* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Lesson 16 - MrsMTGreene

Survey

Document related concepts

History of the euro wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Reserve currency wikipedia , lookup

History of monetary policy in the United States wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Currency war wikipedia , lookup

Transcript

AOF Business in the Global Economy

Lesson 8

The International Monetary

System

Student Resources

Resource

Description

Student Resource 8.1

Reading: The Development of the International Monetary System

Student Resource 8.2

Timeline: The International Monetary System

Student Resource 8.3

Reading: The IMF and the World Bank

Student Resource 8.4

Worksheet: The IMF and the World Bank

Student Resource 8.5

Worksheet: Balance of Trade

Student Resource 8.6

Case Study: International Financial Management

Student Resource 8.7

Organizer: Economic Policy Recommendation Letter

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.1

Reading: The Development of the International

Monetary System

Directions: Make sure you understand the terms at the top of the page before you begin reading. When

you encounter the terms in your reading, underline them.

Terms:

Fixed exchange rate: An exchange rate for a currency that government policy determines should be

fixed (“pegged”) to the market value of another currency, a group of currencies, or another measure of

value (such as the price of gold). Fixed exchange rates tend to help keep inflation in check, but also tend

to hide a currency’s true market value.

Floating exchange rate: An exchange rate that is determined by supply and demand in the foreign

exchange market, mostly without government intervention, and is therefore free to rise or fall.

Gold standard: An exchange rate policy that pegs the value of a currency to the price of gold and

guarantees that all issued currency can be converted to gold on demand at a gold par value.

Gold par value: The amount of currency that is needed to purchase one ounce of gold.

1870s–1914: Industrialism

From ancient times until the Industrial Revolution, when individuals, companies, or governments

purchased goods or services, they generally paid for the goods with gold or silver; or with currency whose

value in gold or silver was well established and trusted. The rise of industrialism caused an explosion in

trade, and by the 1880s shipping heavy gold and silver as payment was seen to be impractical, especially

for international trade. Major trading countries came up with a more efficient means of paying for goods:

paper currency. The values of these countries’ different currencies were defined and protected by the

gold standard. This meant that the value of the currency was pegged to the value of gold; the issuing

governments or central banks promised that they would support the paper currency by exchanging it for a

fixed amount of gold on demand, always keeping as much gold stored as there was paper currency in

circulation. This built confidence in the paper currency, since people knew they could exchange their

paper currency for gold. Major trading countries continued with the gold standard until 1914, when World

War I broke out and these countries, needing money to fill their war chests, began printing a lot more

paper money, often without having gold to back it.

1918–1939: Economic Turbulence

After World War I ended in 1918, the major trading economies slowly returned to the gold standard. But,

when a country’s government decided to return to the gold standard, it had to determine the gold par

value for its currencyand this became a problem. For instance, the British pound suffered high inflation

during World War I because too much money was in circulation, pushing up prices. In 1925, when the

British government decided to return to the gold standard, it did so at the prewar gold par value, making

the value of the pound artificially high. This proved to be huge economic policy mistake; it made the price

of British goods to buyers in other countries skyrocket, pricing them out of foreign markets. This harmed

UK exports, production, and employment long before the 1929 world stock market crash inflicted further

harm; and the cumulative effect of all this, and the associated disruption of world trade, led by 1931 to a

very severe economic depression. The United States was facing economic problems of its own at this

time, and the US government looked for a policy that would avoid the kind of trouble that had happened

with the pound. The US government decided to devalue the dollar, which made the prices of American

exports more competitive in other countries. The goal of the policy was to increase US exports, and

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

hence production and employment in the US. Unfortunately, governments of other trading countries

realized they could do the same; they soon followed suit and devalued their own currencies. Thus a cycle

of competitive devaluations began, in which each country would devalue its currency to match (or even

exceed) the devaluation of the others. This caused severe international economic instability, placing

severe pressure on the gold reserves held by central banks. By 1939, when World War II began, the gold

standard was dead because governments and central banks could not afford to honor their promise to

exchange gold for the paper money they had issued.

1944–1973: Bretton Woods and the Gold Standard

By 1945, when World War II ended, the international economy was in serious trouble. The gold standard

had collapsed; almost all of Europe was suffering from colossal war damage and economic depression;

the economies of Germany and Japan had been largely destroyed. Much of world trade had disappeared

as a result of the 1929–1934 depression, followed by extreme protectionism, competitive devaluations,

and war. The US economy was thriving at home, but there were concerns that unless international trade

was revived, the US would have difficulty as well, unless international trade was revived.

This is why representatives of 44 countries met at Bretton Woods, New Hampshire, to design a new

international monetary system. Two important international financial institutions were formed at Bretton

Woods: the International Monetary Fund (IMF), which would work to maintain order and stability in the

global financial and currency exchange system; and the World Bank, which would promote post-war

reconstruction and longer-term economic development.

One major problem with the old system was the gold standard. The gold standard could not be sustained.

Nevertheless, the participants at Bretton Woods did feel it was best to stay with a fixed exchange rate

regime to help keep the world’s economy stable. However, the participants also felt that the new

exchange rate regime must be more flexible than the gold standard had been; and a cycle of competitive

devaluations of the kind that created huge disruption in the 1930s had to be avoided. That is why they

required the exchange rate of each currency to be fixed to the US dollar (and thus indirectly to the value

of gold) at levels agreed between the member countries; but also decided that the exchange rates could

occasionally be changed, after international consultations. Though the Bretton Woods agreement

restored a link between the value of each currency and the price of gold, it did not require convertibility

into gold: people holding paper currency were not guaranteed they could exchange it for gold.

The IMF was mandated to monitor exchange rates, and help member countries’ governments keep their

exchange rates within 1% of the value established at Bretton Woods.

The major weakness of this exchange rate regime arose from the way that each currency’s value was tied

to the value of gold indirectly via the US dollar. Dollars were used for vast numbers of international

transactions. Most countries’ central banks kept (and still keep) a large part of their currency reserves in

US dollars. Linking currencies to gold via the US dollar worked well in the 1950s, but its success was

dependent of the stability of the dollar in relation to gold: that is, in terms of the amount of gold that one

US dollar could buy. That meant that if the US experienced high inflation, or had a large trade deficit,

there might then be too many dollars in circulation for the US central bank, the Federal Reserve, to be

able to back with gold. That is what began happening in the mid-1960s, when American government

spending and money supply increased dramatically. In 1971, the US abandoned the gold standard, and

by 1973, it had disappeared, worldwide.

1973–Present: Regional and Global Financial Crises

In 1976, the IMF’s member countries agreed that floating exchange rates were now acceptable. Since

then, the world has operated a mixed exchange rate system, which is also called a managed float. This

means that some currencies are allowed to float freely, but other currencies are actively managed by

central banks, and often pegged in value to another currency or to a basket of currencies. This managed

float exchange rate regime has generally led to more volatile exchange rates than before the world

abandoned the gold standard in 1973. There have been long periods when the floating exchange rates

were fairly stable, and distinctly less volatile than many had originally feared. On the other hand, there

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

have also been periods of extreme instability with volatile exchange rates contributing to currency crises

such as the Asian Financial Crisis of 1997. During that crisis several Asian countries, including Malaysia

and South Korea, saw the exchange rates of their currencies decrease by 80% in only a few months.

The IMF often intervenes when such currency crises occur, providing financial assistance {loans) and

expert advice for countries attempting to keep the value of their currency sufficiently stable in the face of

the crisis, and minimize disruption to their economy. In February 2009, the IMF began working with the

governments of the US and other major countries in an effort to moderate the global financial crisis, limit

the economic damage, and help create favorable conditions for recovery.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.2

Timeline: The International Monetary System

Student Name:_______________________________________________________ Date:___________

Directions: Fill out the important events that happened during the years described in Student Resource

8.1, Reading: The Development of the International Monetary System. Be ready to share your answers.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.3

Reading: The IMF and the World Bank

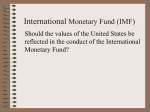

In 1944, as World War II was coming to a close, governments of more than 40 countries met in Bretton

Woods, New Hampshire for the United Nations Monetary and Financial Conference. There, they formed

two organizations through which they would collaborate to manage the global economy. One of these

organizations was the International Monetary Fund (IMF), and the other was the World Bank. The

countries involved wanted to prevent worldwide economic troubles that could lead to instability throughout

the world, and might even eventually lead to war.

The participating countries created these two international financial institutions (IFIs) to help prevent a

new meltdown in the worldwide economy, and also to help countries in need rebuild, which they saw as

being in the common interest of people in all parts of the world. Though the two IFIs have many

similarities, at least on the surface, each one serves a distinct purpose.

During their creation, the IFIs were controversial. For instance, governments of participating countries

argued about how much influence each would have over the IFIs, and how much money they would each

need to invest. The IMF and World Bank were intended to foster peace and prosperity throughout the

world, and many people feel that they have generally done so; others view the IFIs as oppressive tools

that prosperous countries use to impose their will on developing countries.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

When the founding member countries came together to create the IMF, they did so in order to deal with

international monetary difficulties; to ensure free convertibility of currencies (which would help

international trade grow); to ensure that international currency exchange rates remained stable; to ensure

instability in exchange rates and interest rates did not hurt trade; and to ensure that debts owed by one

country to another could be repaid in an orderly way.

The IMF does its job by performing three functions: surveillance, financial assistance, and technical

assistance. In performing the surveillance function, the IMF staff visits each member country and

examines many aspects of its economy, such as its exchange rate, monetary policies, and fiscal policies.

The IMF also does research on regional communities of countries, such as the European Union; and on

the global economy.

Providing financial assistance when major international crises happen is the IMF’s primary function. But in

order to get the money, the country seeking an IMF loan must usually agree to make changes to its

economic policies, based on the IMF’s analysis of what got the country into economic trouble in the first

place. The loans come at a variety of interest rates and for various lengths, depending on the state of the

borrowing country’s economy, and on what it needs the money for. The IMF also provides technical

assistance in such areas as monetary and tax policy and in collecting economic data.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

There are two bodies that control the International Monetary Fund, which is based in Washington, DC.

First is the board of governors. Each of the 184 member countries has a representative on this board.

These representatives meet once a year to deal with big issues and to vote on what’s to be done.

But for daily tasks, the 24-member executive board makes the decisions. Certain member countries—the

United States, the United Kingdom, China, France, Germany, Japan, Russia, and Saudi Arabia—are

permanently on this board, while the 16 other executive board members have two-year terms that rotate

among countries from broad regions, such as Africa or Southeast Asia. The members of the executive

board run different departments within the IMF. For instance, there are groups for various regions of the

world as well as for a variety of issues, such as fiscal planning and research and statistics. One managing

director, with a five-year term, runs this board.

Finally, the International Finance and Monetary Committee also has 24 members and meets twice a year.

Its purpose is to provide the IMF staff with suggestions and advice.

For all three bodies, a country’s voting power is based on a complex set of rules which give by far the

most votes to the countries with the largest economies and which have provided the largest amount of

funding to the IMF over time.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

The World Bank Group deals with money in both the public and private sectors. Developing countries can

borrow money from the IBRD and IDA. These two organizations within the group also offer governments

advice and provide research to help them manage their economic policies. The other three parts of the

World Bank Group deal with money in the private sector, helping out private business projects that benefit

the economy, by making loans and by helping to resolve disputes.

The overall goal of the World Bank is to reduce poverty. It also tries to increase access to education and

medical care and to protect the environment, all while promoting economic development. It does this by

offering loans for projects that improve an area’s economy. Projects have included things like building

roads to connect communities in rural Peru, giving microcredit (less than $1,000) loans to small-business

owners in developing countries, and helping poor mothers and children in Bangladesh get access to

medical care.

World Bank Acronyms:

IBRD: International Bank for Reconstruction and Development

MIGA: Multilateral Investment Guarantee Agency

IDA: International Development Association

IFC: International Finance Committee

ICSID: International Centre for Settlement of Investment Disputes

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

The World Bank is organized in a broadly similar way to the IMF. It too has a board of governors that is

made up of one member from each member country. Voting power here is unequal, as it is in the IMF: it

broadly corresponds to how much money each country contributes to the World Bank.

The day-to-day functions come under the control of the World Bank’s 22 executive directors, who

together are the executive board. Five of these directors are from the member countries permanently

represented on the executive board: the United States, France, Germany, Japan, and the United

Kingdom. The other 17 representatives are elected by all the other countries that are members of the

World Bank.

The organization has a president and vice presidents. The vice presidents each manage a region of the

world or a function, such as poverty reduction or finance. The president of the World Bank is always a US

citizen.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Though these two IFIs are different, they do have many similarities. They were both created at the same

time by a large group of countries as part of a UN effort to help the global economy run in a smooth and

stable way. Both of the IFIs have similar structures, with governing bodies made up of representatives

from the member countries.

Both organizations have come under criticism from those who say their policies put poor people at a

disadvantage and help rich corporations; and from those who feel that they threaten national sovereignty.

Though the IMF and World Bank are alike in many ways, they have distinct purposes. The IMF’s main

goal is to make sure that the system of payments between countries runs smoothly. It lends money to

governments when they need it, but it also monitors the policies and actions that determine countries’

currency exchange rates. It deals with large economic issues that are occurring between countries.

The World Bank, on the other hand, helps developing countries pay for economic development projects

and needed services. It lends money to the governments of these poor countries to help pay for such

projects. Unlike the IMF, which is focused on monetary issues, currency, banking and macroeconomics,

the World Bank is focused on microeconomic policies and structures for particular sectors of the economy

(such as electricity or transportation), and on the funding of specific projects in those sectors.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.4

Worksheet: The IMF and the World Bank

Student Names:_______________________________________________________ Date:___________

Directions: Find at least three differences between the IMF and the World Bank and write them in the

appropriate spaces on the Venn Diagram. Then find at least two similarities and record them in the

shared space.

IMF

World Bank

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.5

Worksheet: Balance of Trade

Student Name:_______________________________________________________ Date:___________

Directions: Answer the questions based on the rules of thumb and the data on the chart. Be ready to

share how you arrived at your answers.

Balance of Trade Rules of Thumb

A country’s balance of payments is the difference between the total of all payments into a

country from other countries (including incoming payments for exported goods and services and

incoming investments); and the total of all payments out from the country (including payments for

imported goods and services and outgoing investments) in a specific time period.

The total balance of payments can be broken down into various parts. One of these is the current

account balance of payments (“current account” for short). The current account shows the flows

of money into and out of a country other than flows of money for the purpose of making

investments.

Economists look to the current account, which measures imports and exports, to determine the

country’s trade balance. A positive number in the current account signifies a trade surplus; a

negative number signifies a trade deficit.

Trade deficits decrease the demand for a country’s currency compared with what it would be if the

country’s imports and exports balanced. Those buying a country’s exports first have to buy its

currency in order to do so. This represents demand for the country’s currency in the FX market.

Those who sell imports into that country are generally paid in its currency; this represents supply

of the currency in the FX market. It follows that if the country has a trade deficit (its imports exceed

its exports) the supply of the currency will exceed the demand; and therefore the currency will tend

to decrease in value. Trade surpluses have the opposite effect: they increase demand for a

currency, and tend to increase its value.

Inflation is a general increase in prices, reducing the purchasing power of a country’s currency.

Exports help maintain high employment levels; slow economic growth raises unemployment rates.

GDP changes can cause currency rate fluctuations.

2007 Balance of Trade Figures for (M)BRIC(K) Countries in US Dollars

GDP

(PPPadjusted)

GDP

Growth

Rate (%)

Exchange

rate yearly

change (%)

Inflation Rate

(%)

Current Account

Balance ($

mlllion)

Unemployment

Rate (%)

MEXICO

$1.4 trillion

-1.60%

+27.76%

6.04%

-6

4.65%

BRAZIL

$1.8 trillion

1.27%

+30.77%

5.61%

-1,645

9.00%

RUSSIA

$2 trillion

1.20%

+40.80%

14.00%

8,595

9.50%

INDIA

$3 trillion

5.30%

+24.02%

7.81%

-15

7.32%

CHINA

$10.8 trillion

9.90%

-2.38%

-1.29%

191,718

4.20%

S. KOREA

$1.2 trillion

-4.30%

+34.79%

3.88%

3,682

3.70%

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Balance of Trade Questions:

1. Which countries have trade deficits?

2. Which countries have trade surpluses?

3. GDP reflects the purchasing power of consumers. If a country’s GDP falls, consumers are less

able to purchase foreign goods, so the country’s imports decline. This means that if the country

had a current account surplus that surplus would increase; or if the country had a current account

deficit, that deficit would diminish, or even turn into a surplus. Which countries may see a change

in the value of their currency due to this effect? Why?

4. How might the negative GDP growth rates of Mexico and China in 2007 affect these countries’

balance of payments?

5. Which countries may see a change in employment numbers? Why?

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.6

Case Study: International Financial Management

Student Name:_______________________________________________________ Date:___________

Directions: Read the policy China implemented and circle your best guess about what the effect was.

Then read about what happened.

Balance of trade is a key indicator of what is happening in a country’s economy, and that is why

governments implement policies to manage it. Many countries seek trade balance (when the income a

country earns from its exports is equal to the money paid to other countries for exports), but others seek

to maximize exports. The Chinese government has managed its economy and its currency so that it will

have a large trade surplus.

Trade Policy

Policy: The Chinese government makes its trade policies as export-friendly as possible.

Effect: China enjoys a trade surplus/deficit.

China is one of the trade leaders in the world. In 2008, the US imported $340 billion worth of goods from

China while exporting only $70 billion there. The world imported $1.4 trillion worth of Chinese goods,

while China imported only $1.1 trillion.

Currency Management

Policy: The Chinese government keeps the value of its currency, known as the renminbi, artificially low.

Effect: This will affect China’s balance of trade by increasing/decreasing exports.

The Chinese government uses a pegged rate for its currency, the renminbi (the major unit of Chinese

currency is called the yuan). China uses a pegged exchange rate regime, meaning that the exchange rate

only fluctuates within a limited range decided upon by the Chinese government. To maintain its controlled

exchange rate, the Chinese government buys or sells its currency to offset market fluctuations. Buying or

selling the renminbi is controlled by law.

In 1997, in order to make Chinese goods more competitive in the US, the Chinese government devalued

the renminbi against the dollar and pegged the exchange rate at 8.27 yuan to the dollar. This made

imports of Chinese goods artificially cheap for Americans, which contributed to the ever-increasing US

trade deficit. (In 2006, the US trade deficit was $817.3 billion, or 6% of the nation’s GDP!) In addition, the

Chinese manufacturing base grew at the expense of the American one. This is why the American

government applied pressure on the Chinese government to revalue the yuan; it did so by pegging the

rate to a basket of currencies in 2008, making the rate 7 yuan to 1 dollar. Nonetheless, economists see

this rate as undervaluing the yuan because you can buy much more in China for 7 yuan than you can in

the US for 1 dollar. The IMF estimates that on a purchasing power parity basis, the true exchange rate

between the yuan and dollar should be 3.69:1.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Inflation Rates

Policy: The Chinese government has lowered/raised interest rates.

Effect: Chinese exports will be cheaper, increasing/decreasing trade.

For the past decade or so, inflation has been one of the biggest concerns the government of China has

had about the performance of the Chinese economy. In February 2008, China’s general inflation rate was

8.7% and the inflation rate on food was 23.3%. High rates of inflation can seriously destabilize

economies. The Chinese government had previously raised interest rates several times, making it more

costly to borrow, presumably because this restrains business which seemed to be “overheating”, creating

scarcities of goods and services, and thus bidding up prices. It seems the Chinese government was trying

to combat inflation, but to limited effect. However, the contraction of the US economy in 2008-2009

impacted China’s economy, by lowering the demand in the US for goods imported from China. In 2009,

consumer prices in China dropped 1.6%. In other words, in 2009 China was undergoing deflation, or

negative inflation rate growth.

While inflation can cause problems for a country’s economy, so can deflation. For example, persistent

deflation can result in a fall in the demand for goods and services, in part because consumers hold off on

buying goods in the hope that prices fall further. This can lead to a downturn in the economy which is

difficult to reverse: this has happened repeatedly in the Japanese economy since the 1990s.

Copyright © 20092012 National Academy Foundation. All rights reserved.

AOF Business in a Global Economy

Lesson 8 The International Monetary System

Student Resource 8.7

Organizer: Economic Policy Recommendation Letter

Student Name:_______________________________________________________ Date:___________

Directions: Use Student Resource 8.6, Case Study: International Financial Management to answer the

questions below. Work on questions 1-6 with a partner. These answers will become the three examples in

your letter. Then write down your own ideas for question 7. This information will also be added to the

letter.

1. What is one trade policy change China could make?

2. What would be the result of this change?

3. What is one way China could change the way it manages its currency?

4. What would be the result of this change?

5. What is one way China could alter its interest rates?

6. How might a change in interest rates affect its trade balance?

7. Of the different economic policy changes China could make, which would you recommend and

why?

Copyright © 20092012 National Academy Foundation. All rights reserved.