This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconom

... adequately capture QE. Modern macroeconomic models used to evaluate policy have three main features. First, they net across entities and describe the behavior of the representative agent. Thus, gross positions do not matter. Second, quantitative models tend to assume arbitrage across markets. This m ...

... adequately capture QE. Modern macroeconomic models used to evaluate policy have three main features. First, they net across entities and describe the behavior of the representative agent. Thus, gross positions do not matter. Second, quantitative models tend to assume arbitrage across markets. This m ...

Chapter 6 - Arjan van Weele

... What is going well in the cooperation? What could or must get better? What is needed for improvement? How to measure the improvements? ...

... What is going well in the cooperation? What could or must get better? What is needed for improvement? How to measure the improvements? ...

Portuguese Banking System: Latest

... of solvency levels in 2013 resulted from the reduction of assets and not from the increase in own funds. ...

... of solvency levels in 2013 resulted from the reduction of assets and not from the increase in own funds. ...

Document

... ■ Causing huge bubbles in asset prices, including residential and commercial real estate ...

... ■ Causing huge bubbles in asset prices, including residential and commercial real estate ...

Minsa`s operating performance was deceivingly strong, as the stellar

... controlling expenses, as investment in the market will have to increase for it to successfully compete in the new environment. However, if the strategy is to undercut Maseca on price, AND not invest as much in the market, we would advise against it. Operating profit soared over 400%, 392.5% per ton. ...

... controlling expenses, as investment in the market will have to increase for it to successfully compete in the new environment. However, if the strategy is to undercut Maseca on price, AND not invest as much in the market, we would advise against it. Operating profit soared over 400%, 392.5% per ton. ...

external employment Role of financial inclusion in meeting the SDGs

... • Innovations in digital financial services (e.g. pay-as-you-go, mobile payments) are likely to accelerate access to these essential resources ...

... • Innovations in digital financial services (e.g. pay-as-you-go, mobile payments) are likely to accelerate access to these essential resources ...

Set 6 - Personal.psu.edu

... iv. And we could extend this out for longer-term bonds too. v. Notice what this implies though. a) If the yield curve slopes up, then short-rates are going to rise b) The yield curve typically slopes up. c) That means if this hypothesis is correct then we would typically see short rates increasing. ...

... iv. And we could extend this out for longer-term bonds too. v. Notice what this implies though. a) If the yield curve slopes up, then short-rates are going to rise b) The yield curve typically slopes up. c) That means if this hypothesis is correct then we would typically see short rates increasing. ...

Marketline Nov 13 - Cascade Investment Advisors

... expensive stocks is to sell them and repurchase cheap stocks. This is what we do every day – well, not every single day, but it’s what we strive to do on an ongoing basis. If we can’t find cheap stocks, then we will buy bonds or sometimes keep cash for a while. The level of the market has no effect ...

... expensive stocks is to sell them and repurchase cheap stocks. This is what we do every day – well, not every single day, but it’s what we strive to do on an ongoing basis. If we can’t find cheap stocks, then we will buy bonds or sometimes keep cash for a while. The level of the market has no effect ...

Cracking the WIP: Better financial management works

... meeting budget hours – while at the same time not explaining to them why it is important, as well as providing them with real-time information about actual performance (hopefully, the key figures being on one page and readily understandable!) The good news is that simple techniques are available to ...

... meeting budget hours – while at the same time not explaining to them why it is important, as well as providing them with real-time information about actual performance (hopefully, the key figures being on one page and readily understandable!) The good news is that simple techniques are available to ...

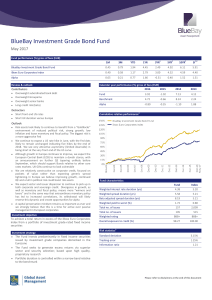

BlueBay Investment Grade Bond Fund

... investments. Investment in derivatives may involve a high degree of gearing or leverage, so that a relatively small movement in the price of the underlying investment results in a much larger movement in the price of the instrument, as a result of which prices are more volatile. All data has been so ...

... investments. Investment in derivatives may involve a high degree of gearing or leverage, so that a relatively small movement in the price of the underlying investment results in a much larger movement in the price of the instrument, as a result of which prices are more volatile. All data has been so ...

P 0 - Faculty Pages

... Recommend QuickBrush or SmileWhite stock for purchase by comparing each company’s intrinsic value with its current market price. Describe one strength of the two-stage DDM in comparison with the constant growth DDM. Describe one weakness inherent in all DDMs. ...

... Recommend QuickBrush or SmileWhite stock for purchase by comparing each company’s intrinsic value with its current market price. Describe one strength of the two-stage DDM in comparison with the constant growth DDM. Describe one weakness inherent in all DDMs. ...

Monetary Policy Update September 2009

... Stronger upturn abroad Rapid normalisation of situation in the financial markets ...

... Stronger upturn abroad Rapid normalisation of situation in the financial markets ...

Short-Term Income Fund - Investor Fact Sheet

... Weighted Average Effective Maturity is the average time to maturity of debt securities held in the fund. Weighted Average Effective Duration (sometimes called “Option-Adjusted Duration”) is a measure of a security’s price sensitivity to changes in interest rates calculated using a model that recogni ...

... Weighted Average Effective Maturity is the average time to maturity of debt securities held in the fund. Weighted Average Effective Duration (sometimes called “Option-Adjusted Duration”) is a measure of a security’s price sensitivity to changes in interest rates calculated using a model that recogni ...

O T Q 2014 Q

... Since Saddam Hussein was removed from power, and his statue was dragged through the streets of Baghdad like the tin cans tied to the back of a newlywed’s car, the seeds of unrest, which had been held at bay by the stranglehold of Mr. Hussein, have been allowed to blossom. The newest iteration is a g ...

... Since Saddam Hussein was removed from power, and his statue was dragged through the streets of Baghdad like the tin cans tied to the back of a newlywed’s car, the seeds of unrest, which had been held at bay by the stranglehold of Mr. Hussein, have been allowed to blossom. The newest iteration is a g ...

power consistency - Voya Investment Management

... Now there is a new way to evaluate funds and identify those that have delivered consistent excess returns with less risk of big losses. At Voya, we call it the Consistency Lens™. What’s the main benefit for you? Less stress. Market swings can cause you to worry about having enough money to retire co ...

... Now there is a new way to evaluate funds and identify those that have delivered consistent excess returns with less risk of big losses. At Voya, we call it the Consistency Lens™. What’s the main benefit for you? Less stress. Market swings can cause you to worry about having enough money to retire co ...

corporations amendment regulations (no

... updates to the market value and the rights of offerees if the provisions are not complied with. For example, in relation to shares, the disclosure regime applies where an offeror obtains shareholder details from a company's register and writes to individual shareholders (generally targeting small sh ...

... updates to the market value and the rights of offerees if the provisions are not complied with. For example, in relation to shares, the disclosure regime applies where an offeror obtains shareholder details from a company's register and writes to individual shareholders (generally targeting small sh ...

FACTORS DETERMINING THE FIRM`S COST OF CAPITAL

... of the firm’s securities (market conditions), operating and financing conditions within the company, and the amount of financing needed for new investments. Factor 1: General Economic Conditions General economic conditions determine the demand for and supply of capital within the economy, as well as ...

... of the firm’s securities (market conditions), operating and financing conditions within the company, and the amount of financing needed for new investments. Factor 1: General Economic Conditions General economic conditions determine the demand for and supply of capital within the economy, as well as ...

joeujeu - Chabot College

... Expected Outcomes for Students: Upon completion of this course, the student should be able to calculate: ...

... Expected Outcomes for Students: Upon completion of this course, the student should be able to calculate: ...

Too Much, Too Many - Goelzer Investment Management

... it is well above yields available on investment grade bonds, thereby compensating investors for the added volatility of owning stocks. We continue to be neutral on equity exposure relative to long-term targets. ...

... it is well above yields available on investment grade bonds, thereby compensating investors for the added volatility of owning stocks. We continue to be neutral on equity exposure relative to long-term targets. ...