* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download first name

Internal rate of return wikipedia , lookup

Business valuation wikipedia , lookup

Household debt wikipedia , lookup

Modified Dietz method wikipedia , lookup

Conditional budgeting wikipedia , lookup

Individual Savings Account wikipedia , lookup

Securitization wikipedia , lookup

Stock valuation wikipedia , lookup

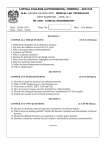

Stock selection criterion wikipedia , lookup

JRE300: Fundamentals of Accounting and Finance SOLUTIONS MIDTERM EXAMINATION (30% of Final Grade): Fall 2011 Time Allowed: 110 minutes FIRST NAME _______________________________________ LAST NAME ________________________________________ STUDENT NUMBER:__________________________________ Instructions: 1) Write all of your answers on the examination paper. If you need additional space, use the back of the page facing the question and clearly identify the question being answered. 2) This is a closed book exam. One single-sided 8.5'x11'aid sheet containing formulas/notes is permitted. Non-programmable calculators are permitted. 3) Pencil or pen may be used. However, papers written in pencil or papers with white outs will not be re-marked. Please remain in your seats during the last 15 minutes of the exam period so you do not disturb others. Question Marks 1 10 2 15 3 35 4 18 5 15 6 7 Total 100 Marks Awarded Question 1 (10 marks) a) (5 marks) Using the table below, classify the following items as Assets, Liabilities or Shareholders' Equity: Common Shares $10 million; Accounts Receivable $2 million; Unearned Revenue $5 million; Goodwill $4 million; Income Tax Payable $6 million; Investments $1 million; Bank Advances $15 million; Preferred Shares $40 million; Retained Earnings $3 million; Property Plant & Equipment $7 million Y&Co. Consolidated Balance Sheet - 2010 Assets Accounts Receivable Goodwill Investments Property/Plant/Equipment $2,000,000 $4,000,000 $1,000,000 $7,000,000 Liabilities Unearned Revenue Income Tax Payable Bank Advances $5,000,000 $6,000,000 $15,000,000 Shareholders' Equity Common Shares Preferred Shares Retained Earnings $10,000,000 $40,000,000 $ 3,000,000 b) (3 marks) Assume the Total Assets of the company equal $23 million. Using the information provided in part a), what are the Total Liabilities of Y&CO? Total Assets = Total Liabilities + Shareholders' Equity $23,000,000 = <?> + $53,000,000 (Common Shares + Pref Shares+ R/E) Total Liabilities = - $30 million c) (2 marks) What would you expect to find under Long Term Investments for Y&CO? investments in stock (other companies) bonds or short term debt instruments like t-bills 1 (any one of the 2) Page | 2 Question 2 (15 marks) a) (5 marks) Using the information provided for Ford Motor Company, conduct a vertical analysis of the company's Cost of Sales and Selling, administrative & Other Expenses using Sales as the base amount for 2009 and 2010. 2010 2009 104,451/119,280 = 88% 98,866/103,868 = 95% 9,040/119,280 = 7.57% 8,354/103,868 = 8% (5 marks) Using the information provided for Daimler, conduct a vertical analysis of the company's Costs of Sales and Selling, General & Administrative Expenses using Revenue as the base amount for 2009 and 2010. 2010 2009 63,912/84,973=75% 54,268/66,928 = 81% 8,517+2,951/84,793 = 13% 7,303+2,838/66,928 =15% Page | 3 Question 2 (15 marks) b) (5 marks) Comparing your results from part a) and part b), what can you conclude regarding expense management at Ford versus Daimler? Please do not exceed 4-5 lines in your answer! Daimler appears better at controlling the costs of making their autos but the vertical analysis of the S, G &A expenses indicates that they spend more (relative to their sales) on staff or advertising than does Ford. It is logical as they make primarily luxury cars. Question 3 (35 marks) Appendix 1 contains the 2007 Balance Sheet, Income Statement and Statement of Cash Flows for General Motors Corporation. Please fill out the table below using the financial statements provided. Please note that you can detach (“rip out”) Appendix 1 for easier analysis. a) (24 marks) Calculate the following ratios for 2007: From the Selected General Motors Financial Statements 2007 2006 Debt to Total Assets = Total Liabilities/Total Assets 184,363/148,883=1.24x $190,766/186,304=1.024x Times Interest Earned = EBIT/Interest Expense -4,390 from (181,122-185,512)/2,902=-1.512x -5,823 from (171,179-211,424)/2,642=-2.204x Cash to Total Debt Coverage= Cash provided by Operating Activities/Average Total Liabilities 7,507/(184,363+190,766/2) = 0.040 or 4.0% -12,350/190,766=-0.064 or -6.4% Cash to Total Debt Coverage: Cash provided by Operating Activities/Average Current Liabilities 7,507/(70,308+66,717/2)= 0.1095or 10.95% -12,350/66,717= -0.185 or -18.5% Page | 4 Working Capital = Current Assets - Current Liabilities 60,135-70,308= - $10,173 5,156-66,717 = -1,561 Current Ratio= Current Assets/Current Liabilities 60,135/70,308=0.86x 65,156/66,717=0.98x b) (5 marks) Using the ratios calculated in part a) comment on General Motors' liquidity in 2007 as compared to 2006. Please identify the ratios that you are using as a reference. Do not exceed 45 sentences in your answer! Cash to Total Debt Coverage using Current Liabilities Measures short-term debt paying ability (cash basis): negative in 2006 and low for 2007 Working Capital: Measures short-term debt paying ability (since current assets include cash, accounts receivable and inventory) - higher is better - negative both years Current Ratio: Measures short-term debt paying ability. This ratio gives a sense of the efficiency of a company's operating cycle or its ability to turn its product into cash. A ratio less than 1 is not a sign of good financial health - GM had a ratio of less than 1 for both 2006 and 2007 c) (5 marks) Using the ratios calculated in part a) comment on General Motors' solvency in 2007 as compared to 2006. Please identify the ratios that you are using as a reference. Do not exceed 4-5 sentences in your answer! Times Interest Earned - Measures ability to meet interest payments as they come due - both years number is negative therefore GM unable to meet its short term debt obligations Debt to Total Assets measure the % of assets provided by creditors (lower is better) - both years it is in excess of 1 or 100% so again very poor Cash to Total Debt Coverage - Measures long-term debt-paying ability (cash basis) - higher is better - Negative for 2006 and at 4%, low for 2007 d) (1 mark) What, in your opinion, happened to General Motors in 2008? Base your opinion on your previous work. Given that GM appeared both insolvent and illiquid, it should be no surprise that the company filed for bankruptcy in 2008. Page | 5 Question 4 (18 marks) KG Spring Skating School had the following account balances as at June 30, 2011: Cash $23,000; Equipment $2,000; Accounts Payable $500; Advanced Registration Fees $17,500; Common Shares $1,000; and Retained Earnings $6,000. The following events occurred during the month of July: July 4 Registration fees received for July skating school (four week skating lessons), $5,500. July 4 Paid for ice time for the month of July, $14,400. July 9 Paid accounts payable outstanding at June 30th. July 11 Booked ice with the city for the September session. It will cost $14,400. No money was paid. July 11 Received and paid a bill for $500 for advertising of the July skating school. July 21 Received a bill for internet services for $100. The bill is not due until August 15th. July 29 Last day of July session. July 29 Received advanced registrations for the next four-week skating session in September, $2,200. July 30 Purchased refreshments, gifts and supplies for end-of-school test day and ribbons for skaters, $500. July 31 Paid coaches and assistant coaches, $1,200. a) Prepare journal entries for each of the above transactions in May using the table format below. If you need to make any assumptions, please state them clearly. (10 marks) Date Accounts Debit July 4 Cash 5,500 Skating Fee Revenue July 4 July 9 Credit 5,500 Ice Rental Expense Cash 14,400 Accounts Payable 500 14,400 Page | 6 Cash July 11 NO ENTRY – NOT A TRANSACTION July 11 Advertising Expense 500 500 Cash July 21 Internet Expense 500 100 Accounts Payable July 29 NO ENTRY – NOT A TRANSACTION July 29 Cash 100 2,200 Advanced Registration Fees (i.e. 2,200 Unearned Revenue) July 30 Volunteer Expense 500 Cash July 31 Salaries Expense Cash 500 1,200 1,200 Page | 7 b) Prepare a Balance Sheet as at July 31, 2011. (8 marks) KG Spring Skating School Balance Sheet July 31, 2011 Assets Current assets Cash Property, Plant & Equipment Equipment Total assets Liabilities and Shareholders' Equity Liabilities Current liabilities Accounts payable Unearned Revenue Total liabilities Shareholders' equity Common shares $ 1,000 Retained earnings (5,200) Total shareholders’ equity Total liabilities and shareholders’ equity $13,600 2,000 $15,600 $ 100 19,700 19,800 (4,200) $15,600 Question 5 (15 marks) a) Penguins Inc. reported net earnings of $775,000 for the year ended September 30, 2011. During the year, depreciation expense was $200,000 and amortization expense was $60,000. An analysis of the year end balance sheets revealed the following: accounts receivable decreased by $350,000, prepaid expenses increased by $95,000, accounts payable decreased by $280,000, income tax payable increased by $5,000 and the company realized a $10,000 gain on the sale of equipment. Calculate the cash provided (used) by operating activities using the indirect method. (8 marks) Page | 8 a) Answer: PENGUINS INC. Cash Flow Statement (Partial)—Indirect Method Year Ended September 30, 2011 Operating activities Net earnings ............................................................................. Adjustments to reconcile net earnings to net cash provided (used) by operating activities Depreciation expense .................................................... Amortization expense .................................................... Gain on the sale of equipment ...................................... Accounts receivable decrease ....................................... Prepaid expenses increase ............................................. Income tax payable increase ......................................... Accounts payable decrease ........................................... Net cash provided by operating activities ......................................... $ 775,000 $200,000 60,000 (10,000) 350,000 (95,000) 5,000 (280,000) 230,000 $1,005,000 b) Assume that the total change in cash and cash equivalents for the year was $470,000. Explain how this is possible given you analysis in Part A of this question (Provide specific examples). (4 marks) Answer: Change in cash and cash equivalents includes changes in cash as a result of investing and financing activities. The company’s decrease in cash and cash equivalents would, therefore, be attributable to negative cash flows from investing and/or financing activities. The company may have paid a dividend to its shareholders (i.e. a financing activity). Or, the company may have spent a large amount of cash on investing activities, such as research and development, the refurbishment of equipment, etc. (i.e. an investing activity). c) What is the main purpose of the cash flow statement? (3 marks) Answer: c) The main purpose of the cash flow statement is to provide information that will enable users to assess the company’s ability to generate cash, the reasons for the differences in net earnings and cash provided by operations (i.e. to assess the reliability of the earnings figure) and to outline the investing and financing transactions during the period. Page | 9 Question 6 (7 marks) Sun Protection Inc. (“SPI”) manufactures and sells sunglasses. Price and cost data are as follows: Selling price per pair of sunglasses Variable costs per pair of sunglasses: Raw materials Direct labor Manufacturing overhead Selling expenses Annual fixed costs: Manufacturing overhead Selling and administrative $25.00 $11.00 5.00 2.50 1.30 $19.80 $192,000 276,000 $468,000 Forecasted annual sales volume (120,000 pairs) $3,000,000 Income tax rate 40% a) SPI estimates that its direct labor costs will increase 8 percent next year. How many units will SPI have to sell next year to reach breakeven? (3 marks) Answer: a) Variable costs increase by $0.40 to $20.20 CM/Unit = $25.00 – 20.20 = $4.80 Breakeven point = $468,000 / 4.80 = 97,500 units Answer b) If SPI's direct labor costs do increase 8 percent, what selling price per unit of product must it charge to maintain the same contribution margin ratio? (4 marks) Current CM ratio = $5.20 / 25.00 = 20.8% Let S = new selling price S – 20.20 / S = .208 S – 20.20 = .208 S 0.792 S = 20.20 S = $25.51 (correct answer) Page | 10 This page is left blank intentionally Page | 11 Appendix 1 - From General Motors 2007 Annual Report Page | 12 Appendix 1 (cont'd) - From General Motors 2007 Annual Report Page | 13 Appendix 1 (cont'd) - From General Motors 2007 Annual Report Page | 14