High Yield Bonds [Junk Bonds] and Their History

... Issues that have been downgraded because the issuer voluntarily significantly increased their debt as a result of a leveraged buyout or recapitalization ...

... Issues that have been downgraded because the issuer voluntarily significantly increased their debt as a result of a leveraged buyout or recapitalization ...

An Asian Investment Fund - Global Clearinghouse for Development

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

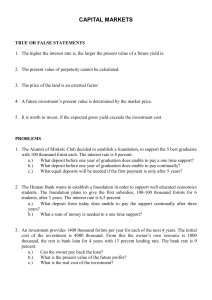

capital markets

... forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he can pay back 1 million in every year (three times). In this case the lending rate is 20 percent. The expected yield is 1,5 million per year. Interest rate is 10 percent. a.) Which loan wou ...

... forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he can pay back 1 million in every year (three times). In this case the lending rate is 20 percent. The expected yield is 1,5 million per year. Interest rate is 10 percent. a.) Which loan wou ...

MA162: Finite mathematics - Financial Mathematics

... How much of Murray’s first payment is due to interest? The first payment is due at the end of the first month. He borrowed $11,000 and interest accrues at i = 0.005 per month. So his outstanding balance right before the first payment is $11, 000 · (1.005) = $11, 055. Therefore, $55 of his first paym ...

... How much of Murray’s first payment is due to interest? The first payment is due at the end of the first month. He borrowed $11,000 and interest accrues at i = 0.005 per month. So his outstanding balance right before the first payment is $11, 000 · (1.005) = $11, 055. Therefore, $55 of his first paym ...

St George

... • At least one borrower on the new home loan must be the same as that on the previous loan • You must hold a St.George transaction account and direct debit your repayments from that account in order to receive a cash back • The cash back will be paid into the linked transaction account within 2 m ...

... • At least one borrower on the new home loan must be the same as that on the previous loan • You must hold a St.George transaction account and direct debit your repayments from that account in order to receive a cash back • The cash back will be paid into the linked transaction account within 2 m ...

Cash payment

... The Market Rate of Interest The selling price of a bond is determined by the market rate of interest versus the stated rate of interest. Interest ...

... The Market Rate of Interest The selling price of a bond is determined by the market rate of interest versus the stated rate of interest. Interest ...

adb applicable lending rates for standard non sovereign guaranteed

... Lending rate for FSL = Base Rate + Lending Spread Base Rates Floating Base Rate: (i) the six (6) month reference rate for USD, YEN (6m Libor) and EUR (6m Euribor) resets on 1 February and 1 August; (ii) the three (3) month reference rate for the ZAR (3m Jibar) resets on 1 February, 1 May, 1 August a ...

... Lending rate for FSL = Base Rate + Lending Spread Base Rates Floating Base Rate: (i) the six (6) month reference rate for USD, YEN (6m Libor) and EUR (6m Euribor) resets on 1 February and 1 August; (ii) the three (3) month reference rate for the ZAR (3m Jibar) resets on 1 February, 1 May, 1 August a ...

The Origins of the U.S. Financial and Economic Crises

... Some banks and other institutions were even eager to lend money to prospective homebuyers with poor credit and a spotty financial history who would not typically qualify for loans. These transactions are known as "subprime" mortgage loans and they usually charge interest rates that are above the "pr ...

... Some banks and other institutions were even eager to lend money to prospective homebuyers with poor credit and a spotty financial history who would not typically qualify for loans. These transactions are known as "subprime" mortgage loans and they usually charge interest rates that are above the "pr ...

Presentation to the Phoenix Chapter of Lambda Alpha International Phoenix, AZ

... that are partially completed, or completed but still vacant. Values for finished but vacant lots across the country are reported to be off about 50 percent from their peak, with some hard-hit regions in the West down even more. Over the past year and a half, developers and their bankers have been wo ...

... that are partially completed, or completed but still vacant. Values for finished but vacant lots across the country are reported to be off about 50 percent from their peak, with some hard-hit regions in the West down even more. Over the past year and a half, developers and their bankers have been wo ...

national securities

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

FREQUENTLY ASKED QUESTIONS Explaining Debt Disclosure

... Of the $99 million listed on the tax bill as Orland Park debt, approximately $73 million of this amount is general obligation debt. When you realize that Orland Park has an equalized assessed valuation (EAV), meaning total taxable value of the community, of more than $2.3 billion, one can place the ...

... Of the $99 million listed on the tax bill as Orland Park debt, approximately $73 million of this amount is general obligation debt. When you realize that Orland Park has an equalized assessed valuation (EAV), meaning total taxable value of the community, of more than $2.3 billion, one can place the ...

Public/SIC Education Presentations/REITS[1]

... As mentioned earlier, you can divest quickly if a situation came up where you had to have money. They provide significant dividend income with slow to moderate growth. ...

... As mentioned earlier, you can divest quickly if a situation came up where you had to have money. They provide significant dividend income with slow to moderate growth. ...

Financial Check Up

... 1. Debt ratio: • Total debt divided by total assets. • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • T ...

... 1. Debt ratio: • Total debt divided by total assets. • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • T ...

Modest Proposal for Overcoming the Euro Crisis

... undermining Europe's credibility with electorates, markets and, ironically,... the credit rating agencies themselves! Instead of closing what was already recognised as a democratic deficit, they deepen it and, in the process, reinforce the Eurozone's unfolding predicament. Eager to please the market ...

... undermining Europe's credibility with electorates, markets and, ironically,... the credit rating agencies themselves! Instead of closing what was already recognised as a democratic deficit, they deepen it and, in the process, reinforce the Eurozone's unfolding predicament. Eager to please the market ...

credit evaluation from the corporate practitioners

... the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This seminar is designed for all levels of credit staff as well as corporate CFOs who are interested to acquire credit evaluation skills, to improve credit decision-making and to mitigate agai ...

... the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This seminar is designed for all levels of credit staff as well as corporate CFOs who are interested to acquire credit evaluation skills, to improve credit decision-making and to mitigate agai ...

PowerPoint Ch. 16

... Valuing and Reporting Investments Trading Securities Companies hold trading securities with the intention of selling them in a short period. Trading means frequent buying and selling. Companies report trading securities at fair value, and report changes from cost as part of net income. ...

... Valuing and Reporting Investments Trading Securities Companies hold trading securities with the intention of selling them in a short period. Trading means frequent buying and selling. Companies report trading securities at fair value, and report changes from cost as part of net income. ...

Contact: Mark Primoff 845-758-7749 primoff@bard

... Whalen describes a Minsky-oriented account of the 2007 credit crunch as starting with the housing boom, which followed the burst of the “dot-com” bubble in 2000. The housing boom was fueled by low interest rates and the proliferation of exotic mortgages, such as interest-only loans and option adjust ...

... Whalen describes a Minsky-oriented account of the 2007 credit crunch as starting with the housing boom, which followed the burst of the “dot-com” bubble in 2000. The housing boom was fueled by low interest rates and the proliferation of exotic mortgages, such as interest-only loans and option adjust ...

Submitting a Claim for Out-of

... used by you to pay mortgage payments, condo fees, rent, personal loan payments, household utilities, and other such expenses, until your pay issue was resolved ...

... used by you to pay mortgage payments, condo fees, rent, personal loan payments, household utilities, and other such expenses, until your pay issue was resolved ...

Finance 534 week 10 quiz 9 Question 1 Which of the following

... short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk. Conservative firms generally use no short-term debt and thus have zero current liabilities. A short-term loan can usually be obtained more quickly than a long-term loan, but the cost of sho ...

... short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk. Conservative firms generally use no short-term debt and thus have zero current liabilities. A short-term loan can usually be obtained more quickly than a long-term loan, but the cost of sho ...

Does PE Create Value.Apr 08

... Directors of public companies are generally part time, not financial experts, have small percentage shareholdings with little incentive or expertise to effectively monitor risk exposure ...

... Directors of public companies are generally part time, not financial experts, have small percentage shareholdings with little incentive or expertise to effectively monitor risk exposure ...

![High Yield Bonds [Junk Bonds] and Their History](http://s1.studyres.com/store/data/021336625_1-47a561b8f719cc930091ca9aa464d999-300x300.png)

![Public/SIC Education Presentations/REITS[1]](http://s1.studyres.com/store/data/012509441_1-4ac192bb5fd15c4b63c90980bf3e65d9-300x300.png)