Chapter 29

... • Loan credit--borrow money for some special purpose • Sales credit--charge a purchase at the time you buy the good or service (charge accounts or credit cards) • Trade credit--used by a business when it receives goods from a wholesaler and pays for it at a specified date; 2/10, n/30 ...

... • Loan credit--borrow money for some special purpose • Sales credit--charge a purchase at the time you buy the good or service (charge accounts or credit cards) • Trade credit--used by a business when it receives goods from a wholesaler and pays for it at a specified date; 2/10, n/30 ...

Student Loans: Should Some Indebtedness Be Forgiven?

... more to do with brand new stadiums and six-figure administrative salaries. After all, if the degrees obtained today were worth the increased cost to obtain them, compared with thirty to forty years ago, then shouldn't those degrees also yield greater salaries upon graduation? Tuition rates continue ...

... more to do with brand new stadiums and six-figure administrative salaries. After all, if the degrees obtained today were worth the increased cost to obtain them, compared with thirty to forty years ago, then shouldn't those degrees also yield greater salaries upon graduation? Tuition rates continue ...

Forward Looking Statements / Guidance

... This presentation contains forward looking information. Forward looking information is based on management assumptions and analysis. Actual experience may differ, and those differences may be material. Forward looking information is subject to uncertainties and risks. This presentation must be read ...

... This presentation contains forward looking information. Forward looking information is based on management assumptions and analysis. Actual experience may differ, and those differences may be material. Forward looking information is subject to uncertainties and risks. This presentation must be read ...

The Interest Tax Deduction

... tc D With tax-deductible interest, the levered firm clearly has an advantage. This ...

... tc D With tax-deductible interest, the levered firm clearly has an advantage. This ...

Financialization and the crisis

... is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meaning that they borrow from corporations to pay for their consumption, financial and real esta ...

... is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meaning that they borrow from corporations to pay for their consumption, financial and real esta ...

Distr. LIMITED 19 February 2016

... In attempting to navigate these challenges, the subregion finds itself at a crossroads. Since the global financial crisis, the region has experienced low growth, high unemployment and a mounting public debt which has reduced the fiscal space necessary to vigorously pursue the goals of sustainable de ...

... In attempting to navigate these challenges, the subregion finds itself at a crossroads. Since the global financial crisis, the region has experienced low growth, high unemployment and a mounting public debt which has reduced the fiscal space necessary to vigorously pursue the goals of sustainable de ...

Chapter 17 INVESTMENTS Investment in Debt

... Chapter 17 INVESTMENTS Investment in Debt Securities Different motivations for investing: To earn a high rate of return. To secure certain operating or financing arrangements with another company. Companies account for investments based on the type of security (debt or equity) and their inte ...

... Chapter 17 INVESTMENTS Investment in Debt Securities Different motivations for investing: To earn a high rate of return. To secure certain operating or financing arrangements with another company. Companies account for investments based on the type of security (debt or equity) and their inte ...

Recent changes in the debt sustainability framework

... in recipient countries and has enabled them to increase their povertyreducing expenditure by almost three and a half percentage points of GDP between 2001 and 2012 ...

... in recipient countries and has enabled them to increase their povertyreducing expenditure by almost three and a half percentage points of GDP between 2001 and 2012 ...

Personal Finance Notes 1

... higher-income groups than from people in lower-income ones; the U.S. federal income tax is an example. Regressive Tax- A tax that takes a larger percentage of income from people in lower-income groups than from higher-income ones. Sales taxes and excise taxes are ...

... higher-income groups than from people in lower-income ones; the U.S. federal income tax is an example. Regressive Tax- A tax that takes a larger percentage of income from people in lower-income groups than from higher-income ones. Sales taxes and excise taxes are ...

The Year in Review Benchmark Returns Ending 12/31/2012

... The last time Congress went down the path of negotiating an increase in the nation’s debt ceiling, Standard and Poor’s downgraded US debt from AAA to AA+ as a result of another increase in the limit. If our thesis about the debt ceiling being raised again holds true, we would expect to see another ...

... The last time Congress went down the path of negotiating an increase in the nation’s debt ceiling, Standard and Poor’s downgraded US debt from AAA to AA+ as a result of another increase in the limit. If our thesis about the debt ceiling being raised again holds true, we would expect to see another ...

6. Key Indicators

... Measure of Debt Repayment Capacity 1. Term Debt and Capital Lease Coverage Ratio: • Funds available from operations to cover scheduled payments divided by scheduled principal payments on term loans and capital leases. • After provision for taxes and withdrawals. • Should be greater than 1.0. • Outs ...

... Measure of Debt Repayment Capacity 1. Term Debt and Capital Lease Coverage Ratio: • Funds available from operations to cover scheduled payments divided by scheduled principal payments on term loans and capital leases. • After provision for taxes and withdrawals. • Should be greater than 1.0. • Outs ...

a PDF of our value guide.

... The program will match the amount that families contribute from a 529 college savings plan or an Educational Savings Account, up to $2,500 per year, to pay for tuition. Students who qualify for the Saver’s Scholarship can still pursue other types of scholarship aid from both WC and elsewhere. ...

... The program will match the amount that families contribute from a 529 college savings plan or an Educational Savings Account, up to $2,500 per year, to pay for tuition. Students who qualify for the Saver’s Scholarship can still pursue other types of scholarship aid from both WC and elsewhere. ...

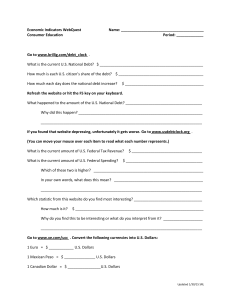

Unit 3: Economic Indicators WebQuest

... How much is each U.S. citizen’s share of the debt? $ _________________________________________ How much each day does the national debt increase? ...

... How much is each U.S. citizen’s share of the debt? $ _________________________________________ How much each day does the national debt increase? ...

Marie Hoerova: Discussion of E. Farhi, J. Tirole, Deadly

... • If worried about opaque / inadequate liquid asset holdings by banks… – cash reserves with the central bank make bank liquidity observable and verifiable – cash holdings can reduce bank risk-taking incentives (Calomiris, Heider and Hoerova, 2014) ...

... • If worried about opaque / inadequate liquid asset holdings by banks… – cash reserves with the central bank make bank liquidity observable and verifiable – cash holdings can reduce bank risk-taking incentives (Calomiris, Heider and Hoerova, 2014) ...