* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Financial Development and Economic Growth: the Overview and the Research Direction

Survey

Document related concepts

Transcript

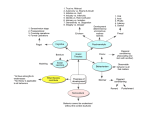

Financial Development and Economic Growth: the Overview and the Research Direction CHEN Pei, LIU Chuan Zhe, School of management China University of Mining and technology, P.R.China, 221008 Abstract: This text generalize and review the related literatures about the theories and demonstration research of financial development at home and abroad, perspicuity the research headway of financial development and economic growth, getting to see from the international trend, it will be the trend and orientation that estimate the strength that the financial development influences each channel accurately, explore the research direction that the more valid evaluation method will be the investigate direction; however, for the our country the article stresses it is an orientation that studying the theories of the financial development system, studying the relation of each other thoroughly from the aspects of the theory and substantial evidence that established in the special circumstance of the our country Keywords: Financial repression; where enterprise leads, finance follows the financial development , 1 Introduction 1.1 A few concepts Financial intermediaries Financial system Financial market Fig.1 Financial system The financial development usually refers is the financial system faces the good aspect to change. Namely "the financial system scale or the efficiency is enhanced" (Khan, 2,000). Manifests in the financial activity quantity and in the quality enhancement, or, more directly, reflected in the financial intermediation or financial market expansion, or the function improvement and the complexity of enhancement. What the finance development theories study is whether financial system has the function of promoting the economic growth or not. 1.2 The formation of the financial development theories The McKinnon and Shaw are financial developments theories of open mountain founder. In 1973 McKinnon: the currency and the capital in the economic development ; In 1973 Shaw: Finance Deepening in the economic development . Henceforth, in a longer period, Theoretical studies have not made much progress, duded to the lack of analytical tools and less convincing policy proposals. Only taking on the patchwork of McKinnon and Shaw theories, Empirical research doesn't have any development. 90's in 20 centuries, King& Levine thesis the finance and growth, Schumpeterian is perhaps right especially announced, starting the empirical research. The financial development theory from this stepped a stage of booming development, the related literature emerge in endlessly, become in recent years a hotspot research realm of the foreign economics, in our country, development of financial theory is even more pronounced. 1.3 The disagreement on the role of the financial system Studying on the function of financial system to economic growth, the economists have different viewpoints, concretely saying, it can is divided into three greatest camps. 1. The important function saying. The Reason: The financial system may provide the financing convenience for the large-scale project, 《 》 》 》 《 29 《 thus promoting the industrialization; Bank can provide the financing support toward the entrepreneur that has a creative opportunity, impels the technical. 2. The counter causal relation saying The conclusion is the economical growth causes the financial development, but is not the financial development causes the economical growth. 3. Unimportant saying The Robert Lucas (1988) thinks the function that the economist overestimates the role of the financial factor in economic growth. Development economists have often expressed doubts about the effect on the financial system. They ignored in the last financial. Economic development, including essays written by eminent scholars who did not mention financial, in the Review of Development Economics was not mentioned in the financial system. 1.4 The function of the financial system 1. Five kinds of functions in the Levine’s (1997) saying that mobilize savings; Resource allocation; Implementation of corporate control; Facilitating risk management; to facilitate the transaction 2.Six kinds of functions in the Khans(2000) saying that t Mobilize savings; Allocating savings; Risk reduction; Have mobility; Facilitate transactions; Implementation of corporate control; Authority managers. 3. Seven greatest functions in the Coles and Slade (1991) saying 2 The research on the relationship between financial development and economic growth 2.1 The theoretical research on relationship between financial development and economic growth 1. The macro view study The macro research is divided into two stages (1)70-80's in 20 centuries The means of the financial repression: One is carrying on control of the interest rate; One is promoting inflationism. The other one is ruling a higher legal reserve level The financial repression harm to the financial system The financial repression harm to the economy From the government's perspective, look at the financial benefits of restraint (2) the research since 1990's First, we will introduce the theories frame of Marco Pagano(1993), the Marco Pagano make a simple on the Endogenous Growth model AK model, investigate the function of financial development for economic growth. ① ② ③ ④ - - AK model: (1) = AK t t The Yt means the total output in the t term, the Kt means the capital in the beginning t term, the A is a constant, and its economic meaning is the unit of capital output or marginal output. Suppose the capital each term to be reduce with constant rate, namely, the depreciation rate is a constant(established for the δ ), the t then expects the capital of the beginning t term descend to leave for(1- δ )Kt in the next term, plus the investment level It in the t term ,the capital save t level is Kt+1 in the t+1 term, namely: K t +1 = (1 − δ ) K t + I t (2) We assume that the economy is closing inspectional, then it does not have the financial intermediary cost in the situation, the produce market balanced condition is It = St, St expresses the deposit in the t term. In the real world, the finance intermediary is engaged in the intermediary activity the general meeting to consume part of resources, namely the finance intermediary cannot deposit completely transforms into the investment which mobilizes, a part is detained in the financial department, and this is the financial intermediary cost. Supposes the ratio Ф deposit is consumed in the intermediary process, The Endogenous Growth model Y 30 and then under the close economic condition the produce market balanced condition is: (1 − φ ) S t + I t Y And g t +1 = (3) t +1 −1 = Y t K t +1 −1 K t (4) (5) = (1 − φ ) AS − δ t +1 t From the top formula we can see, the main factors affecting the growth are the cost of financial intermediaries’ Ф, the marginal product A and last time deposit rate st . Pagano said the financial impact on the development of these three factors can exert influence on growth. 2. micro-study We facilitate micro-depth study revealed the relationship between financial development and economic growth. Unfortunately, the current theory at the macro level of financial development has reached a high degree of technical proficiency level. This aspect research results huge collection of books and but the microscopic angle research literature actually appears extremely rare, this was a financial development theory soft rib. Since microscopic studies are few, we have a simple introduction. (1) The influence on the choice of technology entrepreneurs -McKinnon (1973) (2) the influence on the enterprise growth rate Kunt and Maksimovic(1998) (3) The microcosm effect of the financial development1 So g - Saving the transaction cost Lower the Financing cost Gain the low loan interest rate under the financial restraint Financial supervision strengthened beforehand Financial supervision strengthened in the middle Financial supervision afterwards Enterprises grow Financial development Lower the intermediation cost Increase the investment net income Raise the financing volume Improve the Investment efficiency strengthened Fig. 4 The microcosm effect of the financial development2 2.2 Demonstration research on the relation of the financial development economic growth. 1. Financial intermediaries and economic growth The relations between Financial intermediary property value /GNP and the economic growth rate (Goldsmith, 1,969), the afterwards research added the reflection of the Finance Deepening index. Conclusion: Have a positive correlativity 2. The stock market and economic growth Identifying indicators reflect the development of the stock market, and establish the correlation between per capita GDP. Some use a two-stage least squares (2SLS) variable regression model estimates, some use the ordinary least squares (OLS) estimates. ( 1,2 reference to the study of tanrutong(2002) Contemporary finance and economics 31 ,2002.9) Conclusion: The stock market has the growth effect and the level effect to the financial development ;( the influence of the GDP growth rate and GDP level); some educe the weak relativity. 3. The law and finance According to the research of three scholars of LLSV, the quality (Reflected in the categories legal protection for investors). Mainly is decided by two aspects: one is the characteristic of the law rule; two is the law implement quality. The Study result enunciation, law for finance development, especially, the development of the capital market is essential. Because the establishment (economic aspect) of the law oneself is for the sake of the protecting of the investment, therefore, the finance development can lead the economy growth. 4. The research in the micro-level Carries on the research finance system from the industry level to be helpful to overcoming the reversion choice and the moral risk to lower the business enterprise exterior financing cost mainly depending on the exterior financing in the industry development ; industry growth to economy have a direct function, industry growth performance is two aspects: one is a business enterprise quantity in the industry; Two is the extension of the existing average scale in the industry. Study enunciation: The finance development economic effect to the industry unit quantity augmentative almost 200%.than that to the industry unit extend 5. Carry on a research from the business enterprise layer The finance development business enterprise exterior financing convenience investment opportunity increment business enterprise growth acceleration. The stock market develops to the enterprise financing decision-making influence. - - - - - 3 The conclusion and enlightenment 3.1 Contribution That western theory research on the financial development is a widespread regulation in the market economy, is a long-term market economy summary about the practical experience , it is a referential experience in the finance development and perfect and financial system financial market of the our country. Some conditions in the western theories and assumption usually are exactly check and supervisions the bottleneck of our stock market, It can help us to seek wrong, also resolve the issue by comparing our country's practice with the western fully-fledged theory. The process that the local scholars issue according to the economic traits of China, in many respects has already become a consensus. It will lay a strong foundation for the further research. Moreover, what the scholars put forward the much suggestion in perfecting financial systems also has the much reference value in practice. 3.2 Shortage The financial environment that the abroad research mostly turns according to the pure market that conducts a higher efficiency, the financial system is perfect. It is different with the circumstance of our country. For the period that economy is switching, the reference function in the substantial evidence research is limited in addition to studying the method For the domestic studies, the systematic ness is not strong, valuing the macroscopic research of the financial development, despising the research on the Micro-level. The substantial evidence in the macroscopic relation between the widespread concern stock market growth and economic growth is analyzed by the scholars, however, how to put forward Chinese own standpoint , that is according to that the whole influence in the Micro-level and the quantity of influence is to be studied. 3.3 The research direction See from the international trend, the research will have two greatest tendencies in the financial development. First, in research content, from the point of view of microscopic, the research finance promoting function in the economy growth, estimating the finance each channel influences and the dynamic influence factors of economy will be a new content. Second, from research technique, different to Based on Cross-section data and panel data Analysis Method, Vector Autoregressive Model banes d on the Time Series Data, can analyze the relation and evolution between the financial development and 、 32 economic growth. Finance development of china is special, current research is obviously lagging behind. So there are some breakthrough in studying a method, but lack of the essential theory and practice accumulates the theories .The point of the current research should be the problem that need urgent solution. It is necessary to establish a stock market as soon as possible, which can allocate resources effectively, manage risk properly and enhance a company management etc. Therefore, the research direction will be concentrated in combing current domestic research on the factors of financial development, Unifying understanding of the financial development of the theoretical connotation; revealing the financial impact in the Deeper and micro-level; especially the mid –course; Finding out the influence factor of finance development and as to it's influence in the economy growth, also proposing the optimized way and adopting the valid measure. References [1] Huntington. Financial development and economic growth: based on empirical analysis [J]. Economic science, Issue 3, 2001:31-40(in Chinese). [2] Tan Ruyong. China's financial development and economic growth. The empirical study [J]. Economic research, Issue 10, 1999: 53-61(in Chinese). [3] Jin Yunhui, Yu Cungao. China’s stock market and economic growth. The empirical study(down).Contemporary finance Issue4,1998(in Chinese). [4] Hu Zongyi, Ning Guangrong. Capital market contributes to our country economic growth [J]. Hunan University Journal (Social sciences version), Issue 3, 2004: 35-38(in Chinese). [5] Fama, E. F., Stock Returns. Real Activity, Inflation, and Money. American Economic Review, 1981, 71(4): 545-565. [6] Beck, T., Levine, R., & Loayza, N. Finance and the sources of growth. Journal of Financial Economics, 2000, 58: 261-300. [7] Johansen, S. and Juselius K. Maximum Likelihood Estimation and Inferences on Cointegration - with Applications to the Demand for Money, Oxford Bulletin of Economics and Statistics, 1990,(52): 169-210. [8] Liu, L., Rettenmaier, A. J. and Wang, Z. The Long-Run Relationship between Gross Domestic Product Growth and Stock Returns, Working Paper, Private Enterprise Research Center, Texas A&M University.2005 [9] Benhabib, J. & Spiegel, M.M. The role of financial development in growth and investment. Journal of Economic Growth, 2005,(5): 341–360. [10] Christiano, L. Searching for a break in GNP. Journal of Business and Economic Statistics, 1992, (10):237-250. [11] Christopoulos, D.K. & Tsionas, E.G., Financial development and economic growth: evidence from panel unit root and cointegration tests. Journal of Development Economics, 2004,(73 : 55-74. [12] Deidda L. & Fattouh, B. Non-linearity between finance and growth. Economics Letters, 2002, (74):339–345. , ) The author can be contacted from e-mail : [email protected] 33