TRADING VOLUME TREND AS THE INVESTOR`S SENTIMENT

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

4E: Financial Instruments: Accounting for Financial Instruments

... determining ’bad book’ classification. For example, an entity may contact a customer about missed payments but that does not necessarily mean the entity’s objective shifted from collection of contractual cash flows to recovery. Some preparers believed that this definition should be modified to focus ...

... determining ’bad book’ classification. For example, an entity may contact a customer about missed payments but that does not necessarily mean the entity’s objective shifted from collection of contractual cash flows to recovery. Some preparers believed that this definition should be modified to focus ...

The Accounting Equation

... Total Assets stayed the same. One Asset increased, the other decreased. No change in Liabilities or Owner’s Equity ...

... Total Assets stayed the same. One Asset increased, the other decreased. No change in Liabilities or Owner’s Equity ...

Determinants of FPI over FDI

... between the price paid by buyer and the return if continuing to hold the asset. ...

... between the price paid by buyer and the return if continuing to hold the asset. ...

A Fair and Substantial Contribution by the Financial Sector

... report for our next meeting [June 2010] with regard to the range of options countries have adopted or are considering as to how the financial sector could make a fair and substantial contribution toward paying for any burden associated with government interventions to repair the banking system.” Whi ...

... report for our next meeting [June 2010] with regard to the range of options countries have adopted or are considering as to how the financial sector could make a fair and substantial contribution toward paying for any burden associated with government interventions to repair the banking system.” Whi ...

icma euro commercial paper committee

... to be covered with High Quality Liquid Assets; and hence it does not result in any incremental liquidity being available to support the business. The use of CP as a funding instrument for EU banks and securities companies will therefore become purely as a cash management tool i.e. if there is a spec ...

... to be covered with High Quality Liquid Assets; and hence it does not result in any incremental liquidity being available to support the business. The use of CP as a funding instrument for EU banks and securities companies will therefore become purely as a cash management tool i.e. if there is a spec ...

future value of multiple cash flows

... an interest rate r, multiply the initial investment by (1 + r)t. To find the present value of a future payment, run the process in reverse and divide by (1 + r)t. Present values are always calculated using compound interest. Whereas the ascending lines in Figure 1.4 showed the future value of $100 i ...

... an interest rate r, multiply the initial investment by (1 + r)t. To find the present value of a future payment, run the process in reverse and divide by (1 + r)t. Present values are always calculated using compound interest. Whereas the ascending lines in Figure 1.4 showed the future value of $100 i ...

financial development and real growth: deciding the chicken and

... Companies, Pension Funds, Unit Trusts, Mutual Funds, Stock Exchanges, Mortgage Institutions, etc. The financial intermediary usually designs instruments for this fund mobilization and allocation activity. These instruments are of various forms and of various life-spans. There are short-term instrume ...

... Companies, Pension Funds, Unit Trusts, Mutual Funds, Stock Exchanges, Mortgage Institutions, etc. The financial intermediary usually designs instruments for this fund mobilization and allocation activity. These instruments are of various forms and of various life-spans. There are short-term instrume ...

FREE Sample Here

... Liabilities are what the firm owes to others. Current liabilities are those that must be paid within a year, while long-term liabilities are due in more than a year, like mortgages or long-term loans. Shareholders’ equity is the owners’ residual share of the business, including their original invest ...

... Liabilities are what the firm owes to others. Current liabilities are those that must be paid within a year, while long-term liabilities are due in more than a year, like mortgages or long-term loans. Shareholders’ equity is the owners’ residual share of the business, including their original invest ...

Margin Credit and Stock Return Predictability

... On the other hand, hedge funds, being sophisticated investors could posses superior information about the future cash flows. For example, Brunnermeier and Nagel (2004) find that hedge funds successfully anticipated price movements of technology stocks during the Nasdaq bubble and sold their positio ...

... On the other hand, hedge funds, being sophisticated investors could posses superior information about the future cash flows. For example, Brunnermeier and Nagel (2004) find that hedge funds successfully anticipated price movements of technology stocks during the Nasdaq bubble and sold their positio ...

Chapter 4

... • In order to answer this question, we will need to compute the price elasticity of demand • Applying the general formula, Price elasticity of demand = (1/ Slope of the demand curve) * (P/Q), we get • Price elasticity of demand – The absolute value of the slope of this demand curve is 1/3 – Price is ...

... • In order to answer this question, we will need to compute the price elasticity of demand • Applying the general formula, Price elasticity of demand = (1/ Slope of the demand curve) * (P/Q), we get • Price elasticity of demand – The absolute value of the slope of this demand curve is 1/3 – Price is ...

For personal use only

... All ordinary shares rank equally with one vote attached to each fully paid ordinary share. Ordinary shares do not have a par value. The Company has agreed to issue KuangChi Science Limited with convertible notes with a face value of A$23,020,000. This provides the Company with further liquidity if r ...

... All ordinary shares rank equally with one vote attached to each fully paid ordinary share. Ordinary shares do not have a par value. The Company has agreed to issue KuangChi Science Limited with convertible notes with a face value of A$23,020,000. This provides the Company with further liquidity if r ...

Asymmetric investment returns and the

... has averaged 1.3 percentage points below the rate of nominal GDP growth since 1990. On this basis, stabilising US NFLs at 50-60 per cent of GDP would require the primary deficit to fall to under 1 per cent of GDP, a reduction of at least 5½ per cent of GDP from its current level. This must occur thr ...

... has averaged 1.3 percentage points below the rate of nominal GDP growth since 1990. On this basis, stabilising US NFLs at 50-60 per cent of GDP would require the primary deficit to fall to under 1 per cent of GDP, a reduction of at least 5½ per cent of GDP from its current level. This must occur thr ...

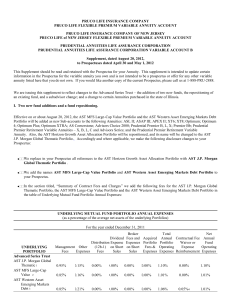

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be reta ...

... Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be reta ...

Report of the management board for the period from 1

... 2015 is primarily a significant improvement in working capital management. The key challenge was to improve the level of inventories which strengthened our balance sheet and at the same time improving level of service for our clients. Successful combination of this two elements resulted in strong re ...

... 2015 is primarily a significant improvement in working capital management. The key challenge was to improve the level of inventories which strengthened our balance sheet and at the same time improving level of service for our clients. Successful combination of this two elements resulted in strong re ...

"Al. I. CUZA" UNIVERSITY of IAŞI DOCTORAL SCHOOL

... This paper was intended to be a starting point for further research of credit risk in the context of restructuring firms. In these circumstances, the risk was considered from a broader perspective, as a complex of risks generated by a variety of events and transactions, generating other risks. We wa ...

... This paper was intended to be a starting point for further research of credit risk in the context of restructuring firms. In these circumstances, the risk was considered from a broader perspective, as a complex of risks generated by a variety of events and transactions, generating other risks. We wa ...

Measuring Historical Volatility

... In pricing options, anticipated volatility over the life of the option is the crucial unknown parameter. While sophisticated volatility estimation procedures, such as GARCH, are popular among finance researchers, these require econometrics software which is difficult for the average undergraduate st ...

... In pricing options, anticipated volatility over the life of the option is the crucial unknown parameter. While sophisticated volatility estimation procedures, such as GARCH, are popular among finance researchers, these require econometrics software which is difficult for the average undergraduate st ...

UN PRI and private equity returns. Empirical evidence from the US

... and diffusion. This initiative gathers different firms and well-known investors. We believe that the contribution offered by this initiative is very significant, since it includes a wide set of CSR principles within an economic and financial framework. In this perspective, the analysis of private eq ...

... and diffusion. This initiative gathers different firms and well-known investors. We believe that the contribution offered by this initiative is very significant, since it includes a wide set of CSR principles within an economic and financial framework. In this perspective, the analysis of private eq ...