Alexander Hamilton – Secretary of Treasury

... Objective: Describe Hamilton’s program for dealing with national debt. Alexander Hamilton – Secretary of Treasury When he took over the job, the States owed European Banks, and Rich Americans 50 Million dollars. Hamilton’s plan – was to consolidate the states debt into one large national debt. Why? ...

... Objective: Describe Hamilton’s program for dealing with national debt. Alexander Hamilton – Secretary of Treasury When he took over the job, the States owed European Banks, and Rich Americans 50 Million dollars. Hamilton’s plan – was to consolidate the states debt into one large national debt. Why? ...

read more - ParenteBeard Wealth Management

... of the third quarter cautious due to uncertainty regarding fiscal deliberations in Washington. That caution was validated when Congress failed to enact a new budget for the current fiscal year, thus shutting down the government on October 1, 2013, and barely avoiding a United States debt default on ...

... of the third quarter cautious due to uncertainty regarding fiscal deliberations in Washington. That caution was validated when Congress failed to enact a new budget for the current fiscal year, thus shutting down the government on October 1, 2013, and barely avoiding a United States debt default on ...

Balancing LOLR Assistance with Avoidance of Moral Hazard

... • If an agent is absolutely 100% sure to repay all debts as promised, it can always issue its own IOU. • Specific paper money, the concept of liquidity, and the need for banks, all derive from the fact that default can never be ruled out completely. • So a liquidity need almost always, absent physi ...

... • If an agent is absolutely 100% sure to repay all debts as promised, it can always issue its own IOU. • Specific paper money, the concept of liquidity, and the need for banks, all derive from the fact that default can never be ruled out completely. • So a liquidity need almost always, absent physi ...

July 2011 - Cypress Financial Planning

... lack the cash necessary to pay all their bills and risk defaulting. Our national debt ceiling has been increased almost 100 times in the past and is usually a simple procedural vote. However, lawmakers are using this vote as a bargaining chip for future spending measures, intertwining the two issues ...

... lack the cash necessary to pay all their bills and risk defaulting. Our national debt ceiling has been increased almost 100 times in the past and is usually a simple procedural vote. However, lawmakers are using this vote as a bargaining chip for future spending measures, intertwining the two issues ...

Credit Risk

... loan class over the past year. RAROC = one-year income on loan/L Example: A bank is planning to make a loan of $5,000,000 to a firm in the steel industry. It expects to charge an up-front fee of 1.5 percent and a servicing fee of 50 basis points. The loan has a maturity of 8 years and a duration of ...

... loan class over the past year. RAROC = one-year income on loan/L Example: A bank is planning to make a loan of $5,000,000 to a firm in the steel industry. It expects to charge an up-front fee of 1.5 percent and a servicing fee of 50 basis points. The loan has a maturity of 8 years and a duration of ...

HANGUP Act

... IN THE SENATE OF THE UNITED STATES llllllllll llllllllll introduced the following bill; which was read twice and referred to the Committee on llllllllll ...

... IN THE SENATE OF THE UNITED STATES llllllllll llllllllll introduced the following bill; which was read twice and referred to the Committee on llllllllll ...

Eighth UNCTAD Debt Management Conference Principles for Promoting Responsible Sovereign Lending and Borrowing

... GDP (Bn USD) Ave. Exchange Rate (ARP/US$) Imports (% GDP) Investment (% GDP) International Reserves (% GDP) Total Deposits (Bn USD) ...

... GDP (Bn USD) Ave. Exchange Rate (ARP/US$) Imports (% GDP) Investment (% GDP) International Reserves (% GDP) Total Deposits (Bn USD) ...

Debt Audit Program

... Debt obligations are any loan, negotiable notes, time-bearing warrants, bonds or leases. A Short-Term debt obligation has a duration of 12 months or less. A Long-Term debt obligation's duration is considered more than 12 months. School districts usually borrow money on a long-term basis to finance c ...

... Debt obligations are any loan, negotiable notes, time-bearing warrants, bonds or leases. A Short-Term debt obligation has a duration of 12 months or less. A Long-Term debt obligation's duration is considered more than 12 months. School districts usually borrow money on a long-term basis to finance c ...

Chap 3

... debt securities a fee for assessing default risk. (Exhibit 3.1). b. Accuracy of Credit Ratings - The ratings issued by the agencies are useful indicators of default risk but they are opinions, not guarantees. c. Oversight of Credit Rating Agencies - The Financial Reform Act of 2010 established an Of ...

... debt securities a fee for assessing default risk. (Exhibit 3.1). b. Accuracy of Credit Ratings - The ratings issued by the agencies are useful indicators of default risk but they are opinions, not guarantees. c. Oversight of Credit Rating Agencies - The Financial Reform Act of 2010 established an Of ...

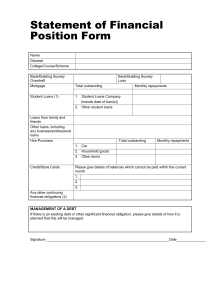

Statement of Financial Position Form

... 1. Student Loans Company (include date of loan(s)) 2. Other student loans ...

... 1. Student Loans Company (include date of loan(s)) 2. Other student loans ...

Welcome to the Good Sense Budget Course

... • Thinking of prepaying mortgage? • Beware of basing a mortgage on two incomes • Exercise caution toward equity loans • Consider an extended household ...

... • Thinking of prepaying mortgage? • Beware of basing a mortgage on two incomes • Exercise caution toward equity loans • Consider an extended household ...

Fear and loathing of negative yielding debt: bond investor`s

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

Debt and Sovereignty: The Lost Lessons

... and moneylenders of the Italian republics and German free cities. For the first time in history, there were banks big enough and secure enough to lend to kings with a reasonable expectation of repayment. Even then, because a lender’s power over a royal borrower was strictly moral, kings remained a p ...

... and moneylenders of the Italian republics and German free cities. For the first time in history, there were banks big enough and secure enough to lend to kings with a reasonable expectation of repayment. Even then, because a lender’s power over a royal borrower was strictly moral, kings remained a p ...

New Economic Bubbles

... Property Taxes in California = $500 per month on $500,000 home Both interest & property taxes are tax deductible (lower your income tax) ...

... Property Taxes in California = $500 per month on $500,000 home Both interest & property taxes are tax deductible (lower your income tax) ...

Capital Markets Briefing (Lothar Mentel, CIO)

... previous weeks, what’s been evident is just how much the markets want to go up. After closing at new lows on Tuesday, they rallied strongly through to Friday merely on the potential for good news, before the rise faltered on the back of further banking sector downgrades. Greek tragedy turning to far ...

... previous weeks, what’s been evident is just how much the markets want to go up. After closing at new lows on Tuesday, they rallied strongly through to Friday merely on the potential for good news, before the rise faltered on the back of further banking sector downgrades. Greek tragedy turning to far ...

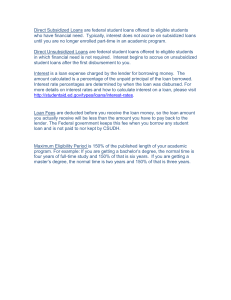

Direct Subsidized Loans are federal student loans offered to eligible

... Interest is a loan expense charged by the lender for borrowing money. The amount calculated is a percentage of the unpaid principal of the loan borrowed. Interest rate percentages are determined by when the loan was disbursed. For more details on interest rates and how to calculate interest on a loa ...

... Interest is a loan expense charged by the lender for borrowing money. The amount calculated is a percentage of the unpaid principal of the loan borrowed. Interest rate percentages are determined by when the loan was disbursed. For more details on interest rates and how to calculate interest on a loa ...

Money 101 for (Imperfect) Parents and Grown-Up Kids

... seniors: 51 percent versus 44 percent last year and in greater amounts than ever before; 83 percent have already put aside at least $1,000 this year, compared to 67 percent last year. That may be just a drop in the tuition bucket, but it can also be the start of a valuable lifetime habit. When young ...

... seniors: 51 percent versus 44 percent last year and in greater amounts than ever before; 83 percent have already put aside at least $1,000 this year, compared to 67 percent last year. That may be just a drop in the tuition bucket, but it can also be the start of a valuable lifetime habit. When young ...