* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Centurion: Real Estate as an alternative to fixed income

Survey

Document related concepts

Transcript

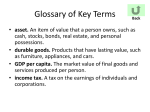

Real Estate Investing An Alternative to Fixed Income Stephanie Kremer Vice President, Business Development & Institutional Sales www.centurionreit.com What is Real Estate? A piece of land, including the air above it and the ground below it, and any buildings or structures on it. Real estate can include business and / or residential properties, and is generally sold either by a realtor or directly by the individual who owns the property (for sale by owner). RESPECT 2 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Types of Real Estate Real Estate Sub Sectors Commercial Services Industrial Apartments Retail Residential Single Family Homes / Condominiums Investing in Apartments for Income & Stability A timely opportunity to invest in one of the safest sectors 1 within the real estate market – income producing apartment properties in Canada RESPECT INTEGRITY SIMPLICITY EXCELLENCE Real Estate Investment Benefits 1 Income: Provides the foundation for monthly income 2 Investment growth: A hard asset that appreciates over time 3 Lower volatility: Not impacted by as many short-term market forces as other asset 4 Capital preservation: For several usages a fundamental staple with downside 5 Inflation hedge: Real estate has a history of protecting against the destruction of wealth classes protection caused by inflation1 RESPECT 4 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Options for investment in Real Estate Direct ownership Pool your money with friends/ business partners Real Estate Investment Trusts: Public and Private Mortgage Investment Trusts RESPECT 5 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Real Estate Investment Trust (REIT) What is a REIT? A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. Modeled after mutual funds, REITs provide investors of all types stable income streams, diversification and long-term capital appreciation. REITs allow anyone to invest in portfolios of properties the same way they invest in other industries – through the purchase of units in the REIT. RESPECT 6 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Property Ownership vs. REIT Investment Direct Property Ownership Real Estate Investment Trust Pride of ownership, you have a piece of property you can touch, feel and call your own You make all the decisions 100% of the profit is yours 100% of the expenses are yours Fully responsible for the day-to day maintenance and operations of the property Shared ownership and profits Management of the property is professionally handled by an experienced property manager Expenses are managed by the trust and does not require any out-of-pocket payments from the unitholder beyond their investment Legal and financial requirements are managed by the asset and property manager Legally responsible for the property Only recipient of capital gains Board of Trustees make decisions in the best interest of the unitholders. Tax structures depend on where you live & where the property is located Unitholders have the right to vote on changes to the Declaration of Trust 100% of the risk is yours RESPECT 7 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Private vs. Public REIT The two main categories of REITs in Canada are publicly traded REITs and private REITs. Differences between Public and Private REITs Publicly-Traded REIT: Private REIT: Trade on a public stock exchange (provide daily liquidity) Not traded on a public stock exchange (generally offer 30-day liquidity) Trading daily also means investors can potentially push price up or down, reflecting current market sentiment, regardless of actual market value of the asset Increased reporting costs due to requirements of a public listing History of more volatile pricing Tend to be more highly correlated to equity markets. Example during recent financial crisis: Value is based on the value of underlying real estate or equity / lending rate (not a “market-traded” price) No additional reporting costs related to a public listing Rational pricing with lower volatility2 Tend to be far less correlated to major equity markets1 2008: Non Listed Property Ownership**: +3.7% Non Listed Apartment Property**: +6.4% 2008: Public REIT Market*: -34.0% S&P/TSX*: -33.0% * Source: Morningstar Research Inc. ** Source IPD (2008 Edition); Note: Non listed property ownership is similar to a Private REIT RESPECT 8 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Mortgage Investment Trust What is a Mortgage Investment Trust? A Mortgage Investment Trust is an income and capital growth oriented investment trust that allows qualified investors to invest in a diversified portfolio of mortgages and opportunistic real estate developments and investments. Simply put, investors pool their money together to invest in mortgage and growth-oriented real estate opportunities. The net profits are distributed back to investors. Mortgages (income) Investments Investment Investor Distributions & Capital Growth Mortgage Investment Trust Income & Capital Growth Growth Oriented Investments (capital growth) RESPECT 9 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Centurion Asset Management Inc. Based in Toronto, Centurion Asset Management Inc. is a Canadian asset management company that offers a growing portfolio of private investment products. Centurion Apartment REIT owns and operates 43 multi-residential rental properties in 16 Canadian communities. Huntsville Gravenhurst Acton Barrie Mississauga Brighton Cambridge Montreal Kitchener Oshawa Waterloo Whitby London Toronto Tillsonburg RESPECT 10 INTEGRITY Hamilton SIMPLICITY www.centurionreit.com EXCELLENCE The Centurion Portfolio Investment Solutions Centurion Apartment REIT Centurion Real Estate Opportunities Trust The Centurion Asset Management Inc.’s Investment Products Portfolio is governed by two separate independent Board of Trustees, the majority of whom are independent of management. Financing Solutions Construction and Development, Refinancing, Bridge and Mezzanine Loans and Equity Participations Property Management Services Multi-residential apartments Student Residences through the Centurion Brand: The MARQ RESPECT 11 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Investing with Centurion 1. We look at the needs of our Investors Income-oriented investors that are looking for: Cash Flow Asset Appreciation Portfolio Diversification Opportunities to Re-Invest 2. Then we offer solutions with the objectives of meeting those needs Monthly Distributions Diversified Portfolio Growth Potential Maximize Unit Value RRSP, RESP, TFSA Eligible RESPECT 12 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Investing with Centurion At Centurion Asset Management Inc. we are: Focused Focused on investing and managing multi-unit residential properties, student housing residences and mortgages Experienced Centurion was established in 2003. Regulated by the Ontario Securities Commission and Financial Services Commission of Ontario. Depth of experience: managed by Greg Romundt, President; Wayne Tuck, COO; Robert Orr, CFO; and, Stephen Stewart, VP Mortgage Investing and Joint Ventures. Supported by experienced analysts and an experienced, majority independent Board of Trustees with executive ownership. Disciplined Established, process-driven investment and operating methodology to manage risk and uncover opportunities to maximize income and value. Diligent approach to asset and property management. Adding value by improving both the physical building and the service experience to maximize income. RESPECT 13 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE Notes 1. Source: Canadian Investment Review, Spring 2001. “Canadian Real Estate and Inflation” by Victor W.K. Li 2. “Rational pricing with lower volatility” means that property values are based on a methodical process involving a number of highly skilled professionals that must opine on and thus impact upon value including a) knowledgeable and professional buyers and sellers b) third party appraisers and c) financial institutions (that will be restricted in loan to value ratios and debt service ratios and other financial covenants). Valuation methods would follow standard valuation guidelines used in the industry and third party appraisers would be accredited professionals. Further, buyers and sellers are not casual participants in the marketplace and are risking substantial capital in a transaction given that the average equity required for a purchase would be substantially larger than that required to buy a few shares of stock in a publicly listed company. Whereas regular stock market investors need to have no specific skills, industry knowledge, infrastructure, substantial capital, substantial capital at risk in a single investment and relationships that would otherwise serve to exclude them from the marketplace, direct property investors must have these at a minimum. The participation of knowledgeable buyers, and the limitations imposed by lenders for debt service and leverage further act to constrain valuation parameters which constraints may not apply on a traded stock. This rational pricing means that in the absence of changes in property net operating income (which ceteris paribus tend to move with inflation) or capitalization rates, that valuations tend to move slowly over time in comparison to how stocks can move constantly and with great volatility over the course of the day (or any other investment horizon). As such, rational pricing would tend to be associated with lower volatility. RESPECT 14 INTEGRITY SIMPLICITY www.centurionreit.com EXCELLENCE