Risk and Return

... Principle of Diversification: Spreading an investment across a number of assets will eliminate some, but not all, of the risk. Diversification is not putting all your eggs in one basket. A typical NYSE stock has a standard deviation of annual returns of 49.24%, while the typical portfolio of 100 o ...

... Principle of Diversification: Spreading an investment across a number of assets will eliminate some, but not all, of the risk. Diversification is not putting all your eggs in one basket. A typical NYSE stock has a standard deviation of annual returns of 49.24%, while the typical portfolio of 100 o ...

The Intersection of Finance and Insurance - mynl.com

... hedge market risk associated with approximately 19.3 million of the 36.1 million shares of Global Crossing owned by the Company. These option agreements were structured as collars in which the Company purchased put options and sold call options on Global Crossing common stock. The average exercise p ...

... hedge market risk associated with approximately 19.3 million of the 36.1 million shares of Global Crossing owned by the Company. These option agreements were structured as collars in which the Company purchased put options and sold call options on Global Crossing common stock. The average exercise p ...

Cost of Capital Corporations often use different costs of capital for

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

BM410-08 Theory 1 - Risk and Return 20Sep05

... Is Standard Deviation still the best measure? Do you care about risk if it is in your favor, i.e. if it adds positive return? What about other measures, such as downside variance, i.e. semi-standard deviation? ...

... Is Standard Deviation still the best measure? Do you care about risk if it is in your favor, i.e. if it adds positive return? What about other measures, such as downside variance, i.e. semi-standard deviation? ...

Chapter 8 - FIU Faculty Websites

... The financial system consists of those institutions in the economy that help to match one person's saving with another person's investment. ...

... The financial system consists of those institutions in the economy that help to match one person's saving with another person's investment. ...

ECONOMIC ANALYSIS OF PROJECTS

... economic efficiency. However, there are many cases in which markets depart from these conditions. Market failure and the government intervention often distort the market from achieving economic efficiency. When government failure or market failure exist, some form of shadow pricing may be required i ...

... economic efficiency. However, there are many cases in which markets depart from these conditions. Market failure and the government intervention often distort the market from achieving economic efficiency. When government failure or market failure exist, some form of shadow pricing may be required i ...

SET2 - CBSE

... firms. Other firms reach to it. So while taking any decision about output or price, a firm takes into account the reaction of other firms to these decisions. It makes oligopoly firms interdependent. ...

... firms. Other firms reach to it. So while taking any decision about output or price, a firm takes into account the reaction of other firms to these decisions. It makes oligopoly firms interdependent. ...

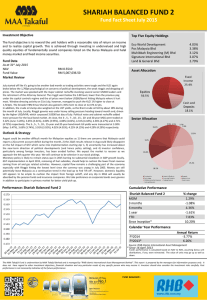

Asset Allocation Views

... In Europe, meanwhile, we are seeing signs of stabilisation in the cyclical environment, equity valuations look relatively attractive and monetary policy will be supportive. The euro has been the main beneficiary of dollar strength as it has weakened significantly, providing a boost to corporate earn ...

... In Europe, meanwhile, we are seeing signs of stabilisation in the cyclical environment, equity valuations look relatively attractive and monetary policy will be supportive. The euro has been the main beneficiary of dollar strength as it has weakened significantly, providing a boost to corporate earn ...

Global Economic and Financial Markets Summary

... a 16-month high in June, led by strength in the peripheral countries of Italy and Spain. The European Central Bank cut interest rates in May, and governments across the periphery are shoring up their finances, reducing the need for external borrowing, and easing stress in the debt markets. While aus ...

... a 16-month high in June, led by strength in the peripheral countries of Italy and Spain. The European Central Bank cut interest rates in May, and governments across the periphery are shoring up their finances, reducing the need for external borrowing, and easing stress in the debt markets. While aus ...

Opportunities for Small Life Insurance Companies to Improve Asset

... major investors, a high-profile default, or other factors. Prices of corporate high-yield debt instruments often are closely linked with the company’s stock prices and typically rise and fall in response to factors that affect stock prices. High-yield debt instruments are generally less liquid than ...

... major investors, a high-profile default, or other factors. Prices of corporate high-yield debt instruments often are closely linked with the company’s stock prices and typically rise and fall in response to factors that affect stock prices. High-yield debt instruments are generally less liquid than ...

Prof. Spence`s presentation (.pps)

... In some countries this may derail it for a longer period (for political as well as economic reasons) Confidence in the stability of global economy is shaken and will not return right away Balance of benefits and risks in the global economy may be shifting at least for awhile ...

... In some countries this may derail it for a longer period (for political as well as economic reasons) Confidence in the stability of global economy is shaken and will not return right away Balance of benefits and risks in the global economy may be shifting at least for awhile ...

Developing a Financial Planning Model

... Internal data that describes the current state of the system Firm’s financial statements Resources and capacities ...

... Internal data that describes the current state of the system Firm’s financial statements Resources and capacities ...

Description of Financial Instruments and

... of institutions sell bonds. Generally, a bond is a promise to repay the principal along with interest on a specified date (maturity). Some bonds do not pay interest, but all bonds require a repayment of principal. Buyers of bonds do not gain any kind of ownership rights to the issuer, unlike in the ...

... of institutions sell bonds. Generally, a bond is a promise to repay the principal along with interest on a specified date (maturity). Some bonds do not pay interest, but all bonds require a repayment of principal. Buyers of bonds do not gain any kind of ownership rights to the issuer, unlike in the ...

Powerpoint Lecture

... Pricing to meet competition Pricing to earn a specific profit Pricing based on consumer demand Pricing to sell more products Pricing to provide customer services ...

... Pricing to meet competition Pricing to earn a specific profit Pricing based on consumer demand Pricing to sell more products Pricing to provide customer services ...

Foundations of Business

... By Ransdell Pierson NEW YORK, Jan 13 (Reuters) - One of Merck & Co's (MRK) most important experimental drugs, blood clot preventer Vorapaxar, has been deemed inappropriate for patients who have suffered a stroke, dashing investor hopes and erasing nearly $8 billion from its market value. Vorapaxar, ...

... By Ransdell Pierson NEW YORK, Jan 13 (Reuters) - One of Merck & Co's (MRK) most important experimental drugs, blood clot preventer Vorapaxar, has been deemed inappropriate for patients who have suffered a stroke, dashing investor hopes and erasing nearly $8 billion from its market value. Vorapaxar, ...

Actuarially Consistent Valuation in an Integrated Market

... The potentialities inherent in the interface of capital markets and insurance markets have been increasingly emphasized by both the private and public sector. This economic and political trend is founded in the growing concerns among societies and individuals about risks whose nature and magnitude h ...

... The potentialities inherent in the interface of capital markets and insurance markets have been increasingly emphasized by both the private and public sector. This economic and political trend is founded in the growing concerns among societies and individuals about risks whose nature and magnitude h ...

Newsletter April 2010 - PNM Financial Management

... To achieve a total positive return in all market conditions through exposure to the global bond markets. The fund will invest primarily in, derivatives, cash and near cash, fixed interest securities, index linked securities, money market instruments and deposits. At times the portfolio may be concen ...

... To achieve a total positive return in all market conditions through exposure to the global bond markets. The fund will invest primarily in, derivatives, cash and near cash, fixed interest securities, index linked securities, money market instruments and deposits. At times the portfolio may be concen ...

Financial Crises: Mechanisms, Prevention, and Management

... Second, the volatility of a price process can vary over time. A sharp price decline may signal that we are about to enter more volatile times. Consequently, margins and haircuts should be larger and lending should be reduced after such a price decline. An extreme example was the situation in August ...

... Second, the volatility of a price process can vary over time. A sharp price decline may signal that we are about to enter more volatile times. Consequently, margins and haircuts should be larger and lending should be reduced after such a price decline. An extreme example was the situation in August ...

Startup Financial Engineering Tutorial

... ◦ However, 15% growth versus 50% growth is consistent with observed 90% public equity decline ◦ Next-generation areas will grow much faster (50%) ...

... ◦ However, 15% growth versus 50% growth is consistent with observed 90% public equity decline ◦ Next-generation areas will grow much faster (50%) ...