* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download S - FBE Moodle

Survey

Document related concepts

Transcript

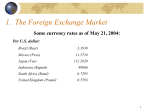

Lecture 2 Exchange Rate Determination Some basic questions • Why aren’t FX rates all equal to one? • Why do FX rates change over time? • Why don’t all FX rates change in the same direction? • What drives forward rates – the rates at which you can trade currencies at some future date? 2 Definitions • r$ : dollar rate of interest (r¥, rHK$,…) • i$ : expected dollar inflation rate • f€/$ : forward rate of exchange • s€/$ : spot rate of exchange – “Indirect quote”: s€/$ = 0.83215 – “Direct quote”: s$/€ = 1.2017 1 $ buys 0.83215 € 1 € buys $1.2017 3 3. Four theories . Difference in interest rates 1 + r€ 1 + r$ Fisher Theory Interest Rate parity Exp. difference in inflation rates 1 + iSFr 1 + i$ Relative PPP Difference between forward & spot rates F€/$ Exp. Theory s€/$ of forward rates Expected change in spot rate E(s€/$) S€/$ 4 Theory #1: Purchasing power parity Law of One Price Versions of PURCHASING POWER PARITY Absolute PPP Relative PPP 5 The Law of One Price • A commodity will have the same price in terms of common currency in every country – In the absence of frictions (e.g. shipping costs, tariffs,..) – Example Price of wheat in France (per bushel): P€ Price of wheat in U.S. (per bushel): P$ S€/$ = spot exchange rate P€ = s€/$ P$ 6 The Law of One Price, continued • Example: Price of wheat in France per bushel (p€) = 3.45 € Price of wheat in U.S. per bushel (p$) = $4.15 S€/$ = 0.83215 (s$/€ = 1.2017) Dollar equivalent price of wheat in France= s$/€ x p€ = 1.2017 $/€ x 3.45 € = $4.15 When law of one price does not hold, supply and demand forces help restore the equality 7 Absolute PPP • Extension of law of one price to a basket of goods • Absolute PPP examines price levels – Apply the law of one price to a basket of goods with price P€ and PUS (use upper-case P for the price of the basket): S€/$ = P€ / PUS where P€ = i (wFR,i p€,i ) PUS = i (wUS,i pUS,i ) 8 Absolute PPP • If the price of the basket in the U.S. rises relative to the price in Euros, the U.S. dollar depreciates: May 21 : s€/$ = P€ / PUS = 1235.75 € / $1482.07 = 0.8338 €/$ May 24: s€/$ = 1235.75 € / $1485.01 = 0.83215 €/$ 9 Relative PPP Absolute PPP: P€ = s€/$ P$ For PPP to hold in one year: P€ (1 + i€) = E(s€/$) P$ (1 + i$), or: P€ (1 + i€) = s€/$ [E(s€/$)/s€/$ )] P$ (1 + i$) Using absolute PPP to cancel terms and rearranging: Relative PPP: 1 + i€ = E(s€/$) 1 + i$ s€/$ 10 Relative PPP • Main idea – The difference between (expected) inflation rates equals the (expected) rate of change in exchange rates: 1 + i€ = E(s€/$) 1 + i$ s€/$ 11 The Purchasing Power Parity TheoryGustav (PPP) The PPP theory was developed by Swedish economists Cassel in 1920 to determine the exchange rate between countries on inconvertible paper currencies. This theory states that, the rate of exchange between two countries is determined by purchasing power in two different countries PPP have two versions: 1. The absolute purchasing power parity theory 2. The relative purchasing power parity theory 12 1) Absolute Purchasing power parity The absolute version states that the exchange rates between two countries is equal to the ratio of the price level in the two countries. The formula is, R AB = PA /PB where RAB is the exchange rate between two countries A and B and PA and PB refers to general price level in two countries 13 Absolute Purchasing power parity (cont..) For example if price of one bushel of wheat is $1 in U.S and £1 in U.K then exchange rate between $ and £ is equal to 1 According to the law of one price, a given commodity should have same price So purchasing power of two currencies is at parity in both countries If the price of one bushel of wheat in term of $ were $0.50 in U.S and £1.50 in U.K …firm would purchase wheat in U.S and resell it in U.K at profit 14 Absolute Purchasing power parity (cont..) This commodity arbitrage would cause the price of wheat to fall in U.K and rise in U.S until the prices were equal to $1per bushel in both economies Criticisms This version is not used because it ignore the transportation cost and other factors. 15 2) The Second Version ( Relative purchasing parity) According to this version the change in the exchange rate over a specific period of time should be proportional to the relative change in price level in the two nations over the same period of time The formula used for determination of exchange rate is R1 =P1a/P0 . R0 where R1 shows exchange rate in period 1, and R0 shows exchange rate in base period for example if general price level does not change in foreign nation from the base period to period 1 Where as general price level in the home nation increase by 50% P1b/P0 16 The Second Version ( Relative purchasing parity) So according to PPP theory the exchange rate (price of a unit of foreign currency in term of domestic currency) should be 50% higher in period 1 as compared to the base period (home currency depreciated by 50%) This theory can be explain with the help of other example. Suppose India and England are on inconvertible paper standard and by spending Rs.60, the bundle of goods can be purchased in India as can be bought by spending £ 1 in England. Thus, according to PPP, the rate of exchange will be Rs. 60= £ 1 Suppose domestic price index increase by 300 and foreign price index rises to 200 the new exchange rate will be Rs 60 =£1.5 17 Explanation (PPP) The exchange rate would be a proper reflection of the purchasing power in each country if the relative values bought the same amount of goods in each country. 18 BOP theory for Determination of exchange rate According to this theory ,exchange rate of a currency depends on its BOP position A favorable BOP raise the exchange rate And unfavorable BOP reduces the exchange rate Thus according to this theory exchange rate is determined by the demand and supply of foreign exchange Demand for foreign exchange arises from the debit side of the balance sheet Supply of foreign exchange arises from credit side of balance sheet 19 BOP theory for Determination of exchange rate (Cont…) • • • • • • • When BOP is unfavorable it means that demand for foreign currency is more than its supply It means that external value of domestic currency in relation to foreign currency fall Consequently exchange rate to fall…..how ? Suppose RS 60=$1 , external value of domestic currency is .017 Due to unfavorable BOP Rs90=$1 so external value of domestic currency is ……… .011 On other hand if BOP is favorable it means that supply of foreign is greater than demand It means that external value of domestic currency in relation to foreign currency rise 20 BOP theory for Determination of exchange rate (Cont…) • • • • Consequently exchange rate to rise Suppose RS 60=$1 , so external value of domestic currency is .017 Due to favorable BOP Rs 40=$1 so external value of domestic currency is ……… .025 In conclusion, in foreign exchange determination BOP is important 21 BOP theory for Determination of exchange rate (Cont…) price of $ in Rupee S R2 R R1 S 0 D Q Dollars 22 What is the evidence? • The Law of One Price frequently does not hold. • Absolute PPP does not hold, at least in the short run. – See The Economist’s Big McCurrencies • Homework: Use The Economist Big Mac Index: July 2013 1. Identify whether Euro, Japanese Yen, Great British Pound, Chinese Yuan, Swiss Frank and your own countries currency s are overvalued or undervalued against USA$. 2. Compare today's exchanage rates with July rates and discuss whether the big mac index gives right directions or not. • The data largely are consistent with Relative PPP, at least over longer periods. 23 Deviations from PPP Simplistic model Why does PPP not hold? Imperfect Markets Statistical difficulties 24 Deviations from PPP Simplistic model Imperfect Markets Statistical difficulties Transportation costs Tariffs and taxes Consumption patterns differ Non-traded goods & services Sticky prices Markets don’t work well Construction of price indexes - Different goods - Goods of different qualities 25 Summary of theory #1: . Exp. difference in inflation rates 1 + i€ 1 + i$ Relative PPP Expected change in spot rate E(s€/$) S€/$ 26 Theory #2: Interest rate parity • Main idea: There is no fundamental advantage to borrowing or lending in one currency over another • This establishes a relation between interest rates, spot exchange rates, and forward exchange rates – Forward market: Transaction occurs at some point in future – BUY: Agree to purchase the underlying currency at a predetermined exchange rate at a specific time in the future – SELL: Agree to deliver the underlying currency at a predetermined exchange rate at a specific time in the future 27 PART IV. INTEREST RATE PARITY THEORY I. INTRODUCTION A. The Theory states: the forward rate (F) differs from the spot rate (S) at equilibrium by an amount equal to the interest differential (rh - rf) between two countries. 28 INTEREST RATE PARITY THEORY 2. The forward premium or discount equals the interest rate differential. (F - S)/S = (rh - rf) where rh = the home rate rf = the foreign rate 29 INTEREST RATE PARITY THEORY 3. In equilibrium, returns on currencies will be the same i. e. No profit will be realized and interest parity exists which can be written (1 + rh) = F (1 + rf) S 30 INTEREST RATE PARITY THEORY B. Covered Interest Arbitrage 1. Conditions required: interest rate differential does not equal the forward or discount. premium 2. Funds will move to a country with a more attractive rate. 31 INTEREST RATE PARITY THEORY 3. Market pressures develop: a. As one currency is more demanded spot and sold forward. b. Inflow of fund depresses interest rates. c. Parity eventually reached. 32 INTEREST RATE PARITY THEORY C. Summary: Interest Rate Parity states: 1. Higher interest rates on a currency offset by forward discounts. 2. Lower interest rates are offset by forward premiums. 33 Example of a forward market transaction • Suppose you will need 100,000€ in one year • Through a forward contract, you can commit to lock in the exchange rate • f$/€ : forward rate of exchange Currently, f$/€ = 1.19854 1 € buys $1.19854 1 $ buys 0.83435 € • At this forward rate, you need to provide $119,854 in 12 months. 34 Interest Rate Parity START (today) $117,228 END (in one year) r$=2.24% (Invest in $) s€/$=0.83215 $117,228 0.83215 = 97,551€ One year (Invest in €) $117,228 1.0224 = $119,854 f€/$=0.83435 97,551€ 1.0251 = 100,000€ r€=2.51% 35 Interest rate parity • Main idea: Either strategy gets you the 100,000€ when you need it. • This implies that the difference in interest rates must reflect the difference between forward and spot exchange rates Interest Rate Parity: 1 + r€ = f€/$ 1 + r$ s€/$ 36 Interest rate parity example • Suppose the following were true: 12 month interest rate U.S Dollar Euro 2.24% 2.70% Spot rate 1.2017 € / $ Forward rate 1.19854 € / $ – Does interest rate parity hold? – Which way will funds flow? – How will this affect exchange rates? 37 Evidence on interest rate parity • Generally, it holds • Why would interest rate parity hold better than PPP? – Lower transactions costs in moving currencies than real goods – Financial markets are more efficient that real goods markets 38 Summary of theories #1 and #2: . Difference in interest rates 1 + r€ 1 + r$ Interest Rate parity Difference between forward & spot rates f€r/$ s€/$ Exp. difference in inflation rates 1 + i€ 1 + i$ Relative PPP Expected change in spot rate E(s€/$) s€/$ 39 Theory #3: The Fisher condition • Main idea: Market forces tend to allocate resources to their most productive uses • So all countries should have equal real rates of interest • Relation between real and nominal interest rates: (1 + rNominal) = (1 + rReal)(1 + i ) (1 + rReal) = (1 + rNominal) / (1 + i ) 40 Example of capital market equilibrium • Fisher condition in U.S. and France: (1 + r$(Real)) = (1 + r$) / (1 + i$) (1 + r€(Real)) = (1 + r€) / (1 + i€) • If real rates are equal, then the Fisher condition implies: 1 + r€ = 1 + r$ 1 + i€ 1 + i$ • The difference in interest rates is equal to the expected difference in inflation rates 41 Summary of theories 1-3: . Difference in interest rates 1 + r€ 1 + r$ Interest Rate parity Difference between forward & spot rates f€/$ s€/$ Fisher Theory Exp. difference in inflation rates 1 + i€ 1 + i$ Relative PPP Expected change in spot rate E(s€/$) s€/$ 42 Theory #4: Expectations theory of forward rates • Main idea: – The forward rate equals expected spot exchange rate f€/$ = E(s€/$) Expectations theory of forward rates: f€/$ = E(s€/$ ) s€/$ s€/$ 43 Expectations theory of forward rates • With risk, the forward rate may not equal the spot rate Group 1: Receive € in six months, want $ Group 2: Contracted to pay out € in six months • Wait six months and convert € to $ • Wait six months and convert $ to € • Sell € forward • Buy € forward or or • If Group 1 predominates, then E(s€/$) < f€/$ • If Group 2 predominates, then E(s€/$) > f€/$ 44 Takeaway: Summary of all four theories . Difference in interest rates 1 + r€ 1 + r$ Fisher Theory Interest Rate parity Exp. difference in inflation rates 1 + i€ 1 + i$ Relative PPP Difference between forward & spot rates f€/$ Exp. Theory s€/$ of forward rates Expected change in spot rate E(s€/$) s€/$ 45