Capital Structure II:

... dividends should benefit the stockholders by reducing the ability of managers to pursue wasteful activities. The free cash flow hypothesis also argues that an increase in debt will reduce the ability of managers to pursue wasteful activities more effectively than dividend increases. The managers m ...

... dividends should benefit the stockholders by reducing the ability of managers to pursue wasteful activities. The free cash flow hypothesis also argues that an increase in debt will reduce the ability of managers to pursue wasteful activities more effectively than dividend increases. The managers m ...

Summary Results 3Q 2011

... sheets. This change in accounting treatment would also have the effect of reducing the yield on the residential mortgage portion of the portfolio as the mortgages brought back on the balance sheet would generally be insured mortgages with lower interest rates. Selected Loan Yields (YTD annualized) ...

... sheets. This change in accounting treatment would also have the effect of reducing the yield on the residential mortgage portion of the portfolio as the mortgages brought back on the balance sheet would generally be insured mortgages with lower interest rates. Selected Loan Yields (YTD annualized) ...

A Modest Proposal for Overcoming the Euro Crisis

... A key to this is not fiscal transfers but rather a tranche transfer: transferring a share of national debt and borrowing to eurobonds held and issued by the ECB. A new institution to issue such eurobonds was recommended in a report to Jacques Delors in 1993.1 The Breughel Institute more recently has ...

... A key to this is not fiscal transfers but rather a tranche transfer: transferring a share of national debt and borrowing to eurobonds held and issued by the ECB. A new institution to issue such eurobonds was recommended in a report to Jacques Delors in 1993.1 The Breughel Institute more recently has ...

Finance Slides 051915

... • Why? Because you do not make a single dollar of profit until you first break even. • Most businesses fail to reach their profit potential because the owners have not performed B/E analysis. • Managing your fixed costs and using B/E analysis to make spending decisions will save you thousands of dol ...

... • Why? Because you do not make a single dollar of profit until you first break even. • Most businesses fail to reach their profit potential because the owners have not performed B/E analysis. • Managing your fixed costs and using B/E analysis to make spending decisions will save you thousands of dol ...

Disclosure of G-SIB indicators

... (1) Deposits due to depository institutions (2) Deposits due to non-depository financial institutions (3) Loans obtained from other financial institutions b. Unused portion of committed lines obtained from other financial institutions c. Net negative current exposure of securities financing transact ...

... (1) Deposits due to depository institutions (2) Deposits due to non-depository financial institutions (3) Loans obtained from other financial institutions b. Unused portion of committed lines obtained from other financial institutions c. Net negative current exposure of securities financing transact ...

disinformation on government debt accumulation

... So, fellow countrymen, why would anyone feel constrained to keep idle, moneys they have borrowed at a cost as high as 15%, while the same monetary control procedure attracts less than 2% in successful economies? With such high returns for risk-free sovereign loans, it should be no surprise that bank ...

... So, fellow countrymen, why would anyone feel constrained to keep idle, moneys they have borrowed at a cost as high as 15%, while the same monetary control procedure attracts less than 2% in successful economies? With such high returns for risk-free sovereign loans, it should be no surprise that bank ...

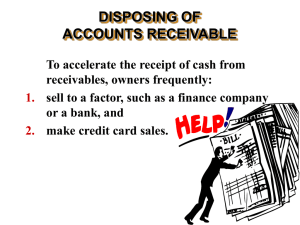

Chapter 10

... When a bond is issued (sold) at its face amount, it is issued at par. In contrast, when a bond is sold at an amount lower than the par amount, it is issued at a discount, and conversely, when it is sold at a price above par, it is issued at a premium. A bond will sell at a discount when the market, ...

... When a bond is issued (sold) at its face amount, it is issued at par. In contrast, when a bond is sold at an amount lower than the par amount, it is issued at a discount, and conversely, when it is sold at a price above par, it is issued at a premium. A bond will sell at a discount when the market, ...

money manager capitalism and the global financial crisis

... usually do not have access to essential data on the loans that will provide income flows. Once we get to tranches of MBSs, to CDOs, squared and cubed, and on to synthetic CDOs we have leveraged and layered those underlying mortgages to a degree that it is pure fantasy to believe that markets can eff ...

... usually do not have access to essential data on the loans that will provide income flows. Once we get to tranches of MBSs, to CDOs, squared and cubed, and on to synthetic CDOs we have leveraged and layered those underlying mortgages to a degree that it is pure fantasy to believe that markets can eff ...

Economic Turmoil and Private Student Loans What it Means to Your Students

... • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were created to bridge the gap between the fund ...

... • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were created to bridge the gap between the fund ...

6 - 3 6 - 33 8th grade warm up week thirty

... Roselie purchased flowers and a card for her Mother. She paid using a method in which no money was taken from a bank account and she received no bill in the mail for the items. What method of payment did she use? ...

... Roselie purchased flowers and a card for her Mother. She paid using a method in which no money was taken from a bank account and she received no bill in the mail for the items. What method of payment did she use? ...

Financial Ratios and Meanings

... Improved by: Improve working capital or reduce unprofitable sales while maintaining working capital Working Capital: Formula: Current Assets - Current Liabilities Meaning: Principal measure of liquidity; Target for working capital should be at least one-half of operating budget Improved by: Increasi ...

... Improved by: Improve working capital or reduce unprofitable sales while maintaining working capital Working Capital: Formula: Current Assets - Current Liabilities Meaning: Principal measure of liquidity; Target for working capital should be at least one-half of operating budget Improved by: Increasi ...

Economic Crisis and the Russian Debt Problem

... or diminish its share in 20–22 strategic companies and privatise almost 5,000 nonstrategic facilities. This could potentially raise funds of US$20–40 billion annually. However, the success of large-scale privatisation will, in many ways, depend on the state of the global and Russian economy. General ...

... or diminish its share in 20–22 strategic companies and privatise almost 5,000 nonstrategic facilities. This could potentially raise funds of US$20–40 billion annually. However, the success of large-scale privatisation will, in many ways, depend on the state of the global and Russian economy. General ...

EXTERNAL STABILITY External stability or external balance

... ation where external indicators such as the balance of payment, foreign liabilities and the exchange rate are at a sustainable level, that is, a level where they can remain in the longer term without negative economic consequences. The past two decades saw the sweep in of globalisation, what was als ...

... ation where external indicators such as the balance of payment, foreign liabilities and the exchange rate are at a sustainable level, that is, a level where they can remain in the longer term without negative economic consequences. The past two decades saw the sweep in of globalisation, what was als ...

Financial Stability 2011/

... Iceland’s commercial banks with a centralised settlement system for foreign exchange transactions, which would reduce settlement risk, one of the problems still unresolved in the aftermath of the banking collapse. The financial crisis highlighted the need for more co-operation and exchange of inform ...

... Iceland’s commercial banks with a centralised settlement system for foreign exchange transactions, which would reduce settlement risk, one of the problems still unresolved in the aftermath of the banking collapse. The financial crisis highlighted the need for more co-operation and exchange of inform ...

Druckenmiller – the Endgame Presentation

... dovishness continues. If the Fed was using an average of Volcker and Greenspan’s response to data as implied by standard Taylor rules, Fed Funds would be close to 3% today. In other words, and quite ironically, this is the least “data dependent” Fed we have had in history. Simply put, this is the bi ...

... dovishness continues. If the Fed was using an average of Volcker and Greenspan’s response to data as implied by standard Taylor rules, Fed Funds would be close to 3% today. In other words, and quite ironically, this is the least “data dependent” Fed we have had in history. Simply put, this is the bi ...