* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Market Snapshot

Survey

Document related concepts

Transcript

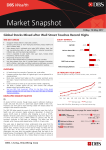

Market Snapshot Wednesday, 19 April 2017 Global Equities Mixed Amid Political Undercurrents Worldwide THE DAY AHEAD Malaysia posts March’s inflation rate. The Euro Area releases February’s balance of trade and March’s inflation data. The US posts the Mortgage Banker’s Association’s (MBA) Mortgage Applications numbers for the week ended 14 April. EQUITY MARKETS Shown in local currency terms. S&P 500 DJ Euro Stoxx 600 OVERVIEW US stocks tumble as Goldman Sachs’s earnings disappoint and commodity prices retreat. European stocks slide with FTSE 100 Index as British Prime Minister Theresa May calls for a snap election. Asian markets end mixed on Tuesday as investors grapple with economic, political, and geopolitical concerns in the region. Japan posts second session of gains, after four straight days of declines. Crude falls on smaller-than-expected US inventory decline. Pound jumps to six-month high as a UK snap election being called in June shocks the market. -0.3% -1.1% 0.3% Nikkei-225 MSCI Asia ex-Japan -0.6% -0.5% MSCI Emerging Markets US TREASURY YIELD CURVE Shows the yield to maturity of current US bills, notes, and bonds. DEVELOPED MARKET EQUITIES 3.0% 5.0% US US stocks fell, mirroring a drop in global shares led by oil producers and miners, as commodity prices retreated and Goldman Sachs Group Inc weighed on financial companies. Treasuries climbed with gold. 4.0% 2.0% 3.0% The S&P 500 lost 0.29% to close at 2,342.19. The benchmark gained 0.86% on Monday in thin trading – marking its best day since 1 March – but failed to move back above its 50-day moving average. The Dow Jones Industrial Average dropped 0.55% to 20,523.28 on Tuesday. Health care stocks exerted the largest drag on the index, down 1.01%. Cardinal Health Inc plunged 11.54%, after Reuters reported that Medtronic Plc was close to selling its medical supplies unit to Cardinal Health for about USD6b. Financial shares, meanwhile, were 0.83% lower. Goldman Sachs lost 4.72% – its worst day since June – after stunning Wall Street with a decline in bond trading revenue. The stock fell the most since the day after the UK voted to leave the European Union. Revenue from fixed-income trading of USD1.69b suffered from weaker demand in commodities and currencies, the New York-based company said Tuesday in a statement, and missed analysts’ USD2.03b estimate. In contrast, Bank of America Corp’s fixed-income trading revenue rose about 29% to USD2.93b billion, beating analysts’ USD2.6b average estimate. Last week, JPMorgan Chase & Co and Citigroup Inc also reported robust first-quarter revenue from bond trading. – Bloomberg News. EUROPE UK equities tumbled on Tuesday after British Prime Minister Theresa May called for surprise early elections to strengthen her hand in Brexit negotiations. European stocks were in a broad decline as markets reopened 2.0% 1.0% 1.0% 0.0% 1M 1M 3M 3M 6M 6M 1YR 2YR 3YR 5YR 7YR 10YR 30YR 0.0% 1YR 2YR 3YR 5YR 7YR 10YR 30YR One year ago Last Close Source: DBS CIO Office, Bloomberg, as of the last business day. Visit the Markets Movers page for more insights: Market Snapshot 19 April 2017 after the Easter holiday. The Stoxx 600 Index plunged 1.11% at the close. All industry groups fell, with energy (-2.99%) and materials (-2.29%) leading declines, the latter affected by a tumble in iron ore prices. The exporter-heavy FTSE 100 Index plunged 2.46% in its biggest drop since the aftermath of the Brexit vote, as the pound rose after May called for a general election in June. Britain’s snap election adds to the roster of upcoming political events in Europe, where uncertainty about the outcome of the French presidential vote has weighed on equities in recent sessions. The FTSE 250 Index of midcaps also fell, dropping 1.16%. Materials shares on the Stoxx 600 Index suffered as iron ore prices tumbled, after some analysts said they are bearish on the raw material’s outlook. Energy producers and construction companies were also among the worst performers on the Stoxx 600 Index, sending the benchmark to the lowest close since 27 March. – Bloomberg News. 2 Equity Markets Returns of equity indices around the world, in local currency terms. Index Close Overnight YTD DJIA 20523.28 -0.55% 3.85% S&P 500 2342.19 -0.29% 4.62% NASDAQ 5849.47 -0.12% 8.66% Europe Euro Stoxx 600 376.35 -1.11% 4.13% Germany DAX 12000.44 -0.90% 4.52% France CAC-40 4990.25 -1.59% 2.63% UK FTSE100 7147.50 -2.46% 0.07% Asia MSCI AxJ 578.80 -0.64% 12.53% US Japan Nikkei-225 18418.59 0.35% -3.64% JAPAN China SHCOMP 3196.71 -0.79% 3.00% Japan’s Nikkei 225 Index slumped 0.24% to 18,375.03 in early Wednesday morning trade, after US and European equities suffered losses overnight. Hong Kong Hang Seng 23924.54 -1.39% 8.75% Taiwan TWSE 9746.56 0.31% 5.33% On Tuesday, the benchmark rose 0.35% to 18,418.59, following a rebound in US shares and a weaker yen. This marked its second session of gains, after four straight days of declines. Four sectors lifted the index by doubledigit points each: telecommunication services (+1.03%), consumer discretionary (+0.37%), information technology (+0.48%), and industrials (+0.30%) added between 11.92 points to 16.12 points to the Nikkei 225 Index. South Korea Kospi 2148.46 0.13% 6.02% Indonesia JCI 5606.52 0.52% 5.85% Malaysia KLCI 1740.60 0.38% 6.02% Singapore STI 3137.54 -0.02% 8.91% India Sensex 29319.10 -0.32% 10.11% Within the telecommunication services sector, SoftBank Group Corp rose 1.61%. Media reports have said the group is seeking a 20% stake in Paytm owner One97 for USD1.4b-USD1.9b. Nippon Telegraph and Telephone Corporation rose 0.97%. Under industrials, Daikin Industries Ltd, Shimizu Corp, and Obayashi Corporation pulled the sub-sector higher, thanks to increases of 0.48%, 2.17%, and 2.05%, respectively. Emerg. Mkt MSCI EM 957.70 -0.52% 11.07% US Vice President Mike Pence pressed Japan for better trade terms on Tuesday, even as he affirmed US support for its Asian allies in dealing with North Korea. In Tokyo, he stressed the need for quick results as he helmed a new economic dialogue arranged by US President Donald Trump and Japanese Prime Minister Shinzo Abe. US Commerce Secretary Wilbur Ross, who was in Japan on Tuesday for separate talks with Trade Minister Hiroshige Seko, also indicated a desire to push for a trade deal with the nation. Japan, meanwhile, is persisting with the Trans-Pacific Partnership – the world’s largest trade deal that Trump pulled out from. – Bloomberg News. ASIAN EQUITIES CHINA Chinese stocks declined on Tuesday. The Shanghai Composite Index closed 0.79% lower at 3,196.71, the Shenzhen Composite Index was down 0.62% to 1,946.42, and the CSI 300 index of blue-chip stocks finished 0.49% lower at 3,462.63. Government Bonds Benchmark yields of major 10-year government bonds. Latest yield Previous yield Change (bps) US 2.17% 2.25% -8.16 Germany 0.16% 0.19% -3.10 Japan 0.01% 0.01% 0.20 China 3.41% 3.42% -0.40 Taiwan 1.00% 1.00% 0.00 South Korea 2.17% 2.18% -0.50 Indonesia 7.06% 7.07% -1.20 Singapore 2.11% 2.11% 0.81 India 6.86% 6.85% 1.70 Commodity futures Prices of one-month futures contracts, grouped by commodity type. WTI crude ($/bbl) Close 1-day change 1-yr high 1-yr low 52.41 -0.46% 55.24 35.24 In just three days the Shanghai Composite Index has fallen 2.44%, the steepest such decline since mid-December. The psychologically key 3,200 level has been breached for the first time in two months, while a measure of volatility is climbing. Gold ($/oz.) 1291.70 0.18% 1377.50 1123.90 Copper ($/ton) 5553.00 -2.15% 6147.20 4625.50 Corn (cents/bu.) 361.75 -1.30% 439.25 301.00 Soybean (cents/bu.) 946.00 -0.76% 1208.50 892.25 As is typical in a USD7t market dominated by individual investors, pinpointing the reasons for the sudden loss of confidence is hard. Traders have cited the securities regulator’s increased scrutiny on irregularities in the market, tensions on the Korean peninsula and fears that a strengthening economy will prompt more tightening by the central bank. The ChiNext gauge of small-cap shares, historically a barometer for the availability of speculative liquidity, has slumped to within a few percentage points of a two-year low. Wheat (cents/bu.) 422.50 0.36% 524.00 359.50 Coffee (cents/lb) 145.55 1.43% 181.65 127.70 Sugar (cents/lb) 475.90 1.19% 608.40 414.20 The recent declines represent a swift reversal. Just a week ago the Shanghai Composite was at heights not seen for 15 months, while volatility was near the lowest level in at least a decade. To be sure, a 30-day index of price swings remains historically low after the Source: Bloomberg, as at the close of the last business day. YTD refers to year-to-date returns. Market Snapshot 19 April 2017 stock -market collapse. And the Shanghai index has not closed down more than 1% on a day since 12 December. Yet the steady losses and increase in volatility are starting to make some traders jumpy. – Bloomberg News. HONG KONG Hong Kong’s Hang Seng Index slumped 1.39% on Tuesday to 23,924.54 – its steepest loss in four months – as the city’s markets reopened after the Easter holidays, its steepest loss in four months. The absence of panic in mainland Chinese equities was a contributing factor behind the gauge’s 9.6% jump in the first quarter – one of the biggest among global indexes. The Hang Seng Composite Enterprises Index in Hong Kong fell 1.58% to 100,43.52, the lowest since 8 February, catching up with losses on mainland exchanges. – Bloomberg News. Sentiment was hit as market participants reacted to geopolitical developments over the weekend. There was also lingering concern over the sustainability of China’s economic recovery, Reuters reported. China’s economy expanded 6.9% in 1Q17 period, beating consensus forecasts and the central government’s 6.5% target. Shares in the financial and petrochemical segments were among the most actively traded on Tuesday as investors took cash off the table. China Construction Bank Corporation, Industrial & Commercial Bank of China Limited, and Bank of China Limited declined 1.92%, 1.79%, and 1.62%, respectively. REST OF ASIA Australian shares extended their declines on Wednesday, falling at the open as investors digested the weak performance in the US equity market following earnings disappointments. The S&P/ASX 200 was down 0.37% to 5,815.20. Shares in Sydney tumbled on Tuesday following the long weekend of public holidays. The S&P/ASX 200 dropped 0.90% to 5,836.74 with resource stocks posing the biggest drags amid a selloff in iron ore. Fortescue Metals Group Limited, Rio Tinto Group and BHP Billiton Limited plunged 7.45%, 1.94%, and 1.56%, respectively. Investors sold off stocks in the mining sector on oversupply concerns, triggered by news that China, which produces half the world’s steel, churned out a record quantity in March, according to Bloomberg News. Meanwhile, shares in Telstra Corp Limited (-3.85%) tanked for the fourth consecutive session as investors fled the counter following rival TPG Telecom’s Limited win in a spectrum auction. South Korean equities pulled back slightly in early Wednesday morning trading as investors paused ahead of rising political uncertainty globally. The Kospi index was down 0.20% to 2,144.08. The country’s stocks finished higher on Tuesday as investors shrugged off geopolitical risks and the Korean won hit a one-week low. The Kospi index rose 0.13% to 2,148.46. Shares on the medical and precision machines, communication, and miscellaneous sub-indices pushed the benchmark higher. Meanwhile, US Vice President Mike Pence said on 18 April, during his visit to North Asia, that the US trade relationship with South Korea is ”falling short”, with the free-trade deal between the countries under review. During Pence’s comments in Seoul, he called the trade gap with South Korea a ”hard truth,” with ”too many” barriers to entry for US businesses. Pence’s comments come just days after South Korea, the US’s sixth-largest trading partner, avoided being tagged a currency manipulator by the US Treasury, though it remains on a watch list of nations deemed at risk of engaging in unfair conduct. The US has not named any country a manipulator since 1994. – Bloomberg News. Taiwanese shares rebounded on Tuesday as anxieties over geopolitical tensions in the Korean Peninsula subsided. The Taiwan Stock Exchange Weighted Index (Taiex) rose 0.31% to 9,746.56, led by gains in the semiconductor industry and electric machinery sub-indices. The biggest mover of the day was Taiwan Semiconductor Manufacturing Company Limited, which edged higher by 0.27% and added 4.41 points to the index. Other movers include Formosa Plastics Corporation, which gained 0.86% and contributed 1.73 points to the index’s rise. 3 FIXED INCOME Treasuries rose – pushing most yields down to their lowest since November 2016 as geopolitical uncertainties, disappointing US data, as well as expectations that a tax reform from the Trump Administration will not be imminent continued to drive the market. The 10-year yield sank 8.2 bps to 2.1682%. Meanwhile, the two-year yield retreated 4.1 bps to 1.1604% and the 30-year yield tanked 7.4 bps to 2.8354%. US Treasury yields declined concurrently with UK Gilt yields during European trading, when the UK 10-year yield traded under 1% for the first time since October, before rebounding with the pound following UK Prime Minister Theresa May’s call for an early general election in June. Treasury yields briefly stabilised as Gilt yields rebounded, then resumed their declines. US 10-year and 30-year yield spreads vs. UK counterparts narrowed, with the 10-year spread approaching its lowest level since mid-February. – Bloomberg News. COMMODITIES Crude fell for a second consecutive session on an industry report that was said to have shown a smaller-than-anticipated US inventory decline. West Texas Intermediate (WTI) oil slipped 0.46% to USD52.41 per barrel while Brent crude retreated 0.85% to USD54.98 a barrel. Supplies fell 840,000 barrels last week according to an American Petroleum Institute (API) report on Tuesday, people familiar with the data said. That contrasted with analysts surveyed by Bloomberg who said supplies probably slipped by 1.4 million barrels. Gasoline stockpiles rose 1.37 million barrels, the API was said to report. The Energy Information Administration will release its data on Wednesday. Separately, industrial metals plunged as traders capitulated amid stock market declines and skepticism surrounding the outlook for commodity demand from China and the US. An index of base metals retreated the most since November. An analyst was bearish on the outlook for iron ore amid expectations for global oversupply and a slowdown in Chinese steel demand. Zinc and nickel, both used in steel alloys, plunged by the most this year as US stocks dropped. – Bloomberg News. CURRENCIES The pound kicked off with a bang after the Easter holidays as UK Prime Minister Theresa May shocked the market by calling a snap election in June. Sterling jumped 2.20% on Tuesday to USD1.28, its highest since early October, 2016. The surge put fresh pressure on the dollar, which stayed near session lows. The US Dollar Index (DXY) was 0.79% lower to 99.50 amid disappointing US housing starts data, as well as a recent deterioration in spending, inflation, and manufacturing activity. Trading flows were lopsided and sterling-centric as the pound rose versus all of its G-10 peers, gaining more than 2 percentage points against the Canadian and Australian dollars. Strong sterling demand saw traders unwind long-held pound shorts. The election is seen as a chance for May to strengthen her hand as the UK enters into Brexit negotiations with the Eurozone and after an opinion poll Monday showed the Conservatives with a 21-point lead over Labour. – Bloomberg News. Meanwhile, the euro rose to its highest level against the dollar in three weeks, driven mainly by the rally in pound as well as the overall weakness in the dollar. It advanced for the fourth straight session, by a marginal 0.01% to USD1.07. Source: Bloomberg News, DBS Group Research and Vickers (DBS), Dow Jones Newswires, Reuters, Agence France-Presse, CNBC, Marketwatch.com Market Snapshot 19 April 2017 4 FX Round-up (as of New York close) EUR/USD FX Technical Outlook Last Overnight change Day high Day low Currency 1.0730 0.82% 1.0736 1.0637 EUR/USD Levels Q2 2017F Q3 2017F Q4 2017F Q1 2018F 1.06 1.05 1.05 1.06 GBP/USD 1.2841 2.20% 1.2905 1.2516 USD/JPY 113 114 116 117 USD/JPY 108.4300 -0.44% 109.22 108.32 GBP/USD 1.24 1.22 1.20 1.18 AUD/USD 0.7560 -0.38% 0.7596 0.7534 AUD/USD 0.73 0.72 0.71 0.70 NZD/USD 0.7043 0.50% 0.7043 0.7000 NZD/USD 0.69 0.68 0.68 0.71 USD/CAD 1.3380 0.47% 1.3400 1.3313 USD/SGD 1.41 1.42 1.44 1.45 USD/SGD 1.3958 -0.16% 1.4001 1.3956 USD/CNH 6.90 6.95 7.00 7.05 AUD/SGD 1.0552 -0.56% 1.0621 1.0532 USD/INR 68.8 68.9 69.1 69.3 NZD/SGD 0.9828 0.30% 0.9842 0.9788 USD/IDR 13551 13614 13677 13740 GBP/SGD 1.7924 2.04% 1.8019 1.7510 EUR/SGD 1.4978 0.67% 1.4988 1.4872 AUD/NZD 1.0735 -0.87% 1.0833 1.0721 USD/IDR 13296 0.08% 13303 13286 USD/INR 64.6288 0.18% 64.6425 64.4750 XAU/USD 1290 0.39% 1292.4 1279 Source: DBS CIO Office, as of 30 March 2017. Notes: Forecasts are in respect of end-of-quarter levels. The information contained in this publication is not investment research or a research recommendation. It is intended only to provide the observations and views of the DBS CIO Office, which may be different from, or inconsistent with, the observations and views of the DBS Bank research department or other DBS Bank personnel. Source: Bloomberg, as of last business day. SGD Against Major Currencies 108 106 104 102 100 98 96 94 92 90 Oct-16 USD/SGD GBP/SGD USD Against Major Currencies AUD/SGD EUR/SGD NZD/SGD 120 EUR/USD GBP/USD AUD/USD NZD/USD USD/JPY 115 110 105 100 95 Dec-16 Feb-17 Apr-17 90 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Source: Bloomberg, as of last business day. Bond risk rating changes Bond Name 12-Apr-17 EIBKOR 5 04/11/22 EXPORT-IMPORT BK KOREA 1 2 Tenor reduction 13-Apr-17 FHCL 7 PERP FULLERTON HEALTHCARE 5 4 Re-rated based on issuer equity risk rating of 5 13-Apr-17 BEIAIJ 3 7/8 04/06/24 INDONESIA EXIMBANK 5 4 Re-rated based on S&P issuer rating of BB+ 13-Apr-17 JPFAIJ 6 05/02/18 COMFEED FINANCE BV 4 5 S&P upgraded paper rating from B+ to BB- 13-Apr-17 PBBGR 1 5/8 07/04/17 DEUT PFANDBRIEFBANK AG 2 3 S&P upgraded issuer rating from BBB to A- 13-Apr-17 FGBUH 5 04/01/19 FIRST GULF BANK 1 2 Moody's upgraded paper rating from A2 to Aa3 13-Apr-17 FGBUH 3 1/4 01/14/19 FIRST GULF BANK 1 2 Moody's upgraded paper rating from A2 to Aa3 13-Apr-17 FGBUH 2.862 10/09/17 FIRST GULF BANK 1 2 Moody's upgraded paper rating from A2 to Aa3 13-Apr-17 RIOLN 4 1/8 05/20/21 RIO TINTO FIN USA LTD 2 3 Moody's upgraded paper rating from Baa1 to A3 Information updated as of 13 April 2017. Issuer Risk rating New Existing Effective Reason Apr-17 Market Snapshot 19 April 2017 5 GLOSSARY General Product Risk Rating A 5-point scale, 1-5, indicates the relative rating of potential loss; “1” being the lowest and “5” being the highest. Bond Risk Rating Credit Rating (S&P / Moody's) AAA AA Outstanding Tenor (Up to X Years) 1 2 3 4 5 1 A 2 BBB 3 6 7 8 9 10 11 12 14 15 16 17 18 19 20 99 Perpetual 3 4 BB B & Below 5 Equity Sector Classification Sector Cond: Cons: Enrs: Finl: Hlth: Indu: Inft: Matr: Prop: 13 2 Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Property Valuation Terminology Equities EPS: P/E: P/B: EG: Bonds YTM: YTC: YTP: Earnings Per Share Price to Earnings Ratio Price to Book Ratio Earnings Growth Yield to Maturity Yield to Call Yield to Put Disclaimers and Important Notice The information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank. This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into, for cash or other consideration, any transaction, and should not be viewed as such. This publication is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations and is not to be taken in substitution for the exercise of judgment by the reader, who should obtain separate legal or financial advice. DBS does not act as an adviser and assumes no fiduciary responsibility or liability (to the extent permitted by law) for any consequences financial or otherwise. The information and opinions contained in this publication has been obtained from sources believed to be reliable but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Opinions and estimates are subject to change without notice. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. To the extent permitted by law, DBS accepts no liability whatsoever for any direct indirect or consequential losses or damages arising from or in connection with the use or reliance of this publication or its contents. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability (to the extent permitted by law) for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version. Country Specific Disclaimer China: This report is distributed in China by DBS Bank (China) Ltd. Indonesia: This report is made available in Indonesia through PT Bank DBS Indonesia. PT Bank DBS Indonesia is registered and supervised by Financial Service Authority (“OJK”). Singapore: This report is distributed in Singapore by DBS Bank Ltd. (Co. Reg. No.: 196800306). Dubai: This publication is being distributed in the Dubai International Financial Centre (“DIFC”) by DBS Bank Ltd., (DIFC Branch) having its office at PO Box 506538, 3rd Floor, Building 3, East Wing, Gate Precinct, DIFC, Dubai United Arab Emirates. DBS Bank Ltd., (DIFC Branch) is regulated by the Dubai Financial Services Authority. This document is intended only for Professional Clients (as defined in the DFSA Rulebook) and no other person may act upon it. India: This report is distributed in India by DBS Bank Ltd. DBS Bank Ltd, merely acts as a distributor/ referrer of the financial products and not as a Portfolio Manager or advisor and accepts no liability in this regard.