* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

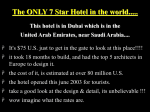

Download Report - Millennium Hotels and Resorts

Financial literacy wikipedia , lookup

Present value wikipedia , lookup

Systemic risk wikipedia , lookup

Business valuation wikipedia , lookup

Investment fund wikipedia , lookup

Financial economics wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Global saving glut wikipedia , lookup

Investment management wikipedia , lookup