General Information - Bank of Ireland Mortgage

... There are two different repayment options; capital repayment and interest only. Capital repayment means you gradually pay off the amount you borrowed together with interest. You make one payment each month, part of it goes towards repaying the capital and part pays the interest due that month. Inter ...

... There are two different repayment options; capital repayment and interest only. Capital repayment means you gradually pay off the amount you borrowed together with interest. You make one payment each month, part of it goes towards repaying the capital and part pays the interest due that month. Inter ...

The Charlotte Regional Commercial Real Estate Capital Conference

... get back off the ground, and what do you think it will take in order for that to happen? When? What will the deals look like? ...

... get back off the ground, and what do you think it will take in order for that to happen? When? What will the deals look like? ...

1 Introduction 2 Analytical Framework

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

Cost of a Car Loan

... Cost of a Car Loan When you are buying a new car, there are many things you must consider. One major consideration is the loan. Banks and other lending institutions charge you interest for the privilege of using their money to buy a car. A down payment of 10% to 20% is generally required. The down p ...

... Cost of a Car Loan When you are buying a new car, there are many things you must consider. One major consideration is the loan. Banks and other lending institutions charge you interest for the privilege of using their money to buy a car. A down payment of 10% to 20% is generally required. The down p ...

banking sector`s updates credit rating : egypt and its

... Banque Du Caire and the private bank Commercial International Bank (CIB) to ‘B3’ from ‘Caa1’. The agency also upgraded the local currency deposit ratings of ALEXBANK to ‘B2’ from ‘B3’. Additionally, the banks’ foreign-currency deposit ratings were upgraded to ‘Caa1’ from ‘Caa2’, reflecting the incre ...

... Banque Du Caire and the private bank Commercial International Bank (CIB) to ‘B3’ from ‘Caa1’. The agency also upgraded the local currency deposit ratings of ALEXBANK to ‘B2’ from ‘B3’. Additionally, the banks’ foreign-currency deposit ratings were upgraded to ‘Caa1’ from ‘Caa2’, reflecting the incre ...

Shop `til We Drop? - Iowa State University Department of Economics

... a homeowner receives a payment from the lender up to some percentage of the home’s value; upon the owner’s death, the loan is repaid, usually through sale of the house.) Maybe. But maybe the post-World War II consumption boom has reached its peak. If the retreat occurs gently, the consequences, at l ...

... a homeowner receives a payment from the lender up to some percentage of the home’s value; upon the owner’s death, the loan is repaid, usually through sale of the house.) Maybe. But maybe the post-World War II consumption boom has reached its peak. If the retreat occurs gently, the consequences, at l ...

The Risks of Sovereign Lending: Lessons from History

... Most of the defaults in the 1820s were by new countries still struggling for their freedom. The demand for loans arose from the need for armaments to protect the borrowers' newly won independence and maintain internal order, not for investments in productive capacity that could repay, the loans. Bet ...

... Most of the defaults in the 1820s were by new countries still struggling for their freedom. The demand for loans arose from the need for armaments to protect the borrowers' newly won independence and maintain internal order, not for investments in productive capacity that could repay, the loans. Bet ...

here

... and slow to respond to market worries, has presided over some of the most interventionist and controversial Fed actions since the central bank's founding in 1913. He has also plunged into the public spotlight to an extent that none of his predecessors would have contemplated, in a profound departure ...

... and slow to respond to market worries, has presided over some of the most interventionist and controversial Fed actions since the central bank's founding in 1913. He has also plunged into the public spotlight to an extent that none of his predecessors would have contemplated, in a profound departure ...

Eurobonds: a crucial step towards political union and an engine for

... • By creating a large bond market in the euro zone that can compete with the dollar bond market, it also creates a market with a lot of liquidity. • This will make it attractive for outside investors (e.g. from Asia) in search of diversification. • This also increases attractiveness for AAAcountries ...

... • By creating a large bond market in the euro zone that can compete with the dollar bond market, it also creates a market with a lot of liquidity. • This will make it attractive for outside investors (e.g. from Asia) in search of diversification. • This also increases attractiveness for AAAcountries ...

The impact of transfer pricing on real estate funding – Mezzanine financing

... Therefore, there is an incentive market credit spreads have made to present what is in substance an external financing less attractive. equity investment in the form of Most mezzanine loans are targeted Therefore, considering using funds debt to obtain the favourable tax available within the company ...

... Therefore, there is an incentive market credit spreads have made to present what is in substance an external financing less attractive. equity investment in the form of Most mezzanine loans are targeted Therefore, considering using funds debt to obtain the favourable tax available within the company ...

Disclosure of G-SIB indicators

... Section 4 - Intra-Financial System Liabilities a. Funds deposited by or borrowed from other financial institutions: (1) Deposits due to depository institutions (2) Deposits due to non-depository financial institutions (3) Loans obtained from other financial institutions b. Unused portion of committe ...

... Section 4 - Intra-Financial System Liabilities a. Funds deposited by or borrowed from other financial institutions: (1) Deposits due to depository institutions (2) Deposits due to non-depository financial institutions (3) Loans obtained from other financial institutions b. Unused portion of committe ...

Century Bonds: Issuance Motivations and Debt versus Equity

... return. The average cumulative 3-day abnormal stock return is 0.35% and it is not statistically difference from zero (t-statistic = 0.461). Although insignificant stock price reactions to straight debt issuance announcements are often documented in prior studies [Eckho (1986), Mikkelson and Partch ( ...

... return. The average cumulative 3-day abnormal stock return is 0.35% and it is not statistically difference from zero (t-statistic = 0.461). Although insignificant stock price reactions to straight debt issuance announcements are often documented in prior studies [Eckho (1986), Mikkelson and Partch ( ...

T7- Bonds

... U.S. Government is far more secure than any corporation. Their default risk--the chance of the debt not being paid back--is extremely small, so small that the U.S. government securities are known as risk free assets. – a government will always be able to bring in future revenue through taxation. – A ...

... U.S. Government is far more secure than any corporation. Their default risk--the chance of the debt not being paid back--is extremely small, so small that the U.S. government securities are known as risk free assets. – a government will always be able to bring in future revenue through taxation. – A ...

April 2016 Investment Letter - "MARCH MARKET

... has its’ roots in a wave of populism brought on by dissatisfaction with the political establishment. Neither party seems to be satisfied with their potential nominees. This election season, which already has been one the craziest ever witnessed, is likely to get even more bizarre and divisive and co ...

... has its’ roots in a wave of populism brought on by dissatisfaction with the political establishment. Neither party seems to be satisfied with their potential nominees. This election season, which already has been one the craziest ever witnessed, is likely to get even more bizarre and divisive and co ...

GDP- (GROSS DOMESTIC PRODUCT)

... SARFAESI Act: law for securitization, reconstruction for financial assets. Replaced Debt Recovery Tribunals (partially).Gives banks power to auction mortgaged/secured assets Credit Crunch: Reduction in the general availability of loans (credit) or a sudden tightening of conditions. If credit crunch ...

... SARFAESI Act: law for securitization, reconstruction for financial assets. Replaced Debt Recovery Tribunals (partially).Gives banks power to auction mortgaged/secured assets Credit Crunch: Reduction in the general availability of loans (credit) or a sudden tightening of conditions. If credit crunch ...

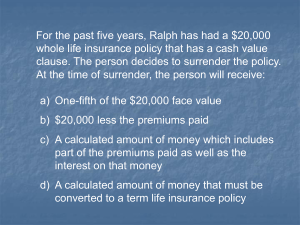

Jumpstart Financial Literacy

... creditworthiness and ability to pay your debts b) You must always pay to receive a credit report c) You are eligible to receive one free credit report per year from each of the three credit reporting companies d) If you declare bankruptcy, it does not appear on your credit report ...

... creditworthiness and ability to pay your debts b) You must always pay to receive a credit report c) You are eligible to receive one free credit report per year from each of the three credit reporting companies d) If you declare bankruptcy, it does not appear on your credit report ...