Personal Financial Statements, Pro Forma

... a) The CPA establishes an understanding with the client preferably in writing, that the financial statements: • Will be used solely to assist the client and the client's advisers in developing the client's personal financial goals and objectives. • Will not be used to obtain credit or for any purpos ...

... a) The CPA establishes an understanding with the client preferably in writing, that the financial statements: • Will be used solely to assist the client and the client's advisers in developing the client's personal financial goals and objectives. • Will not be used to obtain credit or for any purpos ...

Unit F011 - Accounting principles - Scheme of work and

... The Scheme of Work and sample Lesson plans provide examples of how to teach this unit and the teaching hours are suggestions only. Some or all of it may be applicable to your teaching. The Specification is the document on which assessment is based and specifies what content and skills need to be cov ...

... The Scheme of Work and sample Lesson plans provide examples of how to teach this unit and the teaching hours are suggestions only. Some or all of it may be applicable to your teaching. The Specification is the document on which assessment is based and specifies what content and skills need to be cov ...

Download attachment

... GAAP. These different financial reporting frameworks in Canadian GAAP are identified in the CICA Handbook – Accounting as follows: • Part I — International Financial Reporting Standards (IFRSs) • Part II — Accounting standards for private enterprises • Part III — Accounting standards for not- ...

... GAAP. These different financial reporting frameworks in Canadian GAAP are identified in the CICA Handbook – Accounting as follows: • Part I — International Financial Reporting Standards (IFRSs) • Part II — Accounting standards for private enterprises • Part III — Accounting standards for not- ...

Data mining journal entries for fraud detection: A Pilot Study

... involved accounting treatments designed to influence disclosure rather than recognition. For example, line costs were transferred to accounts that rolled up into “Selling, General and Administrative Expenses (SG&A).” These adjustments did not change the reported profits, but did change the allocat ...

... involved accounting treatments designed to influence disclosure rather than recognition. For example, line costs were transferred to accounts that rolled up into “Selling, General and Administrative Expenses (SG&A).” These adjustments did not change the reported profits, but did change the allocat ...

CPA PassMaster Questions–Auditing 4 Export Date: 10/30/08

... from the custodial function allows an individual to misappropriate cash and then cover up the theft by posting credits against the related A/R balance. Choice "a" is incorrect. If fictitious transactions in the revenue cycle are recorded, then the impact on revenues and receivables would be the same ...

... from the custodial function allows an individual to misappropriate cash and then cover up the theft by posting credits against the related A/R balance. Choice "a" is incorrect. If fictitious transactions in the revenue cycle are recorded, then the impact on revenues and receivables would be the same ...

ASRE 2410 Review of a Financial Report Performed by the Independent Auditor of the Entity. The choice of ASRE 2400

... statement by those responsible for the financial report. The related notes ordinarily comprise a summary of significant accounting policies and other explanatory information. The requirements of the applicable financial reporting framework determine the form and content of the financial report. For ...

... statement by those responsible for the financial report. The related notes ordinarily comprise a summary of significant accounting policies and other explanatory information. The requirements of the applicable financial reporting framework determine the form and content of the financial report. For ...

Do 3 - Together We Pass

... Describe the internal control measures which are normally incorporated in the use of cash registers for handling cash sales. 1. Internal control measures that normally exist when cash registers are used in the handling of cash sales (1) Cash registers must display the amount of the cash sales on a s ...

... Describe the internal control measures which are normally incorporated in the use of cash registers for handling cash sales. 1. Internal control measures that normally exist when cash registers are used in the handling of cash sales (1) Cash registers must display the amount of the cash sales on a s ...

ActionAid International Financial Management Framework

... This framework establishes the financial policies and standards (and procedures) for ActionAid International (AAI) and its Affiliates and Associates. The framework demonstrates AAI‟s concern for financial integrity; as such it is important evidence of our accountability to all stakeholders. Finance ...

... This framework establishes the financial policies and standards (and procedures) for ActionAid International (AAI) and its Affiliates and Associates. The framework demonstrates AAI‟s concern for financial integrity; as such it is important evidence of our accountability to all stakeholders. Finance ...

accounting - WordPress.com

... expenses at the time physical cash is actually received or paid out. This contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in a company's books at the time the revenue is earned (but not necessarily received) and records expenses when liabili ...

... expenses at the time physical cash is actually received or paid out. This contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in a company's books at the time the revenue is earned (but not necessarily received) and records expenses when liabili ...

Audit Information for RFP

... information and is loaned to the Contractor on a confidential basis. Any information acquired at the Nation or otherwise relating to processes belonging to the Nation incorporated into this Request for Proposal shall be kept confidential. The Contractor agrees not to use in any unauthorized manner o ...

... information and is loaned to the Contractor on a confidential basis. Any information acquired at the Nation or otherwise relating to processes belonging to the Nation incorporated into this Request for Proposal shall be kept confidential. The Contractor agrees not to use in any unauthorized manner o ...

Corporate Governance and Earnings Management

... and lenders will be more willing to put their money in firms with good governance, they will face lower costs of capital, another source of better firm performance. Other stakeholders, including employees and suppliers, will also want to be associated with and enter into business relationships with ...

... and lenders will be more willing to put their money in firms with good governance, they will face lower costs of capital, another source of better firm performance. Other stakeholders, including employees and suppliers, will also want to be associated with and enter into business relationships with ...

Auditing for Fraud Detection - Professional Education Services

... course is an ideal introduction for beginners in the field of fraud examination and fraudaware auditing. Within the course internal control procedures are examined. Case studies are used throughout to exemplify issues surrounding independent audits of financial statements in terms of a fraud-detecti ...

... course is an ideal introduction for beginners in the field of fraud examination and fraudaware auditing. Within the course internal control procedures are examined. Case studies are used throughout to exemplify issues surrounding independent audits of financial statements in terms of a fraud-detecti ...

The purposes of accounting

... • Conforming to GAAP/IFRS does not mean that the information provided is good, but it is the start ...

... • Conforming to GAAP/IFRS does not mean that the information provided is good, but it is the start ...

Chapter 1 - Pearson Schools and FE Colleges

... hence the reason why the convention of consistency is used. However, this does not mean that the business must always use a particular method; it may make changes provided it has good reason to do so and each change is declared in the notes to the financial statements. The prudence concept. When prep ...

... hence the reason why the convention of consistency is used. However, this does not mean that the business must always use a particular method; it may make changes provided it has good reason to do so and each change is declared in the notes to the financial statements. The prudence concept. When prep ...

APPTICATION OF THE AUDIT PROCESS TO OTHER CYCTES

... or classifications for each transaction, such as repair and maintenance, inventory, or utilities. It also identifies whether the acquisition was for cash or accounts payable. The journal or listing can coyer any time period, typically a month. The journal or listing includes totals of every account ...

... or classifications for each transaction, such as repair and maintenance, inventory, or utilities. It also identifies whether the acquisition was for cash or accounts payable. The journal or listing can coyer any time period, typically a month. The journal or listing includes totals of every account ...

Detecting asset misappropriation: a framework for

... Sales skimming are especially common when the fraudster has access to incoming funds from an unusual source, such as refunds that have not been accounted for by the victim organisation. While, receivables skimming are more difficult to conceal than sales skimming because incoming receivables payment ...

... Sales skimming are especially common when the fraudster has access to incoming funds from an unusual source, such as refunds that have not been accounted for by the victim organisation. While, receivables skimming are more difficult to conceal than sales skimming because incoming receivables payment ...

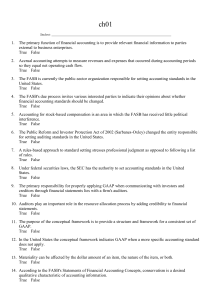

1. The primary function of financial accounting is

... A The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the . purchase method of accounting for the combination. B The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the . pooling method of accounting for the co ...

... A The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the . purchase method of accounting for the combination. B The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the . pooling method of accounting for the co ...

The Auditor`s Responsibility to Detect Fraud

... have been exploited in both the private and public sectors resulting in embarrassing, fraudulent schemes and the loss of assets (Alleyne, et al., 2010). Not only has the incidence of fraud increased, but the dollar amounts of fraud and the number of companies being victimized have also increased (Hu ...

... have been exploited in both the private and public sectors resulting in embarrassing, fraudulent schemes and the loss of assets (Alleyne, et al., 2010). Not only has the incidence of fraud increased, but the dollar amounts of fraud and the number of companies being victimized have also increased (Hu ...

English - EDUCatt

... any case, a report is never conceived of as an attack on a department, but as an objective evaluation which foresees an action plan and a target date by which ...

... any case, a report is never conceived of as an attack on a department, but as an objective evaluation which foresees an action plan and a target date by which ...

Aue2602 Summary

... fewer people involved and if no real distinction between these phases then must place more reliance on : access controls and programmed controls rather then manual controls preventative rather then detective and corrective controls Vital that the information that is being processed is valid, acc ...

... fewer people involved and if no real distinction between these phases then must place more reliance on : access controls and programmed controls rather then manual controls preventative rather then detective and corrective controls Vital that the information that is being processed is valid, acc ...

Administrative Guidelines for Danida Market Development

... Applicants may apply for a total grant of minimum DKK 5 million and maximum DKK 8 million for the partnership project (including possible grant for project development mentioned above). Danida’s support to the partnership project may cover up to 75% of total project costs. The remaining 25% to be c ...

... Applicants may apply for a total grant of minimum DKK 5 million and maximum DKK 8 million for the partnership project (including possible grant for project development mentioned above). Danida’s support to the partnership project may cover up to 75% of total project costs. The remaining 25% to be c ...

Financial Accounting Standards Board (FASB)

... standards but also establishes the effective date and method of transition. 9. Currently, a simple majority (three out of five) is required for approval of an Exposure Draft or a final statement of standards. ...

... standards but also establishes the effective date and method of transition. 9. Currently, a simple majority (three out of five) is required for approval of an Exposure Draft or a final statement of standards. ...

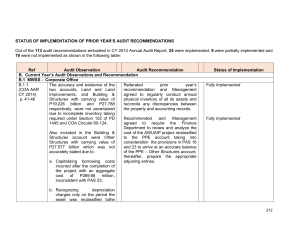

MWSS2015_Part3-Status_of_PY`s_Recomm

... was not accurately reported due to (a) Income pertaining to CY 2013 with an aggregate total of P229.229 million was recognized as revenue during the year and (b) income received in CY 2014 totaling P235.205 million was not recognized as current year’s income. Also, no accrual of income from debt ser ...

... was not accurately reported due to (a) Income pertaining to CY 2013 with an aggregate total of P229.229 million was recognized as revenue during the year and (b) income received in CY 2014 totaling P235.205 million was not recognized as current year’s income. Also, no accrual of income from debt ser ...