Pictet-Asian Local Currency Debt Fund Share in the potential

... securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Bef ...

... securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Bef ...

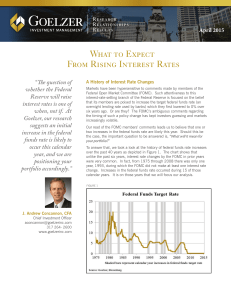

What to Expect From Rising Interest Rates

... unpredictable, the objective should be to build a portfolio that can withstand the market’s ups and downs in order to meet your long-term goals. At Goelzer we do that through a disciplined focus on diversification, quality, earnings, and valuations. ...

... unpredictable, the objective should be to build a portfolio that can withstand the market’s ups and downs in order to meet your long-term goals. At Goelzer we do that through a disciplined focus on diversification, quality, earnings, and valuations. ...

Harbor Mid Cap Value Fund

... The Consumer Discretionary sector was the primary driver of relative underperformance, due to stock selection, which had a negative impact overall. Utilities also weighed on relative returns, again due to stock selection. Conversely, sector allocation added value during the period, as an underweight ...

... The Consumer Discretionary sector was the primary driver of relative underperformance, due to stock selection, which had a negative impact overall. Utilities also weighed on relative returns, again due to stock selection. Conversely, sector allocation added value during the period, as an underweight ...

FIN 3000 Chapter 1 Principles of Finance

... To maximize firm value shareholder’s wealth (as measured by share prices). ...

... To maximize firm value shareholder’s wealth (as measured by share prices). ...

EM Corporate Bonds – Cheap Again

... selling may have included some sovereign wealth funds, which would explain the magnitude of the moves in some securities. If this is correct, another reason for optimism is that the technical selling pressure after Petrobras’ downgrade will likely subside. Late September and early October economic d ...

... selling may have included some sovereign wealth funds, which would explain the magnitude of the moves in some securities. If this is correct, another reason for optimism is that the technical selling pressure after Petrobras’ downgrade will likely subside. Late September and early October economic d ...

Cheung Kong Holdings - NYU Stern School of Business

... – Property boom nearing bubble proportions • In 2002, investment in real estate rose 36.6% while fixed-asset investment rose only 24% • Real estate vacancy rate at 26% – The vacancy rate in the US is only 7% – The international warning level is 10% ...

... – Property boom nearing bubble proportions • In 2002, investment in real estate rose 36.6% while fixed-asset investment rose only 24% • Real estate vacancy rate at 26% – The vacancy rate in the US is only 7% – The international warning level is 10% ...

Slide 1

... performance has been strong relative to competitors. 2. Returns were helped by relatively high allocations to hedged global shares, private markets and good relative performance in debt assets. ...

... performance has been strong relative to competitors. 2. Returns were helped by relatively high allocations to hedged global shares, private markets and good relative performance in debt assets. ...

Panasonic Manufacturing Malaysia Berhad Maintain NEUTRAL

... Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, ...

... Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, ...

Adiós The long awaited correction finally occurred. Prior to the

... represent only 13% of the US economy, while consumption represents 68%. Ultimately, given that the US economy is consumption‐driven, weaker oil and other commodity prices are economic benefits. In other words, the hit comes first; while the offsetting economic positive…comes a bit ...

... represent only 13% of the US economy, while consumption represents 68%. Ultimately, given that the US economy is consumption‐driven, weaker oil and other commodity prices are economic benefits. In other words, the hit comes first; while the offsetting economic positive…comes a bit ...

FIN 397 1-Investment Theory and Practice-Hallman

... We will first cover the overall layout of U.S. financial markets and the financial instruments available in the markets. After this overview we will go directly into the study of equity securities (stocks). The course will cover various methods of security analysis and valuation methods including fi ...

... We will first cover the overall layout of U.S. financial markets and the financial instruments available in the markets. After this overview we will go directly into the study of equity securities (stocks). The course will cover various methods of security analysis and valuation methods including fi ...

Commercialization of Technology

... • Venture capitalists generally: Finance new and rapidly growing companies; Purchase equity securities; Assist in the development of new products or services; Add value to the company through active participation; Take higher risks with the expectation of higher rewards; Have a long-term ...

... • Venture capitalists generally: Finance new and rapidly growing companies; Purchase equity securities; Assist in the development of new products or services; Add value to the company through active participation; Take higher risks with the expectation of higher rewards; Have a long-term ...

Document

... (a) the volume of worldwide cross-border transactions in stocks and bonds grew very rapidly, but the volume of international bank lending declined. (b) the volume of international bank lending grew very rapidly, but the volume of worldwide crossborder transactions in stocks and bonds declined. (c) t ...

... (a) the volume of worldwide cross-border transactions in stocks and bonds grew very rapidly, but the volume of international bank lending declined. (b) the volume of international bank lending grew very rapidly, but the volume of worldwide crossborder transactions in stocks and bonds declined. (c) t ...

Systematic risk

... Investors care only about the mean-variance trade-off of their portfolios in the next period All investors are price-takers. i.e., no investor is dominant such that her action alone will change prices – perfect competition assumption Investors have homogeneous beliefs and equal investment opportunit ...

... Investors care only about the mean-variance trade-off of their portfolios in the next period All investors are price-takers. i.e., no investor is dominant such that her action alone will change prices – perfect competition assumption Investors have homogeneous beliefs and equal investment opportunit ...

AN0008 - ANZ Australian Equities Capital

... rebounded +11.6% after experiencing tough market downgrades over the previous period. Interest rate-sensitive names across real estate investment trusts (REITs) were very mixed, leaving the sector flat over the quarter. Commercial/Industrial portfolios performed well while trusts with meaningful exp ...

... rebounded +11.6% after experiencing tough market downgrades over the previous period. Interest rate-sensitive names across real estate investment trusts (REITs) were very mixed, leaving the sector flat over the quarter. Commercial/Industrial portfolios performed well while trusts with meaningful exp ...

Document

... The following are the important parameters to be considered: 1) Risk – return framework. 2) Utility functions, or indifference curves. There can be various types of Indifference curves representing investors’ perceptions towards riskreturn. Thus there can be following categories of investors: ...

... The following are the important parameters to be considered: 1) Risk – return framework. 2) Utility functions, or indifference curves. There can be various types of Indifference curves representing investors’ perceptions towards riskreturn. Thus there can be following categories of investors: ...