* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download PPT - NCCU SLIS

Modified Dietz method wikipedia , lookup

Financial economics wikipedia , lookup

Business valuation wikipedia , lookup

Financial literacy wikipedia , lookup

Conditional budgeting wikipedia , lookup

Asset-backed commercial paper program wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

International asset recovery wikipedia , lookup

Systemic risk wikipedia , lookup

Securitization wikipedia , lookup

Stock selection criterion wikipedia , lookup

Stock valuation wikipedia , lookup

The Millionaire Next Door wikipedia , lookup

Financialization wikipedia , lookup

Systemically important financial institution wikipedia , lookup

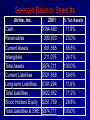

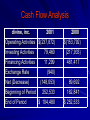

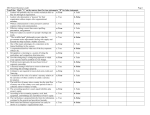

Assessing Vendor Financial Viability – Reprise David S. Goble, Dean of Libraries [email protected] /704-330-6441 ALA Chicago - 2006 How To Assess Your Vendor’s Financial Viability James Gray CEO Coutts Information Services LTD Dan Tonkery Vice President Business Development EBSCO Information Services A Thought from James Gray “A library vendor will get into financial difficulty some time soon. Who knows where, who knows when, but it will happen again-it’s a certainty.” James Gray – CEO Coutts Information Services, LTD Thoughts from Dan Tonkery 1. “Don’t be afraid to operate with a professional business relationship with formal contracts and/or agreements. 2. “Avoid personal or emotional factors when dealing with a vendors. It is just a business.” 3. “Don’t be slow to take action if you are uncomfortable with any factor.” Dan Tonkery VP Business Development EBSCO Information Services Think Like a Banker Manage Risk Risk Factors $ Amount Impact on Services Impact on Operations Worst Case Scenario Time Common Risks Third Party Payments – 3rd Party Payments-Subscription Prepayments – Deposit Accounts – Pro-forma Accounts – Databases Service Dependencies – – – – Integrated Library Systems Collection Development Software Outsourced Services Software Located on Vendor Server Financial Analysis “…a riddle wrapped in a mystery inside an enigma.” Winston Churchill - October, 1939 What Do You Know? Balance Sheet – Presents the results of financial activities for the period covered T/F Annual Report – Prepared by auditors is an infallible report of financial results T/F Profit and Loss Statement – A snap shot of financial condition at year end T/F Current ratio- a measure of how many books the vendor has checked out and what % are not past due T/F Balance Sheet Current Assets Current Liabilities Fixed Assets Less Depreciation Long-Term Liabilities Intangibles Total Liabilities Retained Earnings Owners Equity Total Liabilities & Stockholders Equity Total Assets Income State Net Sales or Revenues Less Cost of Goods Sold Less Operating Expenses: SGA/Depreciation Income From Operations Other Income (Expense): Interest/Dividends Income Before Taxes Less Federal Taxes Net Income Earnings (Losses) per Share Cash-Flow Statement Cash Flows From Operating Activities Received from customers Paid for taxes Net Cash provided (used) by Operating activities $ 500 (100) 400 Cash Flows From Investing Activities Purchase of Equipment Sale of Property Net Cash Provided (used) by investing activities $(300) 1000 700 Cash flows from financing activities Proceeds from issuing stock Payment to retire bonds Net Cash Provided (used) by Financing Activities $ 200 (1000) (800) Net increase (decrease) in cash $ 300 Cash January 1, 200X Cash December 31, 200X $ 150 $ 450 Relationship of Financial Statements Balance Sheet Income Statement Balance Sheet Jan. 1, 200X Statement of Cash Flows Jan. 1, 200Y Major Tools Comparative Financial Statements Common Size Statement Ratio Analysis Specialized Analytical Tools Selected Balance Sheet #s divine, inc. Cash Receivables Current Assets Intangibles Total Assets Current Liabilities Long-term Liabilities Total Liabilities Stock Holders Equity Total Liabilities & SHE 2001 $104,480 2000 $252,533 200,833 601,565 211,075 2,143 281,799 8,621 $874,711 $521,658 $101,294 $622,952 $420,181 $ 25,571 $ 24,727 $ 52,298 $251,759 $874,711 $367,883 $420,181 Selected Balance Sheet #s divine, inc. 2001 Cash $104,480 Receivables 200,833 Current Assets 601,565 Intangibles 211,075 Total Assets $874,711 Current Liabilities $521,658 Long-term Liabilities $101,294 Total Liabilities $622,952 Stock Holders Equity $251,759 Total Liabilities & SHE $874,711 % Tot. Assets 11.9% 23.0% 68.8% 24.1% 100.0% 59.6% 11.6% 71.2% 28.8% 100.0% Liquidity Current Ratio = Current Assets/Current Liabilities divine, inc 2001 $601,565 / $521,658 Current Ratio 1.20 2000 $281,799 / $27,571 Current Ratio 10.22 Liquidity Accounts Receivable Turnover=Net Credit Sales/Average Accounts Receivable divine, inc. 2001 $199,598 / $200,833 Acct.s Rec. Turnover .99 2000 $44,079 / $7,678 Acct.s Rec. Turnover 5.74 Profitability Profit Margin on Sales = Operating Income/Net Sales divine, inc. 2001 PM = $(331,672) / $199,598 Profit Margin -1.66 2000 PM = $(302,542) / $ 44,079 Profit Margin -6.86 Profitability Earnings Per Share divine,inc. 2001 2000 1999 Basic & Diluted Net Loss Per Share $(2.13) $(7.84) $(4.59) Basic & Diluted Net Loss Per Share after Extraordinary Gains $(2.06) $(7.84) $(4.59) Profitability Return on Assets = Net Income/Average Total Assets Return on Stock Holder’s Equity Comprehensive Return on Investment Divine, inc. 2001 $(330,556) $874,711 + $420,181/2 ROA -.51 Cash Flow Analysis divine, inc. 2001 Operating Activities $(237,872) 2000 $(153,792) Investing Activities 79,460 (217,933) Financing Activities 11,299 461,417 Exchange Rate (940) Net (Decrease) (148,053) 89,692 252,533 162,841 $ 104,480 $ 252,533 Beginning of Period End of Period Other Things to Know Independent Auditor’s Report Notes to the Financial Statement What Do You Know? Balance Sheet – Presents the results of financial activities for the period covered T/F 2. Annual Report – Prepared by auditors is an infallible report of financial results T/F 3. Profit and Loss Statement – A snap shot of financial condition at year end T/F 4. Current ratio- a measure of how many books the vendor has checked out and what % are not past due T/F 1. Why Think Like a Banker Our Customers Our Institutions Our funding sources Our Colleagues Our Selves