Accounting for Business Combinations Executive Summary

... than 100% of the target is acquired, the assets acquired and liabilities assumed in a business combination are still recorded at 100% of their fair value (or other amount measured in accordance with Topic 805). The exceptions to the general fair value measurement principle are discussed later in thi ...

... than 100% of the target is acquired, the assets acquired and liabilities assumed in a business combination are still recorded at 100% of their fair value (or other amount measured in accordance with Topic 805). The exceptions to the general fair value measurement principle are discussed later in thi ...

Benchmarking a Transition Economy Capital Market

... should be. Without such analysis it is difficult to determine the nature of investment within a transition economy. In the absence of a liquid and efficient stock market, economic agents cannot invest with the knowledge that adequate liquidity is present to reduce many risks. In this situation, an i ...

... should be. Without such analysis it is difficult to determine the nature of investment within a transition economy. In the absence of a liquid and efficient stock market, economic agents cannot invest with the knowledge that adequate liquidity is present to reduce many risks. In this situation, an i ...

1.8 billion.

... Apartments projects. These impairments related primarily to projects in NSW, where the market was particularly poor, and those at the high end of the market where prices have fallen. No further impairments are expected unless market conditions materially deteriorate further. The balance of unimpaire ...

... Apartments projects. These impairments related primarily to projects in NSW, where the market was particularly poor, and those at the high end of the market where prices have fallen. No further impairments are expected unless market conditions materially deteriorate further. The balance of unimpaire ...

The Great Housing Boom of China - Economic Research

... Housing Price Growth and the Vacancy Rate ...

... Housing Price Growth and the Vacancy Rate ...

Alfjaneirtnjanjgahjktnm,brazjklhhjkznm

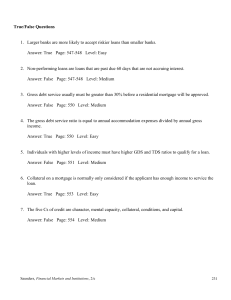

... 37. Business credit scoring models suffer from several weaknesses. These include all but which one of the following? A) Credit score models classify borrowers as either default or non-default with no classification in between. B) The appropriate weights on a credit score model are likely to change o ...

... 37. Business credit scoring models suffer from several weaknesses. These include all but which one of the following? A) Credit score models classify borrowers as either default or non-default with no classification in between. B) The appropriate weights on a credit score model are likely to change o ...

Indirect Cost of Natural Disasters

... In the absence of vulnerability curves for the buildings that can be found in Mumbai, the analysis uses “average damage ratio”. It is assumed that when a property is flooded, a constant share of its value is lost, regardless of the water level and the detailed characteristics of buildings. Using th ...

... In the absence of vulnerability curves for the buildings that can be found in Mumbai, the analysis uses “average damage ratio”. It is assumed that when a property is flooded, a constant share of its value is lost, regardless of the water level and the detailed characteristics of buildings. Using th ...

External Financing and Customer Capital: A Financial Theory

... Lang and Litzenberger, 1989; Chen and Lee, 1995; Bharadwaj, Bharadwaj and Konsynski, 1999), is lower when its product price is stickier. This readily implies that the cost of price stickiness comes from three major channels: (1) compromised operating efficiency, as the firm may not be able to adjust ...

... Lang and Litzenberger, 1989; Chen and Lee, 1995; Bharadwaj, Bharadwaj and Konsynski, 1999), is lower when its product price is stickier. This readily implies that the cost of price stickiness comes from three major channels: (1) compromised operating efficiency, as the firm may not be able to adjust ...

united states securities and exchange commission

... repurchases; and discussions regarding the potential impact of economic conditions on our portfolio. These statements are based on beliefs and assumptions of Piedmont’s management, which in turn are based on currently available information. Important assumptions relating to the forward-looking state ...

... repurchases; and discussions regarding the potential impact of economic conditions on our portfolio. These statements are based on beliefs and assumptions of Piedmont’s management, which in turn are based on currently available information. Important assumptions relating to the forward-looking state ...

Monte Carlo Simulation in Financial Valuation

... This paper uses a simple equity growth model to simulate the future equity, earnings and payouts of companies, based on resampling of historical data for the return on equity and the fraction of earnings retained in the past. This is a reasonable model for companies whose earnings are related to the ...

... This paper uses a simple equity growth model to simulate the future equity, earnings and payouts of companies, based on resampling of historical data for the return on equity and the fraction of earnings retained in the past. This is a reasonable model for companies whose earnings are related to the ...

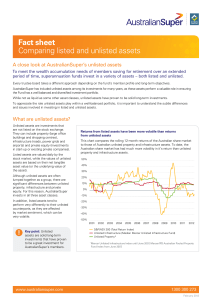

Fact sheet Comparing listed and unlisted assets

... few years. To understand why superannuation funds continue to believe unlisted assets remain a valuable part of their overall portfolio, it is worth looking at the impact of some of these factors in detail. ...

... few years. To understand why superannuation funds continue to believe unlisted assets remain a valuable part of their overall portfolio, it is worth looking at the impact of some of these factors in detail. ...

The Value Relevance of Regulatory Capital Components

... Empirical papers supporting Admati et al. (2013) include that by Mehran and Thakor (2011), who show that bank value increases with capital and thus respond to Modigliani and Miller (1958) and Miller (1995), who cling to capital structure irrelevance. Berger and Bouwman (2013) show that banks’ odds o ...

... Empirical papers supporting Admati et al. (2013) include that by Mehran and Thakor (2011), who show that bank value increases with capital and thus respond to Modigliani and Miller (1958) and Miller (1995), who cling to capital structure irrelevance. Berger and Bouwman (2013) show that banks’ odds o ...

BA ECONOMICS 271 VI SEMESTER CORE COURSE

... controversial subjects that would be impossible without mathematics. Much of Economics theory is currently presented in terms of mathematical Economic models, a set of stylized and simplified mathematical relationship asserted to clarify assumptions and implications. 1.2 The Nature of Mathematical E ...

... controversial subjects that would be impossible without mathematics. Much of Economics theory is currently presented in terms of mathematical Economic models, a set of stylized and simplified mathematical relationship asserted to clarify assumptions and implications. 1.2 The Nature of Mathematical E ...

STANDARD CHARTERED BANK (PAKISTAN) LIMITED

... continuing focus on our clients and customers and a prudent approach to building the balance sheet. Outlook ...

... continuing focus on our clients and customers and a prudent approach to building the balance sheet. Outlook ...

Mining, Exploration and Investment

... The period under review, our first post-listing, has been both challenging and exciting. A firm believer in serendipity, I also maintain that one’s strength is revealed through adversity. Having weathered the listing of our company amidst the global economic crisis, there can be little doubt that we ...

... The period under review, our first post-listing, has been both challenging and exciting. A firm believer in serendipity, I also maintain that one’s strength is revealed through adversity. Having weathered the listing of our company amidst the global economic crisis, there can be little doubt that we ...

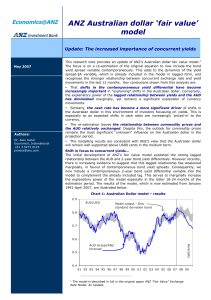

ANZ Australian dollar `fair value` model

... In Australia and the UK, ANZ Investment Bank is a business name of Australia and New Zealand Banking Group Limited, ABN 11 005 357 522 (“ANZBGL”) which is incorporated with limited liability in Australia. ANZBGL holds an Australian Financial Services licence no. 234527 and is authorised in the UK by ...

... In Australia and the UK, ANZ Investment Bank is a business name of Australia and New Zealand Banking Group Limited, ABN 11 005 357 522 (“ANZBGL”) which is incorporated with limited liability in Australia. ANZBGL holds an Australian Financial Services licence no. 234527 and is authorised in the UK by ...

Mitigating Systemic Risk - A Role for Securities Regulators

... regulators will be able to leverage work of other regulatory bodies in their efforts to identify activities in securities markets that contribute to systemic risk. It will be important however for securities regulators to identify or develop their own risk indicators through the use of both qualitat ...

... regulators will be able to leverage work of other regulatory bodies in their efforts to identify activities in securities markets that contribute to systemic risk. It will be important however for securities regulators to identify or develop their own risk indicators through the use of both qualitat ...

2017 10K - The York Water Company

... and maintenance of effective disinfection. The Company holds public water supply permits issued by the DEP, which establishes the groundwater source operating conditions for its wells, including demonstrated 4-log treatment of viruses. All of the satellite systems operated by the Company are in comp ...

... and maintenance of effective disinfection. The Company holds public water supply permits issued by the DEP, which establishes the groundwater source operating conditions for its wells, including demonstrated 4-log treatment of viruses. All of the satellite systems operated by the Company are in comp ...