* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download FREE Sample Here

Household debt wikipedia , lookup

Internal rate of return wikipedia , lookup

Private equity wikipedia , lookup

Financialization wikipedia , lookup

Modified Dietz method wikipedia , lookup

Private equity secondary market wikipedia , lookup

Negative gearing wikipedia , lookup

Conditional budgeting wikipedia , lookup

Securitization wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Global saving glut wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

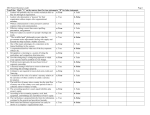

Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes Chapter 2 - Problem Solutions Review Questions 1. Pros, relative to partnerships, for the corporate business form include limited liability of owners (to the amount of their initial investment), ease of ownership transfer and ability to grow the company by issuing additional stock. The major con is double taxation (on corporate earnings and dividends paid to shareholders). 2. Assets: Items owned by the company or that the company has a right to use that have probable future value to the firm. Include cash; accounts receivable, property plant and equipment, inventories and various property rights. There are also other items classified as assets that are discussed later in this book. Liabilities: Amounts owed to others. Represent probable future sacrifices of resources. Include notes payable, mortgages payable, bonds payable, accounts payable, salaries payable and other items owed to others outside the entity. There are other items considered liabilities discussed later in this course. Stockholders’ Equity: Represents the residual claim on the assets of the firm after all liabilities are settled. Includes Common stock, additional paid in capital and retained earnings. 3. Statement of financial position: Provides a snapshot of a company’s assets, liabilities and stockholders’ equity at a point in time. The statement of financial position describes the firm’s resources and claims to those resources. Statement of earnings: Provides a report of changes in stockholders’ equity resulting from a firm’s operating activities. It reports the revenues from sale of goods and services and the expenses from generating those revenues. Statement of cash flows: Describes changes in a company's cash and cash equivalents for a period. The statement shows how investing, financing and operating activities affect cash. 2-1 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes Statement of stockholders’ equity: Provides details about all the transactions that affect stockholders’ equity including stock issuances, stock repurchases, earnings (net income) and dividends paid. 4. Net assets are the same as net book value and total stockholder’s equity. It can be calculated as assets- liabilities. 5. In order to be classified as an asset an item must meet the measurement criteria specified in the conceptual framework. It must be accurate, neutral and verifiable. It must also normally be owned or controlled by the entity. Some items such as internally developed brands, customer satisfaction and the value of a high quality work force cannot be reliably valued or are not owned and so are not reported as assets. 6. Assets = Liabilities + Stockholders’ Equity 7. A classified balance sheet lists items in order of liquidity and classifies assets and liabilities into categories of current and noncurrent. 8. Current assets are cash and assets expected to be converted to cash or expire within one year or the operating cycle of the business, whichever is longer. Current liabilities are those that become due or expected to be settled within one year. 9. Retained earnings represent the cumulative amount of earnings less dividends distributed to stockholders’ since the formation of a business. Note that it does not represent cash as earnings may not be in the form of cash, and even cash that is generated by earnings may have been reinvested in the business. 10. The book value of a company represents the assets minus liabilities of a company recognized according to generally accepted accounting standards. The market value of a company’s stock is based on investors’ expectations about future earnings and cash flows to the company and is determined by a market trading process. In general, because accounting is conservative (meaning that losses and expenses are recognized earlier than gains and revenues) the book value of a company will be less than the market value. For example, some items of value (such as the value of McDonald’s arches) are not 2-2 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes reported as assets. Therefore, the book value and market value of a firm will often differ because of accounting recognition lags changes in market value. Items are recognized in the market but not yet in the accounting records (relates to conservatism above). The difference in these two values can be measured using a market/book value ratio. 11. Net income is the same as net earnings, which is revenues less expenses. 12. The two methods are the direct method and the indirect method. Under the direct method cash flows from operations report cash received from customers and cash paid for various operating costs. The indirect method starts with net income and adjusts income for non-cash earnings items. The indirect method is the most common in practice. 13. FASB Concepts Statement 6 defines comprehensive income as the change in equity of a firm due to transactions and other events and circumstances from non-owner sources. It includes all changes in equity except those resulting from investments by owners and distributions to owners. At first glance, this appears to be a definition of earnings. The difference is that accounting standards allow for some items that affect owners’ equity to bypass the income statement and be recorded directly in stockholders’ equity. Comprehensive income is discussed in Chapter 4. 14. Note to Instructors: In the earlier drafts of this chapter we had covered comprehensive income. However, in the final version this was dropped. We inadvertently left this problem in the chapter and will be removing it in the next printing and replacing it with a different problem. Comprehensive income must be reported separately from earnings. The FASB has recently concluded that a business entity should report all items of revenue, expense, gains, and losses in a single statement of comprehensive income. Note: in prior years many companies reported comprehensive income in the statement of shareholders’ equity. Now it is being reported in the statement of earnings. Applying Your Knowledge 2-3 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes 15. An income statement presents the results of the operating activities of a firm for a period of time. A cash flow statement reports the net cash flows of a firm for a period of time. An income statement presents mainly the results of the operating activities while a cash flow statement reports cash flows relating to operating, investing and financing activities. An Income statement gives the net income, earnings/profits of a firm whereas a cash flow statement explains the inflow and outflow of cash for the period. The Income statement includes items which are not related to cash, such as depreciation. The cash flow statement includes items only related to cash. 16. a. b. c. d. e. CA CL NI and/or CF RE and/or CF NI and/or CF f. g. h. i. j. NCA CS and/or CF CA NCL NI and/or CF 17. a. b. c. d. O F F I e. f. g. h. O I I O 18. Current Assets Noncurrent Assets Total Assets Current Liabilities Noncurrent Liabilities Owners' Equity Total Liabilities & Owners' Equity 19. Retained Earnings Dec. 31, Year 1 Net Income Dividends Declared and Paid Retained Earnings Dec. 31, Year 2 A $100,000 250,000 350,000 50,000 75,000 225,000 B C $650,000 $230,000 400,000 400,000 1,050,000 630,000 500,000 300,000 90,000 250,000 460,000 80,000 D $40,000 150,000 190,000 25,000 10,000 155,000 350,000 1,050,000 630,000 190,000 A $20,000 B C $100,000 $150,000 D $40,000 15,000 6,000 50,000 35,000 400,000 250,000 22,000 10,000 29,000 115,000 300,000 52,000 2-4 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes 20. COMPANY Washington Post ASSETS -Printing machines -Newsprint LIABILITIES -Accounts payable -Deferred subscription revenue -Subscription receivables -Long-term debt International Paper -Timberland -Accrued income tax -Timber/Paper -Notes payable Inventories -Plant & equipment -Long-term debt SBC -Telephone equipment -Advance billings & customer deposits -Receivables from -Long-term debt customers -Receivables from -Accounts payable leased equipment Hartford Financial Services -Investments -Loss reserves Inc. -Loans to policyholders -Commissions payable -Premiums due -Contract claims payable Philip Morris Companies -Food inventories -Tax payable (now part of Altria Group Inc.) -Tobacco inventories -Interest payable -Receivables from -Long-term debt customers Citibank -Investments -Commercial paper (short-term debt) -Third world loans -Time deposits -Mortgage loans -Demand deposits Delta -Spare parts & supplies -Traffic balances payable -Flight equipment -Unearned airline revenue -Ground plant & -Accrued expenses equipment 2-5 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes 21. & 22. COMPANY Washington Post INCOME STATEMENT -Sale of newspapers -Cost of printing -Royalties International Paper -Cost of timber harvested -Depreciation SBC Hartford Financial Services Inc. Philip Morris Companies (now part of Altria Group Inc.) Citibank Delta -Sales revenues -Revenue from local service -Interstate toll revenue -Maintenance expense -Premiums earned CASH FLOW -Advertising costs -Royalties paid -Receipts from advertising -Investments in timberland -Proceeds from sale of properties -Purchase of stock -Investment in phone equipment -Redemption of stock -Increase in investments -Dividends paid -Investment income -Losses -Revenues from tobacco sales -Loans repaid -Claims paid -Dividends paid -Federal excise taxes -Cost of goods sold -Receipts from customers -Proceeds from issuance of debt -Interest payments -Interest income from time deposits with banks -Dividends from companies -Interest expense on commercial paper -Revenue from freight, mail, passengers -Travel agency commissions -Airport rental fees -Increase in investments -Sale of property -Additions to PP&E -Dividends paid -Reduction of long-term debt Note: Some of the items related to operations would only appear directly in the cash flow statement if it were prepared using the direct method. If the indirect method were used the net affect would be reported but would be difficult to see. 2-6 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes 23. Funds can be raised from several sources but the two primary sources are from lenders and owners. The advantage of borrowing from a lender is that your friend would retain complete ownership of the business and would not be required to share the decision-making and the profit of the firm with anyone else. Bringing in another owner would obviously result in the dilution of control over the firm and would also give up some share of the future profits. The disadvantage of borrowing from a lender is that the loan contracts will require repayment of the amount on a set schedule. This increases the risk to the firm that it will not be able to make payments on a timely basis. There could be significant consequences to not making payment including losing ownership of the business. A new owner would not have this same type of contractual arrangement and would be at risk in the same way as your friend. However, the new owner would probably expect a higher return from their investment than would a lender. Therefore, your friend would be giving up more potential profit to a new owner than a lender. There are also tax incentives for borrowing in that from a corporate point of view the interest payments on the loan are deductible for tax purposes. Payments to owners (such as dividends) are not tax deductible. 24. In a partnership it is often very difficult to determine whether payments made to owners are salaries earned by the partners for work performed for the partnership, repayment of loans made by the partner to the partnership or profit sharing by the partners. As an example suppose that the profits earned by the partnership for the month are $5,000 prior to considering the $1,500 paid to the partner. Under the profit sharing arrangement each partner is entitled to $2,500 in profits. If the $1,500 is considered part of the profit sharing then the partner could withdraw another $1,000 as part of his or her profit sharing. If on the other hand the $1,500 is considered salary then the profit of the firm would only be $3,500, which would entitle each partner to $1,750. Therefore, the partner would receive $1,500 for his/her salary and another $1,750 as profit sharing or a total of $3,250. How this situation should be handled would depend on what the partners have agreed to do. It would seem that since the other partner is a “silent” partner that the partner who spends his or her time working for the company should receive a salary. However, this must be specified in the partnership agreement. 2-7 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes Using Real Data 25. a. $1,855,600,000 b. $696,400,000 c. $85,300,000 d. $4,700,000 e. $8,700,000 f. $482,500,000 g. $338,000,000 h. $1,219,500,000 i. $(68,900,000) j. $573,000,000 k. $(500,000) l. $129,200,000 m. $27,000,000 n. $108,200,000 o. $(68,100,000) p. $(20,000,000) Note: must be computed from the change in the balance sheet accumulated other comprehensive income from 1999 to 2000 (68,900,000- 48,900,000). 26. Earnings are increasing each year from 1998-2000 from a loss of $51 million in 1998 to positive earnings of $37.7 million in 2000 (an increase of 174%). 27. Cash flow from operations rose from 1998 to 1999 but fell sharply in 2000 (to minus $500,000) a decrease of 101%. 2-8 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes 28. Sales are fairly flat. They increased slightly in 1999 from 1998 but overall the change in sales from 1998 to 2000 is only an increase of 1%. 29. Total assets: $927,207 (in thousand) Total liabilities: $101,419+105,000+152,403+32,301=$391,123 Total stockholders’ equity: $536,084 $391,123 + $536,084 =$927,207. 30. All amounts are in thousands of $ a. $1,214,628 b. $429,825 c. $8,169 d. $36,787 e. $60,011 f. $7,329 g. $35,686 h. $447,943 i. $120,000 j. $170,147 k. $169,113 l. $4,710 m. $10,000 n. $(113,218) 31. During 2000 Werner repaid long term and short-term debt in the amount of $50,000 and borrowed only $10,000. Werner supported its 2-9 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes cash needs primarily from cash from operation. Since this cash belongs to owners you could say it financed its cash needs primarily from owners equity. Looking at the balance sheet Werner’ equity financing is about 58% of its overall financing ($536,084/927,207). 32. Two largest sources: Cash from operations $170,147 Retirement of property and equipment $60,608 Two largest uses: Additions to plant and equipment: $169,113 Repayment of short and long-term debt; $50,000 (25,000 s.t. + 25,000 l.t.) 33. The biggest reason is due to depreciation expense. Depreciation is a non-cash charge and was $109,107 thousand. In addition deferred tax liability increased implying that cash paid for income taxes was less than the expense. This amount was $18,751 thousand. These two items account for a total difference between cash from operations and net income of $127,858. The difference between net income and cash from operations was $122,124; thus most of the difference can be attributed to these items. The balance is due primarily to changes if various non-cash current asset and current liability accounts. 34. Note to Instructors: In the earlier drafts of this chapter we had covered comprehensive income. However, in the final version this was dropped. We inadvertently left this problem in the chapter and will be removing it in the next printing and replacing it with a different problem. $(34,000) (note the 1999 balance in the accumulated comprehensive loss account was zero. 35. 12/31/2000 was a Sunday. The closing price the previous Friday December 29, 2000 was $17. Shares outstanding on that date were 47,039,290. Hence the total market cap for Werner as of 12/31/2000 was $17 x 47,039,290 = $799,667,930. The book value of Werner’s shareholders’ equity on that date was $536,084,000. The ratio of the market value to the book value is 1.49. The higher market value of Werner’s stock than its book value occurs because accounting does not 2-10 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes reflect all economic resources and because the book value is based primarily on historic cost while market value reflects expectations about future cash inflows. 36. July 1. 37. a. $245,307,000 b. $120,812,000 c. 0 or not material. No interest is reported and Emulex has no notes or bonds payable. The cash flow statement reports some principal payments on capital leases suggesting that there would be some interest on this but the amount appears immaterial. d. $32,187,000 e. 2001 -$52,085,000 (reported with other intangibles on cash flow statement and on the income statement) 2000- 0 f. $(23,603,000) loss g. $38,616,000 h. $590,316,000 i. $861,461,000 j. $59,941,000 k. $(54,785,000) l. $10,844,000 38. Emulex finances its business primarily from owners. Total Stockholder’s equity is $876,686,000 and total liabilities are only $41,328,000. 95% of Emulex is financed with equity. The only debt relates to operating liabilities. 39. They issued common stock and options in the amount of $661,678,000. 2-11 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes 40. 1999 2000 2001 Sales $68,485,000 $139,772,000 $245,307,000 Income $5,265,000 $32,814,000 $(23,603,000) Sales have grown 258% between 1999 and 2001. Income grew 523% from 1999 to 2000 but in 2001 the company suffered a loss of over $23 million. The primary reason for the loss seems to be due to amortization of goodwill and the associated tax effects and the write-off of in-process R&D acquired in the acquisition. Note that the provision for taxes is greater than income before tax suggesting that the goodwill amortization and write off of in-process R&D were not tax deductible. Without these two charges Emulex would have reported income before taxes of $82,949,000, and net income of $50,762,000. 41. No. The cash flow statement shows no dividends. Also this can be verified from the balance sheet. Beginning Retained earnings + net income – dividends = ending retained earnings $43,014,000 -$23,603,000 =$19,411,000 42. July 1, 2000 was a Sunday. The price on the most recent trading date (June 29, 2000) was $40.4 Shares outstanding were 81,799,322 for a total market capitalization of 81,799,322 x $40.4 = $3,304,692,609. The book value of equity as of that date is $876,686,000. The ratio of the market value to book value for Emulex is $3,304,692,609/$876,686,000= 3.77. Emulex is a high tech company that designs, develops and sells fibre channel host bus adaptors (HBA’s). Emulex appears to engage in considerable research and development activities that may create value for 2-12 Full file at http://testbank360.eu/solution-manual-financial-accounting-1st-editionhughes Emulex. However, because of high uncertainty in future realizations GAAP requires that Emulex expense these costs. Note that separate from the inprocess R&D write off that Emulex reported engineering and development cost of over $27 million on 2001. At the time of the July 1, 2000 balance sheet the market valued Emulex’s future cash flow prospects as much stronger than reflected on the balance sheet. Most recently Emulex’s stock price has plunged and as of October 25, 2004 Emulex is trading at a little over $10/share suggesting a significant drop in the market’s view of its prospects. Beyond the Book The answers depend on the company selected. 2-13