* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

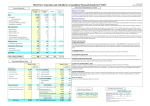

Download “Azerbaijan Caspian Shipping” Closed Joint Stock Company

Negative gearing wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Financial literacy wikipedia , lookup

Investment management wikipedia , lookup

Systemic risk wikipedia , lookup

Global financial system wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Securitization wikipedia , lookup

International asset recovery wikipedia , lookup

Financial economics wikipedia , lookup

Global saving glut wikipedia , lookup

Financial crisis wikipedia , lookup

Corporate finance wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Systemically important financial institution wikipedia , lookup