a governança tem que ser exercida de fato

... ANIMEC (National Association of Capital Market Investors) has drawn up a handbook of twenty-two guidelines (see attached) that, in the opinion of non-controlling (minority) shareholders, will add significant value to the stock of publicly traded Brazilian companies. This idea arose from an analysis ...

... ANIMEC (National Association of Capital Market Investors) has drawn up a handbook of twenty-two guidelines (see attached) that, in the opinion of non-controlling (minority) shareholders, will add significant value to the stock of publicly traded Brazilian companies. This idea arose from an analysis ...

Introduction to Investments

... Bonds with no special security for investors. Investors rank alongside other creditors in the event of bankruptcy. ...

... Bonds with no special security for investors. Investors rank alongside other creditors in the event of bankruptcy. ...

Document in Word format

... Two days ago we received the last instalment for the repayment of the loan extended to Thailand in 1997. Readers will recall that in August 1997 Hong Kong decided to contribute US$1 billion to the US$17.2 billion financing package organised by the International Monetary Fund (IMF) to assist Thailand ...

... Two days ago we received the last instalment for the repayment of the loan extended to Thailand in 1997. Readers will recall that in August 1997 Hong Kong decided to contribute US$1 billion to the US$17.2 billion financing package organised by the International Monetary Fund (IMF) to assist Thailand ...

annual dinner of the chartered institute of bankers

... inclusion of the “unbanked” and the wider population. It would be possible to make payments for wide range of goods and services electronically (by the e-zwich smartcard), instead of by cash, as is currently the predominant practice in the economy. The e-zwich will be introduced early in the coming ...

... inclusion of the “unbanked” and the wider population. It would be possible to make payments for wide range of goods and services electronically (by the e-zwich smartcard), instead of by cash, as is currently the predominant practice in the economy. The e-zwich will be introduced early in the coming ...

a downloadable version

... U.S. Treasuries rallied on the week, even as equities and oil prices climbed. The 10year Treasury yield began the week at 2.06% and closed at 1.92% on January 29. (Yield and price are inversely related.) Driving the decline in yields was dovish language accompanying the Federal Reserve’s January 27 ...

... U.S. Treasuries rallied on the week, even as equities and oil prices climbed. The 10year Treasury yield began the week at 2.06% and closed at 1.92% on January 29. (Yield and price are inversely related.) Driving the decline in yields was dovish language accompanying the Federal Reserve’s January 27 ...

Financial Markets

... Safe investments have lowest return through fixed interest rates Stocks, bonds—no guaranteed rates; stocks—higher return over time If investing over long period, can risk losses in stock some years – if less time and money, may want safer investment Diversification gives better chance of offsetting ...

... Safe investments have lowest return through fixed interest rates Stocks, bonds—no guaranteed rates; stocks—higher return over time If investing over long period, can risk losses in stock some years – if less time and money, may want safer investment Diversification gives better chance of offsetting ...

Inv Club 04_09_10 - Sites at Lafayette

... R-Squared: Measures the percentage of an investment's movement that are attributable to movements in its benchmark index Standard Deviation: Measures how much return on an investment is deviating from the expected normal or average returns Sharpe Ratio: An indicator of whether an investment's return ...

... R-Squared: Measures the percentage of an investment's movement that are attributable to movements in its benchmark index Standard Deviation: Measures how much return on an investment is deviating from the expected normal or average returns Sharpe Ratio: An indicator of whether an investment's return ...

Anatomy of the Financial Crisis, with comments on Acemoglu

... Lehman Brothers, whose failure inflicted maximum adverse effect on the financial system in Sept. 2008, shows up with almost the highest risk rating by CoVaR, but also by VaR. ...

... Lehman Brothers, whose failure inflicted maximum adverse effect on the financial system in Sept. 2008, shows up with almost the highest risk rating by CoVaR, but also by VaR. ...

John Muellbauer

... • Log user cost amplifies falls at low levels, i.e. when recent years’ HP appreciation high relative to tax etc. adj. interest rate. • Similar fit and speed of adj. with LINEAR user cost and CUBIC in last year’s HP appreciation – like Hendry (1994), M&M (EJ 1997) ‘frenzy’ effect. • Similar results f ...

... • Log user cost amplifies falls at low levels, i.e. when recent years’ HP appreciation high relative to tax etc. adj. interest rate. • Similar fit and speed of adj. with LINEAR user cost and CUBIC in last year’s HP appreciation – like Hendry (1994), M&M (EJ 1997) ‘frenzy’ effect. • Similar results f ...

Chapter 1: ANSWERS TO DO YOU UNDERSTAND

... Solution: Financial Intermediaries (FI) can achieve economies of scale with specialization, with competition transactions costs involved in the flow of savings to investment is reduced, and FI with specialization can generate better information about borrowers and reduce bad debt losses. 3. What wou ...

... Solution: Financial Intermediaries (FI) can achieve economies of scale with specialization, with competition transactions costs involved in the flow of savings to investment is reduced, and FI with specialization can generate better information about borrowers and reduce bad debt losses. 3. What wou ...

Unstable Markets - Surbiton High School

... production in the non-agricultural sector. • But food is very income inelastic so farmers have not seen the benefits & have fallen even further behind on relative terms ...

... production in the non-agricultural sector. • But food is very income inelastic so farmers have not seen the benefits & have fallen even further behind on relative terms ...

Financial Stability 2011/

... review of the programme would not be unduly delayed. Positive developments in other areas, including a new report demonstrating that Iceland’s debt would be manageable for the long term and information on dramatically improved recovery from the Landsbanki estate, which will be used to repay the UK a ...

... review of the programme would not be unduly delayed. Positive developments in other areas, including a new report demonstrating that Iceland’s debt would be manageable for the long term and information on dramatically improved recovery from the Landsbanki estate, which will be used to repay the UK a ...

Spanish mortgage finance

... Banco de Valencia had to be rescued by the Span gov with 4.5 billion EUR (investment is entirely lost) Total fiscal loss estimate so far > EUR 50bln, total public exposure is EUR 400 bln (ECB plus Spanish gov) >20% of the loss has to be paid by small savers that invested in subordinated debt and hyb ...

... Banco de Valencia had to be rescued by the Span gov with 4.5 billion EUR (investment is entirely lost) Total fiscal loss estimate so far > EUR 50bln, total public exposure is EUR 400 bln (ECB plus Spanish gov) >20% of the loss has to be paid by small savers that invested in subordinated debt and hyb ...

Session 9: Pricing Policies and Practices

... - Crude ‘rule of thumb’ method - But assumes that cash inflows are known with a high degree of certainty - Neglects the profits over the whole life of the investment and after the pay off period. ...

... - Crude ‘rule of thumb’ method - But assumes that cash inflows are known with a high degree of certainty - Neglects the profits over the whole life of the investment and after the pay off period. ...

statement of risk - ACT Department of Treasury

... The Territory’s financial investments include some diversification across the domestic money and capital markets, including cash, short term debt instruments (maturity less than twelve months) and fixed interest bonds (maturity greater than twelve months), each of which has its own unique risk/retur ...

... The Territory’s financial investments include some diversification across the domestic money and capital markets, including cash, short term debt instruments (maturity less than twelve months) and fixed interest bonds (maturity greater than twelve months), each of which has its own unique risk/retur ...

0 5 10 15 20 25 30 (Unusual)

... • Production Opportunities: the return available within an economy from investment in productive assets. • Time Preferences for Consumption: The preferences of consumer for current consumption as opposed to saving for future consumption. • Risk: The chance that an investment will provide a low or ne ...

... • Production Opportunities: the return available within an economy from investment in productive assets. • Time Preferences for Consumption: The preferences of consumer for current consumption as opposed to saving for future consumption. • Risk: The chance that an investment will provide a low or ne ...

Presentation (PowerPoint Only)

... Mature economies net savings: negative 1 ¼ percent of GDP EM countries net savings: positive 4 ½ percent EM and mature economy current account balances mirrored net savings balances ...

... Mature economies net savings: negative 1 ¼ percent of GDP EM countries net savings: positive 4 ½ percent EM and mature economy current account balances mirrored net savings balances ...

ch697

... There is more than one possible future return. The probability of each outcome is unknown. ®1999 South-Western College Publishing ...

... There is more than one possible future return. The probability of each outcome is unknown. ®1999 South-Western College Publishing ...

20080617_MichaelKeen..

... BUT that does NOT mean carbon pricing now unnecessary: The external damage is still there… …and whether it is higher or lower than we thought depends on whether current prices reflect demand or supply shock Credibility of increasing future prices critical ...

... BUT that does NOT mean carbon pricing now unnecessary: The external damage is still there… …and whether it is higher or lower than we thought depends on whether current prices reflect demand or supply shock Credibility of increasing future prices critical ...

Financial Sector Evolution In the New Regulatory Environment

... aggressive monetary policy. Bank‐affiliated dealers are not as well placed as others, however, to maintain or increase their shares of recovering trading revenues. In absolute terms, some bank‐affiliated dealers are adapting their business plans to regulatory change and ...

... aggressive monetary policy. Bank‐affiliated dealers are not as well placed as others, however, to maintain or increase their shares of recovering trading revenues. In absolute terms, some bank‐affiliated dealers are adapting their business plans to regulatory change and ...

Key Investor Information

... Additional information about this category 5 The assigned risk category is based on an estimate of the subfund's future performance. The method used for this estimate depends on both the fund type and historical data. 5 Historical performance of the subfund is not a reliable indicator for future per ...

... Additional information about this category 5 The assigned risk category is based on an estimate of the subfund's future performance. The method used for this estimate depends on both the fund type and historical data. 5 Historical performance of the subfund is not a reliable indicator for future per ...

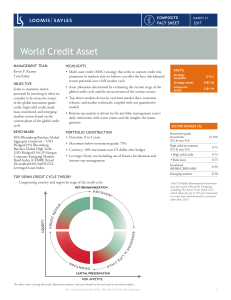

end of the golden age? - Virtus Investment Partners

... Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk. Foreign & Emerging Markets: Investing internationally, especially in e ...

... Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk. Foreign & Emerging Markets: Investing internationally, especially in e ...

Currency Briefing Users Guide

... acct balance, sovereign CDS rates, trader sentiment etc.) and organize it into a comparative format for asiting in trading plans. In addition, some relevant, topical economic news from many sources (Bloomberg, Financial Times, Retail Traffic, The Economist & others) is also included. A further goal ...

... acct balance, sovereign CDS rates, trader sentiment etc.) and organize it into a comparative format for asiting in trading plans. In addition, some relevant, topical economic news from many sources (Bloomberg, Financial Times, Retail Traffic, The Economist & others) is also included. A further goal ...