Gold, copper and silver production in Azerbaijan

... was justified and we will continue to put in place the foundations for sustainable profitability and cash generation. A major contributor to the success in 2016 is the continuing evolution of Anglo Asian into a company for which copper is increasingly a significant proportion of its production. Copp ...

... was justified and we will continue to put in place the foundations for sustainable profitability and cash generation. A major contributor to the success in 2016 is the continuing evolution of Anglo Asian into a company for which copper is increasingly a significant proportion of its production. Copp ...

Mondi Group - Full Year Results Announcement 2015

... 2015 was an extremely successful year for the Group. We achieved excellent results on all key metrics and the strong contribution from all our business units is testament to our consistent strategy, robust business model and high-quality, low-cost asset base. Group revenue of €6,819 million was 7% a ...

... 2015 was an extremely successful year for the Group. We achieved excellent results on all key metrics and the strong contribution from all our business units is testament to our consistent strategy, robust business model and high-quality, low-cost asset base. Group revenue of €6,819 million was 7% a ...

NBER WORKING PAPER SERIES AND CAPITAL STRUCTURE

... and asset fire sale losses. Firms decide on how much debt to hold, when to restructure their debt, and when to default based on their cash flows as well as the macroeconomic conditions. The main mechanism of the model is as follows. First, recessions are times of high marginal utilities, which means ...

... and asset fire sale losses. Firms decide on how much debt to hold, when to restructure their debt, and when to default based on their cash flows as well as the macroeconomic conditions. The main mechanism of the model is as follows. First, recessions are times of high marginal utilities, which means ...

No Arbitrage Conditions For Simple Trading Strategies

... In this section we provide a necessary and sufficient condition for the no arbitrage property of non-negative strict local martingales (i.e. not true martingales, see e.g. [4]) with respect to the simple trading strategies S(F). A typical example of a strict local martingale is the inverse process o ...

... In this section we provide a necessary and sufficient condition for the no arbitrage property of non-negative strict local martingales (i.e. not true martingales, see e.g. [4]) with respect to the simple trading strategies S(F). A typical example of a strict local martingale is the inverse process o ...

The Crisis Aftermath: New Regulatory Paradigms

... banks as lenders of last resort, capital requirements, competition, and risk-taking in banking, and the pro-cyclical effects of risk-sensitive bank capital regulation. Jesús Saurina is Director of the Financial Stability Department at Banco de España. Among other duties, he is responsible for the Fi ...

... banks as lenders of last resort, capital requirements, competition, and risk-taking in banking, and the pro-cyclical effects of risk-sensitive bank capital regulation. Jesús Saurina is Director of the Financial Stability Department at Banco de España. Among other duties, he is responsible for the Fi ...

Research Insight - Risk and Return of Factor Portfolios

... In Figure 3, we show the cumulative performance of the four Momentum factor portfolios. Here, the regression weighting scheme led to much greater differentiation in factor performance. The top‐ performing Momentum factor was for equal weighting, which outperformed root‐cap weighting, which in turn ...

... In Figure 3, we show the cumulative performance of the four Momentum factor portfolios. Here, the regression weighting scheme led to much greater differentiation in factor performance. The top‐ performing Momentum factor was for equal weighting, which outperformed root‐cap weighting, which in turn ...

Repo and Securities Lending - Federal Reserve Bank of New York

... agents. 10 In addition to providing collateral management and settlement services, the clearing banks finance the dealers’ securities during the day under current market practice. 11 The intraday credit exposure results in high concentration risk of the clearing banks vis-à-vis tri-party repo borrow ...

... agents. 10 In addition to providing collateral management and settlement services, the clearing banks finance the dealers’ securities during the day under current market practice. 11 The intraday credit exposure results in high concentration risk of the clearing banks vis-à-vis tri-party repo borrow ...

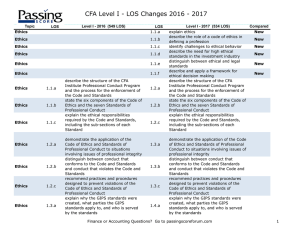

CFA Level I - LOS Changes 2016 - 2017

... explain the use of a tree diagram to represent an investment problem calculate and interpret covariance and correlation calculate and interpret the expected value, variance, and standard deviation of a random variable and of returns on a portfolio calculate and interpret covariance given a joint pro ...

... explain the use of a tree diagram to represent an investment problem calculate and interpret covariance and correlation calculate and interpret the expected value, variance, and standard deviation of a random variable and of returns on a portfolio calculate and interpret covariance given a joint pro ...

Get - Wiley Online Library

... a probability structure and realistic for application. This latter requirement is key, as unlike a probability distribution the only constraint placed upon a utility function is that it be a bounded function of its arguments. It is therefore quite easy to determine a utility form that satisfies any ...

... a probability structure and realistic for application. This latter requirement is key, as unlike a probability distribution the only constraint placed upon a utility function is that it be a bounded function of its arguments. It is therefore quite easy to determine a utility form that satisfies any ...

Solution to Problem #1 - Ka

... Price elasticity of demand = 0 (Or 0 if we take the absolute value) As it is exactly equal to 0, the price elasticity of demand is zero The demand is perfectly inelastic- the quantity demanded does not change regardless of the change in price ...

... Price elasticity of demand = 0 (Or 0 if we take the absolute value) As it is exactly equal to 0, the price elasticity of demand is zero The demand is perfectly inelastic- the quantity demanded does not change regardless of the change in price ...

system of indicators for barbados

... of the phenomena is wanted to capture. But in some cases, “proxies” had to be employed. In general it is sought variables with extensive country coverage but chose in some cases to make use of variables with narrow coverage if they measured critical aspects of risk that would otherwise be overlooked ...

... of the phenomena is wanted to capture. But in some cases, “proxies” had to be employed. In general it is sought variables with extensive country coverage but chose in some cases to make use of variables with narrow coverage if they measured critical aspects of risk that would otherwise be overlooked ...

Stress Testing with a Bottom-Up Corporate Default Prediction Model

... profile of the target portfolio. The change in the default profile will then reflect how vulnerable the target portfolio is under stress. In this paper, we adopt the latter approach. We relate each of the input variables of the default prediction model (i.e., two macroeconomic variables and the six ...

... profile of the target portfolio. The change in the default profile will then reflect how vulnerable the target portfolio is under stress. In this paper, we adopt the latter approach. We relate each of the input variables of the default prediction model (i.e., two macroeconomic variables and the six ...

How working capital management affects the profitability of Afriland

... with sufficient working capital can smoothly operate a business. With adequate working capital, it can make regular payment of salaries and other daily commitments. By paying expenses at time, employee’s morale increases as well as their efficiency. ...

... with sufficient working capital can smoothly operate a business. With adequate working capital, it can make regular payment of salaries and other daily commitments. By paying expenses at time, employee’s morale increases as well as their efficiency. ...

RADIUS GOLD INC. (Form: 20-F/A, Received: 11/04

... Risks Related to the Investment Business and the Common Shares The Company has no operating history as an investment issuer The Company does not have any record of operating as an investment issuer. As result of the completion of the Change of Business (as described herein), the Company is subject t ...

... Risks Related to the Investment Business and the Common Shares The Company has no operating history as an investment issuer The Company does not have any record of operating as an investment issuer. As result of the completion of the Change of Business (as described herein), the Company is subject t ...

Click here for PDF - University Blog Service

... between the proportion of firms' franchised units to their company units and their intangible value. More recently, two studies (Geyskens, Gielens, and Dekimpe 2002; Lee and Grewal 2004) show that a firm's adoption of the Internet as a distribution channel positively influences its intangible value. ...

... between the proportion of firms' franchised units to their company units and their intangible value. More recently, two studies (Geyskens, Gielens, and Dekimpe 2002; Lee and Grewal 2004) show that a firm's adoption of the Internet as a distribution channel positively influences its intangible value. ...

Money market instruments

... It ignores the fact that both of these instruments are very similar in nature. That’s why the term fixed-income securities has been introduced. It embraces all securities that pay a fixed interest at regular intervals regardless of their date of maturity. 1.4 Let us point out that money markets do n ...

... It ignores the fact that both of these instruments are very similar in nature. That’s why the term fixed-income securities has been introduced. It embraces all securities that pay a fixed interest at regular intervals regardless of their date of maturity. 1.4 Let us point out that money markets do n ...

california Tax-Free Funds

... indicator of how the fund will respond to rising rates. If a bond fund has a duration of 5.3 years, for example, the fund’s net asset value (NAV) would be expected to fall about 5.3% for every one-percentage-point rise in rates. Even this is only part of the picture, however—rising rates will also g ...

... indicator of how the fund will respond to rising rates. If a bond fund has a duration of 5.3 years, for example, the fund’s net asset value (NAV) would be expected to fall about 5.3% for every one-percentage-point rise in rates. Even this is only part of the picture, however—rising rates will also g ...

AdamsSafe Harbors - Digital Access to Scholarship at Harvard

... repurchase agreements from key provisions, such as the automatic stay. The primary rationale for this special treatment has been the fear that the failure of an important market participant could cascade if counterparties could not immediately exit their contracts. Reflecting on the recent financial ...

... repurchase agreements from key provisions, such as the automatic stay. The primary rationale for this special treatment has been the fear that the failure of an important market participant could cascade if counterparties could not immediately exit their contracts. Reflecting on the recent financial ...

TRADING VOLUME TREND AS THE INVESTOR`S SENTIMENT

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

A Fair and Substantial Contribution by the Financial Sector

... report for our next meeting [June 2010] with regard to the range of options countries have adopted or are considering as to how the financial sector could make a fair and substantial contribution toward paying for any burden associated with government interventions to repair the banking system.” Whi ...

... report for our next meeting [June 2010] with regard to the range of options countries have adopted or are considering as to how the financial sector could make a fair and substantial contribution toward paying for any burden associated with government interventions to repair the banking system.” Whi ...