Defence Audit Guidelines_Final 25 March 2010

... Pakistan for use in Field Audit Offices (FAOs) for conducting Certification and Compliance with Authority audits. The Manual is based on the INTOSAI Auditing Standards and the international best practices. It covers the entire Audit Cycle and provides guidance with regard to the methods and approach ...

... Pakistan for use in Field Audit Offices (FAOs) for conducting Certification and Compliance with Authority audits. The Manual is based on the INTOSAI Auditing Standards and the international best practices. It covers the entire Audit Cycle and provides guidance with regard to the methods and approach ...

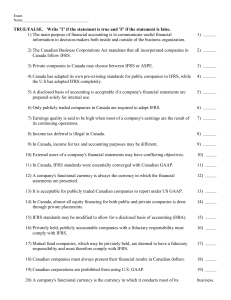

Exam Name___________________________________ TRUE

... 36) The CPA Canada Handbook requires that income for tax purposes be equal to a company's accounting income at all times. ...

... 36) The CPA Canada Handbook requires that income for tax purposes be equal to a company's accounting income at all times. ...

APES 205 Conformity with Accounting Standards

... inconsistent with the AUASB standards. Australian Accounting Standards means the Accounting Standards (including Australian Accounting Interpretations) promulgated by the AASB. Australian Financial Reporting Framework means the framework that uses Australian Accounting Standards as the Applicable Fi ...

... inconsistent with the AUASB standards. Australian Accounting Standards means the Accounting Standards (including Australian Accounting Interpretations) promulgated by the AASB. Australian Financial Reporting Framework means the framework that uses Australian Accounting Standards as the Applicable Fi ...

unit eight accounting

... means all people who work or are seeking work, and their education and skills. Technology refers to scientific and business research and inventions. In order to grow, a nation’s economy must add to its productive resources. For example, a nation must use some of its resources to build factories, he ...

... means all people who work or are seeking work, and their education and skills. Technology refers to scientific and business research and inventions. In order to grow, a nation’s economy must add to its productive resources. For example, a nation must use some of its resources to build factories, he ...

Treasurer`s Guide - Methacton School District

... According to School Board Policy, budgets for non-profit entities should be formulated as “ZeroBased” (income and expenses offset one another). However, H/S are permitted to keep a balance in their accounts at the end of the fiscal year. This amount should be no more than approximately 50% of their ...

... According to School Board Policy, budgets for non-profit entities should be formulated as “ZeroBased” (income and expenses offset one another). However, H/S are permitted to keep a balance in their accounts at the end of the fiscal year. This amount should be no more than approximately 50% of their ...

A GUIDE TO STATUTORY AUDIT PROCEDURES ON EXPECTED

... estimates relating to transactions that are unusual due to their amount and their nature, or that are based on strong assumptions where the management’s judgement plays a significant role may result in a high risk of material misstatement (…)”. Section 7 states that “when accounting estimates leave ...

... estimates relating to transactions that are unusual due to their amount and their nature, or that are based on strong assumptions where the management’s judgement plays a significant role may result in a high risk of material misstatement (…)”. Section 7 states that “when accounting estimates leave ...

Implementation Tool for Auditors

... Once the auditor has concluded that ROMM due to fraud in revenue recognition exists for all or only certain types of revenue and revenue transactions, the auditor is required to treat such risk as a significant risk and accordingly, to the extent not already done so, obtain an understanding of the c ...

... Once the auditor has concluded that ROMM due to fraud in revenue recognition exists for all or only certain types of revenue and revenue transactions, the auditor is required to treat such risk as a significant risk and accordingly, to the extent not already done so, obtain an understanding of the c ...

Revised Guidance Statement GS 009: Auditing SMSFs

... Auditors of APRA regulated superannuation entities, particularly auditors of small APRA funds, may find this Guidance Statement useful in planning, conducting and reporting their audits, but it does not relate specifically to APRA funds. See Division 1, Section 6 of the SISA. Regulated funds, under ...

... Auditors of APRA regulated superannuation entities, particularly auditors of small APRA funds, may find this Guidance Statement useful in planning, conducting and reporting their audits, but it does not relate specifically to APRA funds. See Division 1, Section 6 of the SISA. Regulated funds, under ...

FREE Sample Here

... 33. An auditor discovers a likely fraud during an audit but concludes that the effect of the fraud is not sufficiently material to affect the audit opinion. The auditor should A. Disclose the fraud to the appropriate level of the client's management B. Disclose the fraud to appropriate authorities e ...

... 33. An auditor discovers a likely fraud during an audit but concludes that the effect of the fraud is not sufficiently material to affect the audit opinion. The auditor should A. Disclose the fraud to the appropriate level of the client's management B. Disclose the fraud to appropriate authorities e ...

NHC Financial Statements

... with accounting principles generally accepted in the United States of America. This includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or err ...

... with accounting principles generally accepted in the United States of America. This includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or err ...

Does the Big-4 Effect Exist when Reputation and

... are held constant and when both the Big-4 firms and the non-Big-4 firms face low and similar litigation and reputational risks. This setting and our research design offer several advantages compared to previous studies. Auditing standards and regulatory oversight (e.g., the Public Company Accounting ...

... are held constant and when both the Big-4 firms and the non-Big-4 firms face low and similar litigation and reputational risks. This setting and our research design offer several advantages compared to previous studies. Auditing standards and regulatory oversight (e.g., the Public Company Accounting ...

THE VALUE RELEVANCE OF MANAGERS` AND

... attestations.1 Notably, the existence of underlying material measurement uncertainty represents “bad news”, which both management and auditors can communicate credibly (Skinner 1994). Understanding users’ valuation judgments related to material measurement uncertainty is important to standard setter ...

... attestations.1 Notably, the existence of underlying material measurement uncertainty represents “bad news”, which both management and auditors can communicate credibly (Skinner 1994). Understanding users’ valuation judgments related to material measurement uncertainty is important to standard setter ...

Approved form - Australian Prudential Regulation Authority

... (collectively known as the ‘relevant forms’) of …………………………….. [insert name of the superannuation entity], which comprise part of the APRA Annual Return, for the [year / period] ended .../.../.... I have conducted an independent reasonable assurance engagement on the relevant forms in order to expres ...

... (collectively known as the ‘relevant forms’) of …………………………….. [insert name of the superannuation entity], which comprise part of the APRA Annual Return, for the [year / period] ended .../.../.... I have conducted an independent reasonable assurance engagement on the relevant forms in order to expres ...

Substantive Tests of Transactions and Balances

... account balance is affected by many relatively small transactions, the auditor designs substantive tests of balances directed to selected items (e.g. individual customers, inventory items) which aggregate to create the ending balance. This commonly occurs for the accounts receivable and inventory ba ...

... account balance is affected by many relatively small transactions, the auditor designs substantive tests of balances directed to selected items (e.g. individual customers, inventory items) which aggregate to create the ending balance. This commonly occurs for the accounts receivable and inventory ba ...

Yes, there is a big Difference between Audit on Profit Organizations

... fairness by which a company's financial statements are presented by its management. It is performed by competent, independent and objective person(s) known as auditors, who then issue an auditor's report based on the results of the audit. In cost accounting, it is a process for verifying the cost of ...

... fairness by which a company's financial statements are presented by its management. It is performed by competent, independent and objective person(s) known as auditors, who then issue an auditor's report based on the results of the audit. In cost accounting, it is a process for verifying the cost of ...

LO 5 - Test Banks Shop

... Enron: an economic entity decision as to whether various entities, under the control of Enron, be included in the company’s financial statements WorldCom: the decision as to whether certain costs should have been treated as expenses rather than assets Accounting firms’ independence is question ...

... Enron: an economic entity decision as to whether various entities, under the control of Enron, be included in the company’s financial statements WorldCom: the decision as to whether certain costs should have been treated as expenses rather than assets Accounting firms’ independence is question ...

Essential Keys to Nonprofit Finance

... For many nonprofits, contributions and grants are a major source of revenue, the accounting for which can be fairly complex. It is important to have an understanding of some basic concepts that impact the accounting for these transactions. Contribution transactions are voluntary transfers of assets ...

... For many nonprofits, contributions and grants are a major source of revenue, the accounting for which can be fairly complex. It is important to have an understanding of some basic concepts that impact the accounting for these transactions. Contribution transactions are voluntary transfers of assets ...

DAKOTA PLAINS HOLDINGS, INC. (Form: 8

... were no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to the satisfaction of BDO, would have caused BDO to make reference to the matter in its reports on the financial statements for s ...

... were no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to the satisfaction of BDO, would have caused BDO to make reference to the matter in its reports on the financial statements for s ...

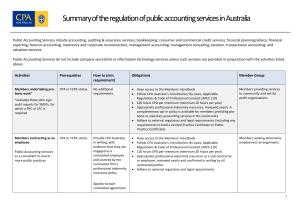

Australia

... Public Accounting Services include accounting; auditing & assurance services; bookkeeping; consumer and commercial credit services; financial planning/advice; financial reporting; forensic accounting; insolvency and corporate reconstruction; management accounting; management consulting; taxation; tr ...

... Public Accounting Services include accounting; auditing & assurance services; bookkeeping; consumer and commercial credit services; financial planning/advice; financial reporting; forensic accounting; insolvency and corporate reconstruction; management accounting; management consulting; taxation; tr ...

Notification 297/2015 dated 28th December, 2015 - Regarding the Internal Audit Manual (672 KB)

... designed to add value and improve an organization’s operations. It helps the organization to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. With commitment to integrity and acco ...

... designed to add value and improve an organization’s operations. It helps the organization to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. With commitment to integrity and acco ...

Internal Control

... A series of questions relating to control procedures required to prevent and detect errors and irregularities ...

... A series of questions relating to control procedures required to prevent and detect errors and irregularities ...

Financial Management Policy

... As a nature of internal auditing of all program, financial, accounting, operational activities of PKSF auditing of Partner Organization’s (PO’s) to be conducted by the trained personnel of inhouse Internal Audit team of PKSF. 10.2. External Audit The Audit Committee in consultation with the Gove ...

... As a nature of internal auditing of all program, financial, accounting, operational activities of PKSF auditing of Partner Organization’s (PO’s) to be conducted by the trained personnel of inhouse Internal Audit team of PKSF. 10.2. External Audit The Audit Committee in consultation with the Gove ...

The Effect of Audit Firm Specialization on Earnings Management

... proxies such as audit quality, earnings management, and financial reporting quality. The main direction in the literature confirms the importance of industry specialization in enhancing auditor performance and improving audit quality. In the last few years, many audit firms were directed towards ree ...

... proxies such as audit quality, earnings management, and financial reporting quality. The main direction in the literature confirms the importance of industry specialization in enhancing auditor performance and improving audit quality. In the last few years, many audit firms were directed towards ree ...

2011 Financials

... accordance with Canadian generally accepted accounting principles, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Auditors' Responsibility Our responsibilit ...

... accordance with Canadian generally accepted accounting principles, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Auditors' Responsibility Our responsibilit ...