* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Circular to shareholders 2016

Survey

Document related concepts

Transcript

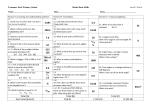

CIRCULAR TO SHAREHOLDERS THIS CIRCULAR IS BEING ISSUED TO THE SHAREHOLDERS OF RS2 SOFTWARE PLC PURSUANT TO THE REQUIREMENTS AND APPLICABLE LEGISLATION IN MALTA 30 MAY 2016 REGISTERED ADDRESS: RS2 BUILDINGS, FORT ROAD, MOSTA MST 1859, M ALTA COMPANY REGISTRATION NUMBER: C 25829 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION 1 Dear Shareholder, I am pleased to invite you to the Annual General Meeting of RS2 Software p.l.c (the “Company”) to be held at The Xara Lodge, L/O Rabat on Thursday, 23 June 2016 at 10.00hrs (the “AGM”). Enclosed within this letter you will find a Circular containing certain information that will put you in a better position to vote on certain resolutions being put forward for your approval at the AGM. The AGM provides an opportunity for the Company’s shareholders (“Shareholders”) to communicate with the directors and I sincerely hope you will take such opportunity. Should you be unable to attend the Meeting in person, I strongly encourage you to exercise your right to vote by appointing a proxy. The ordinary business of the AGM includes the consideration of the 2015 Annual Report and Financial Statements, the appointment of auditors and approval of their fees, the appointment of directors and approval of dividend. I would like to draw your attention in particular to certain resolutions of a special nature that are being put forward for the approval of the Shareholders at the AGM, which merit special comment. The purpose of this Circular is to provide you with further details of such, as well as to explain why the Company’s Board believes that the authorisations being sought are in the best interests of the Company and the Shareholders, and why the Board unanimously recommends that you vote in favour of the resolutions at the AGM. This Circular is to be considered as complimentary to the notice of the AGM and should be read in conjunction with the same. 1. AGGREGATE EMOLUMENT OF DIRECTORS You will be asked to consider and if deem it appropriate vote in favour of the following Resolution 5, which seeks the shareholders’ approval to increase the maximum aggregate emoluments to be paid by the directors in any year as follows: “That, for the purpose of Article 63 of the Articles of Association, the maximum aggregate emoluments that may be paid to the Directors of the Company in any financial year shall be €250,000.” The approval is being sought pursuant to Article 63 of the Articles of Association of the Company which stipulates that “The aggregate emoluments of all Directors in any one financial year, and any increases thereto, shall be such amount as may from time to time be determined by the Company in General Meeting”. The Company’s business has for the last years grown consistently and this has increased the director’s level of work, attention and responsibilities. The increase will be commensurate to such duties and accordingly the Board believes that in the absence of such an increase, the Company may not be able to retain and attract persons of the highest caliber to such posts. Moreover, the increase in directors’ aggregate emoluments is also being made in anticipation of the full Board compliment of eight members should Resolution 6 below be approved. 2 This resolution therefore proposes to increase the maximum limit of the aggregate emoluments that may be paid to directors as remuneration in terms of Article 63 of the Articles of Association of the Company from €100,000 to €250,000 in any one financial year. 2. INCREASE THE MAXIMUM NUMBER OF DIRECTORS Resolution 6 will propose: To replace Article 8 of the Memorandum of Association with the following: “The business and affairs of the Company shall be managed by a Board of Directors which shall be composed of not less than three (3) and not more than eight (8) directors, of which at least one third (1/3) shall be non-executive directors, unless an appointment is made in accordance with the provisions of Article 55.3 of the Articles of Association of the Company”. The Board after having carefully examined its responsibilities in line with the Company’s strategy, and in terms of functional requirements and professional proficiency necessary to assist with strategic priorities, is recommending that the composition of the Board ought to be increased from its current maximum of seven (7) members to eight (8) members. This would enable the Board to embrace a wider spectrum of expertise and skills necessary to achieve the Company’s objectives. In the absence of such increase, the Company’s pursuit of always ensuring that its directors have a broad range of competence will be hindered. 3. CAPITALISATION OF RESERVES AND ALLOTMENT OF BONUS SHARES Resolution 7 will propose: That the directors be and are authorised to capitalise a sum of five hundred thousand Euro (€500,000) being part of the amount standing to the credit of the Company’s non-distributable reserves of the share premium account and that such sum be appropriated to the holders of the issued ordinary shares of the Company registered on Monday, 23 May 2016 (“the Record Date”) and be generally and unconditionally authorised, pursuant to Article 85 of the Companies Act, to exercise all the powers of the Company to apply such amount in paying up and allotting in full five million (5,000,000) Ordinary Shares of ten cents each (€0.10) in the capital of the Company (ranking pari passu in all respects with the existing issued ordinary shares of the Company) to be allotted, issued and credited as fully paid up at par to and amongst such holders in the proportion of 1 (one) new ordinary share of ten cents (€0.10) each for every eighteen (18) Ordinary Shares held at the Record Date but subject to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements or legal or practical problems under the laws of, or the requirements of any regulatory body or exchange (the “Bonus Issue”). As announced on Thursday, 28 April 2016, the Board has proposed the issue of one (1) Ordinary Share for each eighteen (18) Ordinary Shares held by the Shareholders (“the Bonus Issue”) as at close of business on Monday, 23 May 2016 (“the Record Date”). The effect of the Bonus Issue will be to increase the number of ordinary shares in issue and the holding of each shareholder will be increased on a pro-rata basis. 3 The Directors are seeking to capitalise an amount of five hundred thousand Euro (€500,000) standing to the credit of the share premium account, representing circa 5.56% of the issued share capital of the Company as of the date of this Circular and to be authorised to utilise the same for the issuance and allotment of bonus shares. In accordance with the provisions of Article 114(2) of the Companies Act, such amount will be applied to pay up unissued shares of the Company to be issued to shareholders as fully paid up bonus shares. On the basis of the current issued 89,999,912 Ordinary Shares, the Bonus Issue will result in the issue of an aggregate amount of five hundred thousand Euro (€500,000) equivalent to five million (5,000,000) Ordinary Shares of ten Euro cents each (€0.10). The Board believes that the proposed Bonus Issue will benefit Shareholders by enhancing the liquidity and marketability of the Company’s ordinary shares. Information about new shares (Bonus Shares) and admissibility to Listing Application will be made for the listing of the newly issued shares pursuant to the Bonus Issue to be considered as admissible to listing on the Malta Stock Exchange, as a regulated market. Such new shares are expected to be admitted to listing on Friday, 24 June 2016 and dealings are expected to commence on the said Exchange on Monday, 27 June 2016. The above mentioned shares will be identical in all respects and rank pari passu in all respects with each other and with the shares already issued as of the date of this Circular as to all future dividends and distributions which are declared, made or paid. Any fractional entitlement shall be rounded to the nearest share. The new ordinary shares will be issued in fully registered and de-materialised form and will be represented in uncertified form by the appropriate entry in the electronic register maintained on behalf of the Company at the Central Securities Depository of the Malta Stock Exchange. 4. SHARE SPLIT Resolution 8 will propose (a) That, the authorised share capital of the Company currently consisting of ten million Euro (€10,000,000) and divided into one hundred million (100,000,000) Ordinary Shares of ten Euro cents each (€0.10) be increased to ten million Euro and two Euro cents (€10,000,000.02) and re-designated into one hundred sixty six million, six hundred and sixty six thousand, six hundred and sixty seven (166,666,667) Ordinary Shares of six Euro cents each (€0.06). (b) That pursuant to the increase and change in nominal value of the share capital of the Company as set forth in (a) above: i. in the event that Resolution 7 is not approved, the eighty nine million, nine hundred and ninety nine thousand, nine hundred and twelve (89,999,912) Ordinary Shares having a nominal value of ten Euro cents each (€0.10) which are currently in issue in the capital of the Company shall, due to the rounding up of shares as a result of fractional entitlement, be re-designated and divided into one hundred and forty nine million, nine hundred and ninety nine thousand, eight hundred and fifty four (149,999,854) Ordinary Shares having a nominal value of six Euro cents (€0.06) each, and all of the aforementioned one hundred and forty nine million, nine hundred and ninety nine thousand, eight hundred and fifty four (149,999,854) Ordinary Shares shall be allotted proportionally to those members appearing on the register of members of the Company as at Monday, 4 July 2016 (“Eligible 4 ii. Members”) at the ratio of five (5) shares for each three (3) shares held by each of the Eligible Members, subject to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements or legal or practical problems under the laws of, or the requirements of any regulatory body or exchange. The consideration for the increase in the issued share capital of the Company resulting from the re-designation of the Ordinary Shares as aforesaid is to be satisfied by the payment of cash: €0.04; OR in the event that Resolution 7 is approved and pursuant to the issuance of the Bonus Issue as indicated in Resolution 7 above, the ninety four million, nine hundred and ninety nine thousand, nine hundred and twelve (94,999,912) Ordinary Shares having a nominal value of ten Euro cents each (€0.10) which would be in issue following the Bonus Issue as aforesaid shall, due to the rounding up of shares as a result of fractional entitlement, be re-designated and divided into one hundred and fifty eight million, three hundred and thirty three thousand, one hundred and eighty seven (158,333,187) Ordinary Shares having a nominal value of six Euro cents (€0.06) each, and all of the aforementioned one hundred and fifty eight million, three hundred and thirty three thousand, one hundred and eighty seven (158,333,187) Ordinary Shares shall be allotted proportionally to those members appearing on the register of members of the Company as at Monday, 4 July 2016 (“Eligible Members”) at the ratio of five (5) shares for each three (3) shares held by each of the Eligible Members, subject to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements or legal or practical problems under the laws of, or the requirements of any regulatory body or exchange. The consideration for the increase in the issued share capital of the Company resulting from the re-designation of the Ordinary Shares as aforesaid is to be satisfied by the payment of cash: €0.02. The Board believes that considering the current trading price of the Company’s shares it is appropriate to recommend a five (5) for three (3) share split, which will increase the number of ordinary shares in issue by a factor of 1.76. The proposed share split is expected to improve the marketability and liquidity of the shares of the Company as a result of the increase in the number of shares in issue. Furthermore, the adjustment in the market price of the shares is expected to make such shares more affordable and thus they will appeal to a wider group of investors. The passing of Resolution 8(b)(i) OR 8(b)(ii) is dependent on the passing of Resolution 7 above which, through the issuance of the Bonus Shares, would increase the issued share capital of the Company by five million (5,000,000) Ordinary Shares. How will this affect shareholders? By means of the share split proposal, every three (3) existing shares will be sub-divided into five (5) new shares. Each shareholder will hold the same proportionate interest in the Company following the share split as they did prior to the aforementioned share split. Currently, the authorised share capital of the Company is of ten million Euro (€10,000,000) divided into one hundred million (100,000,000) Ordinary Shares of ten Euro cents each (€0.10). Should the shareholders approve the share split proposal, the Company’s authorised share capital and the shares in issue will be re-designated to one hundred sixty six million, six hundred and sixty six thousand, six hundred and sixty seven (166,666,667) Ordinary Shares of six Euro cents each (€0.06). For illustrative purposes only, based on the closing middle market price of the existing shares of €3.85 per share on Monday, 2 May 2016, the theoretical price following completion of the share split would be €2.31 per share. 5 This is determined as follows: Before Share split After Share split Hypothetical number of Shares held 100 167 Nominal Value (price per Share in €) 0.10 0.06 Mid Market Price (price per Share in €) 3.85 2.31 Total Value (€) 385.00 385.00 The above information is provided for illustrative purposes only. The market price of the shares, both before and after the completion of the share split may vary depending on market conditions at the relevant time. All shares arising from the share split shall rank pari passu with each other. Shareholders are not required to make any payment to the Company in respect of the Share Split. 5. AMENDMENT TO MEMORANDUM OF ASSOCIATION Should the resolutions aforementioned be approved, changes to the Memorandum of Association of the Company must be undertaken. The change to be registered in the Memorandum of Association is dependent on the passing of Resolution 8(b)(i) OR 8(b)(ii) above. Resolution 9 at the AGM will amend Clause 7 of the Memorandum of Association of the Company solely to reflect the changes brought by Resolution 8(b)(i) OR 8(b)(ii) above. If Resolution 8(b)(i) is passed, Resolution 9 shall read as follows: That subject to and conditional upon the passing of Resolution 8 above, Clause 7 of the Memorandum of Association of the Company shall be replaced with the following: “7. SHARE CAPITAL (a) The authorised share capital of the Company is ten million Euro and two Euro cents (€10,000,000.02) divided into one hundred sixty six million, six hundred and sixty six thousand, six hundred and sixty seven (166,666,667) Ordinary Shares of six Euro cents each (€0.06). (b) The issued share capital is of eight million, nine hundred and ninety nine thousand, nine hundred ninety one Euro and twenty four Euro cents (€8,999,991.24) divided into one hundred forty nine million, nine hundred ninety nine thousand, eight hundred fifty four (149,999,854) Ordinary Shares of six Euro cents (€0.06) each. (c) All shares shall rank pari passu. (d) In the event of there being any unissued shares in the capital of the Company, such shares shall be at the disposal of the Board of Directors who, subject to any provision in the Memorandum and Articles of Association, may allot, issue or otherwise deal with or dispose of the same to such persons on such terms and conditions and at such times as the Board of Directors shall think fit.” If however, Resolution 8(b)(ii) is passed, Resolution 9 shall read as follows: “7. SHARE CAPITAL (a) The authorised share capital of the Company is ten million Euro and two Euro cents (€10,000,000.02) divided into one hundred sixty six million, six hundred and sixty six thousand, six hundred and sixty seven (166,666,667) Ordinary Shares of six Euro cents each (€0.06). 6 (b) The issued share capital is of nine million, four hundred and ninety nine thousand, nine hundred ninety one Euro and twenty two cents (€9,499,991.22) divided into one hundred fifty eight million, three hundred and thirty three thousand, one hundred and eighty seven (158,333,187) Ordinary Shares of six Euro cents (€0.06) each. (c) All shares shall rank pari passu. (d) In the event of there being any unissued shares in the capital of the Company, such shares shall be at the disposal of the Board of Directors who, subject to any provision in the Memorandum and Articles of Association, may allot, issue or otherwise deal with or dispose of the same to such persons on such terms and conditions and at such times as the Board of Directors shall think fit.” Further information You are advised to read the whole of this document and not to rely solely on parts of it. All the Directors of the Company, whose names appear on page 8, accept responsibility for the information contained in this document. To the best of the knowledge and belief of the Directors who have taken all reasonable care to ensure that such is the case, the information contained in this document is in accordance with the facts and does not omit anything likely to affect the import of such information. The Shareholders who remain in doubt as to what action to take are encouraged to seek appropriate independent professional advice. Where any or all of the shares have been sold or transferred by the addressee, the Circular and any other relevant documents should be passed to the person through whom the sale or transfer was effected for transmission to the purchaser or transferee. Recommendation The Board of the Company considers that all the resolutions set out in this Circular are in the best interests of Shareholders as a whole. Accordingly, the Directors of the Company unanimously recommend that Shareholders vote in favour of the resolutions to be proposed at the General Meeting, as they intend to do in respect of their own beneficial holdings. Yours sincerely, Mr. Mario Schembri Chairman 7 COMPANY DETAILS Company Name Company Number Registered Office Company Directors Company Secretary RS2 Software p.l.c C 25829 RS2 Buildings, Fort Road, Mosta MST 1859, Malta Mario Schembri [Chairman & Non-Executive Director] Radi Abd el Haj [Executive Director] Robert Tufigno [Non-Executive Director] Maurice Xuereb [Non-Executive Director] Franco Azzopardi [Non-Executive Director] Christopher Wood [Non-Executive Director] John Elkins [Non-Executive Director] Ivan Gatt Documents available for inspection The following documents will be available for inspection at the Company’s registered office for fourteen (14) days from the date of publication of the Circular: o The Memorandum and Articles of Association of the Company, including a version with the proposed amendments; o The last Annual Financial Report and the half-yearly financial report of the Company. 8