Creditor Rights and Capital Structure: Evidence from International Data:

... low levels of long-term debt. This pattern is robust to controlling for key firm characteristics (e.g., firm size, profitability, asset tangibility and growth opportunities) and various country-level factors (e.g., legal origin, financial market development and per capital GDP). In contrast, the eff ...

... low levels of long-term debt. This pattern is robust to controlling for key firm characteristics (e.g., firm size, profitability, asset tangibility and growth opportunities) and various country-level factors (e.g., legal origin, financial market development and per capital GDP). In contrast, the eff ...

8.3 Credit Terms

... Annual Percentage Rate (APR) describe the interest rate for a whole year rather than a monthly interest rate on a loan. Credit Rating - evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or a government ...

... Annual Percentage Rate (APR) describe the interest rate for a whole year rather than a monthly interest rate on a loan. Credit Rating - evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or a government ...

Letter Of Demand - ATA Australian Trades Association

... Letter of Demand (Invoice: # 0000, Dated: 00/00/0000) I draw your attention to the above invoice that to date remains unpaid. Despite numerous attempts to contact your account department through reminder telephone calls and repeated invoices sent / emailed to you, your debt for the account remains u ...

... Letter of Demand (Invoice: # 0000, Dated: 00/00/0000) I draw your attention to the above invoice that to date remains unpaid. Despite numerous attempts to contact your account department through reminder telephone calls and repeated invoices sent / emailed to you, your debt for the account remains u ...

Paulson`s plan was not a true solution to the crisis

... Given the recent explosion in leverage, the challenge is unlikely to be one of mispricing of the toxic mortgage-backed securities alone. Many people and institutions made leveraged bets that have since gone sour. Their debt cannot be repaid. Creditors are responding accordingly. Now turn to the cri ...

... Given the recent explosion in leverage, the challenge is unlikely to be one of mispricing of the toxic mortgage-backed securities alone. Many people and institutions made leveraged bets that have since gone sour. Their debt cannot be repaid. Creditors are responding accordingly. Now turn to the cri ...

Comments on the Paper “Crunch Time: Fiscal Crises and

... Additional $750 Billion LSAP Long-term interest rates decline 20-25 basis points Cumulative gain in GDP of 1.6 percent or $260 billion Reduces unemployment by 0.25 percent or 400,000 jobs ...

... Additional $750 Billion LSAP Long-term interest rates decline 20-25 basis points Cumulative gain in GDP of 1.6 percent or $260 billion Reduces unemployment by 0.25 percent or 400,000 jobs ...

Public finances at a crossroads

... government debt-to-GDP ratios stand at 120%. The debt ratio in the United States exceeds 100%, and is about 250% in Japan. At the moment, debt ratios in most countries are no longer rising, but they are not going down much either, because very little progress is being made in cutting budget deficit ...

... government debt-to-GDP ratios stand at 120%. The debt ratio in the United States exceeds 100%, and is about 250% in Japan. At the moment, debt ratios in most countries are no longer rising, but they are not going down much either, because very little progress is being made in cutting budget deficit ...

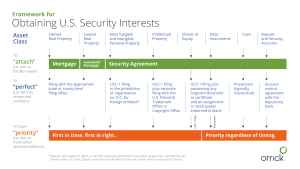

Obtaining US Security Interests

... Filing with the appropriate state or county level filing office ...

... Filing with the appropriate state or county level filing office ...

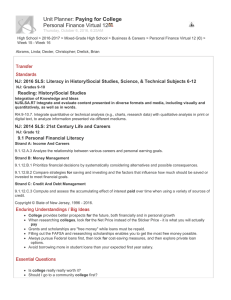

Lesson Plan for College Debt The goal of this activity is to increase

... Financing college has become more challenging during the past generation because the cost of attending post-secondary schools has grown faster than inflation for decades. As a result, many students must borrow substantial amounts of money to pay for education. They and their parents should make info ...

... Financing college has become more challenging during the past generation because the cost of attending post-secondary schools has grown faster than inflation for decades. As a result, many students must borrow substantial amounts of money to pay for education. They and their parents should make info ...

Phd Economics, Siena - Finance – Final exam (16 April 2014

... 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with probability 60%) or 40,000 Euros per year (with probability 40%). If the risk-free rate ...

... 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with probability 60%) or 40,000 Euros per year (with probability 40%). If the risk-free rate ...

Atlas - Atlas - Paying for College

... 9.1.12.B.1 Prioritize financial decisions by systematically considering alternatives and possible consequences. 9.1.12.B.2 Compare strategies for saving and investing and the factors that influence how much should be saved or invested to meet financial goals. Strand C: Credit And Debt Management 9.1 ...

... 9.1.12.B.1 Prioritize financial decisions by systematically considering alternatives and possible consequences. 9.1.12.B.2 Compare strategies for saving and investing and the factors that influence how much should be saved or invested to meet financial goals. Strand C: Credit And Debt Management 9.1 ...

7-0 - McGraw-Hill Education Canada

... • Bonds of similar risk (and maturity) will be priced to yield about the same return, regardless of the coupon rate • If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond • This is a useful concept that can be transferred to valuing assets oth ...

... • Bonds of similar risk (and maturity) will be priced to yield about the same return, regardless of the coupon rate • If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond • This is a useful concept that can be transferred to valuing assets oth ...

Article by Nicholas Dietrich of Gowlings expanding on comments

... markets. Just as the federal government and some senior and influential business leaders have lamented the hollowing-out of public corporate Canada through take-private acquisitions, many by foreign entities, it seems clear that any potential regulatory response would be addressing yesterday’s probl ...

... markets. Just as the federal government and some senior and influential business leaders have lamented the hollowing-out of public corporate Canada through take-private acquisitions, many by foreign entities, it seems clear that any potential regulatory response would be addressing yesterday’s probl ...

Custody Warrant Fact Sheet - Northern Ireland Courts and Tribunals

... The creditor has obtained a court order for monies owed and has applied to recover these monies through the EJO. Your details are now recorded on the Public Register of Debtors, and may be viewed by any person who pays the relevant search fee. Your debt record will appear on the Register for 12 year ...

... The creditor has obtained a court order for monies owed and has applied to recover these monies through the EJO. Your details are now recorded on the Public Register of Debtors, and may be viewed by any person who pays the relevant search fee. Your debt record will appear on the Register for 12 year ...

Banks can handle home price fall, says Glenn Stevens

... “You care, of course, whether asset prices seem divorced from their fundamentals. That’s often in the eye of the beholder,’’ he said. “But the thing you most care about is, ‘is there a lot of borrowed money behind the assets’. “(With) housing, the debt being carried there is pretty significant now, ...

... “You care, of course, whether asset prices seem divorced from their fundamentals. That’s often in the eye of the beholder,’’ he said. “But the thing you most care about is, ‘is there a lot of borrowed money behind the assets’. “(With) housing, the debt being carried there is pretty significant now, ...

Chp. 1.1 Simple Interest

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...