payment holiday - BondPlus Online

... consecutive repayments The additional funds will enable them to use the funds for an emergency, furnish their new home or use it for a holiday over the festive period. Example : Registration of a bond usually takes between 2 -3 months. If a client applies for a home loan and takes up the payment hol ...

... consecutive repayments The additional funds will enable them to use the funds for an emergency, furnish their new home or use it for a holiday over the festive period. Example : Registration of a bond usually takes between 2 -3 months. If a client applies for a home loan and takes up the payment hol ...

T14.1 Chapter Outline

... 1. What is the relationship between cost of capital and firm value? Cet. par., the lower the cost of capital, the higher the value of the firm. 2. When we use the dividend growth model to estimate the firm’s cost of equity, we make a key assumption about future dividends of the firm. What is that as ...

... 1. What is the relationship between cost of capital and firm value? Cet. par., the lower the cost of capital, the higher the value of the firm. 2. When we use the dividend growth model to estimate the firm’s cost of equity, we make a key assumption about future dividends of the firm. What is that as ...

Lessons from history

... Source: Federal Reserve Bank of St. Louis. Government-sponsored enterprises (GSE) are federal agencies or federally sponsored agencies designed to lend money to certain groups of borrowers such as homeowners, farmers and students. Debt issued by GSEs is not guaranteed by the federal government. Exam ...

... Source: Federal Reserve Bank of St. Louis. Government-sponsored enterprises (GSE) are federal agencies or federally sponsored agencies designed to lend money to certain groups of borrowers such as homeowners, farmers and students. Debt issued by GSEs is not guaranteed by the federal government. Exam ...

Nike Apparel: The Ten Essential Components (each worth a point)

... the finite life case), don’t forget to get it back. This should include the book value of the fixed assets that have not been depreciated by year 10 plus the working capital salvage. You can also add in the salvage value of the expansion facilities, though it is unlikely that Nike will actually sell ...

... the finite life case), don’t forget to get it back. This should include the book value of the fixed assets that have not been depreciated by year 10 plus the working capital salvage. You can also add in the salvage value of the expansion facilities, though it is unlikely that Nike will actually sell ...

Lenders Serving Agriculture Real Estate Lenders

... 2,300 agricultural professionals (including lenders) were recently surveyed. 84% believe farmers will experience financial stress in the next 3 years. When lender responses were sorted out, 54% felt the chance of financial stress is high and 26% felt this would be very high. The cost of inpu ...

... 2,300 agricultural professionals (including lenders) were recently surveyed. 84% believe farmers will experience financial stress in the next 3 years. When lender responses were sorted out, 54% felt the chance of financial stress is high and 26% felt this would be very high. The cost of inpu ...

Current Newsletter - Superior Savings Credit Union

... It’s the Season for Tax Scams According to the IRS, aggressive and threatening phone calls from criminals who pose as IRS agents remain a major threat to taxpayers. Scammers make calls and demand the victim pay a bogus tax bill by providing a debit or credit card number. Many phone scams even threat ...

... It’s the Season for Tax Scams According to the IRS, aggressive and threatening phone calls from criminals who pose as IRS agents remain a major threat to taxpayers. Scammers make calls and demand the victim pay a bogus tax bill by providing a debit or credit card number. Many phone scams even threat ...

Personal Finance

... - How the Federal Reserve affects those institutions. (The Rules of the Game) Global Influences: global markets, trends, and foreign economies - How other markets and economies affect us? ...

... - How the Federal Reserve affects those institutions. (The Rules of the Game) Global Influences: global markets, trends, and foreign economies - How other markets and economies affect us? ...

1. The primary operating goal of a publicly

... If a market is strong-form efficient, this implies that the returns on bonds and stocks should be identical. If a market is weak-form efficient, this implies that above-average returns can best be achieved by focusing on past movement of stock prices. If your uncle earned a higher return on his port ...

... If a market is strong-form efficient, this implies that the returns on bonds and stocks should be identical. If a market is weak-form efficient, this implies that above-average returns can best be achieved by focusing on past movement of stock prices. If your uncle earned a higher return on his port ...

Stock Market Analysis and Personal Finance Mr. Bernstein Bonds

... When interest rates fall, bond prices rise When interest rates rise, bond prices fall Example: Exxon 5% due 4/5/2023…at 5% yield bond price =100. At 4% yield bond price = 110. Why? 5% coupon is reduced by capital loss of 10% over ten years, or 1% per year. ...

... When interest rates fall, bond prices rise When interest rates rise, bond prices fall Example: Exxon 5% due 4/5/2023…at 5% yield bond price =100. At 4% yield bond price = 110. Why? 5% coupon is reduced by capital loss of 10% over ten years, or 1% per year. ...

The Political Economy of Shadow Banking

... of eventual par payment at maturity doesn’t do much good. On any given day, only a very small fraction of outstanding primary debt is coming due, and in a crisis the need for current cash can easily exceed it. In such a circumstance, the only way to get cash ...

... of eventual par payment at maturity doesn’t do much good. On any given day, only a very small fraction of outstanding primary debt is coming due, and in a crisis the need for current cash can easily exceed it. In such a circumstance, the only way to get cash ...

Caught in a deflation trap

... with the Great Depression of the 1930s and Japan’s more recent slump. Six years ago I wrote a paper along with some of my former colleagues at the US Federal Reserve that examined Japan’s experience to shed light on how countries might prevent deflation. Alas, I think it’s time to dust off that stud ...

... with the Great Depression of the 1930s and Japan’s more recent slump. Six years ago I wrote a paper along with some of my former colleagues at the US Federal Reserve that examined Japan’s experience to shed light on how countries might prevent deflation. Alas, I think it’s time to dust off that stud ...

The Fed's Intertemporal Game - Center for Financial Stability

... doubling down of a bet being waged over time. If the game ends poorly and market interest rates rise sharply, all players lose. “Forward guidance” is predicated on the idea that comments and communiqués from the Fed can lower short-term interest rate expectations, thereby reducing longer term rates. ...

... doubling down of a bet being waged over time. If the game ends poorly and market interest rates rise sharply, all players lose. “Forward guidance” is predicated on the idea that comments and communiqués from the Fed can lower short-term interest rate expectations, thereby reducing longer term rates. ...

From Stormy Expansion to Riding out the Storm: Banking

... Pushed by expanding income (on the back of rising oil prices) and by rapid external debt accumulation, the Kazakh banking sector featured one of the most dynamic credit booms in CESEE until 2007. Following the U.S. subprime crisis, banks’ access to external funding plummeted and credit expansion gro ...

... Pushed by expanding income (on the back of rising oil prices) and by rapid external debt accumulation, the Kazakh banking sector featured one of the most dynamic credit booms in CESEE until 2007. Following the U.S. subprime crisis, banks’ access to external funding plummeted and credit expansion gro ...

MDM example - IBLF Russia

... professionally and they are able to understand the credit market and the banking products in general and realize all the consequences of their actions in such field The retail customer instead, especially in a vastly under banked country like Russia where loans to individuals are a recent developm ...

... professionally and they are able to understand the credit market and the banking products in general and realize all the consequences of their actions in such field The retail customer instead, especially in a vastly under banked country like Russia where loans to individuals are a recent developm ...

Programme Information

... BTC will either apply Fitch’s simulation model should any asset’s rating fall below AA- or subject to the terms and conditions of the Credit Enhancement Agreement SBSA will fully guarantee the asset ...

... BTC will either apply Fitch’s simulation model should any asset’s rating fall below AA- or subject to the terms and conditions of the Credit Enhancement Agreement SBSA will fully guarantee the asset ...

Investment Analysis

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

chapter 5

... stockholders' equity to finance operations. At some point in time, the company will have to repay this debt. The company will either have to repay this debt by (1) generating cash from operations, (2) selling assets, (3) borrowing additional cash, or (4) acquiring cash by issuing stock. From the sta ...

... stockholders' equity to finance operations. At some point in time, the company will have to repay this debt. The company will either have to repay this debt by (1) generating cash from operations, (2) selling assets, (3) borrowing additional cash, or (4) acquiring cash by issuing stock. From the sta ...

Sterling corporate bonds: an investor`s guide

... In the European Union, this document is only for the attention of “Professional” investor as defined in Directive 2004/39/EC dated 21 April 2004 on markets in financial instruments (“MIFID”), to investment services providers and any other professional of the financial industry, and as the case may b ...

... In the European Union, this document is only for the attention of “Professional” investor as defined in Directive 2004/39/EC dated 21 April 2004 on markets in financial instruments (“MIFID”), to investment services providers and any other professional of the financial industry, and as the case may b ...

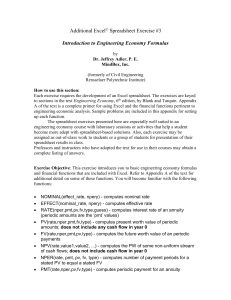

Additional Computer Exercise 3

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...