Measurement Uncertainty – Disclosure Requirements

... material and should be disclosed in the notes to the Summary Financial Statements. However, where there is potential variability of an amount less than $10 million, but the amount is significant to the ministry or organization, this amount should be reported. OCG Contact Information: Brendan Watkins ...

... material and should be disclosed in the notes to the Summary Financial Statements. However, where there is potential variability of an amount less than $10 million, but the amount is significant to the ministry or organization, this amount should be reported. OCG Contact Information: Brendan Watkins ...

Global Tensions and Economic Security -

... • In the Eurozone and Japan they are still trying to find ways to stimulate demand • In the U.S. and U.K interest rates are about to increase, but there is widespread concern that any movement back to normal might trigger financial turmoil • However leaving monetary policy loose will encourage exces ...

... • In the Eurozone and Japan they are still trying to find ways to stimulate demand • In the U.S. and U.K interest rates are about to increase, but there is widespread concern that any movement back to normal might trigger financial turmoil • However leaving monetary policy loose will encourage exces ...

Market Microstructure and Intermediation

... between buyers and sellers by acting as intermediaries ...

... between buyers and sellers by acting as intermediaries ...

Chapter 16

... However, the efficient market hypothesis states that no such profits exist because events and circumstances that lead to changing profits are usually incremental and partially anticipated in advance. Thus the gains from substantial gaps in the financial markets are rare exceptions rather than common ...

... However, the efficient market hypothesis states that no such profits exist because events and circumstances that lead to changing profits are usually incremental and partially anticipated in advance. Thus the gains from substantial gaps in the financial markets are rare exceptions rather than common ...

Seeking higher returns or lower risk through ETFs

... funds are diversified portfolios that can be used for ...

... funds are diversified portfolios that can be used for ...

Discrete-time affine term structure

... A (τ ) a real function, B = B (τ ) ∈ IRn a vector function and Xt ∈ IRn a vector collecting the n stochastic risk factors. As Dai and Singleton (2000) clearly show, ATSM constitute a wide class of models encompassing the majority of the most popular and standard models (for instance, the Vasiček (1 ...

... A (τ ) a real function, B = B (τ ) ∈ IRn a vector function and Xt ∈ IRn a vector collecting the n stochastic risk factors. As Dai and Singleton (2000) clearly show, ATSM constitute a wide class of models encompassing the majority of the most popular and standard models (for instance, the Vasiček (1 ...

Financial Development and Economic Growth: the Overview and the Research Direction

... to Based on Cross-section data and panel data Analysis Method, Vector Autoregressive Model banes d on the Time Series Data, can analyze the relation and evolution between the financial development and ...

... to Based on Cross-section data and panel data Analysis Method, Vector Autoregressive Model banes d on the Time Series Data, can analyze the relation and evolution between the financial development and ...

Investment Outlook

... • This presentation is not to be construed as investment advice • Girard is sometimes “early” in forecasts – Anomalies take time to correct ...

... • This presentation is not to be construed as investment advice • Girard is sometimes “early” in forecasts – Anomalies take time to correct ...

Royce Opportunity Fund

... All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee o ...

... All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee o ...

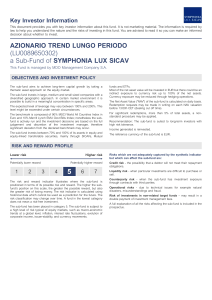

AZIONARIO TREND LUNGO PERIODO (LU0089650302) a Sub

... The sub-fund aims to achieve long-term capital growth by taking a thematic asset approach on the equity market. The sub-fund invests in large, medium and small sized companies with a diversified geographic approach. In certain market environment it is possible to build in a meaningful concentration ...

... The sub-fund aims to achieve long-term capital growth by taking a thematic asset approach on the equity market. The sub-fund invests in large, medium and small sized companies with a diversified geographic approach. In certain market environment it is possible to build in a meaningful concentration ...

Basel II

... Basel II has resulted in the evolution of a number of strategies to allow banks to make risky investments, such as the subprime mortgage market. Higher risks assets are moved to unregulated parts of holding companies. Alternatively, the risk can be transferred directly to investors by securitization ...

... Basel II has resulted in the evolution of a number of strategies to allow banks to make risky investments, such as the subprime mortgage market. Higher risks assets are moved to unregulated parts of holding companies. Alternatively, the risk can be transferred directly to investors by securitization ...

This PDF is a selection from a published volume from... Research Volume Title: Demography and the Economy

... and living standards will likely fall for some segments of the population in some economies, regardless of how the pension system is financed. A move to a funded system can possibly provide limited relief from the harmful effects of population aging. He also shows that if current levels of living sta ...

... and living standards will likely fall for some segments of the population in some economies, regardless of how the pension system is financed. A move to a funded system can possibly provide limited relief from the harmful effects of population aging. He also shows that if current levels of living sta ...

Financing natural disaster risk in developing countries

... Hurricane Mitch 1998: 2,000 million USD in direct losses of total assets (private and public), 18% of capital stock > 100 year event ...

... Hurricane Mitch 1998: 2,000 million USD in direct losses of total assets (private and public), 18% of capital stock > 100 year event ...

Presentation - Kerns Capital Management, Inc.

... and political uncertainty; and derivative securities, which may carry market, credit, and liquidity risks. The Fund may also engage in short selling activities, which are more risky than "long" positions because the potential loss on a short sell is unlimited. The Fund may use leveraging and/or hedg ...

... and political uncertainty; and derivative securities, which may carry market, credit, and liquidity risks. The Fund may also engage in short selling activities, which are more risky than "long" positions because the potential loss on a short sell is unlimited. The Fund may use leveraging and/or hedg ...

Is Fair Value Equal to Fair Market Value?

... The use of an asset by market participants that would maximize its value or the value of the group of assets in which those market participants would use it. An asset is valued using one of the following premises: 1. In use. This premise is used if the maximum value would be provided to market parti ...

... The use of an asset by market participants that would maximize its value or the value of the group of assets in which those market participants would use it. An asset is valued using one of the following premises: 1. In use. This premise is used if the maximum value would be provided to market parti ...

Practical Special Purpose Vehicles

... Catastrophic risks, compliance & KYC, corruption, money laundering Enron revisited ...

... Catastrophic risks, compliance & KYC, corruption, money laundering Enron revisited ...