* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

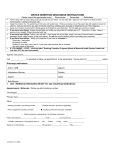

Download Pacer ETFs Receives “Most Innovative Financial Products 2016

Survey

Document related concepts

Corporate venture capital wikipedia , lookup

International investment agreement wikipedia , lookup

Early history of private equity wikipedia , lookup

Interbank lending market wikipedia , lookup

Private money investing wikipedia , lookup

Stock trader wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Socially responsible investing wikipedia , lookup

Hedge (finance) wikipedia , lookup

Financial crisis wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Transcript

Pacer ETFs Receives “Most Innovative Financial Products 2016” Award from Wealth & Finance International Magazine Decorated new ETF issuer recognized for industry‐leading innovation Paoli, Pa. – (July 26, 2016) – Wealth & Finance International Magazine has just awarded Pacer ETFs “Most Innovative Financial Products 2016” as part of the magazine’s 2016 Alternative Investment Awards. Wealth & Finance International awarded Pacer ETFs this prestigious recognition based on the company’s “dedication to client service, innovation and success.” “We are thrilled to receive this award,” says Sean O’Hara, President of Pacer ETFs Distributors. “We set out to design innovative financial products to help investors manage downside risk. This award is further validation our efforts were a success.” “Customer service and innovation have always been focal points for Pacer,” said Joe Thomson, Chairman and President of Pacer Financial. “Our success is driven by our ability to develop innovative products to offer investors specific portfolio solutions. We will continue to develop new and innovative products that help investors navigate turbulent market conditions.” Wealth & Finance International’s 2016 Alternative Investment Awards recognize companies that are improving the financial landscape with hard work and professionalism. Judged solely on merit through a comprehensive selection process, the 2016 Alternative Investment Awards recipients are a true representation of market leaders at the cutting edge of the financial industry. About Pacer: Pacer ETFs, distributed by Pacer Financial, is a new ETF provider that launched in June 2015. Pacer ETFs offers exchange traded funds as tools to help investors diversify their portfolios. They provide a selection of strategy driven ETFs that aim to serve as long‐term investment options. As a national wholesaling organization, Pacer Financial has partnered with ETF and ETN providers, including RBS, beginning in 2008. These partnerships allowed Pacer to gain invaluable knowledge and relationships. The entrepreneurial culture and national sales and marketing teams allow Pacer to get to the market quickly and adapt to change in the industry. About Wealth & Finance International Wealth & Finance International is a monthly publication dedicated to delivering high quality informative and up‐to‐the‐minute global business content. It is published by AI Global Media Ltd, a publishing house that has reinvigorated corporate finance news and reporting. Developed by a highly skilled team of writers, editors, business insiders and regional industry experts, Wealth & Finance International reports from every corner of the globe to give readers the inside track on the need‐to‐know news and issues affecting banking, finance, regulation, risk and wealth management in their region. Media Contact: Freddy Martino Gregory FCA for Pacer ETFs (610) 228‐2093 [email protected] Company Contact: Ashlee Thomson (610) 981‐6214 [email protected] Disclosure: Before investing you should carefully consider the Funds’ investment objectives, risks, charges and expenses. This and other information is in the prospectus. A copy may be obtained by visiting www.paceretfs.com or calling 1‐877‐337‐0500. Please read the prospectus carefully before investing. An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commissions and ETF expenses will reduce investment returns. There can be no assurance that an active trading market for ETF shares will be developed or maintained. The risks associated with these funds are detailed in the prospectus and could include factors such as concentration risk, equity market risk, fixed income risk, government obligations risk, high portfolio turnover risk, large and mid‐capitalization investing risk, new fund risk, other investment companies risk, passive investment risk, tracking risk, trend lag risk, currency exchange rate risk, European investments risk, foreign securities risk, geographic concentration risk, forward currency contracts risk, non‐diversification risk and/or special risks of exchange traded funds. Distributor: Pacer Financial, Inc., member FINRA, SIPC, an affiliate of Pacer Advisors, Inc. NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED ###