DEMOCRATIC REPUBLIC OF CONGO Debt Treatment

... their appropriate contribution in terms of debt relief to the enhanced HIPC Initiative, on top of traditional debt relief mechanisms and consistent with the proportional burden sharing based on their relative exposure in net present value of total external debt at Decision Point after the full use o ...

... their appropriate contribution in terms of debt relief to the enhanced HIPC Initiative, on top of traditional debt relief mechanisms and consistent with the proportional burden sharing based on their relative exposure in net present value of total external debt at Decision Point after the full use o ...

The Debt-Ceiling Crisis - Center for American Progress

... in the world. Thus, the borrowing rate on Treasuries is intertwined with the global economy in myriad ways. At the most basic level, this borrowing rate is used as a benchmark for interest rates on common financial products in the United States such as mortgages and auto loans. A spike in interest r ...

... in the world. Thus, the borrowing rate on Treasuries is intertwined with the global economy in myriad ways. At the most basic level, this borrowing rate is used as a benchmark for interest rates on common financial products in the United States such as mortgages and auto loans. A spike in interest r ...

Written evidence submitted by the Parliamentary Debt Management

... Debt management companies authorised by the Financial Conduct Authority can charge a fee for any compliant debt management where a consumer is contributing in excess of £50 per month into their arrangement. (2) In this section – “fee” means the sum charged by debt management companies to creditors a ...

... Debt management companies authorised by the Financial Conduct Authority can charge a fee for any compliant debt management where a consumer is contributing in excess of £50 per month into their arrangement. (2) In this section – “fee” means the sum charged by debt management companies to creditors a ...

The Risk and Term Structure of Interest Rates

... • Re-Securitization: A series of primary markets — The losses of information to investors are more and more as the chain of structure — securities and special purpose vehicles — stretches longer and longer (Gorton (2008)). — This is different from the “originate-to-distribute” view, which says that ...

... • Re-Securitization: A series of primary markets — The losses of information to investors are more and more as the chain of structure — securities and special purpose vehicles — stretches longer and longer (Gorton (2008)). — This is different from the “originate-to-distribute” view, which says that ...

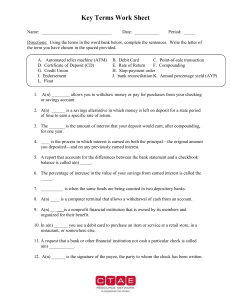

Debt and Easy Access Credit - Missouri Council for Economic

... Car title loans are set up to be repaid as a single large payment after a very short term, usually a month. The person taking the loan has to give the lender the title to his/her car or a set of keys. If the loan is not repaid in one month or another round of fees paid to extend the loan, the lender ...

... Car title loans are set up to be repaid as a single large payment after a very short term, usually a month. The person taking the loan has to give the lender the title to his/her car or a set of keys. If the loan is not repaid in one month or another round of fees paid to extend the loan, the lender ...

Impact of Macroprudential Policy Measures on Economic Dynamics: Simulation Using

... But nothing comes free • Inevitably aspects of structure are arbitrary - Banks can’t raise capital - Boom is always ‘false’ and of fixed duration - No household or firm balance sheets or ‘debt overhang’ ...

... But nothing comes free • Inevitably aspects of structure are arbitrary - Banks can’t raise capital - Boom is always ‘false’ and of fixed duration - No household or firm balance sheets or ‘debt overhang’ ...

Development - School

... • After countries began to default on their interest payments on multilateral loans, the IMF and WB introduced a range of ‘structural adjustment packages’. SAP’s are an agreement that the indebted country must sign up to in order for the IMF and WB to reschedule their debt repayment. SAP’s are rigor ...

... • After countries began to default on their interest payments on multilateral loans, the IMF and WB introduced a range of ‘structural adjustment packages’. SAP’s are an agreement that the indebted country must sign up to in order for the IMF and WB to reschedule their debt repayment. SAP’s are rigor ...

Businessworld - STAY AHEAD EVERY WEEK

... under CDR are standard assets," says Siby Antony, chief general manager, IDBI. Banks account for such restructured debts as standard assets though they are classified in a separate category from the other assets. Only a small portion of the loans which have been restructured so far (numbers aren't a ...

... under CDR are standard assets," says Siby Antony, chief general manager, IDBI. Banks account for such restructured debts as standard assets though they are classified in a separate category from the other assets. Only a small portion of the loans which have been restructured so far (numbers aren't a ...

DEBT - Association for Financial Professionals of Arizona

... Types of Financing: Debt, Debt plus equity, and Equity Restrictions: Percentage of capital issued, Interest rates and related ventures Length of financing agreements: Generally five years ...

... Types of Financing: Debt, Debt plus equity, and Equity Restrictions: Percentage of capital issued, Interest rates and related ventures Length of financing agreements: Generally five years ...

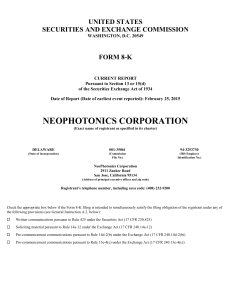

neophotonics corporation

... Documents ”) with The Bank of Tokyo-Mitsubishi UFJ, Ltd. (the “ Bank ”) that provided for (i) a term loan in the aggregate principal amount of 500 million Japanese Yen (approximately $4.2 million) (“ Contract A Loan ”) and (ii) a term loan in the aggregate principal amount of 1.0 billion Japanese Ye ...

... Documents ”) with The Bank of Tokyo-Mitsubishi UFJ, Ltd. (the “ Bank ”) that provided for (i) a term loan in the aggregate principal amount of 500 million Japanese Yen (approximately $4.2 million) (“ Contract A Loan ”) and (ii) a term loan in the aggregate principal amount of 1.0 billion Japanese Ye ...

Neither a Lender nor a Borrower Be

... instruments ensures its liquidity and cash equivalency for investors. The elimination of Treasuries would de facto force investors to seek substitutes. While local and state government agencies as well as foreign governments also issue debt, they are also less than perfect substitutes for Treasuries ...

... instruments ensures its liquidity and cash equivalency for investors. The elimination of Treasuries would de facto force investors to seek substitutes. While local and state government agencies as well as foreign governments also issue debt, they are also less than perfect substitutes for Treasuries ...

Section 2. Stock Market Crash and Great Depression Powerpoint File

... New technologies came about and even though people could not afford them, citizens would buy new radios, vacuums, etc which got them into more debt ...

... New technologies came about and even though people could not afford them, citizens would buy new radios, vacuums, etc which got them into more debt ...

The Fed`s 405% problem

... The broadly held consensus of strong US growth and higher rates took a bit of a knock in the past week, when Fed Chairman Ben Bernanke delayed tapering of QE. The markets had fully priced the policy change. What monster on the horizon prompted the U-turn? The official reason is that the economic dat ...

... The broadly held consensus of strong US growth and higher rates took a bit of a knock in the past week, when Fed Chairman Ben Bernanke delayed tapering of QE. The markets had fully priced the policy change. What monster on the horizon prompted the U-turn? The official reason is that the economic dat ...

Public Debt: Private Asset

... economy were to slide into a recession. One of the burdens they cite is that government debt tends to “crowd out” private investment. When it borrows, the federal government is competing for funds with private industries, state and local governments, and other borrowers. Despite this competition, th ...

... economy were to slide into a recession. One of the burdens they cite is that government debt tends to “crowd out” private investment. When it borrows, the federal government is competing for funds with private industries, state and local governments, and other borrowers. Despite this competition, th ...

democratic republic of congo

... Index declined by more than 10% in the last ten years; it now ranks 167 out of 177 countries. Since 2001, however, with support from the Bretton Woods Institutions (WB/IMF), the government has launched the implementation of economic, financial and structural refor ms aimed at stabilizing the macroec ...

... Index declined by more than 10% in the last ten years; it now ranks 167 out of 177 countries. Since 2001, however, with support from the Bretton Woods Institutions (WB/IMF), the government has launched the implementation of economic, financial and structural refor ms aimed at stabilizing the macroec ...

1 - BrainMass

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

An enhanced methodology of compiling financial

... FISIM should be compiled on the basis of the difference between market interest rates on loans and deposits and a reference rate as a rate between bank interest rates on deposits and loans. ...

... FISIM should be compiled on the basis of the difference between market interest rates on loans and deposits and a reference rate as a rate between bank interest rates on deposits and loans. ...

Golden Rule - ander europa

... • The macro-economic scoreboard does not take into account different levels of economic development of the member states and imposes a one-size-fits-all framework • During the run-up to the crisis the ECB kept interest rates low, which was helpful for the struggling German economy, but caused overhe ...

... • The macro-economic scoreboard does not take into account different levels of economic development of the member states and imposes a one-size-fits-all framework • During the run-up to the crisis the ECB kept interest rates low, which was helpful for the struggling German economy, but caused overhe ...

the three stages of raising money

... on any salvageable assets. These deal structures put further pressure on management to create a successful company. The initial investment, or first round of financing, is typically for a relatively small amount, often in the range of $2-$3 million, to get the enterprise started. VCs don’t like to ...

... on any salvageable assets. These deal structures put further pressure on management to create a successful company. The initial investment, or first round of financing, is typically for a relatively small amount, often in the range of $2-$3 million, to get the enterprise started. VCs don’t like to ...