Financial Liberalisation In New Zealand

... Empirical results for New Zealand indicate that financial liberalisation has had a positive impact on investment but a negative impact on savings ...

... Empirical results for New Zealand indicate that financial liberalisation has had a positive impact on investment but a negative impact on savings ...

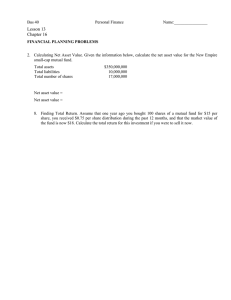

Lesson 13 key - Bakersfield College

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

Perfect Competition and Monopoly

... • What is the profit-maximizing output level? • What is the profit-maximizing price? • What role does cost play in determining output and price? ...

... • What is the profit-maximizing output level? • What is the profit-maximizing price? • What role does cost play in determining output and price? ...

Systemic Risk and Sentiment

... 2011) emphasizes the importance of systemic risk and sentiment. These two concepts, and the relationship between them, are important for regulatory bodies. • The FCIC describes systemic risk as “a precipitous drop in asset prices, resulting in collateral calls and reduced liquidity.” In its report, ...

... 2011) emphasizes the importance of systemic risk and sentiment. These two concepts, and the relationship between them, are important for regulatory bodies. • The FCIC describes systemic risk as “a precipitous drop in asset prices, resulting in collateral calls and reduced liquidity.” In its report, ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... household surveys; the Flow of Funds Accounts report book values. As a rule, data sets in which the unit of observation is an economic agent provide little information on the nature of contracts beyond book value or fair value. In contrast, transaction data tend to come with more detailed informatio ...

... household surveys; the Flow of Funds Accounts report book values. As a rule, data sets in which the unit of observation is an economic agent provide little information on the nature of contracts beyond book value or fair value. In contrast, transaction data tend to come with more detailed informatio ...

Ensure comprehensive financial regulation

... and limiting its impact Imperfect markets • Incomplete information about physical assets, which does not cover all commodities • The physical and financial commodities markets are insufficiently regulated compared to other markets, and thus open to abuses What we plan to do • Reduce volatility throu ...

... and limiting its impact Imperfect markets • Incomplete information about physical assets, which does not cover all commodities • The physical and financial commodities markets are insufficiently regulated compared to other markets, and thus open to abuses What we plan to do • Reduce volatility throu ...

chapter 9 - U of L Class Index

... A major problem with comparing a firm to its industry is that you may not feel comfortable with the measure of central tendency for the industry. Specifically, you may feel that the average value is not a very useful measure because of the wide dispersion of values for the individual firms within th ...

... A major problem with comparing a firm to its industry is that you may not feel comfortable with the measure of central tendency for the industry. Specifically, you may feel that the average value is not a very useful measure because of the wide dispersion of values for the individual firms within th ...

NBER WORKING PAPER SERIES

... been rarely has capital corporate that fact the of account takes which model, two—real--asset richer a In growth. productivity in fall a to response in occurs pattern same This unity. exceeds consumption in substitution of elasticity intertemporal the if only risk equity increasing with fall values ...

... been rarely has capital corporate that fact the of account takes which model, two—real--asset richer a In growth. productivity in fall a to response in occurs pattern same This unity. exceeds consumption in substitution of elasticity intertemporal the if only risk equity increasing with fall values ...

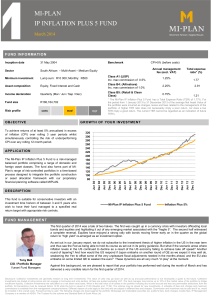

Schroder ISF* Latin American

... eurozone composite PMI index reached a 73-month high. Latin American markets finished in negative territory, owing to a decline in the Brazilian market. Ongoing weakness in commodity prices was also a headwind. The MSCI Latin America 10/40 index posted a negative return to underperform the MSCI Emer ...

... eurozone composite PMI index reached a 73-month high. Latin American markets finished in negative territory, owing to a decline in the Brazilian market. Ongoing weakness in commodity prices was also a headwind. The MSCI Latin America 10/40 index posted a negative return to underperform the MSCI Emer ...

Study of simple SIR epidemic model

... The Simple epidemic model developed by Kermack and Mckendrick in 1927. This model establishes the broad principles of epidemiology and is a building block for the later [1,2,3,7]. Mathematical model are important tools are analyzing the spread and control of infectious disease. The name epidemiology ...

... The Simple epidemic model developed by Kermack and Mckendrick in 1927. This model establishes the broad principles of epidemiology and is a building block for the later [1,2,3,7]. Mathematical model are important tools are analyzing the spread and control of infectious disease. The name epidemiology ...

Ch7 Portf theory sols 12ed

... c. The Capital Asset Pricing Model (CAPM) is a general equilibrium market model developed to analyze the relationship between risk and required rates of return on assets when they are held in well-diversified portfolios. The SML is part of the CAPM. The Capital Market Line (CML) specifies the effic ...

... c. The Capital Asset Pricing Model (CAPM) is a general equilibrium market model developed to analyze the relationship between risk and required rates of return on assets when they are held in well-diversified portfolios. The SML is part of the CAPM. The Capital Market Line (CML) specifies the effic ...

The Case for Middle Market Lending

... What is “middle market” lending, and why should investors know about it? The U.S. “middle market” consists of around 200,000 businesses, which are privately held and generally classified by revenue (e.g., under $1 billion) or EBITDA (e.g., $5-50 million). The U.S. middle market produces about one-th ...

... What is “middle market” lending, and why should investors know about it? The U.S. “middle market” consists of around 200,000 businesses, which are privately held and generally classified by revenue (e.g., under $1 billion) or EBITDA (e.g., $5-50 million). The U.S. middle market produces about one-th ...

Lecture Presentation to accompany Investment Analysis & Portfolio

... Borrowing requires fixed payments which must be paid ahead of payments to stockholders. The use of debt increases uncertainty of stockholder income and causes an increase in the stock’s risk premium. ...

... Borrowing requires fixed payments which must be paid ahead of payments to stockholders. The use of debt increases uncertainty of stockholder income and causes an increase in the stock’s risk premium. ...

[Ke E/(E+D)] + [Kd D/(E+D)]

... if you are manager of a firm with no debt, and you generate high income and cash flows each year, you tend to become complacent. The complacency can lead to inefficiency and investing in poor projects Costs of debt Bankruptcy costs Agency costs Loss of future flexibility Corporate Finance ...

... if you are manager of a firm with no debt, and you generate high income and cash flows each year, you tend to become complacent. The complacency can lead to inefficiency and investing in poor projects Costs of debt Bankruptcy costs Agency costs Loss of future flexibility Corporate Finance ...

The Efficient Market Hypothesis

... • Arbel and Strebel gave another interpretation of smallfirm-in-January effect. Because small firms tend to be neglected by large institutional investors, information about smaller firms is less available. • This information deficiency makes smaller firms riskier investments that command higher retu ...

... • Arbel and Strebel gave another interpretation of smallfirm-in-January effect. Because small firms tend to be neglected by large institutional investors, information about smaller firms is less available. • This information deficiency makes smaller firms riskier investments that command higher retu ...

Graeme Oram Presentation[1]

... boundaries (The Challenge to Professionals) What are the priorities? In Short – The Solution is Strong Partnerships …. With A Clear Agenda for Change and a Commitment to Action It may be that creating strong partnerships to deliver affordable credit itself creates a gateway to wider financial inclus ...

... boundaries (The Challenge to Professionals) What are the priorities? In Short – The Solution is Strong Partnerships …. With A Clear Agenda for Change and a Commitment to Action It may be that creating strong partnerships to deliver affordable credit itself creates a gateway to wider financial inclus ...

economic overview

... and risky products. The results have been dismissals at high levels and overall reduction in staff. Commercial banks with SIVs/conduits: They will necessarily reduce their investment bank activities (originate to distribute) in favour of the traditional buy-and-hold model, while trying to capture ca ...

... and risky products. The results have been dismissals at high levels and overall reduction in staff. Commercial banks with SIVs/conduits: They will necessarily reduce their investment bank activities (originate to distribute) in favour of the traditional buy-and-hold model, while trying to capture ca ...

VRSK

... increasing risk based management and analytics in the P&C Insurance, Mortgage, Healthcare, and Supply-chain industries. •Potential catalysts are acquisitions, organic growth in both Risk Assessment and Decision Analytics, and share buybacks. ...

... increasing risk based management and analytics in the P&C Insurance, Mortgage, Healthcare, and Supply-chain industries. •Potential catalysts are acquisitions, organic growth in both Risk Assessment and Decision Analytics, and share buybacks. ...

File

... • A price floor is the minimum price that can be legally charged for a good or service. • The government interferes with market equilibrium when it creates a price floor. • Minimum wage is an example of a price floor. E. Napp ...

... • A price floor is the minimum price that can be legally charged for a good or service. • The government interferes with market equilibrium when it creates a price floor. • Minimum wage is an example of a price floor. E. Napp ...

Description of Financial Instruments and Principal

... government, states and provinces, cities, corporations, and many other types of institutions sell bonds. Generally, a bond is a promise to repay the principal along with interest on a specified date (maturity). Some bonds do not pay interest, but all bonds require a repayment of principal. Buyers of ...

... government, states and provinces, cities, corporations, and many other types of institutions sell bonds. Generally, a bond is a promise to repay the principal along with interest on a specified date (maturity). Some bonds do not pay interest, but all bonds require a repayment of principal. Buyers of ...

Word file - Islamic Development Bank

... weaknesses of the conventional system. It introduces greater discipline into the financial system by requiring the financier to share in the risk. It links credit expansion to the growth of the real economy by allowing credit primarily for the purchase of real goods and services which the seller own ...

... weaknesses of the conventional system. It introduces greater discipline into the financial system by requiring the financier to share in the risk. It links credit expansion to the growth of the real economy by allowing credit primarily for the purchase of real goods and services which the seller own ...

![[Ke E/(E+D)] + [Kd D/(E+D)]](http://s1.studyres.com/store/data/020124919_1-d1a577e860ab264b71a0e8a1a0742507-300x300.png)

![Graeme Oram Presentation[1]](http://s1.studyres.com/store/data/021314501_1-3cb04f79840be6ebc60c4382080f818a-300x300.png)