inflation: ticking time bomb or damp squib?

... This material, including any statements, information, data and content contained within it and any materials, information, images, links, graphics or recording provided in conjunction with this material are being furnished by T. Rowe Price for general informational purposes only. The material is not ...

... This material, including any statements, information, data and content contained within it and any materials, information, images, links, graphics or recording provided in conjunction with this material are being furnished by T. Rowe Price for general informational purposes only. The material is not ...

Martin DD Evans Forex Trading and the WMR Fix

... financial markets. This paper presents statistical evidence pertinent to this issue. ...

... financial markets. This paper presents statistical evidence pertinent to this issue. ...

Measures of Total Debt Financing for Developing Countries

... • Transaction rating (assuming use of a structure to breach the sovereign ceiling) is limited by local currency rating of the transaction • Local currency ratings for infrastructure projects are generally limited by the sovereign’s local currency rating because of regulatory risk • In most developin ...

... • Transaction rating (assuming use of a structure to breach the sovereign ceiling) is limited by local currency rating of the transaction • Local currency ratings for infrastructure projects are generally limited by the sovereign’s local currency rating because of regulatory risk • In most developin ...

Negative Externality: A Framework for Contemplating Systemic Risk

... those decisions or actions might not serve, and might not be in the best interest of, the health of the financial system overall. In fact, individual firm activity might act against the common good by serving to decrease the solvency of the system. Such perverse incentives can easily result from non ...

... those decisions or actions might not serve, and might not be in the best interest of, the health of the financial system overall. In fact, individual firm activity might act against the common good by serving to decrease the solvency of the system. Such perverse incentives can easily result from non ...

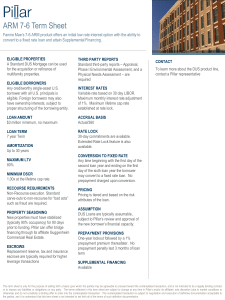

ARM 7-6 Term Sheet

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

CDS Spread Determinants

... running the time-series regressions for each firm Calculate the cross-sectional mean of the estimated coefficients. ...

... running the time-series regressions for each firm Calculate the cross-sectional mean of the estimated coefficients. ...

Slides - Courses

... Remember that a z-score tells us where a score is located within a distribution– specifically, how many standard deviation units the score is above or below the mean. ...

... Remember that a z-score tells us where a score is located within a distribution– specifically, how many standard deviation units the score is above or below the mean. ...

Reorganizing and Evolving Corporate Structures of

... Separation between the BOVESPA “trading access” and the “decision making power” The trading access and the others services provided by the Stock Exchange were separated The decision-making power now belongs to the shareholders (that will not be, necessarily, the former brokerage houses or the ...

... Separation between the BOVESPA “trading access” and the “decision making power” The trading access and the others services provided by the Stock Exchange were separated The decision-making power now belongs to the shareholders (that will not be, necessarily, the former brokerage houses or the ...

Intro to ratios

... that pushes the P/E down to 5, which would be remarkably cheap. Historically, most largecapitalization companies have had P/E ratios in the teens. For analysis of a company’s financial health, instead of its stock price, financial analysts use other ratios. These are derived using numbers made avail ...

... that pushes the P/E down to 5, which would be remarkably cheap. Historically, most largecapitalization companies have had P/E ratios in the teens. For analysis of a company’s financial health, instead of its stock price, financial analysts use other ratios. These are derived using numbers made avail ...

Open pit optimization and resource calculation of polymetallic

... might be used. For example, the NPV analysis with the use of ultimate pits gold and base scenarios for the first 10 years of the production shows 23,6 % advantage of NPV value (with 8% discount rate) for gold scenario. Simultaneously the average grade of gold is 5% higher and copper is 11% higher wi ...

... might be used. For example, the NPV analysis with the use of ultimate pits gold and base scenarios for the first 10 years of the production shows 23,6 % advantage of NPV value (with 8% discount rate) for gold scenario. Simultaneously the average grade of gold is 5% higher and copper is 11% higher wi ...

Quantitative Techniques and Financial Mathematics

... higher than the coupon rate,then the bond value decreases.This is because the present value of payments received decrease,leading to a fall in bond prices. When the interest rate decreases,and becomes lower than the coupon rate,then the present value of payments increases and the bond’s market price ...

... higher than the coupon rate,then the bond value decreases.This is because the present value of payments received decrease,leading to a fall in bond prices. When the interest rate decreases,and becomes lower than the coupon rate,then the present value of payments increases and the bond’s market price ...

Quantitative Techniques and Financial Mathematics

... higher than the coupon rate,then the bond value decreases.This is because the present value of payments received decrease,leading to a fall in bond prices. When the interest rate decreases,and becomes lower than the coupon rate,then the present value of payments increases and the bond’s market price ...

... higher than the coupon rate,then the bond value decreases.This is because the present value of payments received decrease,leading to a fall in bond prices. When the interest rate decreases,and becomes lower than the coupon rate,then the present value of payments increases and the bond’s market price ...

Quantitative Techniques and Financial Mathematics

... higher than the coupon rate,then the bond value decreases.This is because the present value of payments received decrease,leading to a fall in bond prices. When the interest rate decreases,and becomes lower than the coupon rate,then the present value of payments increases and the bond’s market price ...

... higher than the coupon rate,then the bond value decreases.This is because the present value of payments received decrease,leading to a fall in bond prices. When the interest rate decreases,and becomes lower than the coupon rate,then the present value of payments increases and the bond’s market price ...

(Keq) WITH THE TI-NSPIRE

... [NOCl] = 0.50 – 2x = 0.48 M [NO] = 2x = 2(9.8 x 10-3) = 1.9 x 10-2 M [Cl2] = x = 9.8 x 10-3M H. Selfcheck: Always check calculations by substituting the values that were determined into the Equilibrium Expression. If the K value calculated from these values equal the given value of K, then the calcu ...

... [NOCl] = 0.50 – 2x = 0.48 M [NO] = 2x = 2(9.8 x 10-3) = 1.9 x 10-2 M [Cl2] = x = 9.8 x 10-3M H. Selfcheck: Always check calculations by substituting the values that were determined into the Equilibrium Expression. If the K value calculated from these values equal the given value of K, then the calcu ...

Student Activity PDF

... [NOCl] = 0.50 – 2x = 0.48 M [NO] = 2x = 2(9.8 x 10-3) = 1.9 x 10-2 M [Cl2] = x = 9.8 x 10-3M H. Selfcheck: Always check calculations by substituting the values that were determined into the Equilibrium Expression. If the K value calculated from these values equal the given value of K, then the calcu ...

... [NOCl] = 0.50 – 2x = 0.48 M [NO] = 2x = 2(9.8 x 10-3) = 1.9 x 10-2 M [Cl2] = x = 9.8 x 10-3M H. Selfcheck: Always check calculations by substituting the values that were determined into the Equilibrium Expression. If the K value calculated from these values equal the given value of K, then the calcu ...

Notes

... Need limits on what can be said GAAP o A set of commonly accepted conventions backed up by some legally authoritative body GAAP is inductive, not deductive “open” o In other words, evolving, debateable. Users must have some idea of how the numbers were prepared to understand what they mean ...

... Need limits on what can be said GAAP o A set of commonly accepted conventions backed up by some legally authoritative body GAAP is inductive, not deductive “open” o In other words, evolving, debateable. Users must have some idea of how the numbers were prepared to understand what they mean ...

Ch - Pearson Canada

... efficiently a firm is using its assets. Asset management ratios are also known as efficiency ratios. Inventory turnover is an example. The economic resources owned by an enterprise. A financial statement which gives a snapshot of an enterprise's financial position at a particular point in time, norm ...

... efficiently a firm is using its assets. Asset management ratios are also known as efficiency ratios. Inventory turnover is an example. The economic resources owned by an enterprise. A financial statement which gives a snapshot of an enterprise's financial position at a particular point in time, norm ...

Lecture notes on the Theory of Nonrenewable Resources

... This equation expresses that the rent on the resource that is extracted just before reaching T must equal the expected rent on marginal resource unit just after the information about the uncertain price is revealed. (4.13) is thus a zero arbitrage condition at T , so that there is no "jump" in ( ...

... This equation expresses that the rent on the resource that is extracted just before reaching T must equal the expected rent on marginal resource unit just after the information about the uncertain price is revealed. (4.13) is thus a zero arbitrage condition at T , so that there is no "jump" in ( ...

Capital Requirements Directive - Pillar 3 Disclosures as at May 2017

... Due to the Firm’s size and nature of our activities the assessment has identified no additional risk- based capital requirements under pillar 2. Stress testing has shown that unless there is an exceptional down turn in economic conditions the Firm will continue to be able to meet its pillar 1 financ ...

... Due to the Firm’s size and nature of our activities the assessment has identified no additional risk- based capital requirements under pillar 2. Stress testing has shown that unless there is an exceptional down turn in economic conditions the Firm will continue to be able to meet its pillar 1 financ ...

Why Do Interest Rates Change?

... 1. The quantity demanded of an asset is usually positively related to wealth, with the response being greater if the asset is a luxury than if it is a necessity 2. The quantity demanded of an asset is positively related to its expected return relative to alternative assets 3. The quantity demanded o ...

... 1. The quantity demanded of an asset is usually positively related to wealth, with the response being greater if the asset is a luxury than if it is a necessity 2. The quantity demanded of an asset is positively related to its expected return relative to alternative assets 3. The quantity demanded o ...