* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Download sample pages

Protectionism wikipedia , lookup

Currency war wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

International monetary systems wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Global financial system wikipedia , lookup

Exchange rate wikipedia , lookup

Fear of floating wikipedia , lookup

Deficit spending wikipedia , lookup

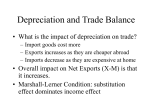

Extract 2 Extract 2 Globalisation and balance of payments imbalances Globalisation and Balance of Payments Imbalances www.tutor2u.net Extract 2: Key Term Glossary Key term Brief definition Balance of Payments imbalances Persistent trade deficits or surpluses Current account surplus Net external trade and income is positive Current account deficit The amount by which money relating to trade, investment income and transfers going out of a country is more than the amount coming in Exchange rate index The trade-weighted value of a currency Financial flows Flows of capital across national borders Excess savings When gross national savings > investment Capital account (BoP) Balance of investment flows Depreciation Fall in the external value of a currency Marshall Lerner Condition A devaluation of a currency improves the BoP only if the combined (or sum of) price elasticities of demand for imports & exports are greater than one. www.tutor2u.net Extract 2: Some Suggested Questions 1. Analyse two causes of a current account deficit in countries such as the United States 2. Analyse two causes of a current account surplus in countries such as China 3. Analyse why depreciation in the US dollar might not necessarily lead to a fall in their external deficit 4. Comment on two policies that might be used to correct a deficit on the current account of the balance of payments 5. Describe what is meant by balance of payments imbalances 6. Distinguish between the current account and the capital account of the balance of payments 7. Distinguish between the current account and the capital account of the balance of payments 8. Evaluate the case for and against protectionism as a policy to help prevent a recession and rising unemployment www.tutor2u.net The Fast-Changing Global Economy 40% Percentage share of world GDP, at current market prices & exchange rates 35% 31.4% 30% 28.5% 26.2% 25% 20% 22.7% 19.6% 15% 10% 5% 0% 1980 1990 2000 US EU-28 Asia-Pacific 2010 2015 Source: IMF World Outlook The world economy is changing rapidly! Since 1980 the share of global economic output has shifted towards Asian-Pacific countries who now dominate. www.tutor2u.net Extract 2: Text and Commentary • While globalisation has brought about an increase in the volume of world trade, it has also increased balance of payments imbalances. • Much of the discussion about these global imbalances has focused on China’s current account surplus and the USA’s current account deficit • Imbalances refer to the persistent current account surpluses for some countries contrasted with large current account deficits in other nations. • The main way of measuring trade / current account imbalances is as a % of GDP www.tutor2u.net Extract 2: Text and Commentary • The period between 2007 and 2013 saw fluctuations in the current account deficit of the USA and in its effective exchange rate index. • Changes in its effective exchange rate (see Fig. 2.2) did not always have the expected impact on the USA’s current account deficit. • The USA runs a permanent (i.e. a structural) current account deficit. • Countries running external deficits normally see their currency depreciate • The size of the US external deficit halved from 2007 to 2009 – in large part due to the recession. • It has since been fairly stable at around $200bn per year • But real growth in the US economy post crisis has brought about a fall in the deficit as a % of US GDP www.tutor2u.net Fig. 2.1 Current Account Balances of China and USA Surplus China’s current account surplus has more than halved since peaking > $400bn in 2008. It has also declined as a % of China’s GDP Deficit The US current account deficit has narrowed from over $700bn in 2007 to under $400bn in 2009 and has remained fairly stable at this level since – declining as a share of GDP www.tutor2u.net Current Account Balances of China and USA (% of GDP) % of GDP is a better measure of the scale of a deficit or a surplus Surplus China’s current account surplus measured as a share of GDP has diminished significantly since peaking at 10% of GDP in 2007. The surplus averaged 2% of national output in 2012-2014 Deficit www.tutor2u.net Fig. 2.2 Effective exchange rate index of US dollar ($) 104 103 Base Year for the Index Appreciation 100 99 98 Depreciation 99 95 Overall, the US dollar has been depreciating against a tradeweighted basket of other currencies. But the size of the changes in percentage terms in the external value of the $ have been small. www.tutor2u.net US Dollar – Chinese Yuan Exchange Rate Yuan per $1 China ends their fullyfixed exchange rate against the US dollar Yuan appreciating v $ China devalues the Yuan in summer of 2015 Effective return of a fixed exchange rate during the global financial crisis www.tutor2u.net How changes in the exchange rate affects trade balance $ has fallen in value e.g. v Chinese Yuan US goods and services cheaper in foreign currency terms Demand for US imports should fall Demand for US exports should rise Imports into the USA more expensive prices in US $s Ceteris paribus, value of US exports will rise Ceteris paribus, value of US imports will fall So the US trade deficit should reduce in size! Depreciation in market value of the US $ www.tutor2u.net Will an Exchange Rate Depreciation improve the BoP? The diagram below shows the “J Curve effect” – it shows the time lags between a falling currency and an improved trade balance Trade surplus Currency depreciation here Trade deficit Trade deficit may grow in the initial period after depreciation Time period after depreciation Net improvement in trade provided certain conditions are met – known as the Marshall Lerner condition www.tutor2u.net