* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Bankruptcy Equilibrium: Secured and Unsecured assets

Debt collection wikipedia , lookup

Debt settlement wikipedia , lookup

Floating charge wikipedia , lookup

Investment management wikipedia , lookup

Household debt wikipedia , lookup

Securitization wikipedia , lookup

Credit rationing wikipedia , lookup

Public finance wikipedia , lookup

Financial economics wikipedia , lookup

Financial crisis wikipedia , lookup

Bankruptcy Equilibrium: Secured and Unsecured

assets

Aloisio Araujo

a,b

a

and J. Mauricio Villalba

IMPA,

b

a

FGV

Rio de Janeiro - Brazil

February, 2016

Preliminary version

Abstract

Economies with lack of commitment have been extensively studied using instruments like collateral to back promises and market exclusion to

avoid default. We study an economy with secured and unsecured assets,

where the last ones play an important role in allowing interstate and intertemporal transfers. Bankruptcy punishment is the seize of a fraction

of agent’s income, this leads to lack of convexity in the budget set. If the

return matrix has ex ante full rank we can implement the Arrow Debreu

allocation (AD) with a large enough seizure rate, indirectly proving equilibrium existence.

Key words: Bankruptcy, seizure rate, debt constraint, contagion.

1

Introduction

Debt is an important financial tool to transfer wealth among dates and to insurance among different states of nature. We can separate debt into two categories:

Secured debt, as mortgage loan, is backed by some collateral; it played an important role during the last financial crisis [14]. Unsecured debt as credit card

debt and student loans, is not backed by collateral, this does not mean there

is no default punishment, actually its punishment (established by a bankruptcy

law) might be hard.

Although most debt is secured, the role of unsecured debt is still important in

the economy, especially for people who lack of collateral. It also depends on

demographic variables. As can be seen in [12], unsecured debt is more important for people under 35 years old. Also, in the case of firm debt [9] shows

that unsecured debt moves procyclically and tends to lead the GDP, while the

secured debt is acyclical.

1

For secured debts, the collateral constraint imposes a debt limit; individuals

cannot take large amounts of secured debt because at the same time they need

to constitute the collateral requirement, which is some durable commodity with

limited supply. For unsecured debt, we need to introduce a maximum amount

of debt. Consider an individual who goes to a financial institution to ask for

a loan, the bank usually makes a credit analysis of the individual in order to

determine the agent’s ability to repay the debt, and determines a credit limit as

the maximum amount of money that the bank should lend the individual [21].

For simplicity, we do not model the way this limit is estimated and we assume

that this limit is exogenously established by some intermediate agent or a regulator.1

When the regulator defines the limit of credit, he might not have all individual’s

relevant information, or might have incomplete information about future events

and fails to determine a limit of credit below which the debtor always honors

her debts. So in certain scenarios the debtor agent might not be able to repay

her debt, in this situation we say that she goes bankruptcy.

Allowing for bankruptcy brings some technical difficulties, agent’s feasible set

(including consumption and portfolio) is no longer a convex set, so it is possible

that the best response correspondence is not convex, this prevents us to use the

classical fixed point theorems to prove equilibrium existence. To overcome this

difficulty, two seminal papers on the subject [6] and [25] work with a non-atomic

set of agents2 . In a dynamical economy, this approach has been used to study

some policy implications of a change in the Bankruptcy legislation [13].

Bankruptcy is idiosyncratic; each agent decides how much to delivery, this

could create a cascade effect. Agents might default by contagion. Portfolios

define a lending network among agents, creating a framework to study systemic risk. There are several studies about network stability (see for example [1–3, 11, 16, 19, 27]) and its dependence on shocks and network structure.

Most of these works assume that links and portfolios are exogenously given,

implying that a more stable network is always preferred. Allowing a greater

number of defaults (less stability) might be better when prices and portfolios

are endogenous. In an exogenous framework, defaulting asset is overvalued if

the shock that leads to default is large enough (lender is paying too much for

an asset that defaults). An endogenous price reflects default probabilities, so

lender pays a fair price.

In this paper, we address an economy with finite agents (or finite types). There

are two dates and agents can transfer resources among dates and states of nature

by negotiating a set of secured and unsecured assets. In bankruptcy, the seizure

rate defines how much of the income is confiscated. This hybrid model combines

the collateral model studied in [7, 17] and the model of unsecured claims and

1 In [23] this credit limit is endogenous. It is defined as an optimal choice for the lender

manager. Because of private information, bankruptcy probability might be positive.

2 When introducing a set of continuous agents, the economy turns out to be convex, in the

sense that the aggregate best response correspondence is convex valued, and, except for some

technical details, equilibrium existence can be proved in a similar way as in an Arrow-Debreu

economy.

2

bankruptcy studied in [6, 25]. Assuming that there is a finite type of agents

we can prove equilibrium existence when agents choose a convex combination of

optimal strategies. This can be interpreted in two ways: 1) there is a continuum

of agents of each type, meaning that in equilibrium identical agents can take

different choices, or 2) agents choose mixed strategies. In either case, the proof

is quite standard, we only need to replace the best response correspondence by

its convex hull.

Without the convexification approach, we can prove equilibrium existence by

implementing the Arrow Debreu allocation. We are interested in study conditions that ensure its implementation with a mix of secured and unsecured assets.

In [20] with permanent exclusion, equilibrium might be Pareto ranked. In a similar context, [8] shows that the Arrow Debreu allocation can be implemented

with partial exclusion and strong risk aversion. In our setting, if the vector of

individual state transference is contained in the span of the payoff matrix, then

we need to check if the collateral constraint is satisfied. In case it is not, we

can add unsecured assets without changing the matrix span. Next, in order

to ensure that in equilibrium this span is not changed, we need to consider a

seizure rate high enough to avoid bankruptcy in equilibrium; this does not rule

out the possibility of default on some of the secured assets.

A necessary condition to implement the Arrow Debreu allocation is a monotonicity relation3 similar to [5]. This condition is necessary for the collateral

constraint and it is sufficient if we implement with only one secured asset. In

the pure secured model [5, 17], the collateral constraint implies that individuals

cannot make any temporal transfers, they are net savers. Introducing unsecured assets relaxes this and individuals can transfer resources between dates

and states of nature without worrying about the collateral constraint. This is

very important when there is lack of collateral; also, it is important for individuals with low income, some of them probably still young and looking for student

loans that does not require collateral.

Paper is organized as follows: next we study the hydrid model of secured and

unsecured assets are characterize conditions to implement the Arrow Debreu

Allocation without bankruptcy.

2

Implementing the Arrow-Debreu Equilibrium

with a mix of secured and unsecured assets.

2.1

The Model

We consider an economy with two periods t = 0, 1 and S possible states of

nature s ∈ S = {1, · · · , S} in t = 1.

In each state s ∈ S ∗ = {0, 1, · · · , S} (s = 0 represents period 0), there are spot

markets for two commodities l = 1, 2. Commodity l = 1 is perishable while

l = 2 is durable, this means that consuming one unit of the durable good in

3 The

value of net consumption should be larger in states with higher relative prices.

3

t = 0 guarantees a consumption of one unit of this commodity in the next pe2(S+1)

riod. The vector of prices is p = (p0 , p1 , · · · , pS ) ∈ R++ , where psl is the

price of commodity l in state s for l = 1, 2 and s ∈ S ∗ .

There is a set I = {1, · · · , I} of agents with strictly increasing, concave and

2(S+1)

continuous utility functions ui : R+

→ R. They are also characterized by

2(S+1)

i

i

i

their endowments w = (w0 , · · · , wS ) ∈ R++ .

There is a set of assets that can be negotiated in t = 0 and promise returns in

t = 1. In this set of assets we consider secured and unsecured assets.

Let Jsec = {1, · · · , J sec } be the set of secured assets. A secured asset j promises

rsj units of the perishable commodity in state s. They differ on the collateral

requirement C j to back the promises. An agent selling one unit of the secured

asset j should constitute C j > 0 units of the durable good. We assume that

debtor holds the collateral and it can not be used to back other promises. Agent

defaults if the value of the debt is greater that the value of the collateral.

So, a

secured asset with collateral requirement C j returns min ps1 rsj ; ps2 C j in state

s.

On the other hand, there is a set Junsec = {1, · · · , J unsec } of unsecured assets. Their promises are not backed by collateral, which does not imply that

agents can default without suffering any penalty. Creditors are protected by a

bankruptcy law that establishes the bankruptcy procedure.

We assume that all unsecured assets are numeraire, they pay in units of the

perishable good, a unit of the unsecured asset j promises to pay rs′j units of the

unsec

perishable commodity.

If an agent i holds portfolio z ∈ RJ

, the total debt

P

in state s is4 j (zj )− ps1 rs′j . Debtor might file for bankruptcy, in that case all

debt is forgiven (excluding secured debt), but the judge can seize some of the

debtor income to partially repay the creditors.

Debtor’s income is composed by non financial and financial income. Non financial income is the value of the endowment ps wsi and the value of the durable good

sec

sec

consumed in t = 0, ps2 x02 . If the agent holds a portfolio (θ, ϕ) ∈ RJ+ ×RJ+ (θ

represents long positions and ϕ short selling) of secured assets, then her financial

income is:

sec

J

X

j=1

unsec

JX

(zj )+ κjs ps1 rs′j .

(θj − ϕj ) min ps1 rsj ; ps2 C j +

j=1

Where κjs ∈ [0, 1] is the delivery rate, defined in equilibrium according to

debtors’ deliveries.

The bankruptcy procedure states that secured debt have senior priority up to

the value of the collateral, after paying the secured debt up the collateral value,

all financial income can be garnished. But only a fraction γ ∈ [0, 1] of the

4 For any number a we call (a)− = max{0, −a} and (a)+ = max{0, a} the negative and

positive part of a.

4

endowment can be garnished. So, in case of bankruptcy, judge can seize5 :

γps wsi

+ ps2 x02 +

sec

J

X

(θj − ϕj ) min

j=1

ps1 rsj ; ps2 C j

+

unsec

JX

(zj )+ κjs ps1 rs′j ,

j=1

so, the delivery of unsecured debts will be:

Dsi

= min{

unsec

JX

(zj )− ps1 rs′j ;

j=1

γps wsi

+ ps2 x02 +

sec

J

X

(θj − ϕj ) min

j=1

sec

unsec

Let (q sec , q unsec ) ∈ RJ++ × RJ++

i’s budget constraint in t = 0 is

ps1 rsj ; ps2 C j

+

unsec

JX

(zj )+ κjs ps1 rs′j }.

j=1

be the vector of asset prices in t = 0, agent

p0 (x0 − w0i ) + q sec (θ − ϕ) + q unsec z ≤ 0

(1)

and the collateral constraint for secured assets

x02 ≥

sec

J

X

ϕj C j

(2)

j=1

In t = 1, state s, the budget constraint is

sec

ps (xs −wsi −(0, x02 ))+Dsi

≤

J

X

j=1

unsec

JX

(zj )+ κjs ps1 rs′j

(θj −ϕj ) min ps1 rsj ; ps2 C j +

j=1

(3)

So, given commodities and asset’s prices and delivery rate, the budget set

for agent i, B i (p, q sec , q unsec , κ) consists on all vectors of consumption and

portfolio satisfying (1),(2), (3) and a bounded short selling constraint for unsecured assets zj ≥ −m with m ≥ 0 for all j ∈ Junsec . We say that a

consumption bundle x is affordable if there is a portfolio (θ, ϕ, z) such that

(x, θ, ϕ, z) ∈ B i (p, q sec , q unsec , κ)6 .

5 We could consider a more general punishment, but in order to study the seizure rate γ

we’ve chosen this form. Also notice that by the collateral constraint this term is non negative,

with a more general punishment rule we can not assure this, so we should consider only the

positive part.

6 The budget set B i (p, q sec , q unsec , κ) could be written as the union of 2S convex sets, each

of them defines the states of nature in which agent i defaults in the unsecured debt. One

of such sets is the non bankruptcy region in which for all states of nature, the following

constraints hold:

J unsec

X

Dsi =

(zj )− ps1 rs′j .

j=1

5

PJ unsec

If agent i hold a positive unsecured debt j=1 (zj )− ps1 rs′j > 0, the delivery

for each asset is proportional to the value of the debt:

′

−

′j

i

i

Ds,j

′ = τs (zj ′ ) ps1 rs ,

with

τsi = PJ unsec

j=1

Dsi

(zj )− ps1 rs′j

The proceedings are distributed proportionally among all creditors. The

delivery rate adjusts to match the total delivery of debtors with creditors returns

for each unsecured asset j ∈ J unsec and state s:

X

X

i

κjs ps1 rs′j

(zji )+ =

Ds,j

(4)

i∈I

i∈I

Definition 2.1 An equilibrium7 for the economy with secured and unsecured

assets is a vector of prices p, q sec , q unsec, delivery rates κ and an allocation of

consumption and portfolios xi , θi , ϕi , z i i∈I , such that:

• For each i, xi is affordable with the portfolio (θi , ϕi , z i ) and is optimal in

the set of all affordable consumption bundles in B i (p, q sec , q unsec , κ).

P

i

i

•

i∈I x0 − w0 = 0.

P

i

i

i

• For each s ∈ S:

i∈I xs − ws − (0, w02 ) = 0.

P

i

•

i∈I z = 0

P

i

i

•

i∈I (θ − ϕ ) = 0

• (4) holds.

We would like to compare this equilibrium with the Arrow-Debreu equilibrium,

so we proceed to define it.

Definition 2.2 An Arrow-Debreu equilibrium (AD) is a vector of allocations

(xi )i∈I and a vector of prices p such that:

PS

2(S+1)

• For each i, xi is optimal in the set of all y ∈ R+

with s=0 ps (ys −

P

S

wsi ) − s=1 ps2 y02 ≤ 0.

P

i

i

•

i∈I x0 − w0 = 0.

P

i

i

i

• For each s ∈ S:

i∈I xs − ws − (0, w02 ) = 0.

7 We refer to the appendix for a proof of equilibrium existence when each i ∈ I chooses a

convex combination of optimal strategies. This could be interpreted as an equilibrium with

random strategies or a type of continuum agents such that in equilibrium identical agents

might choose different strategies.

6

2.2

Some Implementation Results

A first question to ask: When is AD allocation implementable for the economy

with secured and unsecured assets? Even though it is hard to find conditions

that are necessary and sufficient, we can find a necessary condition associated

to the seizure rate.

Proposition 2.1 Let (xi )i∈I , p be the AD equilibrium. If xi is affordable in

the non bankruptcy region for all agents, then seizure rate satisfies:

+

ps xis

∗

γ ≥ γ = max

1−

ps wsi

(s,i)∈S×I

Proof Let mi = ps (xis − wsi ) − ps2 xi02 s∈S ∈ RS be the vector of transferences

between states of nature. Since xi is affordable in the non bankruptcy region,

then there are an unsecured and secured portfolios z i and (θi − ϕi ) such that:

mis

=

sec

J

X

(θji

−

ϕij ) min

j=1

ps1 rsj ; ps2 C j

+

unsec

JX

zji ps1 rs′j ,

j=1

where we have set the delivery rate κ equal to one. Also for xi to be affordable

in the non bankruptcy region:

−mis ≤ γps wsi + ps2 xi02 ,

so, for all agents i and states s:

γ≥

ps xis

1−

ps wsi

implying that γ ≥ γ ∗ .

If J unsec = 0, in [17] it is showed that a necessary condition to implement the

AD equilibrium with secured assets is

ps (xis − wsi ) ≥ 0

(5)

This condition implies that individuals can not transfer endowments from one

state to another, the value of consumption must be always at least equal to the

value of the endowment. As in [5], we say that J CC ⊂ Jsec is a set of complete

collaterized assets if for each state s, there is some secured asset j ∈ J CC with

ps1 = ps2 C j (assuming that rsj = 1 for all secured assets). In [5] it is shown a

necessary condition to implement an AD equilibrium with secured assets J CC :

Proposition 2.2 Given an AD equilibrium (p, (xi )i∈I ), a necessary condition

for there to exists an equilibrium with complete collaterized assets with the same

allocation is that for all agents i and all pairs of states s and s′ with pps2

> pps′′ 2 :

s1

s 1

1

1

ps (xis − wsi ) ≥

ps′ (xis′ − wsi ′ ) ≥ 0.

ps1

ps′ 1

7

(6)

It turns out that this condition is also sufficient for two states of nature and if

agents preferences does not depend on the durable commodity in t = 0.

One of the main issues of the pure secured model is that the collateral constraint

is too hard for debtors, actually if we consider the durable good as another way

of saving, then all agents are net savers.

The existence of the set of secured assets J CC is guarantee if we assume that all

agents have identical homothetic preferences. With this, equilibrium commodity

prices depends only on aggregate terms, so if the AD allocation is implementable,

then prices should be the same. After computing AD prices we can compute

the collateral requirements necessary to construct the set of secured assets J CC .

Generically, the S × S return matrix will be of full rank8 , so all transfers ps (xis −

wsi − (0, xi02 )) are attainable for some secured portfolio. Nevertheless, those

portfolios might violate the collateral constraint and in an equilibrium with

pure secured assets some assets might not be traded and equilibrium will not

be Pareto efficient (although it might be Pareto constraint).

One way to weaken condition 5 is to introduce unsecured assets. They do

not require collateral and allow agents to transfer endowments among states of

nature. If the return matrix of the unsecured assets is equal to the J CC secured

assets, then we might be able to implement an AD equilibrium with a mix of

secured and unsecured assets. As the combined return matrix is already of full

rank, in order to keep the full rank property the seizure rate established by the

bankruptcy law should be large enough to avoid default on unsecured assets.

The next result formalizes our observation for the case of two states of nature

Proposition 2.3 Let (p, (xi )i∈I ) be the AD equilibrium when S = 2. Suppose,

without lost of generality, that β = pp12

− pp11

> 0. If the seizure rate satisfies

22

21

+

ps xis

1−

γ ≥ γ = max

.

ps wsi

(s,i)∈S×I

∗

Then, there is a debt constraint m such that the AD allocation is feasible for all

agents if, and only if, one of the following conditions holds:

a) For all i:

1

1

p1 (xi1 − w1i ) −

p2 (xi2 − w2i ) ≥ 0

p11

p21

b) For all i:

1

β

1

p1 (xi1 − w1i ) −

p2 (xi2 − w2i ) ≤

p2 (xi2 − w2i ) + p22 xi02 .

p11

p21

p11

Proof The claim on the seizure rate is due to proposition 2.1.

8 Generically

the price ratios ps1 /ps2 are different for all s, we concentrate in this case.

8

a) We implement the AD equilibrium using the secured asset with collateral

requirement C 1 = p11 /p12 and the unsecured asset with returns (p11 , p21 ).

The collateral constraint is equivalent to:

xi02 + z1i C 1 ≥ 0

Let mi = ps (xis − wsi ) − ps2 xi02 s∈S ∈ RS be the vector of transferences

between states of nature.

Define

τ=

then,

τ=

1

1

p1 (xi1 − w1i ) −

p2 (xi2 − w2i ),

p11

p21

1

1

(mi1 + p12 xi02 ) −

(mi + p22 xi02 )

p11

p21 2

The secured and unsecured portfolios span all transfers, so

mi1 = p11 z1i + p11 z2i

mi2 = p22

so

τ=

p11 i

z + p21 z2i ,

p12 1

p12 p21 − p11 p22 i

(x02 + z1i C 1 )

p11 p21

Then, τ ≥ 0 if, and only if, the collateral constraint is satisfied.

b) In this case we implement the AD equilibrium with the secured asset with

collateral requirement C 2 = p21 /p22 and the unsecured asset with returns

(p11 , p22 p11 /p12 ). The collaretal constraint is equivalent to

xi02 + z2i C 2 ≥ 0

Define

τ∗ =

1

1

β

p1 (xi1 − w1i ) −

p2 (xi2 − w2i ) −

p2 (xi2 − w2i ) + p22 xi02 ,

p11

p21

p11

The return matrix is the same as in the previous item, so

τ∗ =

p12 p21 − p11 p22

(−z2i C 2 − xi02 )

p11 p21

then, τ ∗ ≤ 0 if, and only if, the collateral constraint is satisfied.

The first condition is similar to (6), it preserves the order, but it doesn’t require

non negativeness. With this, the AD allocation is feasible with the secured

asset with the lowest collateral requirement and the unsecured asset. The second

condition is new to our knowledge and it says that even if the monotone relation

(6) fails, the AD allocation is still feasible if the failure of (6) is not too large. In

this case, the AD allocation is feasible using the secured asset with the largest

9

collateral requirement.

Compared to the pure collateral economy, Proposition 2.3 enlarges the sets of

economies (endowments) for which the AD allocation is implementable. In this

proposition at least one asset is secured, even if those conditions are not satisfied,

we still can implement AD, but we will need both assets to be unsecured.

Proposition 2.3 shows conditions that guarantee feasibility of the AD allocation,

but it does not say anything about optimality. Recall that debtors who holds

the unsecured asset might file for bankruptcy and deliver less than the promise.

The budget set can be decomposed as the union of convex sets, one of them

is the set of consumption bundles and portfolios such that agent does not file

for bankruptcy. Proposition 2.3 actually shows that consumption bundles in

this sets are contained in the Arrow Debreu budget set, but it is still possible

to find another consumption bundle in the other sets (sets in which agent fills

for bankruptcy at least in one state) that improves her utility (see the 2x2

example).

Next proposition establishes that if the AD allocation is feasible, then it is

optimal, provided a high enough seizure.

Proposition 2.4 If the Arrow Debreu Allocation (xi )i∈I is feasible in the non

bankruptcy region and if for all agents, preferences are represented by a C 1

utility function ui that satisfy Inada condition

lim

min{xsl }→0

u′i (x) = +∞.

Then, there is some γ ∗∗ < 1 such that the Arrow Debreu allocation is an equilibrium for the non commitment economy for all γ ≥ γ∗∗.

2.2.1

2 × 2 Model

We borrow a parametric version of an example given in [5] to point out how to

implement the AD allocation with a mix of secured and unsecured assets and

the relevance of the latter. AD allocation might not be implementable with a

pure secured asset market when durable good is unevenly distributed, we need

to introduce at least one unsecured asset. The unsecured asset used depends

on durable preferences and distribution. Also, the interstate shock plays an important role when the interstate shock gets larger, agents need larger portfolios

to attain these hedging.

There are two agents with identical homothetic preferences and two equal probably states of nature

2

α log(x01 ) + (1 − α) log(x02 ) +

1X

(α log(xs1 ) + (1 − α) log(xs2 )) ,

2 s=1

where α denotes the preference for the perishable good. Endowments are as

follow

i

i

i

wi = (w01

, η i w02 , w11

, 0, w21

, 0).

10

Agents receive an endowment of the durable commodity only in t = 0, η i represents the fraction of the durable commodity that belongs to agent i.

Since utilities are homothetic, commodity prices are independent on the endowment’s distribution. Arrow Debreu prices are

(1 − α) w01 w01 (1 − α) w01 w01 (1 − α) w01

p = 1, 2

,

,

,

,

,

α w02 2w11

α 2w02 2w21

α 2w02

P i

.

where wsl = i wsl

Notice that durable price is the same in both states of nature. This equality is

due to equal probabilities and because agents receive durable endowments only

in t = 0.

Endogenous collateral requirements are

Cs =

α w02

.

1 − α ws1

The return matrix for the J CC secured assets (if w11 > w21 , asset 1 is the

sub-prime and asset 2 is prime)9,10 is

w01

1

1

,

R=

11

1 w

2w11

w21

which is clearly a full rank matrix, so all transfers are possible, but the needed

portfolio might not meet the collateral constraint.

The collateral constraint depends on durable consumption:

i

i

i

w02 w01

w11

w21

i

i

x02 = α

+ η i w02 .

− 2η +

+

2

w01

2w11

2w21

We can also compute portfolios for assets 1 and 2:

i

i

wi − w21

w01

α

(1 − α) i

wi

wi

z1i = w11

+2

,

η + 11 + 21 − w11 11

2

w01

α

2w11

2w21

w11 − w21

z2i =

i

i

i

i

w11

w21 − w21

w11

p11 w11

− p21 w21

=−

w11 − w21

p11 − p21

The collateral constraint:

∆i = xi02 − C 1 (z1i )− − C 2 (z2i )− ≥ 0,

its sign is independent of durable endowment. Both durable consumption and

collateral requirement are proportional to durable endowment, so the sign of the

last expression will be independent of it. To fix ideas lets fix some numerical

values:

w1 = (4, 4(1 − η), 4, 0, 4, 0)

9 The

case w11 < w21 is analogous and if there is equality, the return matrix is singular.

asset is the one with highest default probability. In our context (as in [5] ) the

sub-prime asset is the one with the lowest collateral requirement.

10 Sub-prime

11

1

1

0.8

0.8

0.6

η≥

3 α

5 1−α

η

η

0.6

η−1+

0.4

α(1+9α)

15(1−α)2

≤0

0.4

0.2

0

0.2

0

0.1

0.2

0.3

0.4

0.5

α

0.6

0.7

0.8

0.9

0

1

0

0.1

0.2

0.3

0.4

0.5

0.6

α

a)

0.7

0.8

0.9

1

b)

1

0.8

0.4

0.3

γ

η

0.6

0.2

0.4

0.1

0.2

0

0

1

0

0.1

0.2

0.3

0.4

0.5

α

0.6

0.7

0.8

0.9

1

0.8

1

c)

0.8

0.6

0.6

η

0.4

α

0.4

0.2

0.2

0

0

d)

Figure 1:

w2 = (2, 4η, 6, 0, 2, 0),

agent 1 endowment is deterministic, she has a long position on the sub-prime

asset and a short position on the prime asset.

Collateral constraint for agents 1 and 2 are, respectively, equivalent to:

α(1 + 9α)

≥0

15(1 − α)2

3 α

η−

≥ 0.

51−α

1−η−

(7)

(8)

If at least one asset is unsecured, the seizure rate necessary to implement the

AD allocation must be at least:

1

3 (1 − α)

1 5 (1 − α)

∗

γ ≥ γ = max 0;

−

(1 − η); −

η

(9)

10 2 α

3 3 α

γ ∗ is a non decreasing function of α and it is concave on the durable distribution.

Given a preference parameter, the seizure rate needed to implement AD attains

its minimum when the durable is more fairly distributed.

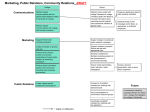

Figure 1 (above) shows the values of α and η for which the collateral constraint

are satisfied. The left (right) one corresponds to collateral constraint when only

the prime (sub-prime) asset is secured. c) shows the values of α and η for which

the AD allocation can be implemented using secured assets only. In d) we show

the minimum seizure rate that implements the AD allocation when at least one

asset is unsecured.

12

2.2.2

Feasibility does not imply optimality

If η = 0 and α = 0.2, agent 1 holds all the durable, the AD allocation is

x1 = (5.52, 3.68, 9.20, 3.68, 5.52, 3.68) and x2 = (0.48, 0.32, 0.80, 0.32, 0.48, 0.32).

The required portfolios are z 1 = (9.20, −4.00) and z 2 = (−9.20, 4.00). Agent 2

is poor in the first date and borrows heavily on asset 1, but she does not satisfy

the collateral constraint: x202 − (z12 )− C 1 = −0.6. The AD allocation is not

feasible with two secured assets. The trade off agents face is choosing between

increasing consumption today and reducing risk in t = 1. Clearly asset 2 is

better for risk sharing, but since agent 2 is too poor and have high preferences

on consuming the durable good, then she prefers to choose asset 1 with the

lowest collateral requirement.

If asset 1 were unsecured, agents 1 and 2 would be able to choose portfolios z 1

and z 2 , respectively. Agent’s 2 total debt in both states is (z12 )− ps1 rs1 = 2.76.

She will honor her debt as long as the seizure rate is large enough:

2

+ ps2 x202 + z22 ps1 ≥ 2.76

min γps1 ws1

s=1,2

then agent 2 does not default in the unsecured asset and the Arrow Debreu

allocation is attainable.

For this example γ ∗ = 0.33. We also need a constraint for the maximum amount

of unsecured debt, otherwise agent 2 could take an arbitrarily large amount of

debt in the unsecured asset and attain an unbounded utility. For this example

we take a debt constraint m = 9.2, that is just enough to allow portfolio z 2 .

For this example, condition b) of proposition 2.3 holds, so the AD allocation is

supported with the secured asset with the largest collateral constraint (asset 2)

and an unsecured asset with the same payoff of secured asset 1.

As we mentioned, γ ∗ only guarantees that the AD allocation is feasible and

is optimal in the non bankruptcy subset. We should check whether there is

another consumption bundle in the bankruptcy region that improves the utility

of agent 2 (the seller of the unsecured asset).

Budget set can be written as the union of four convex sets:

1. The Non bankruptcy region.

2. Bankruptcy only in state s = 1.

3. Bankruptcy only in state s = 2.

4. Bankruptcy in both states.

Table (1) shows optimal consumption bundles and portfolios for each case. Notice that in order to keep her promise agent 2 must buy some amount of the

secured asset. In the bankruptcy regions she could reduce her long position on

the secured asset, this will reduce her income in t = 1 and she won’t be able

to keep her promise, her consumption in the bankruptcy state will reduce, but

she increases her consumption in t = 0. If the reduce of her income (associated

13

Case

1

2(s = 1)

3(s = 2)

4

x01

0.48

0.63

0.56

1.50

x02

0.32

0.28

0.47

0.84

x11

0.80

0.80

0.93

0.80

x12

0.32

0.32

0.37

0.32

x21

0.48

0.51

0.26

0.27

x22

0.32

0.34

0.17

0.18

z

-9.20

-9.20

-3.20

-9.20

θ

4.00

5.20

0.00

0.00

ϕ

0.00

0.82

2.80

5.01

Utility

-3.0729

-3.0575

-3.1738

-2.6643

Table 1: Agents optimize in the full bankruptcy region.

to γ) is small enough, then her extra consumption in t = 0 more than offset

her losses in t = 1, this way she can get an utility greater than with the AD

bundle. As can be seen in the table her best choice is to file for bankruptcy in

both states, so the AD allocation (even being feasible) is not an equilibrium.

Nevertheless, as proposition 2.4 says, if we increase further the seizure rate,

then agent 2 income losses for bankruptcy have a greater (negative) effect than

the consumption increases in t = 0. Our numerical experiments shows that it

suffices to take a seizure rate γ ≥ 0.46.

This example shows the relevance of unsecured assets when collateral constraints are too tight. Unsecured debt provides a way of transferring endowments between states without worrying about the correct amount of durable

consumption. Whats more, to avoid unsecured default, the seizure rate does

not need to take too large values, avoiding draconian penalties of default.

2.2.3

A Numerical Exercise with social mobility

Through this example, we show how the seizure rate needed to implement the

AD allocation reduces as the social mobility increases. Agents in the lowers

quartiles borrows on unsecured assets, if in the next period there is a reasonable

chance to end up in one of the uppers quartiles, then they have more chances to

repay their debts. The reduction on the default probability reduces the seizure

rate (default punishment) needed to implement the AD allocation.

As in [5], there are 4 agents, endowments roughly match US income and wealth

distribution [15]. Data on social mobility [18] shows that agents in the lowers

quartiles jump to the upper ones with positive probability. To keep things

simple we consider 3 states of nature:

1. Agents remain in the same quartile.

2. Agent 1 jumps to quartile 2; agent 3 jumps to quartile 4 and vice verse.

3. An state with more social mobility: agents in quartiles 3-4 jump to quartiles 1-2 and vice verse.

State 3 represent the state with more social mobility, its probability is ǫ > 0.

State 1’s probability is π.

After normalizing, endowments distribution is as follow:

14

w01

w02

w11

w12

w21

w22

w31

w32

Agent 1

0.61

0.84

0.63

0

0.21

0

0.11

0

agent 2

0.22

0.12

0.21

0

0.63

0

0.05

0

agent 3

0.12

0.04

0.11

0

0.05

0

0.63

0

agent 4

0.05

0

0.05

0

0.11

0

0.21

0

Agents preferences are identical and homothetic.

α log(x01 ) + (1 − α) log(x02 ) +

3

X

πs (α log(xs1 ) + (1 − α) log(xs2 )) .

s=1

In [28] they estimate α = 0.8.

In the AD equilibrium each agent consumes xi = αpwi /2 of each commodity in

each state of nature; where:

pwi = 1 + 2

1−α i

i

i

i

i

i

w02 + π(w11

− w21

) + w21

+ ǫ(w31

− w21

),

α

is increasing with more social mobility for poor agents (3 and 4).

The vector of inter temporal and interstate transfers for each agent is:

i

mi = (πs (xi − ws1

))s=1,2,3 .

Consider 3 Arrow securities paying on the perishable commodity. Return matrix

will be:

π

0

0

R = 0 1−π −ǫ 0 .

0

0

ǫ

Portfolios are:

z i = xi 1 − w1i ,

where 1 is a column vector of ones and w1i is agent i’s endowment of the perishable commodity in t = 1.

Asset 3 plays an important role for poor agents, they would like to short sell it

and pay in the state in which they have more endowment. If it were secured

agents would not be able to meet the collateral requirements.

Following [5], the endogenous collateral requirement is C = α/(1 − α) (it is the

same for the three assets because there is no aggregate risk).

Numerical exercises11 shows that assets 2 and 3 need to be unsecured to implement the AD allocation.

11 Let µ = (µ , µ , µ ) such that µ = 1 if asset j is secured and 0 otherwise. We can write

1

2

3

j

the collateral constraint for each agent as a function of probabilities π, ǫ and µ:

α

µ(z i )− .

∆i (π, ǫ, µ) = xi −

1−α

15

0.5

0.55

0.6

0.65

0.7

0.75

0.8

1

0.8

γ

0.6

0.4

0.2

0

1

0.8

0.6

0.4

0.2

0

π

0

0.1

0.2

0.4

0.3

0.5

0.6

ε

Figure 2: Minimum seizure rate for AD feasibility. The gray region represents

combinations of π and ǫ that satisfy the collateral constraint.

The minimum seizure rate for AD allocation’s feasibility is:

γ ≥ γ∗ =

max

(s,i)∈{2,3}×I

1−

pei

i

2ws1

+

.

Which is decreasing with ǫ when it is low enough as can be seen in figure 2.

Since asset 1 is secured, we also need to check the collateral constraint. The

combinations of probabilities that satisfies it are given by:

1−α i

i

i

i

min 1 + 2

w02 − (2 − π)w11 + (1 − π − ǫ)w21 + ǫw31 ≥ 0.

i=1,··· ,4

α

3

Conclusions

We have studied an economy with bankruptcy, showed conditions to implement

the AD allocation with a mix of secured and unsecured assets and provided

conditions to guarantee equilibrium existence.

In a pure secured economy AD allocation might not be implemented even if the

For each µ we define the set:

n

o

Lµ = (π, ǫ) ∈ [0, 1]2 : π + ǫ ≤ 1, ∆i (π, ǫ, µ) ≥ 0 for all i = 1, · · · , 4 .

We estimate the set Lµ for the 8 possible values of µ and verify that except for µ = (0, 0, 0)

and µ = (1, 0, 0) the set is empty. Since we try to use the lest quantity of unsecured assets

then we keep with µ = (1, 0, 0)

16

return matrix has full rank, individuals are not able to meet the collateral constraints. In this situation it is useful to introduce unsecured without changing

the return matrix. Agents do not need to worry with the collateral constraint,

nevertheless to guarantee that individuals do not default on unsecured debt,

preserving the return spam, the seizure rate should be large enough. We also

provided and example with social mobility in which today poor agents can borrow using an unsecured asset and if the probability of ending up in the first

quantiles (more social mobility) is positive, then we can implement AD allocation.

References

[1] Acemoglu, D., Ozdaglar, A., and Salehi, A. T. Systemic risk and

stability in financial networks. Working Paper, 2014.

[2] Allen, F., and Babus, A. Networks in finance. Survey, 2008.

[3] Allen, F., and Gale, D. Financial contagion. Journal of Political

Economics 108, 1 (2000).

[4] Araujo, A. P. General equilibrium, preferences and financial institutions

after the crisis. Economic Theory 58, 2 (2015), 217–254.

[5] Araujo, A. P., Kubler, F., and Schommer, S. Regulating collateralrequirements when markets are incomplete. Journal of Economic Theory

147, 2 (2012), 450 – 476.

[6] Araujo, A. P., and Páscoa, M. R. Bancruptcy in a model of unsecured

claims. Economic Theory 20, 3 (2002), 455–481.

[7] Araujo, A. P., Páscoa, M. R., and Torres-Martı́nez, J. P. Collateral avoids ponzi schemes in incomplete markets. Econometrica 70, 4

(2002), 1613–1638.

[8] Azariadis, C., and Kaas, L. Endogenous credit limits with small default

costs. Journal of Economic Theory 148, 2 (2013), 806–824.

[9] Azariadis, C., Kass, L., and Wen, Y. Self-fulfilling credit cycles. 2015.

[10] Berge, C. Topological Spaces. Oliver and Boyd LTD, 1963.

[11] Blume, Lawrence, Easley, D., Kleinbergv, J., Kleinberg, R.,

and Tardos, E. Which networks are least susceptible to cascading failures? In 52nd IEEE Annual Symposium on Foundations od Computer

Science (2011), pp. 392–402.

[12] Bureau, U. C. Survey of income and program participation. Tech. rep.,

U.S. Census Bureau, 1996-2008.

17

[13] Chatterjee, S., Corbae, D., Nakajima, M., and Rı́os-Rull, J.-V.

A quantitative theory of unsecured consumer credit with risk of default.

Econometrica 75, 6 (2007), 1525–1589.

[14] Demyanyk, Y., and Van Hemert, O. Understanding the subprime

mortgage crisis. Review of Financial Studies 24, 6 (2011), 1848–1880.

[15] Di, Z. Growing wealth, inequality, and housing in the united states. Tech.

rep., Harvard University’s Joint Center for Housing Studies, 2007.

[16] Freixas, X., Parigi, B. M., and Rochet, J.-C. Systemic risk, interbank relations, and liquidity provision by the central bank. Journal of

money, credit and banking (2000), 611–638.

[17] Geanakoplos, J. Collaterized asset markets. 2007.

[18] Hertz, T. Understanding mobility in america. Tech. rep., Center for

Amenrican Progress, 2006.

[19] Jackson, M. O. A survey of models of network formation: Stability and

efficiency. Survey, 2003.

[20] Kehoe, T. J., and Levine, D. K. Debt-constrained asset markets. The

Review of Economic Studies (1993), 865–888.

[21] Leippold, M., Vanini, P., and Ebnoether, S. Optimal credit limit

management under different information regimes. Journal of Banking &

Finance 30, 2 (2006), 463–487.

[22] Mas-Colell, A., Whinston, M. D., and Green, J. R. Microeconomic

theory. Oxford University press, 1995.

[23] Mateos-Planas, X. Credit limits and bankruptcy. Economics Letters

121, 3 (2013), 469–472.

[24] Poblete-Cazenave, R., and Torres-Martı́nez, J. P. Equilibrium

with limited-recourse collateralized loans. Economic Theory 53, 1 (2013),

181–211.

[25] Sabarwal, T. Competitive equilibria with incomplete markets and endogenous bankruptcy. Contributions to Theoretical Economics (2003).

[26] Villalba, J. M. Bankruptcy in general equilibrium: Existence, Efficiency

and Contagion. PhD thesis, IMPA, 2016.

[27] Vivier-Lirimont, S. Contagion in interbank debt networks. Working

Paper, 2006.

[28] Yao, R., and Zhang, H. H. Optimal consumption and portfolio choices

with risky housing and borrowing constraints. Review of Financial studies

18, 1 (2005), 197–239.

18

[29] Zame, W. R. Efficiency and the role of default when security markets are

incomplete. The American Economic Review 83, 5 (1993), 1142–1164.

4

Appendix A

Mixed Strategy Equilibrium

We will call a mixed equilibrium an equilibrium in which each agent ı ∈ I

chooses a convex combination of optimal strategies in the budget set.

To prove a mixed equilibrium we proceed as follows: first we define a truncated economy, associated to it there is a generalized game, whose equilibrium

is proved using the Kakutani fix point theorem after defining an adequate correspondence. Then we show that this fixed point is an equilibrium for the truncated economy as the boundaries get larger. Finally, by lower hemi-continuity

of the budget set correspondence we prove that the sequence of truncated equilibrium converges to a mixed equilibrium for the original economy.

4.1

The truncated Economy

For each n ∈ N we define a truncated economy.

Let

n

K = [0, n]

2(S+1)

In

× 0,

C

J sec

h n iJ sec

unsec

× 0,

× [−2m, 2Im]J

,

C

with C = min C j .

j∈Jsec

Let

P = ∆2+j

+

sec

+J unsec −1

× ∆2−1

+

S

,

be the space of prices. We define the truncated budget set

SJ unsec

βni : P × [0, 1]

⇒ K n,

as βni (p, q, κ) = B i (p, q, κ) ∩ K n .

Using standard arguments we prove the following12

Lemma 4.1 For n large enough, βni is continuous.

prove upper hemi-continuity its enough to notice that B i has a closed graphic and

i has no empty interior, it is easy to prove that β̊ i is lower hemiis compact. Since βn

n

¯i

¯i

i = β̊

continuous, then β̊n

is lower hemi-continuous too. It remains to prove that βn

n , which

can be proved for n large enough as in [24]

12 To

Kn

19

4.1.1

A Generalized Game

In the generalized game we consider all agents i ∈ I, the market and an additional player that defines the equilibrium delivery rates. We proceed to define

each player optimization problem and constraints.

Each agent ı ∈ I solves:

X

1

τsi

max

U i (x) −

i ×[0,1]S

2

(x,θ,ϕ,z,τ )∈βn

s∈S

Let

SJ unsec

ψni : P × [0, 1]

X

j∈Junsec

2

ps1 rsj (zji )+ − Dsi

(10)

S

⇒ K n × [0, 1]

2(S+1)

sec

be agent i’s optimal choice for 10. Consider the function w : R+

× RJ+ ×

sec

unsec

sec

sec

unsec

unsec

unsec

2(S+1)

S

RJ+ × RJ

× [0, 1] → R+

× RJ+ × RJ+ × RJ+

× RJ+

× RSJ

+

as

(x, θ, ϕ, z, τ ) → (x, θ, ϕ, z + , z − , τ ◦ z),

with τ ◦ z = (τs zj+ ; (s, j) ∈ S × Junsec ).

Next we consider the compact set:

2(S+1)

∇n = [0, n]

J sec h

sec

n iJ

In

J unsec

J unsec

SJ unsec

× 0,

×[0, 2Im]

×[0, 2m]

×[0, 2m]

.

× 0,

C

C

And define13 :

SJ unsec

Ψin = Conv w ◦ ψni : P × [0, 1]

⇒ ∇n ,

(11)

By the Berge maximum theorem [10] and the fact that w is a continuous function

and convex combination preserves upper hemi-continuity we have

Lemma 4.2 The correspondence Ψin is upper hemi-continuous, with convex,

compact and non empty values.

Given an allocation (xi , θi , ϕi , z1i , z2i , y i )i∈I ∈ ∇In , the market player solves:

X

X

X

X X

max p0

(xi0 − ei0 )+ q sec

(θi − ϕi )+ q unsec

(z1i − z2i )+

ps

(xis − eis ).

(p,q)∈P

i∈I

i∈I

i∈I

s∈S

i∈I

(12)

Delivery rate player solves:

maxunsec −

κ∈[0,1]SJ

13 Conv

X

"

ps1 rsj κsj

(s,j)∈S×Junsec

refers to the convex hull of a set.

20

X

i∈I

i

z2j

−

X

i∈I

i

ysj

#2

;

(13)

Let µ1 and µ2 be the best response correspondence for the market and the delivery rate players, respectively.

A mixed equilibrium for the generalized game is characterized by a fix point

of the following correspondence:

Y

SJ unsec

SJ unsec

µ=

⇒ ∇In × P × [0, 1]

,

Ψin × µ1 × µ2 : ∇In × P × [0, 1]

i∈I

by Kakutani fix point theorem we have the following

Proposition 4.3 The Generalized game has a mixed equilibrium.

4.1.2

Equilibrium for the truncated economy

Now we prove the following proposition

Proposition 4.4 For n large enough, a mixed equilibrium for the generalized

game is an equilibrium for the truncated economy.

Proof By definition all agents choice a convex combination of optimal strategies, so we only need to check market clearing conditions and the equilibrium

delivery rate.

Given a fix point xi , θi , ϕi , z1i , z2i , y i i∈I , p, q, κ . For each agent there are

indexes li = 1, · · · , N 14 such that:

N

X

+

−

xi , θi , ϕi , z1i , z2i , y i =

αli xili , θlii , ϕili , zlii , zlii , τlii ◦ zlii ,

li =1

with αli ≥ 0,

P

αli = 1 and xili , θlii , ϕili , zlii , τlii ∈ ψni (p, q, κ).

By 13 we have that κ satisfy the equilibrium delivery rate equation 4:

#

"

XX

XX

i

i −

i

−

= 0.

αli τli s (zli j )

αli (zli j ) −

ps1 rsj κsj

i∈I

i∈I

li

li

To prove market clearing we first notice that by adding agents budget constraint in t = 0 we have:

X

X

X

p0

(xi0 − ei0 ) + q sec

(θi − ϕi ) + q unsec

z i ≤ 0,

(14)

i∈I

i∈I

i∈I

and by the market optimization problem 12:

X

i∈I

14 By

(xi0 − ei0 ),

X

(θi − ϕi ),

i∈I

X

i∈I

zi

!

≤ 0.

(15)

Carathéodory’s theorem we can fix N = 2(S + 1) + 2J sec + J unsec + S + 1 for all agents

21

Adding up the budget constraint in t = 1, using 15 and the delivery rate equation:

X

ps ( (xis − eis − Y eis )) ≤ 0

(16)

i∈I

and by 13 we have that

X

(xis − eis − Y ei0 ) ≤ 0.

(17)

i∈I

15, 17, the collateral constraint and the short selling constraint on unsecured

assets implies that consumption and portfolios are uniformly bounded (independent of n). So, for n large enough the optimal choice is in the interior of

K n , this implies two things: 1) Prices are strictly positive and 2) the budget

constraints in t = 0, 1 hold with equality. This means that 14 and 16 holds

with equality, and since prices are strictly positive 15 and 17 also holds with

equality.

4.2

A mixed equilibrium

We proceed to prove:

Theorem 4.5 Under the hypothesis made on preferences, endowments and asset structure, there is a mixed equilibrium for the economy.

i

i

, zn2

, yni i∈I , pn , qn , κn ,

Proof We have a bounded sequence of equilibria xin , θni , ϕin , zn1

with

N

+

X

− i

i

i

i

i

i

i

,

, ϕinli , znl

αnli xinli , θnl

, znl

, τnli ◦ znl

xin , θni , ϕin , zn1

, zn2

, yni =

i

i

i

i

li =1

and

i

i

i

, τnl

, ϕinli , znl

xinli , θnl

∈ ψni (pn , qn , κn ).

i

i

i

We can extract a sub-sequence, such that

i

i

i

→ xili , θlii , ϕili , zlii , τlii ,

, τnl

, ϕinli , znl

xinli , θnl

i

i

i

and

(pn , qn , κn ) → (p, q, κ).

Feasibility, market clearing conditions and the equilibrium seizure rate equation

holds (because it holds for eachn), so to prove equilibrium existence we have

to prove that xili , θlii , ϕili , zlii , τlii is optimal when prices are (p, q, κ).

Take any (x, θ, ϕ, z) ∈ B i (p, q, κ).

For n large enough (x, θ, ϕ, z) ∈ βni (p, q, κ).

22

By lower hemi-continuity, there is a sequence (xm , θm , ϕm , zm , pm , qm , κm )

converging to (x, θ, ϕ, z, p, q, κ) with (xm , θm , ϕm , zm ) ∈ βni (pm , qm , κm ) for m

i

large enough. For m ≥ n large enough (xm , θm , ϕm , zm ) ∈ βm

(pm , qm , κm ), so

U i (ximli ) ≥ U i (xm ),

taking limits we obtain:

U i (xili ) ≥ U i (x),

which proves optimality.

23