative rather then detective and corrective controls Vital that the information that is being processed is valid, acc ...

... fewer people involved and if no real distinction between these phases then must place more reliance on : access controls and programmed controls rather then manual controls preventative rather then detective and corrective controls Vital that the information that is being processed is valid, acc ...

Annual Audit - Atlantic City Municipal Utilities Authority

... certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing stan ...

... certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing stan ...

Does Fair Value Reporting Affect Risk Management?

... Many firms, however, employ economically effective hedging strategies which are designed such that the derivative instrument’s value and the underlying exposure are not highly correlated. For example, Brown and Toft (2002) show that it is often optimal for a firm to hedge using derivative strategies ...

... Many firms, however, employ economically effective hedging strategies which are designed such that the derivative instrument’s value and the underlying exposure are not highly correlated. For example, Brown and Toft (2002) show that it is often optimal for a firm to hedge using derivative strategies ...

ORRS 2011 (Text)

... Changes to the Operational Risk reporting standards must be approved by the Board of ORX. The Definitions Working Group has the responsibility for reviewing the Operational Risk Reporting Standards and making recommendations to the Board of ORX. The Definitions Working Group will review requests fro ...

... Changes to the Operational Risk reporting standards must be approved by the Board of ORX. The Definitions Working Group has the responsibility for reviewing the Operational Risk Reporting Standards and making recommendations to the Board of ORX. The Definitions Working Group will review requests fro ...

Revised Guidance Statement GS 009: Auditing SMSFs

... contain a pension fund and have made an irrevocable election to become regulated in the approved form within the specified time. Approved SMSF auditor is defined in paragraph 13. The SMSF Annual Return (NAT 71226) comprises income tax reporting, regulatory reporting and member contributions reportin ...

... contain a pension fund and have made an irrevocable election to become regulated in the approved form within the specified time. Approved SMSF auditor is defined in paragraph 13. The SMSF Annual Return (NAT 71226) comprises income tax reporting, regulatory reporting and member contributions reportin ...

10414-378 IFRS IT White Paper WEB FINAL

... expectations could be the use of XBRL as further discussed below in the section IFRS Transition in Canada: How XBRL Is Helping. A key feature of the XBRL Global Ledger (GL) Framework and tools such as Convergence Assistant is that they can facilitate reporting under different standards such as U.S. ...

... expectations could be the use of XBRL as further discussed below in the section IFRS Transition in Canada: How XBRL Is Helping. A key feature of the XBRL Global Ledger (GL) Framework and tools such as Convergence Assistant is that they can facilitate reporting under different standards such as U.S. ...

department of management and entrepreneurship subject information (overview of syllabus)

... The basic methods and some selected techniques of cost accounting for application in the business environment. Cost elements, material costs, labour costs and overheads, job costing and manufacturing statements. The basic methods to calculate the profitability of a manufacturing concern, depreciatio ...

... The basic methods and some selected techniques of cost accounting for application in the business environment. Cost elements, material costs, labour costs and overheads, job costing and manufacturing statements. The basic methods to calculate the profitability of a manufacturing concern, depreciatio ...

Demand Management User Manual

... sphere of Government, or any other institution identified in national legislation, contracts for goods or services, it must do so in accordance with a system which is fair, equitable, transparent, competitive and ...

... sphere of Government, or any other institution identified in national legislation, contracts for goods or services, it must do so in accordance with a system which is fair, equitable, transparent, competitive and ...

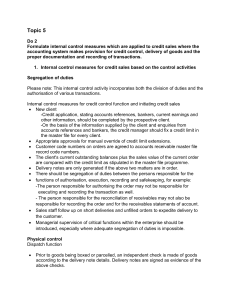

Do 3 - Together We Pass

... Describe the internal control measures which are normally incorporated in the use of cash registers for handling cash sales. 1. Internal control measures that normally exist when cash registers are used in the handling of cash sales (1) Cash registers must display the amount of the cash sales on a s ...

... Describe the internal control measures which are normally incorporated in the use of cash registers for handling cash sales. 1. Internal control measures that normally exist when cash registers are used in the handling of cash sales (1) Cash registers must display the amount of the cash sales on a s ...

APPTICATION OF THE AUDIT PROCESS TO OTHER CYCTES

... utilities. It also identifies whether the acquisition was for cash or accounts payable. The journal or listing can coyer any time period, typically a month. The journal or listing includes totals of every account number included for the time period. The same transactions included in the journal or l ...

... utilities. It also identifies whether the acquisition was for cash or accounts payable. The journal or listing can coyer any time period, typically a month. The journal or listing includes totals of every account number included for the time period. The same transactions included in the journal or l ...

report (text only) - RTF 202Kb - Opens in a new

... involves: providing leadership and direction; representing wards and constituents; and scrutinising policy direction and the performance of services. They also perform key roles in making choices between competing priorities, setting objectives to meet the needs of their communities and ensuring tha ...

... involves: providing leadership and direction; representing wards and constituents; and scrutinising policy direction and the performance of services. They also perform key roles in making choices between competing priorities, setting objectives to meet the needs of their communities and ensuring tha ...

annual report 2016

... OML has always taken great pride in operating a tightly run ship when looking at the costs of our work against the industry. This aspect is not negotiable. During the year OML has chosen to allocate some of its retained earnings back to the contributing companies. We need a certain level in reserves ...

... OML has always taken great pride in operating a tightly run ship when looking at the costs of our work against the industry. This aspect is not negotiable. During the year OML has chosen to allocate some of its retained earnings back to the contributing companies. We need a certain level in reserves ...

Lesson Preparation Project

... Much PAT research has tried to explain and predict firms’ inventory policy choices. Dopuch and Pincus (1988) reported evidence that tax savings are high for LIFO firms and that firms keep using FIFO do not suffer large tax consequences, for reasons including low amounts of inventory, high variabilit ...

... Much PAT research has tried to explain and predict firms’ inventory policy choices. Dopuch and Pincus (1988) reported evidence that tax savings are high for LIFO firms and that firms keep using FIFO do not suffer large tax consequences, for reasons including low amounts of inventory, high variabilit ...

Audit Information for RFP

... and will undertake such measures as are necessary to require its employees and all approved Subcontractors or Joint Ventures to maintain complete confidentiality. Debarment: By submitting a response to this Request for Proposal, the Contractor certifies to the best of their knowledge and belief that ...

... and will undertake such measures as are necessary to require its employees and all approved Subcontractors or Joint Ventures to maintain complete confidentiality. Debarment: By submitting a response to this Request for Proposal, the Contractor certifies to the best of their knowledge and belief that ...

THE VALUE RELEVANCE OF MANAGERS` AND

... related investment gain. Second, we manipulate auditor disclosure at three levels: absent, auditor narrative disclosure, and auditor visual disclosure. Participants receiving the auditor narrative disclosure manipulation view a fully-narrative critical auditing matter disclosure related to material ...

... related investment gain. Second, we manipulate auditor disclosure at three levels: absent, auditor narrative disclosure, and auditor visual disclosure. Participants receiving the auditor narrative disclosure manipulation view a fully-narrative critical auditing matter disclosure related to material ...

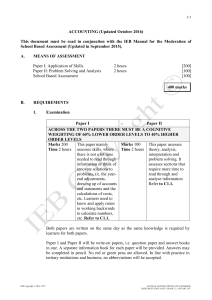

The outcomes that need to be achieved in grades 10 to 12 are

... • an emphasis on the assessment of the 'learning process' rather than 'rules' in both examination papers; • giving impetus, specifically in the second examination paper, to what the Accounting Education Change Commission in the US referred to as 'an information development and communication process' ...

... • an emphasis on the assessment of the 'learning process' rather than 'rules' in both examination papers; • giving impetus, specifically in the second examination paper, to what the Accounting Education Change Commission in the US referred to as 'an information development and communication process' ...

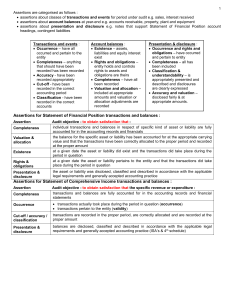

Sales Transaction Assertions

... amount due from a customer because of returned goods or an allowance granted Remittance advice – a document that accompanies the sales invoice mailed to the customer that can be returned to the seller with the cash payment Customer statement – A document summarizing customer balance and account ...

... amount due from a customer because of returned goods or an allowance granted Remittance advice – a document that accompanies the sales invoice mailed to the customer that can be returned to the seller with the cash payment Customer statement – A document summarizing customer balance and account ...