base prospectus £100000000 secured bond issuance

... The distribution of the Base Prospectus and any Final Terms and the offering, sale or delivery of the Bonds in certain jurisdictions may be restricted by law. Persons into whose possession this Base Prospectus or any Final Terms comes, are required by the Issuer to inform themselves about, and to ob ...

... The distribution of the Base Prospectus and any Final Terms and the offering, sale or delivery of the Bonds in certain jurisdictions may be restricted by law. Persons into whose possession this Base Prospectus or any Final Terms comes, are required by the Issuer to inform themselves about, and to ob ...

CMS Energy Corporation

... We have not included or incorporated by reference any separate financial statements of the Trusts. CMS Energy and the Trusts do not consider that such financial statements would be material to holders of Trust Preferred Securities of the Trusts because each Trust is a special purpose entity, has no ...

... We have not included or incorporated by reference any separate financial statements of the Trusts. CMS Energy and the Trusts do not consider that such financial statements would be material to holders of Trust Preferred Securities of the Trusts because each Trust is a special purpose entity, has no ...

NSTAR ELECTRIC COMPANY doing business as - corporate

... facts. These statements are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify our forward-looking statements through the use of words or phrases such as "estimate," "expect," "anticipate," "intend," "plan," "project," ...

... facts. These statements are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify our forward-looking statements through the use of words or phrases such as "estimate," "expect," "anticipate," "intend," "plan," "project," ...

Investing in CLOs - CION Investments

... as “CLO arbitrage.” Figure 1 illustrates this arbitrage condition in terms of an income statement. The quality of the arbitrage (i.e. the volume of excess spread) will vary during the life of the CLO. This is largely due to changes in the underlying loan portfolio over time. While CLO liabilitie ...

... as “CLO arbitrage.” Figure 1 illustrates this arbitrage condition in terms of an income statement. The quality of the arbitrage (i.e. the volume of excess spread) will vary during the life of the CLO. This is largely due to changes in the underlying loan portfolio over time. While CLO liabilitie ...

State-Boston Retirement System Complaint

... manipulation of the market for U.S. Treasury bills, notes, and bonds (together, "Treasury securities"), and derivative financial products based on these Treasury securities, including Treasury futures and options traded on the Chicago Mercantile Exchange (collectively with Treasury securities, "Trea ...

... manipulation of the market for U.S. Treasury bills, notes, and bonds (together, "Treasury securities"), and derivative financial products based on these Treasury securities, including Treasury futures and options traded on the Chicago Mercantile Exchange (collectively with Treasury securities, "Trea ...

Supervision of Credit Rating Agencies: The Role of Credit Rating

... institutional and big investors, and are expressly not intended to serve as advice on whether or not to buy a specific product. In point 10 of Directive 2003/125 (Market Abuse Implementing Directive), for example, there is an express statement that credit ratings are not investment advice within the ...

... institutional and big investors, and are expressly not intended to serve as advice on whether or not to buy a specific product. In point 10 of Directive 2003/125 (Market Abuse Implementing Directive), for example, there is an express statement that credit ratings are not investment advice within the ...

SOUTHWEST AIRLINES CO

... beliefs, intentions, and strategies for the future, and the assumptions underlying these forward-looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “belie ...

... beliefs, intentions, and strategies for the future, and the assumptions underlying these forward-looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “belie ...

Frequently Asked Questions About

... A blank check company is a development stage company that has no specific business plan or purpose or has indicated its business plan is to engage in a merger or acquisition with an unidentified company or companies, another entity or person. (Securities Act Rule 419(a)(2)). A shell corporation is a ...

... A blank check company is a development stage company that has no specific business plan or purpose or has indicated its business plan is to engage in a merger or acquisition with an unidentified company or companies, another entity or person. (Securities Act Rule 419(a)(2)). A shell corporation is a ...

What is Arbitrage? - Palladium Capital Advisors

... share price, exercise price, time to option expiration, and the risk free rate. Volatility is a measure of the tendency of a market price or yield to vary over time. As volatility is usually the only variable not known with certainty in advance, arbitrage opportunities may arise when the theoretical ...

... share price, exercise price, time to option expiration, and the risk free rate. Volatility is a measure of the tendency of a market price or yield to vary over time. As volatility is usually the only variable not known with certainty in advance, arbitrage opportunities may arise when the theoretical ...

Policy for Securities Trading

... (i) recommend that a third party Trade in the Issuer’s Securities; or (ii) convey such MNPI to an unauthorized third party. Such actions constitute “tipping.” Tipping is prohibited regardless of whether or not the Employee or Family Member who provides the tip receives any monetary or other benefit. ...

... (i) recommend that a third party Trade in the Issuer’s Securities; or (ii) convey such MNPI to an unauthorized third party. Such actions constitute “tipping.” Tipping is prohibited regardless of whether or not the Employee or Family Member who provides the tip receives any monetary or other benefit. ...

shares as security in modern times: problems and prospects

... Professor Sir Roy Goode13 states that security interest is “a right given to one party in the assets of another party to secure payment or performance by that other party or by a third party” and postulates that it arises from a transaction intended as a security, and is created by grant or declara ...

... Professor Sir Roy Goode13 states that security interest is “a right given to one party in the assets of another party to secure payment or performance by that other party or by a third party” and postulates that it arises from a transaction intended as a security, and is created by grant or declara ...

Bancroft - NYU School of Law

... o May not issue a public sales campaign prior to the filing of the registration statement. (ie publicity may have effect of conditioning market – this is an “offer”). o Example 1: Underwriter arranging mining public financing distributes brochure describing in “glowing generalities” the future possi ...

... o May not issue a public sales campaign prior to the filing of the registration statement. (ie publicity may have effect of conditioning market – this is an “offer”). o Example 1: Underwriter arranging mining public financing distributes brochure describing in “glowing generalities” the future possi ...

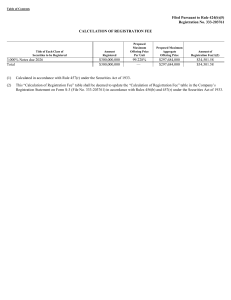

Reporting Responsibilities on U.S. Holdings of Foreign Securities

... advisory clients). As such, an investment adviser is expected to include in its TIC SLT aggregate reportable data about (i) its proprietary reportable assets, (ii) reportable portfolio investments of its managed account clients (unless the adviser knows that the client is itself filing TIC SLT) and ...

... advisory clients). As such, an investment adviser is expected to include in its TIC SLT aggregate reportable data about (i) its proprietary reportable assets, (ii) reportable portfolio investments of its managed account clients (unless the adviser knows that the client is itself filing TIC SLT) and ...

Hedge Funds - Presentation to BNM

... Hedge funds based in US often take the form of a LIMITED PARTNERSHIP under the section 3(c)(1) Investment Company Act which allows for exemption from most of US SEC regulations. However, the fund is limited to no more than 100 partners, who must be an “accredited investors” and the fund is prohibite ...

... Hedge funds based in US often take the form of a LIMITED PARTNERSHIP under the section 3(c)(1) Investment Company Act which allows for exemption from most of US SEC regulations. However, the fund is limited to no more than 100 partners, who must be an “accredited investors” and the fund is prohibite ...

2017 Division 7A Checklist

... a payment to the extent that – it is to the entity, on behalf of the entity or for the benefit of the entity a credit to the extent that – it is to the entity, on behalf of the entity or for the benefit of the entity a transfer of property to the entity. Section 109CA further provides that a p ...

... a payment to the extent that – it is to the entity, on behalf of the entity or for the benefit of the entity a credit to the extent that – it is to the entity, on behalf of the entity or for the benefit of the entity a transfer of property to the entity. Section 109CA further provides that a p ...

initial public offer of securities

... in the value of more than HK$5 million and up to the value of pool B. Where one of the pools is undersubscribed, the surplus securities should be transferred to satisfy demand in the other pool and be allocated accordingly. No applications should be accepted from investors applying for more than the ...

... in the value of more than HK$5 million and up to the value of pool B. Where one of the pools is undersubscribed, the surplus securities should be transferred to satisfy demand in the other pool and be allocated accordingly. No applications should be accepted from investors applying for more than the ...

Investors Rights Agreement

... refusal within said twenty (20) day period (the “Election Period”), the Company shall have one hundred twenty (120) days thereafter to sell or enter into an agreement (pursuant to which the sale of New Securities covered thereby shall be closed, if at all, within sixty (60) days from the date of sai ...

... refusal within said twenty (20) day period (the “Election Period”), the Company shall have one hundred twenty (120) days thereafter to sell or enter into an agreement (pursuant to which the sale of New Securities covered thereby shall be closed, if at all, within sixty (60) days from the date of sai ...

Institutional Investors in Corporate Loans

... percent of loans. Mutual funds also began investing in corporate loans in the early 1990s, through vehicles marketed as “prime funds.” Throughout much of the 1990s, prime funds were the major institutional investor but provided relatively little of the total funding to corporate loans. The growth of ...

... percent of loans. Mutual funds also began investing in corporate loans in the early 1990s, through vehicles marketed as “prime funds.” Throughout much of the 1990s, prime funds were the major institutional investor but provided relatively little of the total funding to corporate loans. The growth of ...

Collective Investment Schemes Control Act: Determination on

... "systemic risk" refers to systemic risk as defined in the Financial Markets Act; "total expense ratio" means a measure of a portfolio's assets that have been expended as payment for services rendered in the management of the portfolio or fund, expressed as a percentage of the average daily value of ...

... "systemic risk" refers to systemic risk as defined in the Financial Markets Act; "total expense ratio" means a measure of a portfolio's assets that have been expended as payment for services rendered in the management of the portfolio or fund, expressed as a percentage of the average daily value of ...

nextera energy, inc. - corporate

... hereby appoints the Trustee as its agent for all such purposes; provided , however , that the Company reserves the right to change, by one or more Officer’s Certificates, any such office or agency and such agent. The Trustee will initially be the Security Registrar and the Paying Agent for the Deben ...

... hereby appoints the Trustee as its agent for all such purposes; provided , however , that the Company reserves the right to change, by one or more Officer’s Certificates, any such office or agency and such agent. The Trustee will initially be the Security Registrar and the Paying Agent for the Deben ...

Investor Questionnaire

... The Investor is a natural person whose net worth on the date of this Agreement (i.e., excess of total assets over total liabilities) exceeds $1,000,000. The Investor is a natural person and had Income in excess of $200,000 in each of the two most recent years and reasonably expects to have Income i ...

... The Investor is a natural person whose net worth on the date of this Agreement (i.e., excess of total assets over total liabilities) exceeds $1,000,000. The Investor is a natural person and had Income in excess of $200,000 in each of the two most recent years and reasonably expects to have Income i ...

Note Purchase Agreement

... Securities Law Compliance. Such Investor has been advised that the Notes and the underlying securities have not been registered under the Securities Act, or any state securities laws and, therefore, cannot be resold unless they are registered under the Securities Act and applicable state securities ...

... Securities Law Compliance. Such Investor has been advised that the Notes and the underlying securities have not been registered under the Securities Act, or any state securities laws and, therefore, cannot be resold unless they are registered under the Securities Act and applicable state securities ...

rule change

... deletions from the immediately preceding filing. The purpose of Exhibit 4 is to permit the staff to identify immediately the changes made from the text of the rule with which it has been working. The self-regulatory organization may choose to attach as Exhibit 5 proposed changes to rule text in plac ...

... deletions from the immediately preceding filing. The purpose of Exhibit 4 is to permit the staff to identify immediately the changes made from the text of the rule with which it has been working. The self-regulatory organization may choose to attach as Exhibit 5 proposed changes to rule text in plac ...

An Introduction to Hedge Fund Strategies

... the manager to choose net-long or net-short (positive beta or negative beta) market exposure, while still focussing primarily on stock-selection opportunities. It has the disadvantage, from the perspective of the final investor that, it is no longer clear how the hedge fund allocation affects overal ...

... the manager to choose net-long or net-short (positive beta or negative beta) market exposure, while still focussing primarily on stock-selection opportunities. It has the disadvantage, from the perspective of the final investor that, it is no longer clear how the hedge fund allocation affects overal ...

Financial Accounting and Accounting Standards

... LO 2 Understand the procedures for discount and premium amortization on bond investments. ...

... LO 2 Understand the procedures for discount and premium amortization on bond investments. ...

Mortgage-backed security

A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The mortgages are sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. The mortgages of an MBS may be residential or commercial, depending on whether it is an Agency MBS or a Non-Agency MBS; in the United States they may be issued by structures set up by government-sponsored enterprises like Fannie Mae or Freddie Mac, or they can be ""private-label"", issued by structures set up by investment banks. The structure of the MBS may be known as ""pass-through"", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateralized debt obligations (CDOs).The shares of subprime MBSs issued by various structures, such as CMOs, are not identical but rather issued as tranches (French for ""slices""), each with a different level of priority in the debt repayment stream, giving them different levels of risk and reward. Tranches—especially the lower-priority, higher-interest tranches—of an MBS are/were often further repackaged and resold as collaterized debt obligations. These subprime MBSs issued by investment banks were a major issue in the subprime mortgage crisis of 2006–8.The total face value of an MBS decreases over time, because like mortgages, and unlike bonds, and most other fixed-income securities, the principal in an MBS is not paid back as a single payment to the bond holder at maturity but rather is paid along with the interest in each periodic payment (monthly, quarterly, etc.). This decrease in face value is measured by the MBS's ""factor"", the percentage of the original ""face"" that remains to be repaid.