* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Fossil economy - Beyond Zero Emissions

Climate change mitigation wikipedia , lookup

Open energy system models wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

100% renewable energy wikipedia , lookup

Fossil fuel phase-out wikipedia , lookup

German Climate Action Plan 2050 wikipedia , lookup

Politics of global warming wikipedia , lookup

Energiewende in Germany wikipedia , lookup

Energy policy of the United Kingdom wikipedia , lookup

Low-carbon economy wikipedia , lookup

Business action on climate change wikipedia , lookup

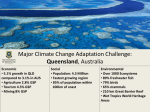

Mitigation of global warming in Australia wikipedia , lookup