Title of presentation located in this space

... This publication is the sole property of Jones Lang LaSalle IP, Inc. and must not be copied, reproduced or transmitted in any form or by any means, either in whole or in part, without the prior written consent of Jones Lang LaSalle IP, Inc. The information contained in this publication has been obta ...

... This publication is the sole property of Jones Lang LaSalle IP, Inc. and must not be copied, reproduced or transmitted in any form or by any means, either in whole or in part, without the prior written consent of Jones Lang LaSalle IP, Inc. The information contained in this publication has been obta ...

NEW PATHWAYS (RASASS)

... Undertake any relevant training as required by New Pathways. Undertake any other tasks not outlined in this job description but which will assist the aims and objectives of New Pathways. Essential: ...

... Undertake any relevant training as required by New Pathways. Undertake any other tasks not outlined in this job description but which will assist the aims and objectives of New Pathways. Essential: ...

Global Equities. BIFURCATED MARKET ENVIRONMENT LIKELY

... across most developed equity markets, possibly accelerating in the second half. The outlook for emerging equities is both more uncertain and more diverse, reflecting their varying exposures to changes in commodity prices. Our views on some key regions: United States: Recent consensus estimates hav ...

... across most developed equity markets, possibly accelerating in the second half. The outlook for emerging equities is both more uncertain and more diverse, reflecting their varying exposures to changes in commodity prices. Our views on some key regions: United States: Recent consensus estimates hav ...

Document

... listings of public sector banks and entry of new private sector banks • Separate regulator for banking • We should not mix up insolvency with illiquidity ...

... listings of public sector banks and entry of new private sector banks • Separate regulator for banking • We should not mix up insolvency with illiquidity ...

Geren. Con.SU.J:t1nlil

... However, mandatory expensing, as proposed by the FASB, would require a value to be placed on a stock option before it has been exercised, when in fact the value of that option cannot even be determined until it is exercised. Not only does this make no sense at all, it would be even another roadblock ...

... However, mandatory expensing, as proposed by the FASB, would require a value to be placed on a stock option before it has been exercised, when in fact the value of that option cannot even be determined until it is exercised. Not only does this make no sense at all, it would be even another roadblock ...

Revenue Recognition Certificates

... Given today’s Treasury rates of 2%, Govt needs to pay 0.3% of GDP of which principal is some $20 billion ...

... Given today’s Treasury rates of 2%, Govt needs to pay 0.3% of GDP of which principal is some $20 billion ...

Transaction Exposure

... Operating (Economic) Exposure – change in firm PV resulting from change in expected future operating cash flows due to unexpected forex change ...

... Operating (Economic) Exposure – change in firm PV resulting from change in expected future operating cash flows due to unexpected forex change ...

KAVAR Canvas - Kavar Capital Partners, LLC

... In 5 of the last 6 trading days, the Dow Jones Industrial Average has closed higher or lower than the previous session by more than 125 points1 – rare in a stock market tenderized with tranquility. Fears of any Federal Reserve Bank interest rate alterations The Fed meets this week, a 2-day dalliance ...

... In 5 of the last 6 trading days, the Dow Jones Industrial Average has closed higher or lower than the previous session by more than 125 points1 – rare in a stock market tenderized with tranquility. Fears of any Federal Reserve Bank interest rate alterations The Fed meets this week, a 2-day dalliance ...

Calculus Worked-Out Problem 14.2: The Problem Consider again

... same as in Calculus Worked-Out Problem 14.1. They include $845 in fixed costs and variable costs equal to VC = 5Q + Q2/80, where Q is the number of pizzas produced in a day. Suppose that in the long run, there is free entry into the market and the fixed cost is avoidable. What are the long-run marke ...

... same as in Calculus Worked-Out Problem 14.1. They include $845 in fixed costs and variable costs equal to VC = 5Q + Q2/80, where Q is the number of pizzas produced in a day. Suppose that in the long run, there is free entry into the market and the fixed cost is avoidable. What are the long-run marke ...

Managerial Economics—Meaning,nature,scope

... All managerial decision problems are solved with the help of tools ,concepts and principles in….a) Economic theory; b) Managerial economics c) Mathematical economics. Role of economic theory---In any business, the businessman has to decide what , how ,when ,how much , whom , where etc. ...

... All managerial decision problems are solved with the help of tools ,concepts and principles in….a) Economic theory; b) Managerial economics c) Mathematical economics. Role of economic theory---In any business, the businessman has to decide what , how ,when ,how much , whom , where etc. ...

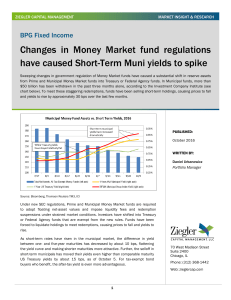

2015 MARKET OUTLOOK - WT Wealth Management

... Our view is that the current bull market is secular, not cyclical. Secular bull markets—like from 1949 to 1968 and 1982 to 2000—are extended bull markets characterized by above-average annualized returns and generally less-dramatic downside risk. Plus, lower energy prices put downward pressure on ov ...

... Our view is that the current bull market is secular, not cyclical. Secular bull markets—like from 1949 to 1968 and 1982 to 2000—are extended bull markets characterized by above-average annualized returns and generally less-dramatic downside risk. Plus, lower energy prices put downward pressure on ov ...

Housing Finance in Emerging Markets: Policy and

... Risks in Origination Process Credit Risk: Non-verification of borrower ability and willingness to pay can contribute to higher default rates Fraud: Misleading or inaccurate information provided by appraiser, guarantor, credit information provider Agency Risk: Third party does not follow guidelines ...

... Risks in Origination Process Credit Risk: Non-verification of borrower ability and willingness to pay can contribute to higher default rates Fraud: Misleading or inaccurate information provided by appraiser, guarantor, credit information provider Agency Risk: Third party does not follow guidelines ...

Portfolio Theory - University of Toronto

... rewards of individual securities in constructing their portfolios. Standard investment advice was to identify those securities that offered the best opportunities for gain with the least risk and then construct a portfolio from these. Following this advice, an investor might conclude that railroad s ...

... rewards of individual securities in constructing their portfolios. Standard investment advice was to identify those securities that offered the best opportunities for gain with the least risk and then construct a portfolio from these. Following this advice, an investor might conclude that railroad s ...

Great Eastern Concludes Financial Year 2016 with Strong New

... Koh Li-San Vice President, Group Finance Tel: (65) 6248 2000 Email: [email protected] ...

... Koh Li-San Vice President, Group Finance Tel: (65) 6248 2000 Email: [email protected] ...

Identifying financial services

... simple deposit-loan case but the logic of measuring implicitly priced financial services extends directly to a more general case with other assets involved – it emphasises the fact that both sides of the balance sheet are important for the production of a financial service ==> link back to definitio ...

... simple deposit-loan case but the logic of measuring implicitly priced financial services extends directly to a more general case with other assets involved – it emphasises the fact that both sides of the balance sheet are important for the production of a financial service ==> link back to definitio ...

Mr. Bleu - Advisor Perspectives

... must admit that one fabulous Picasso with signature “Sue”, heads the fireplace mantle in our bedroom. My own artistic skills are severely limited – I even suspect I am missing the entire right half of my brain which drives fine motor skills and the ability to draw. Because of the auction catalogues ...

... must admit that one fabulous Picasso with signature “Sue”, heads the fireplace mantle in our bedroom. My own artistic skills are severely limited – I even suspect I am missing the entire right half of my brain which drives fine motor skills and the ability to draw. Because of the auction catalogues ...