Financial Accounting Standards Board (FASB)

... The international nature of business requires companies to be able to make their financial statements understandable to users all over the world. In an attempt to harmonize conflicting standards, the International Accounting Standards Board (IASB) was formed in 1973 to develop worldwide accounting s ...

... The international nature of business requires companies to be able to make their financial statements understandable to users all over the world. In an attempt to harmonize conflicting standards, the International Accounting Standards Board (IASB) was formed in 1973 to develop worldwide accounting s ...

Outpatient Pharmacy Billing Review

... Based on the work performed, each of the three clinics requires some degree of improvements to enhance controls for charge capture and billing. Written standard operating procedures are lacking in all three clinics. A recurring issue identified during this review is the inaccuracies in the entries o ...

... Based on the work performed, each of the three clinics requires some degree of improvements to enhance controls for charge capture and billing. Written standard operating procedures are lacking in all three clinics. A recurring issue identified during this review is the inaccuracies in the entries o ...

Guide to Certifications

... between strategy and financial performance are critical. IMA’s CMA program embodies an extensive curriculum covering accounting, finance and important related fields. The four-part exam is designed to develop and measure critical thinking and decisionmaking skills. For more information, visit www.im ...

... between strategy and financial performance are critical. IMA’s CMA program embodies an extensive curriculum covering accounting, finance and important related fields. The four-part exam is designed to develop and measure critical thinking and decisionmaking skills. For more information, visit www.im ...

Auditing for Fraud Detection - Professional Education Services

... issues which are involved with each cycle and how an auditor may be able to detect fraud in those cycles. Chapter 3 addresses cash collections and receivables (the revenue and collection accounting cycle) which covers sales, sales returns, accounts receivable, account writeoffs, and cash collections ...

... issues which are involved with each cycle and how an auditor may be able to detect fraud in those cycles. Chapter 3 addresses cash collections and receivables (the revenue and collection accounting cycle) which covers sales, sales returns, accounts receivable, account writeoffs, and cash collections ...

Substantive Tests of Transactions and Balances

... is indirect evidence that controls are operating. This is the reason that some auditors say the evaluation of controls is not final until the audit is completed. Substantive audit tests can always provide some additional evidence of the functioning of controls. In a true dual-purpose test, different ...

... is indirect evidence that controls are operating. This is the reason that some auditors say the evaluation of controls is not final until the audit is completed. Substantive audit tests can always provide some additional evidence of the functioning of controls. In a true dual-purpose test, different ...

a) Purposes of internal controls

... – Ensure reliable accounting. – Urge adherence to company policies. – Promote efficient operations. ...

... – Ensure reliable accounting. – Urge adherence to company policies. – Promote efficient operations. ...

5 ACCOUNTING FOR

... homework problems should be prepared in pencil. If the partially filled-in working papers are used (which we recommend), we show the students the worksheet for an extensive problem so that they will appreciate the time savings inherent in this supplement. It is the nature of accounting that new conc ...

... homework problems should be prepared in pencil. If the partially filled-in working papers are used (which we recommend), we show the students the worksheet for an extensive problem so that they will appreciate the time savings inherent in this supplement. It is the nature of accounting that new conc ...

Document

... The italic nature of the “VOTY” gives out a brand message of “leaning forward”, encompassing the very value of the branding qualities of the event and publication recognisable among its readers and participants. The use of red and black highlights the contrast in its brand image to fully highlight t ...

... The italic nature of the “VOTY” gives out a brand message of “leaning forward”, encompassing the very value of the branding qualities of the event and publication recognisable among its readers and participants. The use of red and black highlights the contrast in its brand image to fully highlight t ...

An examination of the fraudulent factors associated with

... Title XI classifies fraud as a criminal action and assigns harsher punishments to particular actions included in corporate fraud and record tampering. Statement of Auditing Standards Number 99 (SAS No. 99) In 1997, SAS No. 82, Consideration of Fraud in a Financial Statement Audit, was adopted in ord ...

... Title XI classifies fraud as a criminal action and assigns harsher punishments to particular actions included in corporate fraud and record tampering. Statement of Auditing Standards Number 99 (SAS No. 99) In 1997, SAS No. 82, Consideration of Fraud in a Financial Statement Audit, was adopted in ord ...

Guide to New Canadian Independence Standard

... acceptance internationally. In developing this new standard, the Committee consulted extensively with members, regulators, the provincial institutes and other stakeholders. The result is a modern standard that reflects the updated global standard recently issued by the International Federation of Ac ...

... acceptance internationally. In developing this new standard, the Committee consulted extensively with members, regulators, the provincial institutes and other stakeholders. The result is a modern standard that reflects the updated global standard recently issued by the International Federation of Ac ...

Does the Big-4 Effect Exist when Reputation and

... litigation and reputational risks. This setting and our research design offer several advantages compared to previous studies. Auditing standards and regulatory oversight (e.g., the Public Company Accounting Oversight Board in the U.S. and the Professional Oversight Board in the U.K.) require all au ...

... litigation and reputational risks. This setting and our research design offer several advantages compared to previous studies. Auditing standards and regulatory oversight (e.g., the Public Company Accounting Oversight Board in the U.S. and the Professional Oversight Board in the U.K.) require all au ...

User guide to Standing Direction 1

... The FMCF was launched by the Department of Treasury and Finance (DTF) in July 2003 and was subsequently updated in July 2005 and August 2007. The Directions are designed to supplement the Financial Management Act 1994 (FMA). ...

... The FMCF was launched by the Department of Treasury and Finance (DTF) in July 2003 and was subsequently updated in July 2005 and August 2007. The Directions are designed to supplement the Financial Management Act 1994 (FMA). ...

Defence Audit Guidelines_Final 25 March 2010

... Pakistan for use in Field Audit Offices (FAOs) for conducting Certification and Compliance with Authority audits. The Manual is based on the INTOSAI Auditing Standards and the international best practices. It covers the entire Audit Cycle and provides guidance with regard to the methods and approach ...

... Pakistan for use in Field Audit Offices (FAOs) for conducting Certification and Compliance with Authority audits. The Manual is based on the INTOSAI Auditing Standards and the international best practices. It covers the entire Audit Cycle and provides guidance with regard to the methods and approach ...

ACCOUNTING AND AUDITING LAW OF

... cash flows, changes in equity, and other financial and non-financial information that are of importance for external and internal users of financial reports, b) bookkeeping is a system that includes collecting, classification, records keeping and recapitulation of business transactions, as well as s ...

... cash flows, changes in equity, and other financial and non-financial information that are of importance for external and internal users of financial reports, b) bookkeeping is a system that includes collecting, classification, records keeping and recapitulation of business transactions, as well as s ...

A GUIDE TO STATUTORY AUDIT PROCEDURES ON EXPECTED

... phases of the project to replace IAS 39: classification and measurement, impairment, and hedge accounting. This standard was endorsed by the European Union upon adoption of Commission Regulation (EU) No. 2016/2067 published in the Official Journal of the European Union on 29 November 2016. The stand ...

... phases of the project to replace IAS 39: classification and measurement, impairment, and hedge accounting. This standard was endorsed by the European Union upon adoption of Commission Regulation (EU) No. 2016/2067 published in the Official Journal of the European Union on 29 November 2016. The stand ...

The Auditor`s Responsibility to Detect Fraud

... suffered irreparable damage (Carmichael, 2004). Management fraud is also essentially fraudulent financial reporting or misapplication of accounting principles (Alleyne, et al, 2010). An example would be an overstatement of ending inventory on the balance sheet to show more inventory on hand than is ...

... suffered irreparable damage (Carmichael, 2004). Management fraud is also essentially fraudulent financial reporting or misapplication of accounting principles (Alleyne, et al, 2010). An example would be an overstatement of ending inventory on the balance sheet to show more inventory on hand than is ...

Detecting asset misappropriation: a framework for

... to examine areas related to asset misappropriation that had never been examined before and alert external auditors in Egypt to a type of fraud which was given less attention. The current study also proposed a framework for external auditors that might help them properly assess and respond to fraud r ...

... to examine areas related to asset misappropriation that had never been examined before and alert external auditors in Egypt to a type of fraud which was given less attention. The current study also proposed a framework for external auditors that might help them properly assess and respond to fraud r ...

ActionAid International Financial Management Framework

... Streamline processes for recording financial events and reporting financial information ...

... Streamline processes for recording financial events and reporting financial information ...

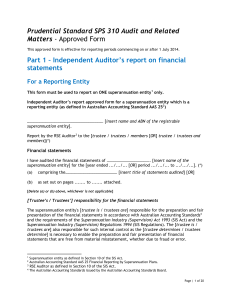

Approved form - Australian Prudential Regulation Authority

... statements of ……………….[name of superannuation entity] for the [year ended .../.../... [OR] period .../.../... to .../.../...] (*) (only to the extent that they reflect the information required by paragraph 66 of Australian Accounting Standard AAS 25 Financial Reporting by Superannuation Plans) [delet ...

... statements of ……………….[name of superannuation entity] for the [year ended .../.../... [OR] period .../.../... to .../.../...] (*) (only to the extent that they reflect the information required by paragraph 66 of Australian Accounting Standard AAS 25 Financial Reporting by Superannuation Plans) [delet ...

English - EDUCatt

... speakers of English to use English successfully in the auditing profession. The 10 units provide vocabulary, reading, writing, speaking exercises and pronunciation and include a considerable amount of authentic texts provided by ENI. This means that the book should prepare would-be auditors for the ...

... speakers of English to use English successfully in the auditing profession. The 10 units provide vocabulary, reading, writing, speaking exercises and pronunciation and include a considerable amount of authentic texts provided by ENI. This means that the book should prepare would-be auditors for the ...

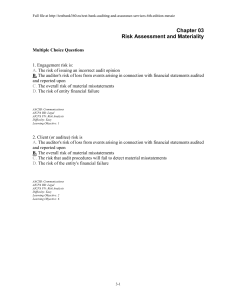

FREE Sample Here

... Full file at http://testbank360.eu/test-bank-auditing-and-assurance-services-6th-edition-messie ...

... Full file at http://testbank360.eu/test-bank-auditing-and-assurance-services-6th-edition-messie ...

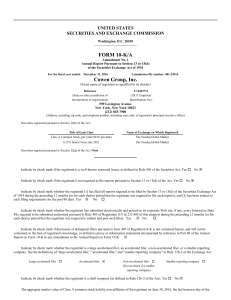

DOC

... The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for ...

... The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for ...

Treasurer`s Guide - Methacton School District

... organizations conduct business. Many seasoned Treasurers contributed to this guide, drawing from a wide spectrum of experiences. Primary references for the guide are School Board Policy # 141 (which should be referenced often for specific organizational information), and Robert’s Rules of Order. Byl ...

... organizations conduct business. Many seasoned Treasurers contributed to this guide, drawing from a wide spectrum of experiences. Primary references for the guide are School Board Policy # 141 (which should be referenced often for specific organizational information), and Robert’s Rules of Order. Byl ...

2012 Audited Financial Statements

... Promises to give, revenue and support recognition --- Contributions, including unconditional promises to give, are recorded as received. All contributions are available for unrestricted use unless specifically restricted by the donor. Conditional promises to give are recognized when the conditions o ...

... Promises to give, revenue and support recognition --- Contributions, including unconditional promises to give, are recorded as received. All contributions are available for unrestricted use unless specifically restricted by the donor. Conditional promises to give are recognized when the conditions o ...