* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Net Profit Ratio

Syndicated loan wikipedia , lookup

Financialization wikipedia , lookup

Investment fund wikipedia , lookup

Business valuation wikipedia , lookup

Private equity wikipedia , lookup

Securitization wikipedia , lookup

International asset recovery wikipedia , lookup

Investment management wikipedia , lookup

Early history of private equity wikipedia , lookup

Global saving glut wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

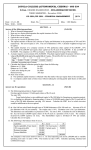

FINANCIAL RATIO ANALYSIS RATIO - MEANING • Relationship or Proportion that one amount bears to another, the first number being the ‘Numerator’ & the later ‘Denominator’ OR • Relationship b/w two figures expressed Mathematically Advantages/Importance/Significance - Ratio Analysis • • • • Analytical Tool for measuring performance. Ratios makes Comparison Easy. Inter firm Comparison possible. Ascertainment of Short term Liquidity & Long term Solvency position possible. • Analysis about the STRENGTHS & WEAKNESSES of the firm’s operations. • Analyze Past Performance & make further projections. TYPES OF RATIOS LIQUIDITY CAPITAL STRUCTURE OR LEVERAGE TURNOVER/ACTIVITY/PERFORMANCE PROFITABILITY MARKET INDICATORS LIQUIDITY CURRENT RATIO QUICK/ ACID TEST RATIO ABSOLUTE LIQUID/SUPER QUICK RATIO STOCK TO WORKING CAPITAL RATIO INVENTORY TURNOVER RATIO ACCOUNTS RECEIVABLE TURNOVER RATIO CURRENT RATIO CURRENT ASSETS, LOANS & ADVANCES CURRENT LIABILTIES & PROVISIONS QUICK/ACID TEST RATIO CURRENT ASSETS, LOANS & ADVANCES- INVENTORIES CURRENT LIABILTIES & PROVISIONS- BANK O/D ABSOLUTE LIQUID/SUPER QUICK RATIO ABSOLUTE LIQUID ASSETS* CURRENT LIABILTIES * Cash in hand + Cash at Bank + Short term Investments STOCK TO WORKING CAPITAL RATIO Inventory or Stock** x 100 Working Capital ** (opening stock + closing stock) 2 From the given Balance Sheet calculate Current , Liquid, Absolute Liquid & Stock to Working Capital ratios. Balance Sheet LIABILTY Share Capital Reserves Rs. ASSETS 2,00,000 Fixed Assets Rs. 1,60,000 80,000 Current Assets: CURRENT LIABILITIES: Stock 1,20,000 Creditors 80,000 Debtors 60,000 Bills Payable 40,000 Short term Investments 40,000 Cash 4,00,000 20,000 4,00,000 • Current Ratio= 2,40,000 = 2: 1 1,20,000 • Quick Ratio = 2,40,000 – 1,20,000 = 1: 1 1,20,000 • Absolute Ratio = 20,000 = 0.167 1,20,000 • Stock to Working Capital = 1,20,000 x 100 = 100% 1,20,000 CAPITAL STRUCTURE OR LEVERAGE • Shareholders Equity Ratio • Long Term Debt to Shareholders Net Worth Ratio • Capital Gearing Ratio • Debt-Equity Ratio • Fixed Assets to Long term Funds Ratio • Proprietary or Net Worth Ratio • Current Assets to Net Worth • Shareholders Equity Ratio = Shareholders Equity* Total Assets( tangible) *(Equity Share Capital + Preference Share Capital + Reserves & Surplus) – (Accumulated losses like preliminary expenses, discount on issue of shares, debentures, etc. appearing on the Assets side of Balance Sheet). • Long Term Debt to Shareholders Net Worth Ratio = Long Term Debt Shareholders Net Worth* * Capital + free Reserves – Intangible Assets • Capital Gearing Ratio = Fixed Interest Bearing Securities* Equity Shareholder's Funds** *Debentures + Long Term Loans + Preference Share Capital ** Equity Share Capital + Reserves & Surplus • Debt- Equity Ratio = Debt* Equity** *All external Long term loans **Share Capital and all Reserves & Surplus • Fixed Assets to Long Term Funds Ratio = Fixed Assets Long Term Funds* *Share Capital, Reserves & Surplus & Long Term Loans • Proprietary or Net Worth Ratio = Shareholders Net Worth* Total Assets** *(Equity Share Capital + Preference Share Capital + Reserves & Surplus) – (Accumulated losses or Fictitious Assets like preliminary expenses, discount on issue of shares, debentures, etc. appearing on the Assets side of Balance Sheet). ** Fixed Assets + Current Assets – Fictitious Assets • Current Assets to Net Worth = Current Assets Net Worth TURNOVER/ACTIVITY/PERFORMANCE • • • • • • • • • • • Inventory Turnover Ratio Inventory Ratio Debtors Turnover Ratio Debtors Collection Period or Debtors Velocity Bad debts to Sales Ratio Creditors Turnover Ratio Creditors Payment Period or Creditors Velocity Fixed Assets Turnover Ratio Total Assets Turnover Ratio Working Capital Turnover Ratio Sales to Capital Employed INVENTORY TURNOVER RATIO COST OF GOODS SOLD AVERAGE INVENTORY INVENTORY RATIO Inventory/ Current Assets DEBTORS OR ACCOUNTS RECEIVABLE TURNOVER RATIO NET CREDIT SALES/AVG. ACCOUNTS RECEIVABLE DEBTORS COLLECTION PERIOD OR DEBTORS VELOCITY Average Debtors x 365 (in days) Net Credit Sales Bad debts to Sales Ratio Bad Debts x 100 Sales Creditors Turnover Ratio Net Credit Purchase Average A/c’s Payable Creditors Payment Period or Creditors Velocity Average A/c’s Payable x 365 (in days) Credit Purchases Fixed Assets Turnover Ratio Sales/ Fixed Assets Total Assets Turnover Ratio Sales/ Total Assets Working Capital Turnover Ratio Sales/ Working Capital Sales to Capital Employed Sales/ Capital Employed PROFITABILITY Gross Profit Margin= Gross Profit x 100 Net Sales Net Profit Ratio = Net Profit before Interest & Tax x 100 Sales Net Profit Margin= NetProfit x 100 Net Sales Cash Profit Ratio = Cash Profit* x 100 Sales * Net Profit + Depreciation Return on Total Assets = Net Profit After tax x 100 Total Assets Return on Shareholders Funds or Return on Net Worth = Net Profit after Interest & Tax x 100 Net Worth* * Equity Capital + Reserves & Surplus Return on Equity = Profit after tax x Net Sales x Total Assets Net Sales Total Assets Net Worth ROE= Net Profit Margin x Total Assets Turnover Ratio x Total Assets to Net Worth Operating Ratio or Operating Cost Ratio = Operating Cost* x 100 Net Sales *Cost of Goods sold + Operating Expenses Interest Cover Ratio = Profit Before Interest, Depreciation & Tax Interest Expense Dividend Cover Ratio (i) Equity Dividend Cover = Net Profit after Tax- Preference Dividend Equity Dividend (ii) Preference Dividend Cover = Net Profit after Tax Preference Dividend Debt Service Coverage Ratio (DSCR) = Profit After tax+ Depreciation+ Interest on Loan Interest on Loan+ Loan Repayment in a year MARKET INDICATORS OR MARKET BASED RATIOS Earnings per Share (EPS) = Net Profit after Tax- Preference Dividend No. of Equity Shares Price Earnings Ratio (P/E Ratio) = Current Market Price of Equity Share Earnings per Share Market Price to Book Value Ratio (P/BV Ratio) = Market Price Per Share Book Value Per Share Cash Earnings Per Share Ratio = Net Profit after tax+ Depreciation No. of Equity Shares Dividend Payout Ratio (D/P Ratio) = Dividend Per Share Earnings Per Share Book Value Ratio = Equity Share Capital+ Reserves- P&L A/c Debit Balance Total no. of Equity Shares Dividend Yield Ratio = Dividend Per Share x 100 Market Price DUPONT ANALYSIS • DUPONT Company of USA introduced a system of Financial Analysis • Analyses Net Profit Margin in terms of Asset Turnover • Extension of ROI measuring the overall profitability & operational efficiency of the firm Advantages/ Uses of Dupont Analysis • Measuring the managerial performance by linking the Net Profit Margin to Total Assets Turnover. • Segregation and Identification of factors that affect the OVERALL PERFORMANCE of the company. • Considers INTERRELATIONSHIP of Accounting Information given in the Financial Statements. • Comparative Analysis can be done