* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Introduction

Survey

Document related concepts

Transcript

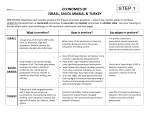

Reem Alrukaiti 201001612 Halla Alghunaim 201001249 MONETARY POLICY IN SAUDI ARABIA Implementation The Saudi Arabia monetary policies have a range of targets, which are given different emphasis at different times. Targets include short-term interest rates, growth rates of narrow money and broad money, monetary conditions, inflation, the exchange rate and other economic indicators. The Saudi Arabia monetary policy is provide a stable monetary environment for the economy , and encouraging the foreign investment and stable economic growth and stable exchange rate for Saudi riyals. The monetary policy provides a strong banking system and stability of exchange rate for the Saudi riyals which remain stable for 3.75 for $1 US dollar. And Stable inflation rate. The Saudi Arabian monetary agency Monetary policy is one of the ways in which the Government can influence the economy. In Saudi Arabia, this task is carried out by the Saudi Arabian Monetary Agency (SAMA) as an agent of the Government and the country’s central bank and controller for banking system and the only authority of issuing the currency. SAMA is assigned with the conduct of monetary policy by the following functions: 1- Required reserve ratio: By Banking Control Law, banks are required to maintain a percentage of their customers’ deposits with SAMA as cash reserves. This is a regulation of principle, designed both as a monetary policy measure and to ensure that the banks have passable liquidity to cover their customers’ deposits. SAMA adjusted this ratio between 7% and 12% and 2% for saving/time deposit. 2- Open market operations through purchases or sale of government securities in the open market to control money supply and interest rate. In Saudi Arabia the bond market is early stage and narrow. Banking system in Saudi Arabia Saudi Arabia’s regulatory system matches with the international standards for banking supervision. Banks are meeting accounting and revelation standards prescribed by SAMA, which are in line with International Accounting Standards. The Saudi Arabia's banking system remains stable, because of the following factors (1) a benign operating environment; (2) low problem loan levels; (3) strong loss-absorption capacity, underpinned by high capital profitability; and (4) the low-cost deposit base and ample liquidity. Saudi Arabia’s banking system is well integrated with global banking; with eleven banks operating in the Kingdom have foreign shareholders, including branch or joint venture set-ups. And ensured a competitive and diversified banking environment which meets the best international banking practices. Money functions Three primary functions money are 1-a medium of exchange 2- unit of account 3- stored of value The following definitions of monetary aggregates in Saudi Arabia (SAMA) 1- M1 = currency in circulation + demand deposit 2-M2=M1 +short-run time saving deposit 3-M3 = M2 plus long-run saving deposits. Exchange rate Exchange rate targeting is the principal monetary policy objective, complemented by an operational focus on system liquidity and the medium-term goal of maintaining price and financial stability and it is the price at which one currency (domestic currency riyals) is exchanged by other currency (foreign currency as dollar). Factors that influences exchange rate The Factors that affects the exchange rate are: 1-The strength and stability of Riyal internally and externally 2-Government monetary policy and regulating the commercial bank and exchange dealers 3- The strong economy and high economic growth with a surplus in balance of trade. 4- A large amount stock of foreign currencies. Relationship between us dollars and Saudi riyals The monetary policy in Saudi Arabia according to the openness of the economy, with the riyal effectively pegged to the US dollar since the suspension of the Saudi riyal link in May 1981. In Saudi Arabia, the exchange rate plays a key role in monetary policy. It is an important variable for price stability and the balance of payments. Intervention policy under the fixed exchange rate is influenced by the level of foreign exchange outflow and the dollar/riyal interest rate different. This will have direct effects interest arbitrage, and indirect effects by current account decline on Saudi Arabia’s foreign exchange reserves. With perfect asset substitutability, a small change in interest rates results in a large change in reserves, reflecting the general point that there cannot be an autonomous monetary policy in a fixed exchange rate system with perfect asset substitutability Inflation Housing and food prices have been the drivers of inflation in Saudi Arabia Rents were driven up by demographic pressure and supply shortage. Food prices rose because of droughts and the increase in domestic demand in the commodityexporting countries. When inflation is due to supply side factors such as these, exchange rate moves and monetary policy are less effective in containing it. There was some public pressure during 2007 and 2008 to revalue the riyal to mitigate the impact of inflation on consumers. And this because of the inflationary boom and increasing consumer purchasing power relatively to high oil prices. In Saudi Arabia, supply side inflation is better handled through subsidies on essential items. And The monetary policy can affect price stability. From the mid-1980s to the mid-2000s, inflation was low and stable, averaging about 1% annually. After 2006, inflation began to pick up, reflecting robust domestic demand and rising food and rental prices, and it peaked at 11.1% in July 2008. Currently, inflation is 5.8%. References www.SAMA.gov.sa en.wikipedia.org/.../Saudi Arabia