Chapter Eight: International Solutions to Currency Mismatching?

... monetary system.” Indeed, at the time of its creation, the SDR’s diversification properties were thought to confer on it such an advantage over each of the incumbent reserve currencies that it was regarded as desirable to put some restrictions on the SDR’s use to prevent an excessively rapid switch ...

... monetary system.” Indeed, at the time of its creation, the SDR’s diversification properties were thought to confer on it such an advantage over each of the incumbent reserve currencies that it was regarded as desirable to put some restrictions on the SDR’s use to prevent an excessively rapid switch ...

Bond Issues

... What are project financing arrangement? Classification of liabilities Entries for bond transactions Entries for non-interest –bearing debt Long-term debt disclosure ...

... What are project financing arrangement? Classification of liabilities Entries for bond transactions Entries for non-interest –bearing debt Long-term debt disclosure ...

Financial Maths Solutions

... A outdoor setting has a marked price of C $980. The store offers a discount of 5% to account customers and a further 5% discount for accounts that are settled within 7 days. Calculate the price paid for the outdoor setting by an account customer who settles their account within 7 days. A $735 B $882 ...

... A outdoor setting has a marked price of C $980. The store offers a discount of 5% to account customers and a further 5% discount for accounts that are settled within 7 days. Calculate the price paid for the outdoor setting by an account customer who settles their account within 7 days. A $735 B $882 ...

statement of risk - ACT Department of Treasury

... Interest Rate Risk – Territory Borrowings Total Territory borrowings are accounted for at amortised cost and are typically held to maturity, or repaid on an amortising basis. Approximately 78 per cent of general government sector borrowings are held on a fixed rate basis with the remainder on a floa ...

... Interest Rate Risk – Territory Borrowings Total Territory borrowings are accounted for at amortised cost and are typically held to maturity, or repaid on an amortising basis. Approximately 78 per cent of general government sector borrowings are held on a fixed rate basis with the remainder on a floa ...

Risk, Return and Capital Budgeting

... asset and equity β’s and thus it is more difficult to use comparable firms’ data to determine the overall cost of capital for a specific project. The reason is that debt interest payments reduce taxes; thus, holding fixed the risk of the before-tax cash flows, more debt makes total after-tax cash fl ...

... asset and equity β’s and thus it is more difficult to use comparable firms’ data to determine the overall cost of capital for a specific project. The reason is that debt interest payments reduce taxes; thus, holding fixed the risk of the before-tax cash flows, more debt makes total after-tax cash fl ...

Interest Rate 1 Interest Rate Interest Rate What is the interest rate

... we view in the marketplace are called nominal interest rates because there is a premium included for potential peaks in the inflation rate. Nominal interest rate is also not free from the risk of default so the borrower is subject to a default risk premium. When there is no inflation expected we exp ...

... we view in the marketplace are called nominal interest rates because there is a premium included for potential peaks in the inflation rate. Nominal interest rate is also not free from the risk of default so the borrower is subject to a default risk premium. When there is no inflation expected we exp ...

issues to correctly assess the investment climate and its risks.

... on natural resources. Moreover, and more importantly, the debt that underlies these commodities and these ...

... on natural resources. Moreover, and more importantly, the debt that underlies these commodities and these ...

To view this press release as a Word document

... ratio, the researchers estimate expected developments under several scenarios. Under the first scenario, the researchers assume that home prices will continue to increase in the first year by a similar rate to that of the past two years and afterward will develop in line with the expected inflation ...

... ratio, the researchers estimate expected developments under several scenarios. Under the first scenario, the researchers assume that home prices will continue to increase in the first year by a similar rate to that of the past two years and afterward will develop in line with the expected inflation ...

V. Towards a financial stability

... in foreign currency. Defaults on domestic debt, albeit less frequent than those on foreign debt, are far from rare. Often, but not always, domestic defaults accompany external defaults, tending to occur when countries face harsher economic conditions and markedly higher inflation. In these circumsta ...

... in foreign currency. Defaults on domestic debt, albeit less frequent than those on foreign debt, are far from rare. Often, but not always, domestic defaults accompany external defaults, tending to occur when countries face harsher economic conditions and markedly higher inflation. In these circumsta ...

1969

... crisis of confidence in the banking system, why hasn’t a restoration of banking confidence brought a return to strong economic growth? The likely answer is that banks were only part of the problem.” ...

... crisis of confidence in the banking system, why hasn’t a restoration of banking confidence brought a return to strong economic growth? The likely answer is that banks were only part of the problem.” ...

Where Do Firms Issue Debt?

... jurisdictions can attract more bond issues by changing their legal rules. To this end, we consider two main aspects of the legal environment that could plausibly influence a firm’s decision to locate its bond issue in a particular jurisdiction. First, jurisdictions may differ in the degree of protec ...

... jurisdictions can attract more bond issues by changing their legal rules. To this end, we consider two main aspects of the legal environment that could plausibly influence a firm’s decision to locate its bond issue in a particular jurisdiction. First, jurisdictions may differ in the degree of protec ...

ICG: The Rise of Private Debt as an Institutional Asset Class

... highest return of 63% and the lowest at 2%. ...

... highest return of 63% and the lowest at 2%. ...

Debt Overhang and Recapitalization in Closed and Open Economies

... theoretical literature of the past 20 years is that financial contracts – and debt in particular – are used strategically to create or remedy various types of governance problems. For instance, it is often optimal to make renegotiation difficult for governance reasons. Hart and Moore (1995) model th ...

... theoretical literature of the past 20 years is that financial contracts – and debt in particular – are used strategically to create or remedy various types of governance problems. For instance, it is often optimal to make renegotiation difficult for governance reasons. Hart and Moore (1995) model th ...

Chapter 5 The Financial Environment: Markets, Institutions, and

... thus, they are essentially interest-bearing checking accounts. h. Organized security exchanges, such as the New York Stock Exchange, facilitate communication between buyers and sellers of securities. Each organized exchange is a physical entity and is governed by an elected board of governors. The o ...

... thus, they are essentially interest-bearing checking accounts. h. Organized security exchanges, such as the New York Stock Exchange, facilitate communication between buyers and sellers of securities. Each organized exchange is a physical entity and is governed by an elected board of governors. The o ...

Part III. Project Description

... grace period of up to 2 years, depending on the financing needs of the project to be financed ...

... grace period of up to 2 years, depending on the financing needs of the project to be financed ...

How the Federal Reserve uses Fiscal and Monetary Policy to

... side effect because the total supply of goods and services is essentially finite in the short term and with more dollars chasing that finite set of products, prices go up. If inflation gets too high, then all sorts of unpleasant things happen to the economy. Therefore, the trick with interest rate m ...

... side effect because the total supply of goods and services is essentially finite in the short term and with more dollars chasing that finite set of products, prices go up. If inflation gets too high, then all sorts of unpleasant things happen to the economy. Therefore, the trick with interest rate m ...

The Farm Credit Crisis: Will It Hurt the Whole Economy?

... GNP deflator rose at an 8.1 percent average annual rate while tIle C Pt rose at a 9 per-cent aver-age rate. ‘I’he price of far-mnlarid rose even ninor-e rapidly: th eaverage price of an acre of farm real estate rose at a 14.4 I er’cent annual rate from 1972 thm-or.ngb 1981 Cbar 1 indicates that tota ...

... GNP deflator rose at an 8.1 percent average annual rate while tIle C Pt rose at a 9 per-cent aver-age rate. ‘I’he price of far-mnlarid rose even ninor-e rapidly: th eaverage price of an acre of farm real estate rose at a 14.4 I er’cent annual rate from 1972 thm-or.ngb 1981 Cbar 1 indicates that tota ...

Real estate terms and definitions

... when closing a loan. Points are a percentage of the total loan amount (one point is equal to 1 percent of the loan amount). For a $100,000 loan, one point costs $1,000. Pre-paids/Escrow Account Deposits: These costs are for the payment of taxes and/or insurance and other items that must be made at s ...

... when closing a loan. Points are a percentage of the total loan amount (one point is equal to 1 percent of the loan amount). For a $100,000 loan, one point costs $1,000. Pre-paids/Escrow Account Deposits: These costs are for the payment of taxes and/or insurance and other items that must be made at s ...

debt management objectives

... In response to the adverse impact of the global economic and financial crisis on the economies of the ECCU, the Monetary Council articulated a comprehensive Eight Point Stabilisation and Growth Programme, designed to stabilise these economies and ultimately steer them towards a path of sustainable e ...

... In response to the adverse impact of the global economic and financial crisis on the economies of the ECCU, the Monetary Council articulated a comprehensive Eight Point Stabilisation and Growth Programme, designed to stabilise these economies and ultimately steer them towards a path of sustainable e ...

AP Macro 4-1 Money and Banking

... A credit card is NOT money. It is a short-term loan (usually with a higher than normal interest rate). Ex: You buy a shirt with a credit card, VISA pays the store, you pay VISA the price of the shirt plus interest and fees. Total credit cards in circulation in U.S: 576.4 million Average number of cr ...

... A credit card is NOT money. It is a short-term loan (usually with a higher than normal interest rate). Ex: You buy a shirt with a credit card, VISA pays the store, you pay VISA the price of the shirt plus interest and fees. Total credit cards in circulation in U.S: 576.4 million Average number of cr ...

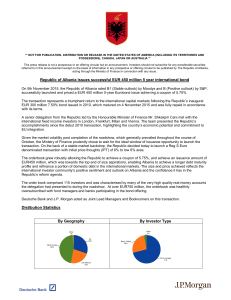

Republic of Albania issues successful EUR 450 million 5 year

... Deutsche Bank and J.P. Morgan acted as Joint Lead Managers and Bookrunners on this transaction. ...

... Deutsche Bank and J.P. Morgan acted as Joint Lead Managers and Bookrunners on this transaction. ...